News

SpaceX wins new Falcon Heavy launch contract as rocket’s prospects stabilize

SpaceX has won a new Falcon Heavy launch contract from Swedish telecommunications company Ovzon, which hopes to procure a large geostationary communications satellite in time for launch in the fourth quarter of 2020.

Excluding two pending contracts, a consequence of the many years of delays suffered since SpaceX first began marketing the rocket, Ovzon’s commitment is now the fourth commercial contract secured by Falcon Heavy in 2019 and 2020, solidifying enough demand to sustain – on average – biannual launches over the next two or so years.

Ovzon signs agreement with SpaceX for first satellite launch – read the full release here: https://t.co/M9YWRCyp5L

In an important step towards growing our satellite service offering, Ovzon has entered into an agreement with SpaceX for launch of Ovzon’s first GEO satellite. pic.twitter.com/HfMfl9jnNV— Ovzon AB (@OvzonAB) October 16, 2018

Speaking at IAC 2018, SpaceX VP of Reliability Hans Koenigsmann was by no means wrong when he described the latent demand seen for Falcon Heavy launches, stating that “there aren’t too many customers for it”. Indeed, just three firm launch contracts over the next two years did not bode particularly well for Falcon Heavy as a competitive complement to SpaceX’s commercial launch business – without regular demand and assuming a competitive and fixed-price market, the cost of maintaining the infrastructure needed to build and fly a distinct launch vehicle will inevitably end up cannibalizing profitability or even the ability to break even.

For vehicles like ULA’s Delta IV Heavy, NASA’s SLS, or the late Space Shuttle, the unique capabilities offered by certain low-volume rockets or even just the risk of faltering can lead to situations where anchor customers will swallow huge cost premiums for the sake of simply preserving those capabilities. In non-competitive markets, it does not take much for nearly any capability to become essentially priceless. SpaceX, however, paid for Falcon Heavy’s development without seeking – and even actively turning down – most government development funding or guaranteed launch contracts.

- Falcon Heavy ahead of its inaugural launch. (SpaceX)

- The extraordinary might of Delta IV Heavy’s hydrolox-burning RS-68A engines, producing a combined 2.1 million pounds of thrust at liftoff. (Tom Cross)

A tough life for big birds

As such, Falcon Heavy’s utility and existence are in a far more precarious position than most rockets, owing to the fact that SpaceX would likely not hesitate to kill the vehicle if commercial demand rapidly withered to nothing, far from impossible with just three total launches contracted over a period of fewer than two years. Prior to the USAF announcing a new Falcon Heavy launch contract in June 2018, that number was just two secured launches. Combined with the USAF purchase, Ozvon’s new contract suggests that prospects for the super-heavy-lift rocket may be at least warm enough to sustain its useful existence.

SpaceX's Falcon Heavy manifest:

– Arabsat 6A (NET early 2019)

– STP-2 (NET 2019)

– AFSPC-52 (NET September 2020)

– Ovzon (NET Q4 2020)Pending confirmed payloads:

– Viasat

– Inmarsat— Michael Baylor (@MichaelBaylor_) October 16, 2018

There is also a decent chance that, once Falcon Heavy has proven itself with one or two real satellite launches, commercial launch customers will warm to its impressive capabilities. Most notably, Ozvon may have sided with Falcon Heavy solely because the powerful rocket can place its Ozvon-3 communications satellite directly into geostationary orbit (GEO), compared to the far more common process of launching the satellite roughly halfway there and letting it finish the journey on its own, known as geostationary transfer orbit (GTO) insertion.

There is undoubtedly significant commercial upside for geostationary communications satellites to arrive at their operational orbits as quickly as possible, rather than spending weeks or even months slowly making their way uphill from GTO. The cost of dedicated launches of Delta IV Heavy or Ariane 5 have far outweighed the benefits of earlier operability for as long as the rockets have been flying, though, and smaller and more affordable vehicles like Falcon 9, Atlas 5, or dual-manifested Ariane 5s simply aren’t powerful enough to launch traditionally-sized commsats directly to GEO.

- Falcon Heavy clears the top of the strongback in a spectacular fashion. Two of the rocket’s three manifested missions are now for the USAF. (Tom Cross)

- Falcon Heavy’s stunning dual side booster recovery. (SpaceX)

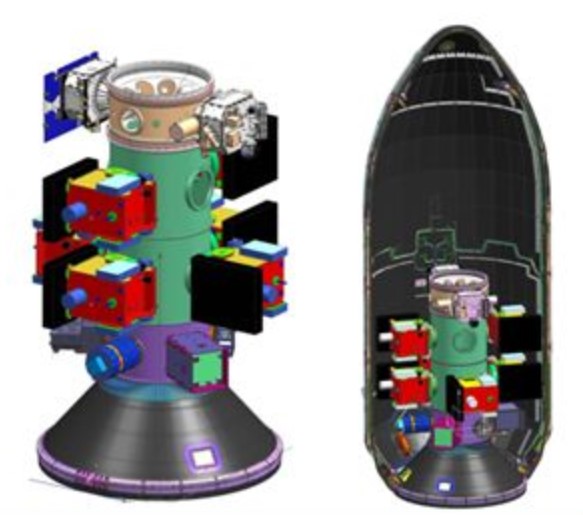

- SpaceX’s second Falcon Heavy launch will either be the USAF’s STP-2, a collection of smaller satellites, or Arabsat 6A, a large communications satellite. (USAF)

- The communications satellite Arabsat-6A. (Lockheed Martin)

In that regard, Falcon Heavy launches could become a commercial game changer and a distinct competitive advantage for companies that select it. Now with at least four launch contracts secured over the next ~24 months, Falcon Heavy will have a much better chance at demonstrating its true capabilities, potentially enabling military-premium launch services (~$250m+) at commercial-premium prices (~$90-150m). If it performs as intended in its next few launches, expected sometime in H1 2019, Falcon Heavy will be a strong contender for at least five additional USAF contracts as well as certain NASA missions scheduled to launch in the 2020s.

Experience with Falcon Heavy may only be tangentially beneficial at best to SpaceX’s greater BFR ambitions, but commercially, competitively, and reliably operating a rocket as large as FH for customers like the USAF and NASA would go a long, long way towards solidifying SpaceX’s perception as a ULA-equivalent launch provider for roughly half the cost.

For prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket recovery fleet check out our brand new LaunchPad and LandingZone newsletters!

Elon Musk

Why Tesla’s Q3 could be one of its biggest quarters in history

Tesla could stand to benefit from the removal of the $7,500 EV tax credit at the end of Q3.

Tesla has gotten off to a slow start in 2025, as the first half of the year has not been one to remember from a delivery perspective.

However, Q3 could end up being one of the best the company has had in history, with the United States potentially being a major contributor to what might reverse a slow start to the year.

Earlier today, the United States’ House of Representatives officially passed President Trump’s “Big Beautiful Bill,” after it made its way through the Senate earlier this week. The bill will head to President Trump, as he looks to sign it before his July 4 deadline.

The Bill will effectively bring closure to the $7,500 EV tax credit, which will end on September 30, 2025. This means, over the next three months in the United States, those who are looking to buy an EV will have their last chance to take advantage of the credit. EVs will then be, for most people, $7,500 more expensive, in essence.

The tax credit is available to any single filer who makes under $150,000 per year, $225,000 a year to a head of household, and $300,000 to couples filing jointly.

Ending the tax credit was expected with the Trump administration, as his policies have leaned significantly toward reliance on fossil fuels, ending what he calls an “EV mandate.” He has used this phrase several times in disagreements with Tesla CEO Elon Musk.

Nevertheless, those who have been on the fence about buying a Tesla, or any EV, for that matter, will have some decisions to make in the next three months. While all companies will stand to benefit from this time crunch, Tesla could be the true winner because of its sheer volume.

If things are done correctly, meaning if Tesla can also offer incentives like 0% APR, special pricing on leasing or financing, or other advantages (like free Red, White, and Blue for a short period of time in celebration of Independence Day), it could see some real volume in sales this quarter.

You can now buy a Tesla in Red, White, and Blue for free until July 14 https://t.co/iAwhaRFOH0

— TESLARATI (@Teslarati) July 3, 2025

Tesla is just a shade under 721,000 deliveries for the year, so it’s on pace for roughly 1.4 million for 2025. This would be a decrease from the 1.8 million cars it delivered in each of the last two years. Traditionally, the second half of the year has produced Tesla’s strongest quarters. Its top three quarters in terms of deliveries are Q4 2024 with 495,570 vehicles, Q4 2023 with 484,507 vehicles, and Q3 2024 with 462,890 vehicles.

Elon Musk

Tesla Full Self-Driving testing continues European expansion: here’s where

Tesla has launched Full Self-Driving testing in a fifth European country ahead of its launch.

Tesla Full Self-Driving is being tested in several countries across Europe as the company prepares to launch its driver assistance suite on the continent.

The company is still working through the regulatory hurdles with the European Union. They are plentiful and difficult to navigate, but Tesla is still making progress as its testing of FSD continues to expand.

Today, it officially began testing in a new country, as more regions open their doors to Tesla. Many owners and potential customers in Europe are awaiting its launch.

On Thursday, Tesla officially confirmed that Full Self-Driving testing is underway in Spain, as the company shared an extensive video of a trip through the streets of Madrid:

Como pez en el agua …

FSD Supervised testing in Madrid, Spain

Pending regulatory approval pic.twitter.com/txTgoWseuA

— Tesla Europe & Middle East (@teslaeurope) July 3, 2025

The launch of Full Self-Driving testing in Spain marks the fifth country in which Tesla has started assessing the suite’s performance in the European market.

Across the past several months, Tesla has been expanding the scope of countries where Full Self-Driving is being tested. It has already made it to Italy, France, the Netherlands, and Germany previously.

Tesla has already filed applications to have Full Self-Driving (Supervised) launched across the European Union, but CEO Elon Musk has indicated that this particular step has been the delay in the official launch of the suite thus far.

In mid-June, Musk revealed the frustrations Tesla has felt during its efforts to launch its Full Self-Driving (Supervised) suite in Europe, stating that the holdup can be attributed to authorities in various countries, as well as the EU as a whole:

Tesla Full Self-Driving’s European launch frustrations revealed by Elon Musk

“Waiting for Dutch authorities and then the EU to approve. Very frustrating and hurts the safety of people in Europe, as driving with advanced Autopilot on results in four times fewer injuries! Please ask your governing authorities to accelerate making Tesla safer in Europe.”

Waiting for Dutch authorities and then the EU to approve.

Very frustrating and hurts the safety of people in Europe, as driving with advanced Autopilot on results in four times fewer injuries!

Please ask your governing authorities to accelerate making Tesla safer in Europe. https://t.co/QIYCXhhaQp

— Elon Musk (@elonmusk) June 11, 2025

Tesla said last year that it planned to launch Full Self-Driving in Europe in 2025.

Elon Musk

xAI’s Memphis data center receives air permit despite community criticism

xAI welcomed the development in a post on its official xAI Memphis account on X.

Elon Musk’s artificial intelligence startup xAI has secured an air permit from Memphis health officials for its data center project, despite critics’ opposition and pending legal action. The Shelby County Health Department approved the permit this week, allowing xAI to operate 15 mobile gas turbines at its facility.

Air permit granted

The air permit comes after months of protests from Memphis residents and environmental justice advocates, who alleged that xAI violated the Clean Air Act by operating gas turbines without prior approval, as per a report from WIRED.

The Southern Environmental Law Center (SELC) and the NAACP has claimed that xAI installed dozens of gas turbines at its new data campus without acquiring the mandatory Prevention of Significant Deterioration (PSD) permit required for large-scale emission sources.

Local officials previously stated the turbines were considered “temporary” and thus not subject to stricter permitting. xAI applied for an air permit in January 2025, and in June, Memphis Mayor Paul Young acknowledged that the company was operating 21 turbines. SELC, however, has claimed that aerial footage shows the number may be as high as 35.

Critics are not giving up

Civil rights groups have stated that they intend to move forward with legal action. “xAI’s decision to install and operate dozens of polluting gas turbines without any permits or public oversight is a clear violation of the Clean Air Act,” said Patrick Anderson, senior attorney at SELC.

“Over the last year, these turbines have pumped out pollution that threatens the health of Memphis families. This notice paves the way for a lawsuit that can hold xAI accountable for its unlawful refusal to get permits for its gas turbines,” he added.

Sharon Wilson, a certified optical gas imaging thermographer, also described the emissions cloud in Memphis as notable. “I expected to see the typical power plant type of pollution that I see. What I saw was way worse than what I expected,” she said.

-

Elon Musk3 days ago

Elon Musk3 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News1 week ago

News1 week agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoxAI’s Grok 3 partners with Oracle Cloud for corporate AI innovation

-

News2 weeks ago

News2 weeks agoSpaceX and Elon Musk share insights on Starship Ship 36’s RUD

-

News2 weeks ago

News2 weeks agoWatch Tesla’s first driverless public Robotaxi rides in Texas

-

News2 weeks ago

News2 weeks agoTesla has started rolling out initial round of Robotaxi invites