News

SpaceX’s attempts to buy bigger Falcon fairings complicated by contractor’s ULA relationship

According to a report from SpaceNews, SpaceX recently approached global aerospace supplier RUAG with the intention of procuring a new, larger payload fairing for its Falcon 9 and Heavy rockets.

RUAG is a prolific supplier of rocket fairings, spacecraft deployment mechanisms, and other miscellaneous subassemblies and components, and US company United Launch Alliance (ULA) has relied on RUAG for fairings and various other composites work for its Atlas V, Delta IV, and (soon) Vulcan launch vehicles. According to SpaceNews, that close relationship with ULA forced RUAG to turn SpaceX away, owing to ULA’s argument that the specific fairing technology SpaceX was pursuing is ULA’s intellectual property. The ramifications of this development are not earthshaking but they’re still worth exploring.

Update: A more recent report by SpaceNews seemingly revealed that RUAG has no such exclusivity or IP agreement with ULA. Nevertheless, it’s worth noting that the reality is probably somewhere in between RUAG’s official statement and the more incendiary information that preceded it. As a commercial entity, RUAG is in no way obligated to supply hardware or services to any prospective buyer, and the political and economic ties between ULA and RUAG are likely more influential than public statements will ever acknowledge.

“In a June 12 letter to Smith, the company’s CEO Peter Guggenbach makes the case that legislation forcing access to suppliers is unnecessary in this case because RUAG does not have an exclusive arrangement with ULA and is willing to work with SpaceX or any other launch providers.

“For this competition, we are in the process of submitting or have submitted proposals to multiple prime contractors regarding launch vehicle fairings. In those agreements, we share technical data to support a prime contractor’s bid while protecting our intellectual property.”

RUAG vice president Karl Jensen told SpaceNews the company has a “significant partnership” with ULA but is looking to work with others too. “We have an offer to SpaceX,” he said. “We don’t know if they’ll accept it.”

SpaceNews, 06/13/2019

Additionally, it’s likely that SpaceX is interested in procuring a few RUAG fairings not for the 5.4m diameter – the actual usable diameter is almost the same as Falcon 9’s own fairing – but for the added height, up to ~16.5m compared to F9’s ~11m.

New fairing needed

According to rules behind the latest phase of the US Air Force military launch competition (LSA Phase 2), competitors – likely to include ULA (Vulcan), Blue Origin (New Glenn), Northrop Grumman (Omega), and SpaceX (Falcon 9/Heavy) – will have to offer a larger, 5.4-meter (17 ft) diameter payload fairing to compete for any of the several dozen launch contracts up for grabs.

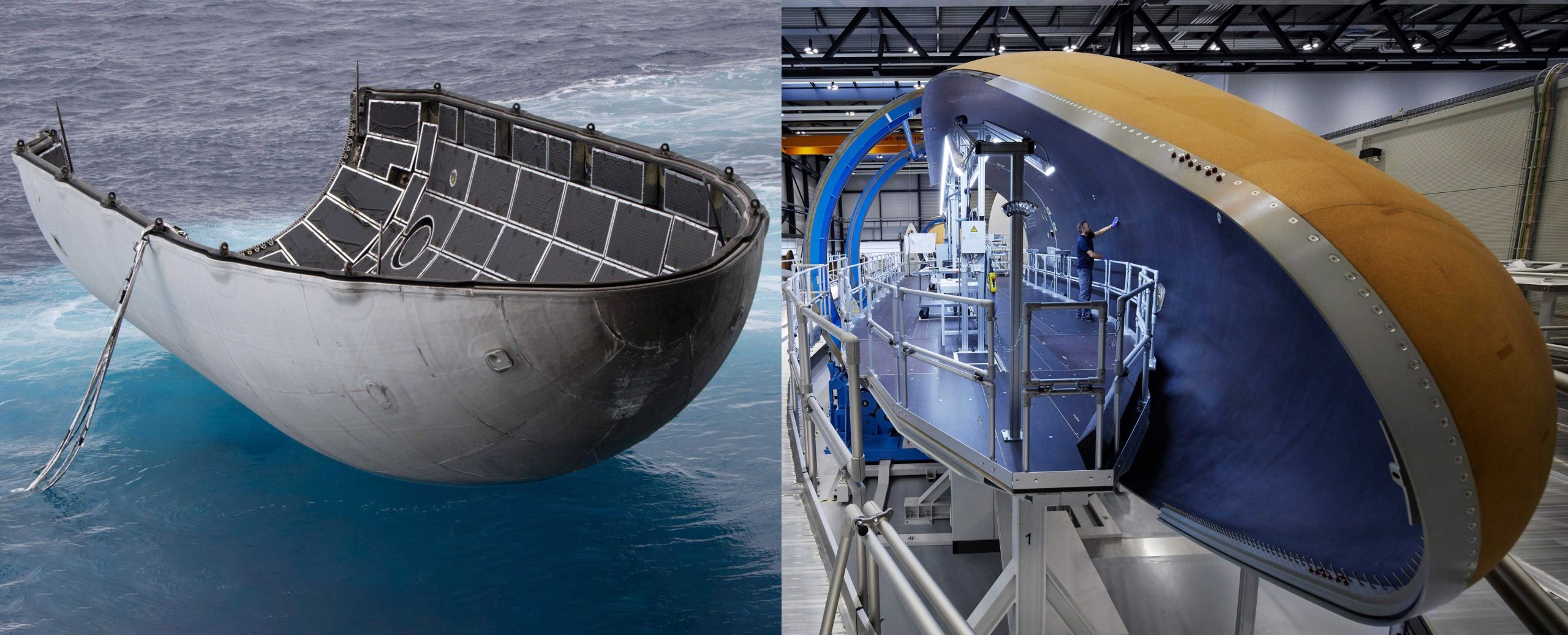

SpaceX’s Falcon 9 and Heavy rockets were designed with a 5.2m-diameter fairing that flew on the very first Falcon 9 launch and continues to be SpaceX’s only fairing today, albeit with several major modifications and upgrades since its 2010 debut. Blue Origin plans to jump straight into 7m-diameter fairing development for its large New Glenn launch vehicle, expected to launch for the first time no earlier than (NET) 2021.

Procured from RUAG, ULA has several fairing options, including its largest, a 5.4m-diameter fairing that flies on Atlas V 500-series vehicles and also flies on Arianespace’s Ariane 5. Northrop Grumman’s (formerly Orbital ATK’s) Omega will feature a 5.25m-diameter fairing if the rocket makes it to flight hardware production.

Although most of the two-dozen or so satellites to be launched as part of LSA Phase 2 are likely small enough to fit Falcon’s 5.2m fairing and Omega’s 5.25m fairing, SpaceX (and Northrop Grumman) would presumably miss out on opportunities to launch those larger (and likely higher-profile) satellites, effectively handing the contracts to Blue Origin or ULA. SpaceX is thus faced with a conundrum that has three possible solutions.

- Build a brand new fairing with a significantly larger diameter (5.4m+) and be forced to buy tens of millions of dollars of custom tooling and new manufacturing space for a handful of rare launches with a rocket family meant to be made redundant by Starship/Super Heavy.

- Buy a handful of 5.4m-diameter fairings from RUAG, the only practical commercial source on Earth.

- Forgo the ability to compete for the few launches that require a larger fairing.

With #2 reportedly removed by ULA’s interference for dubious reasons, the the remaining options are unsavory at best. It’s possible that SpaceX will willingly design, build and certify an entirely new Falcon fairing for US military launches, but the expense of that process – likely $50M-$100M or more – means that it would probably be contingent upon SpaceX receiving the $500M it has recently begun lobbying for.

For reference, all three of the launch providers SpaceX is competing against – ULA, NGIS, and Blue Origin – were respectively awarded ~$970M, ~$790M, and $500M by the US Air Force to complete the development of their respective launch vehicles. SpaceX can technically compete in the ~30 launch contract competition to follow, but the company wouldn’t receive a penny of development funding to meet the same requirements its competitors are being paid hundreds of millions of dollars for. In lieu of this undeniable imbalance, SpaceX – via Congressman Adam Smith – secured language in the FY2020 National Defense Authorization Act that would provide the company $500M (equivalent to Blue Origin’s award) if they win one of Phase 2’s two block-buy contracts.

Despite the fact that the USAF has plans to spend more than $2B assisting the development of three new rockets, LSA Phase 2 procurement has been inexplicably structured in such a way that only two companies/rockets can win, with one receiving 60% of contracts and the other receiving 40%. In other words, with that baffling award structure and under the assumption that SpaceX wins one of the slots, two of the three rockets the USAF is throwing money at will either die on the drawing board (Omega) or have a significantly lower chance of achieving military launch certification (New Glenn).

Ultimately, it’s clear that building an entirely new fairing would be valuable for SpaceX, even if it might be extremely expensive and of dubious strategic merit alongside the simultaneously development of Starship/Super Heavy, a vehicle that will feature a reusable 9m-diameter payload bay. Whether or not SpaceX bites that particular bullet, the LSA Phase 2 competition remains as baffling and fascinating as ever.

Elon Musk

California city weighs banning Elon Musk companies like Tesla and SpaceX

A resolution draft titled, “Resolution Ending Engagement With Elon Musk-Controlled Companies and To Encourage CalPERS To Divest Stock In These Companies,” alleges that Musk “has engaged in business practices that are alleged to include violations of labor laws, environmental regulations, workplace safety standards, and regulatory noncompliance.”

A California City Council is planning to weigh whether it would adopt a resolution that would place a ban on its engagement with Elon Musk companies, like Tesla and SpaceX.

The City of Davis, California, will have its City Council weigh a new proposal that would adopt a resolution “to divest from companies owned and/or controlled by Elon Musk.”

This would include a divestment proposal to encourage CalPERS, the California Public Employees Retirement System, to divest from stock in any Musk company.

A resolution draft titled, “Resolution Ending Engagement With Elon Musk-Controlled Companies and To Encourage CalPERS To Divest Stock In These Companies,” alleges that Musk “has engaged in business practices that are alleged to include violations of labor laws, environmental regulations, workplace safety standards, and regulatory noncompliance.”

It claims that Musk “has used his influence and corporate platforms to promote political ideologies and activities that threaten democratic norms and institutions, including campaign finance activities that raise ethical and legal concerns.”

If adopted, Davis would bar the city from entering into any new contracts or purchasing agreements with any company owned or controlled by Elon Musk. It also says it will not consider utilizing Tesla Robotaxis.

Hotel owner tears down Tesla chargers in frustration over Musk’s politics

A staff report on the proposal claims there is “no immediate budgetary impact.” However, a move like this would only impact its residents, especially with Tesla, as the Supercharger Network is open to all electric vehicle manufacturers. It is also extremely reliable and widespread.

Regarding the divestment request to CalPERS, it would not be surprising to see the firm make the move. Although it voted against Musk’s compensation package last year, the firm has no issue continuing to make money off of Tesla’s performance on Wall Street.

The decision to avoid Musk companies will be considered this evening at the City Council meeting.

The report comes from Davis Vanguard.

It is no secret that Musk’s political involvement, especially during the most recent Presidential Election, ruffled some feathers. Other cities considered similar options, like the City of Baltimore, which “decided to go in another direction” after awarding Tesla a $5 million contract for a fleet of EVs for city employees.

News

Tesla launches new Model 3 financing deal with awesome savings

Tesla is now offering a 0.99% APR financing option for all new Model 3 orders in the United States, and it applies to all loan terms of up to 72 months.

Tesla has launched a new Model 3 financing deal in the United States that brings awesome savings. The deal looks to move more of the company’s mass-market sedan as it is the second-most popular vehicle Tesla offers, behind its sibling, the Model Y.

Tesla is now offering a 0.99% APR financing option for all new Model 3 orders in the United States, and it applies to all loan terms of up to 72 months.

It includes three Model 3 configurations, including the Model 3 Performance. The rate applies to:

- Model 3 Premium Rear-Wheel-Drive

- Model 3 Premium All-Wheel-Drive

- Model 3 Performance

The previous APR offer was 2.99%.

NEWS: Tesla has introduced 0.99% APR financing for all new Model 3 orders in the U.S. (applies to loan terms of up to 72 months).

This includes:

• Model 3 RWD

• Model 3 Premium RWD

• Model 3 Premium AWD

• Model 3 PerformanceTesla was previously offering 2.99% APR. pic.twitter.com/A1ZS25C9gM

— Sawyer Merritt (@SawyerMerritt) February 15, 2026

Tesla routinely utilizes low-interest offers to help move vehicles, especially as the rates can help get people to payments that are more comfortable with their monthly budgets. Along with other savings, like those on maintenance and gas, this is another way Tesla pushes savings to customers.

The company had offered a similar program in China on the Model 3 and Model Y vehicles, but it had ended on January 31.

The Model 3 was the second-best-selling electric vehicle in the United States in 2025, trailing only the Model Y. According to automotive data provided by Cox, Tesla sold 192,440 units last year of the all-electric sedan. The Model Y sold 357,528 units.

News

Tesla hasn’t adopted Apple CarPlay yet for this shocking reason

Many Apple and iPhone users have wanted the addition, especially to utilize third-party Navigation apps like Waze, which is a popular alternative. Getting apps outside of Tesla’s Navigation to work with its Full Self-Driving suite seems to be a potential issue the company will have to work through as well.

Perhaps one of the most requested features for Tesla vehicles by owners is the addition of Apple CarPlay. It sounds like the company wants to bring the popular UI to its cars, but there are a few bottlenecks preventing it from doing so.

The biggest reason why CarPlay has not made its way to Teslas yet might shock you.

According to Bloomberg‘s Mark Gurman, Tesla is still working on bringing CarPlay to its vehicles. There are two primary reasons why Tesla has not done it quite yet: App compatibility issues and, most importantly, there are incredibly low adoption rates of iOS 26.

Tesla’s Apple CarPlay ambitions are not dead, they’re still in the works

iOS 26 is Apple’s most recent software version, which was released back in September 2025. It introduced a major redesign to the overall operating system, especially its aesthetic, with the rollout of “Liquid Glass.”

However, despite the many changes and updates, Apple users have not been too keen on the iOS 26 update, and the low adoption rates have been a major sticking point for Tesla as it looks to develop a potential alternative for its in-house UI.

It was first rumored that Tesla was planning to bring CarPlay out in its cars late last year. Many Apple and iPhone users have wanted the addition, especially to utilize third-party Navigation apps like Waze, which is a popular alternative. Getting apps outside of Tesla’s Navigation to work with its Full Self-Driving suite seems to be a potential issue the company will have to work through as well.

According to the report, Tesla asked Apple to make some changes to improve compatibility between its software and Apple Maps:

“Tesla asked Apple to make engineering changes to Maps to improve compatibility. The iPhone maker agreed and implemented the adjustments in a bug fix update to iOS 26 and the latest version of CarPlay.”

Gurman also said that there were some issues with turn-by-turn guidance from Tesla’s maps app, and it did not properly sync up with Apple Maps during FSD operation. This is something that needs to be resolved before it is rolled out.

There is no listed launch date, nor has there been any coding revealed that would indicate Apple CarPlay is close to being launched within Tesla vehicles.