SpaceX

SpaceX’s Starlink satellites may use unique solar array deployment mechanism

Spotted on an official SpaceX T-shirt commemorating Starlink’s first two prototype satellites and corroborated through analysis of limited public photos of the spacecraft, SpaceX appears to be testing a relatively unique style of solar arrays on the first two satellites launched into orbit, known as Tintin A (Alice) and B (Bob).

It’s difficult to judge anything concrete from the nature of what may be immature prototypes, but SpaceX’s decision to take a major step away from its own style of solar expertise – Cargo Dragon’s traditional rigid panel arrays – is almost certainly motivated by a need to push beyond the current state of the art of satellite design and production.

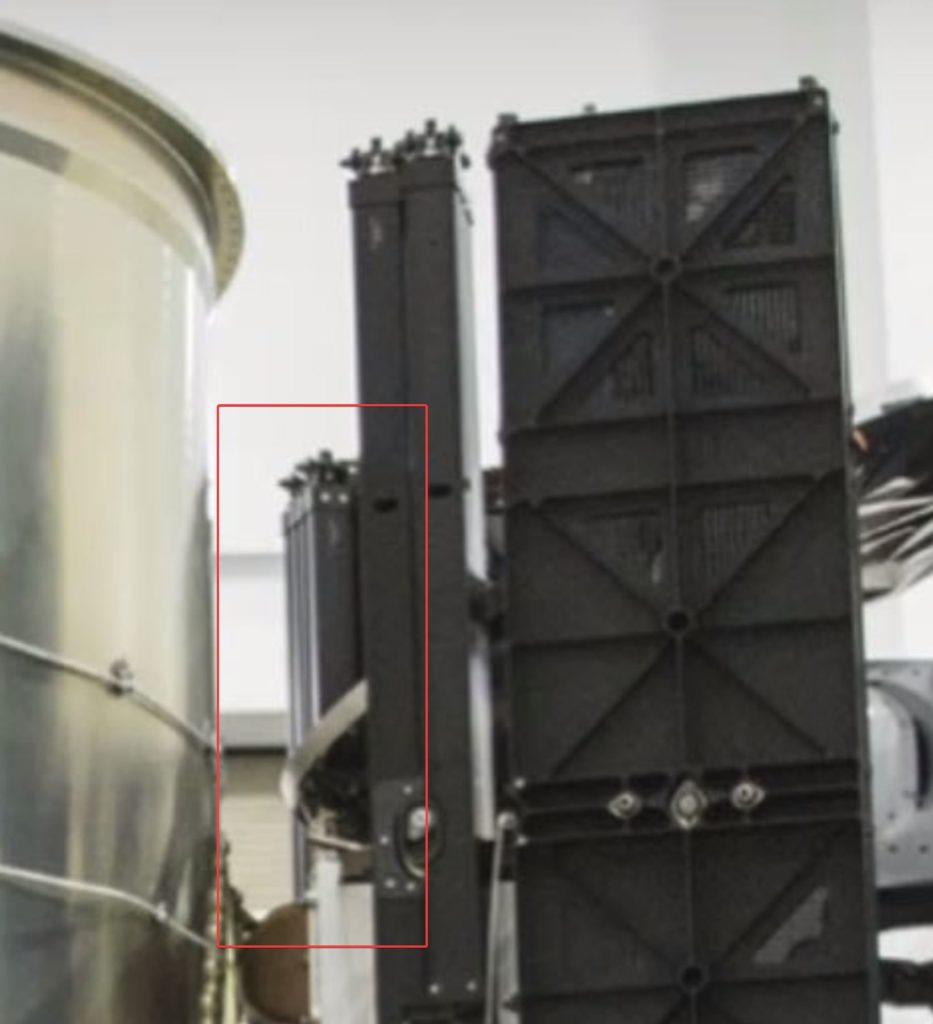

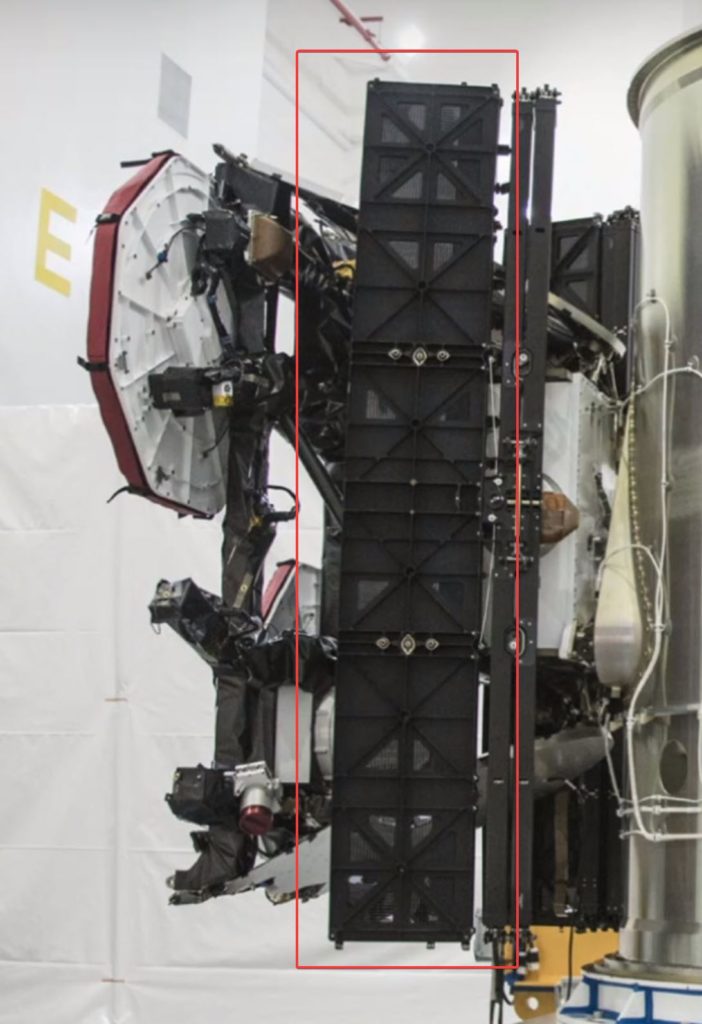

- The axis Tintin solar arrays would deploy along. (SpaceX)

- Just like a scissor mechanism, Tintin’s solar arrays have an extremely thin sandwich of what looks like four interlocking leaves. (SpaceX)

- If the thin structure is a scissor deployment mechanism, the wider black section would be a housing for wiring and the solar array panels, likely thin and flexible rectangles that fold out to reach their full 6m length. (SpaceX)

Unlike any discernible solar panel deployment mechanism with a flight history, SpaceX’s Starlink engineers seem to have taken a style of deployment used successfully on the International Space Station and mixed it with a modern style of solar arrays, relying on several flexible panels that can be efficiently packed together and designed to be extremely lightweight. While a major departure from SpaceX’s successful Cargo Dragon solar arrays, the mechanisms visible on the Tintins seem to have the potential to improve upon the packing efficiency, ease of manufacturing, and number of failure modes present on Dragon’s panels.

In essence, those three motivations are indicative of the challenges SpaceX’s Starlink program must solve in a more general sense. In order to even approach SpaceX’s operational aspirations for Starlink (i.e. high-speed internet delivered from space almost anywhere on Earth), the company will need to find ways to mass-produce hundreds or thousands of high-performance satellites annually at a price-per-unit unprecedented in the history of commercial satellites, all while keeping the weight and volume of each satellite as low as possible (no more than a few hundred kilograms).

To give an idea of where the industry currently stands, satellite internet provider Viasat launched its own Viasat-2 spacecraft in 2017. Weighing in around 6500 kg (14300 lb), the immense satellite cost at least $600 million and offers an instantaneous bandwidth of 300 gigabits per second, impressive but also gobsmackingly expensive at $2 million/Gbps. To ever hope to make Starlink a reality, SpaceX will need to beat that value by at least a factor of 5-10, producing Starlink satellites for no more than $1-3 million apiece ($4.5B-$13.5B alone to manufacture the initial 4,425 satellite constellation) with a bandwidth of 20 Gbps – baselined in official statements.

Compared to the state of the art, a $1 million satellite with optical (laser) interlinks, multiple phased array antennae, electric ion propulsion, two 1-2 kW solar arrays, and bandwidth on the order of 20 Gbps is – to put it nicely – wildly ambitious. Fundamentally, SpaceX will need to revolutionize design and mass-production of all of the above subcomponents, and perhaps the unfamiliar solar arrays present on the Tintin twins are a first step towards tackling at least one of those revolutions-in-waiting.

Will do another rev before final design

— Elon Musk (@elonmusk) May 27, 2018

According to CEO Elon Musk, another set of prototype satellites will likely be launched and tested in orbit before settling on a finalized Starlink design.

For prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket recovery fleet check out our brand new LaunchPad and LandingZone newsletters!

News

SpaceX launches Ax-4 mission to the ISS with international crew

The SpaceX Falcon 9 launched Axiom’s Ax-4 mission to ISS. Ax-4 crew will conduct 60+ science experiments during a 14-day stay on the ISS.

SpaceX launched the Falcon 9 rocket kickstarting Axiom Space’s Ax-4 mission to the International Space Station (ISS). Axiom’s Ax-4 mission is led by a historic international crew and lifted off from Kennedy Space Center’s Launch Complex 39A at 2:31 a.m. ET on June 25, 2025.

The Ax-4 crew is set to dock with the ISS around 7 a.m. ET on Thursday, June 26, 2025. Axiom Space, a Houston-based commercial space company, coordinated the mission with SpaceX for transportation and NASA for ISS access, with support from the European Space Agency and the astronauts’ governments.

The Ax-4 mission marks a milestone in global space collaboration. The Ax-4 crew, commanded by U.S. astronaut Peggy Whitson, includes Shubhanshu Shukla from India as the pilot, alongside mission specialists Sławosz Uznański-Wiśniewski from Poland and Tibor Kapu from Hungary.

“The trip marks the return to human spaceflight for those countries — their first government-sponsored flights in more than 40 years,” Axiom noted.

Shukla’s participation aligns with India’s Gaganyaan program planned for 2027. He is the first Indian astronaut to visit the ISS since Rakesh Sharma in 1984.

Axiom’s Ax-4 mission marks SpaceX’s 18th human spaceflight. The mission employs a Crew Dragon capsule atop a Falcon 9 rocket, designed with a launch escape system and “two-fault tolerant” for enhanced safety. The Axiom mission faced a few delays due to weather, a Falcon 9 leak, and an ISS Zvezda module leak investigation by NASA and Roscosmos before the recent successful launch.

As the crew prepares to execute its scientific objectives, SpaceX’s Ax-4 mission paves the way for a new era of inclusive space research, inspiring future generations and solidifying collaborative ties in the cosmos. During the Ax-4 crew’s 14-day stay in the ISS, the astronauts will conduct nearly 60 experiments.

“We’ll be conducting research that spans biology, material, and physical sciences as well as technology demonstrations,” said Whitson. “We’ll also be engaging with students around the world, sharing our experience and inspiring the next generation of explorers.”

SpaceX’s Ax-4 mission highlights Axiom’s role in advancing commercial spaceflight and fostering international partnerships. The mission strengthens global space exploration efforts by enabling historic spaceflight returns for India, Poland, and Hungary.

News

Starlink Cellular’s T-Mobile service to grow with third-party app data

From Oct 2025, T-Satellite will enable third-party apps in dead zones! WhatsApp, X, AccuWeather + more coming soon.

Starlink Cellular’s T-Mobile service will expand with third-party app data support starting in October, enhancing connectivity in cellular dead zones.

T-Mobile’s T-Satellite, supported by Starlink, launches officially on July 23. Following its launch, T-Mobile’s Starlink Cellular service will enable data access for third-party apps like WhatsApp, X, Google, Apple, AccuWeather, and AllTrails on October 1, 2025.

T-Mobile’s Starlink Cellular is currently in free beta. T-Satellite will add MMS support for Android phones on July 23, with iPhone support to follow. MMS support allows users to send images and audio clips alongside texts. By October, T-Mobile will extend emergency texting to all mobile users with compatible phones, beyond just T-Mobile customers, building on its existing 911 texting capability. The carrier also provides developer tools to help app makers integrate their software with T-Satellite’s data service, with plans to grow the supported app list.

T-Mobile announced these updates during an event celebrating an Ookla award naming it the best U.S. phone network, a remarkable turnaround from its last-place ranking a decade ago.

“We not only dream about going from worst to best, we actually do it. We’re a good two years ahead of Verizon and AT&T, and I believe that lead is going to grow,” said T-Mobile’s Chief Operating Officer Srini Gopalan.

T-Mobile unveiled two promotions for its Starlink Cellular services to attract new subscribers. A free DoorDash DashPass membership, valued at $10/month, will be included with popular plans like Experience Beyond and Experience More, offering reduced delivery and service fees. Meanwhile, the Easy Upgrade promotion targets Verizon customers by paying off their phone balances and providing flagship devices like the iPhone 16, Galaxy S25, or Pixel 9.

T-Mobile’s collaboration with SpaceX’s Starlink Cellular leverages orbiting satellites to deliver connectivity where traditional networks fail, particularly in remote areas. Supporting third-party apps underscores T-Mobile’s commitment to enhancing user experiences through innovative partnerships. As T-Satellite’s capabilities grow, including broader app integration and emergency access, T-Mobile is poised to strengthen its lead in the U.S. wireless market.

By combining Starlink’s satellite technology with strategic promotions, T-Mobile is redefining mobile connectivity. The upcoming third-party app data support and official T-Satellite launch mark a significant step toward seamless communication, positioning T-Mobile as a trailblazer in next-generation wireless services.

News

Starlink expansion into Vietnam targets the healthcare sector

Starlink aims to deliver reliable internet to Vietnam’s remote clinics, enabling telehealth and data sharing.

SpaceX’s Starlink expansion into Vietnam targets its healthcare sector. Through Starlink, SpaceX seeks to drive digital transformation in Vietnam.

On June 18, a SpaceX delegation met with Vietnam’s Ministry of Health (MoH) in Hanoi. SpaceX’s delegation was led by Andrew Matlock, Director of Enterprise Sales, and the discussions focused on enhancing connectivity for hospitals and clinics in Vietnam’s remote areas.

Deputy Minister of Health (MoH) Tran Van Thuan emphasized collaboration between SpaceX and Vietnam. Tran stated: “SpaceX should cooperate with the MoH to ensure all hospitals and clinics in remote areas are connected to the StarLink satellite system and share information, plans, and the issues discussed by members of the MoH. The ministry is also ready to provide information and send staff to work with the corporation.”

The MoH assigned its Department of Science, Technology, and Training to work with SpaceX. Starlink Vietnam will also receive support from Vietnam’s Department of International Cooperation. Starlink Vietnam’s agenda includes improving internet connectivity for remote healthcare facilities, developing digital infrastructure for health examinations and remote consultations, and enhancing operational systems.

Vietnam’s health sector is prioritizing IT and digital transformation, focusing on electronic health records, data centers, and remote medical services. However, challenges persist in deploying IT solutions in remote regions, prompting Vietnam to seek partnerships like SpaceX’s.

SpaceX’s Starlink has a proven track record in healthcare. In Rwanda, its services supported 40 health centers, earning praise for improving operations. Similarly, Starlink enabled remote consultations at the UAE’s Emirati field hospital in Gaza, streamlining communication for complex medical cases. These successes highlight Starlink’s potential to transform Vietnam’s healthcare landscape.

On May 20, SpaceX met with Vietnam’s Ministry of Industry and Trade, announcing a $1.5 billion investment to provide broadband internet, particularly in remote, border, and island areas. The first phase includes building 10-15 ground stations across the country. This infrastructure will support Starlink’s healthcare initiatives by ensuring reliable connectivity.

Starlink’s expansion in Vietnam aligns with the country’s push for digital transformation, as outlined by the MoH. By leveraging its satellite internet expertise, SpaceX aims to bridge connectivity gaps, enabling advanced healthcare services in underserved regions. This collaboration could redefine Vietnam’s healthcare infrastructure, positioning Starlink as a key player in the nation’s digital future.

-

Elon Musk1 week ago

Elon Musk1 week agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

Elon Musk3 days ago

Elon Musk3 days agoElon Musk confirms Grok 4 launch on July 9 with livestream event

-

Elon Musk17 hours ago

Elon Musk17 hours agoxAI launches Grok 4 with new $300/month SuperGrok Heavy subscription

-

News7 days ago

News7 days agoTesla Model 3 ranks as the safest new car in Europe for 2025, per Euro NCAP tests

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoA Tesla just delivered itself to a customer autonomously, Elon Musk confirms

-

Elon Musk1 week ago

Elon Musk1 week agoxAI’s Memphis data center receives air permit despite community criticism

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla’s Omead Afshar, known as Elon Musk’s right-hand man, leaves company: reports

-

News2 weeks ago

News2 weeks agoXiaomi CEO congratulates Tesla on first FSD delivery: “We have to continue learning!”