News

SpaceX’s first BFR manufacturing facility approved by the Port of LA

SpaceX has been given initial approval by the Port of Los Angeles to acquire and develop a massive vacant lot into a facility capable of manufacturing the first BFR prototypes and refurbishing the company’s reusable Falcon 9 boosters. This approval is without a doubt the biggest step forward yet for the company’s ultimate goal of sending massive spaceships to Mars.

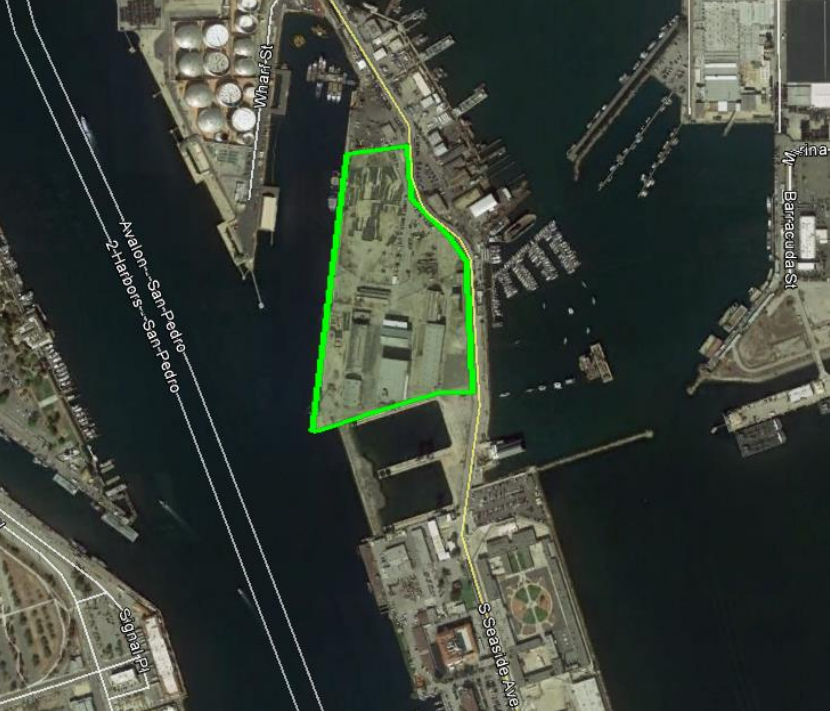

A request summary completed on March 6 details SpaceX’s proposal, laying out a bright future of rocket manufacturing for the abandoned 18-acre lot at Berth 240, one that might soon support “composite curing, cleaning, painting, and assembly [of commercial transportation vessels]” that “would need to be transported by water due to their size.” This description meshes almost perfectly with past discussion of BFR manufacturing plans from SpaceX executives like Elon Musk and Gwynne Shotwell, both of which have in the recent past affirmed the need for any BFR manufacturing facility to be located adjacent to a large body of water due to the difficulty of transporting rocket hardware as large as BFR.

- Might those cranes be refurbished? (Pauline Acalin)

- Teslarati photographer Pauline Acalin took a trip down to the Port to take a look at the vacant lot. (Pauline Acalin)

- An outline of the Port of San Pedro lot SpaceX hopes to develop. (Port of LA)

On March 15, around a week after the environmental impact assessment gave a green light for SpaceX’s facility, Port of Los Angeles’ Board of Harbor Commissioners approved the proposal, effectively giving SpaceX permission to begin serious demolition and construction activities at Berth 240, an abandoned lot located on the San Pedro side of the greater Port of Los Angeles, which refers to both Ports of San Pedro and Long Beach. To provide context, SpaceX’s primary manufacturing facilities in Hawthorne, CA occupy 10-15 acres of urban real estate – in other words, even partial development of Berth 240’s 18 acres would mark a huge expansion of the company’s available manufacturing and refurbishment space, an absolute necessity for the construction of a launch vehicle as large as BFR.

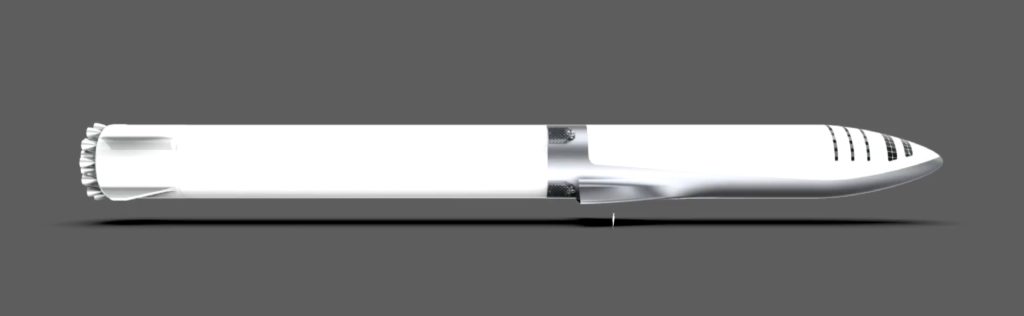

The construction of such a facility would make it significantly easier for SpaceX to build its first BFR/BFS prototypes, avoiding the massive disruption and cost that transporting the 9m-diameter vehicle through downtown LA. Rather than dealing with that nightmare, SpaceX would instead be able to simply crane an assembled booster or spaceship onto a barge (perhaps a drone ship?) that would then ship the rocket hardware through the Panama Canal to the company’s facilities in Cape Canaveral, FL or Boca Chica, TX.

Caught a glimpse of SpaceX’s upcoming Mars facility. @teslarati #SpaceX #BFR pic.twitter.com/hNWzIL5jeH

— Pauline Acalin (@w00ki33) March 19, 2018

While it is likely to take a fair amount of time to prepare the lot for the construction of a facility capable of manufacturing advanced composite rocket components, the wording in the Port documentation also suggests that SpaceX means to transfer its Falcon 9 recovery work to the new berth as soon as it’s available. Indeed, the comparatively massive space would give SpaceX far more room for recovery operations with the drone ship Just Read The Instructions (JRTI), and could potentially become a one-stop-shop for booster recovery and refurbishment. As of now, boosters recovered on the West Coast are transported to the Hawthorne factory for all refurbishment work, operations that themselves already require brief road stoppages to accommodate the sheer size of Falcon 9. As of 2018, SpaceX is planning for BFR to be 50% taller and close to three times as wide as Falcon 9 (350 feet long and 30 feet in diameter).

Although SpaceX is specifically named in the study, the company appears to have created a distinct LLC to lease the lot, referred to as “WW Marine Composites” by the authors. At the point of publishing, WW Marine Composites does at least appear to exist, but that is the sum of all info available on the circa-2016 LLC. This obscure, stealthy LLC appears to continue SpaceX’s habit of purchasing and leasing land through shell corporations, a common behavior of businesses thanks to its tax benefits and protection against liability. Finally, an additional document from December 2017 hints that SpaceX is still working closely with Janicki Industries, a globally-renowned carbon composite structures manufacturer that SpaceX tasked with the creation of the first 12m-diameter composite tank, revealed to the surprise of almost everyone in 2016 and soon after tested to destruction in 2017.

- SpaceX’s carbon fiber Starship tank prototype, revealed during Elon Musk’s 2016 IAC presentation. (SpaceX)

- SpaceX’s massive carbon fiber liquid oxygen tank seen testing in Northern Washington. BFR’s tankage will be 25% narrower, and thus easier to manufacture. (SpaceX)

- BFR’s booster and spaceship, tiny human for scale. (SpaceX)

Regardless, it will be exciting to watch SpaceX develop what will likely become its newest property acquisition. BFR is a massive rocket and will require commensurately massive manufacturing hardware, hardware that is likely to be spotted by any number of eagle-eyed SpaceX fans and observers in the LA area. Berth 240 may also uniquely lend itself to some incredible photos of the company’s progress, thanks in part to the fact that it’s all but surrounded by shoreline that is accessible to the public. Teslarati photographer Pauline Acalin visited the site just after receiving insight on the latest development to get a feel for the location.

It’s liable (and perhaps probable) to change, but curious observer can currently walk up right beside Berth 240, a location that might soon support SpaceX’s first BFR manufacturing. (Pauline Acalin)

Follow us for live updates, behind-the-scenes sneak peeks, and a sea of beautiful photos from our East and West coast photographers.

Teslarati – Instagram – Twitter

Tom Cross – Twitter

Pauline Acalin – Twitter

Eric Ralph – Twitter

Cybertruck

Tesla drops latest hint that new Cybertruck trim is selling like hotcakes

According to Tesla’s Online Design Studio, the new All-Wheel-Drive Cybertruck will now be delivered in April 2027. Earlier orders are still slated for early this Summer, but orders from here on forward are now officially pushed into next year:

Tesla’s new Cybertruck offering has had its delivery date pushed back once again. This is now the second time, and deliveries for the newest orders are now pushed well into 2027.

According to Tesla’s Online Design Studio, the new All-Wheel-Drive Cybertruck will now be delivered in April 2027. Earlier orders are still slated for early this Summer, but orders from here on forward are now officially pushed into next year:

🚨 Tesla has updated the $59,990 Cybertruck Dual Motor AWD’s estimated delivery date to April 2027.

First deliveries are still slated for June, but if you order it now, you’ll be waiting over a year.

Demand appears to be off the charts for the new Cybertruck and consumers are… pic.twitter.com/raDCCeC0zP

— TESLARATI (@Teslarati) February 26, 2026

Just three days ago, the initial delivery date of June 2026 was pushed back to early Fall, and now, that date has officially moved to April 2027.

The fact that Tesla has had to push back deliveries once again proves one of two things: either Tesla has slow production plans for the new Cybertruck trim, or demand is off the charts.

Judging by how Tesla is already planning to raise the price based on demand in just a few days, it seems like the company knows it is giving a tremendous deal on this spec of Cybertruck, and units are moving quickly.

That points more toward demand and not necessarily to slower production plans, but it is not confirmed.

Tesla Cybertruck’s newest trim will undergo massive change in ten days, Musk says

Tesla is set to hike the price on March 1, so tomorrow will be the final day to grab the new Cybertruck trim for just $59,990.

It features:

- Dual Motor AWD w/ est. 325 mi of range

- Powered tonneau cover

- Bed outlets (2x 120V + 1x 240V) & Powershare capability

- Coil springs w/ adaptive damping

- Heated first-row seats w/ textile material that is easy to clean

- Steer-by-wire & Four Wheel Steering

- 6’ x 4’ composite bed

- Towing capacity of up to 7,500 lbs

- Powered frunk

Interestingly, the price offering is fairly close to what Tesla unveiled back in late 2019.

Elon Musk

Elon Musk outlines plan for first Starship tower catch attempt

Musk confirmed that Starship V3 Ship 1 (SN1) is headed for ground tests and expressed strong confidence in the updated vehicle design.

Elon Musk has clarified when SpaceX will first attempt to catch Starship’s upper stage with its launch tower. The CEO’s update provides the clearest teaser yet for the spacecraft’s recovery roadmap.

Musk shared the details in recent posts on X. In his initial post, Musk confirmed that Starship V3 Ship 1 (SN1) is headed for ground tests and expressed strong confidence in the updated vehicle design.

“Starship V3 SN1 headed for ground tests. I am highly confident that the V3 design will achieve full reusability,” Musk wrote.

In a follow-up post, Musk addressed when SpaceX would attempt to catch the upper stage using the launch tower’s robotic arms.

“Should note that SpaceX will only try to catch the ship with the tower after two perfect soft landings in the ocean. The risk of the ship breaking up over land needs to be very low,” Musk clarified.

His remarks suggest that SpaceX is deliberately reducing risk before attempting a tower catch of Starship’s upper stage. Such a milestone would mark a major step towards the full reuse of the Starship system.

SpaceX is currently targeting the first Starship V3 flight of 2026 this coming March. The spacecraft’s V3 iteration is widely viewed as a key milestone in SpaceX’s long-term strategy to make Starship fully reusable.

Starship V3 features a number of key upgrades over its previous iterations. The vehicle is equipped with SpaceX’s Raptor V3 engines, which are designed to deliver significantly higher thrust than earlier versions while reducing cost and weight.

The V3 design is also expected to be optimized for manufacturability, a critical step if SpaceX intends to scale the spacecraft’s production toward frequent launches for Starlink, lunar missions, and eventually Mars.

News

Tesla FSD (Supervised) could be approved in the Netherlands next month: Musk

Musk shared the update during a recent interview at Giga Berlin.

Tesla CEO Elon Musk shared that Full Self-Driving (FSD) could receive regulatory approval in the Netherlands as soon as March 20, potentially marking a major step forward for Tesla’s advanced driver-assistance rollout in Europe.

Musk shared the update during a recent interview at Giga Berlin, noting that the date was provided by local authorities.

“Tesla has the most advanced real-world AI, and hopefully, it will be approved soon in Europe. We’re told by the authorities that March 20th, it’ll be approved in the Netherlands,’ what I was told,” Musk stated.

“Hopefully, that date remains the same. But I think people in Europe are going to be pretty blown away by how good the Tesla car AI is in being able to drive.”

Tesla’s FSD system relies on vision-based neural networks trained on real-world driving data, allowing vehicles to navigate using cameras and AI rather than traditional sensor-heavy solutions.

The performance of FSD Supervised has so far been impressive. As per Tesla’s safety report, Full Self-Driving Supervised has already traveled 8.3 billion miles. So far, vehicles operating with FSD Supervised engaged recorded one major collision every 5,300,676 miles.

In comparison, Teslas driven manually with Active Safety systems recorded one major collision every 2,175,763 miles, while Teslas driven manually without Active Safety recorded one major collision every 855,132 miles. The U.S. average during the same period was one major collision every 660,164 miles.

If approval is granted on March 20, the Netherlands could become the first European market to greenlight Tesla’s latest supervised FSD (Supervised) software under updated regulatory frameworks. Tesla has been working to secure expanded FSD access across Europe, where regulatory standards differ significantly from those in the United States. Approval in the Netherlands would likely serve as a foundation for broader EU adoption, though additional country-level clearances may still be required.