News

Tesla Battery Day can mean doomsday for legacy carmakers shifting to electric

Tesla is expected to hold its Battery Day in April as Elon Musk announced during the company’s Q4 earnings call. The chief executive said the company has a “compelling story” to tell about things that can “blow people’s minds.” These statements do not only pique the interest of the electric vehicle community; they also hint of updates that can spell disaster for legacy car manufacturers trying to catch up with Tesla in the electric vehicle market.

Batteries are key to staying on top of the electric vehicle segment and Tesla is the leader of the pack when it comes to batteries and energy efficiency. This has been validated by organizations such as Consumer Reports and even by competitors who go deep into their pockets and go as far as cutting their workforces to catch Tesla in terms of hardware, software, and battery technology.

Come Tesla Battery Day, the obvious would be made more obvious. Tesla could further widen the gap and set itself apart from the rest, not just as the maker of the Model 3, Model Y, Cybertruck or other vehicles in its lineup but as an energy company.

Mass Production Of Cheaper Batteries

Batteries are among the most expensive components of an electric vehicle. This is true for Tesla and other electric vehicle manufacturers. With pricey batteries, car manufacturers cannot lower prices of their vehicles and therefore cannot encourage the mass adoption of zero-emission cars.

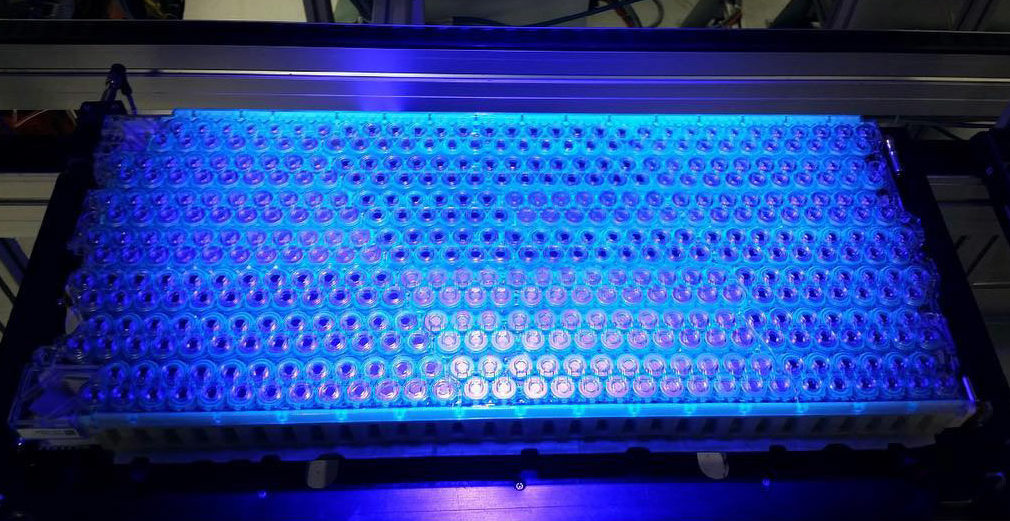

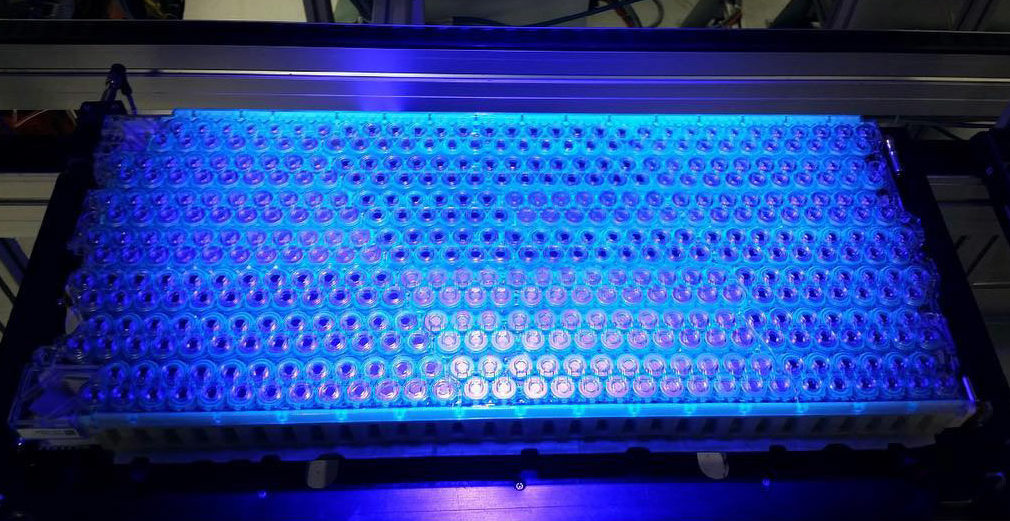

Tesla has reportedly been running its “Roadrunner” secret project that can lead to mass production of battery cells at $100/kWh. According to rumors, Tesla already has a pilot manufacturing line in its Fremont facility that can produce higher-density batteries using technology advancements developed in-house and gained through the Maxwell acquisition. With a $100/kWh battery, the prices of Tesla’s vehicles can be competitive even without government subsidies.

Aside from the Roadrunner project, Tesla has also been setting itself up to succeed in the battery game and dominate the market with its partnerships. It has a long relationship with Panasonic that helped it manufacture batteries in Giga Nevada, but has also signed battery supply agreements with LG Chem and CATL in China.

Battery prices have been going down significantly in the last decade. According to BloombergNEF, the cost of batteries dropped by 13% last year. From $1,100/kWh in 2010, the price went down to around $156.kWh in 2019. This is predicted to come close to the target $100/kWh by 2023. If Tesla achieves the $100/kWH cost sooner than the rest, it will give the company a massive advantage over its competitors and that will eventually lead to better profit margins.

Aside from cheaper batteries, the increased battery production capacity is also key in bringing products such as the all-electric Cybertruck and Tesla Semi to life.

“The thing we’re going to be really focused on is increasing battery production capacity because that’s very fundamental because if you don’t improve battery production capacity, then you end up just shifting unit volume from one product to another and you haven’t actually produced more electric vehicles… make sure we get a very steep ramp in battery production and continue to improve the cost per kilowatt-hour of the batteries,” Musk said during the Q4 2019 earnings call.

Enhanced Tesla Batteries

Tesla already has good batteries through its years of research, experimentation, and partnerships with battery producers. It has invested a good amount of money and effort to make sure it’s leading the battery game.

This advantage is made very clear on how Tesla was able to produce the most efficient electric SUV today in the form of the soon-to-be-released Model Y crossover with an EPA rating of 315 miles per single charge versus the Porsche Taycan with a range of around 200 miles.

With the acquired technologies from companies such as Maxwell and recently a possible purchase of a lithium-ion battery cell specialist startup in Colorado, Tesla demonstrates it’s not stopping its efforts to perfect its battery technology. Maxwell manufactures battery components and ultracapacitors and it’s just a matter of time before Tesla makes use of these technologies.

When asked about Maxwell’s ultracapacitor technology during the Q4 2019 earnings call, Musk said, “It’s an important piece of the puzzle.”

Musk also referenced the Maxwell acquisition during an extensive interview at the Third Row Podcast. “It’s kind of a big deal. Maxwell has a bunch of technologies that if they are applied in the right way I think can have a very big impact,” Musk said during a Third Row Podcast interview.

There are rumors out of China claiming that Tesla may come up with a battery that combines the best traits of Maxwell’s supercapacitors and dry electrode technologies. This could mean batteries that could charge faster, pack more energy density, and last longer.

Controlling Battery Supply

Knowing what works and what doesn’t for electric car batteries puts Tesla on top of the game. Of course, add to that what could be the best battery management system that makes Tesla vehicles among the most efficient if not the best in utilizing their batteries. With the advantage on hardware and software fronts, the thought of Tesla becoming a battery supplier is far from being a crazy idea.

Its competitors such as Audi and Jaguar have recently expressed concerns about their battery supplies as they both depend on LG Chem. Tesla– aside from its partnerships with Panasonic, LG Chem, and CATL — pushes the limit to develop its new battery cells in-house and that opens up a lot of possibilities for Tesla as a business.

“It would be consistent with the mission of Tesla to help other car companies with electric vehicles on the battery and powertrain front, possibly on other fronts. So it’s something we’re open to. We’re definitely open to supplying batteries and powertrains and perhaps other things to other car companies,” Musk was quoted as saying.

Recent job postings for a cell development engineer and equipment development engineers suggest that Tesla might actually be considering the idea of introducing a battery line of its own. But of course, the next-generation batteries would be first used for its vehicle lineup. Once it meets that demand and hits economies of scale, one can only imagine how Tesla could play the important role of supplying batteries to other carmakers.

Whether Tesla would announce cheaper batteries, enhanced electric car batteries, or give updates about its efforts, Battery Day in April will most definitely be worth the wait. For other car manufacturers, time would pause during that day as they listen to what Elon Musk and his team will say. And most likely, after the company talk, other car manufacturers will have to go back to their drawing boards once more in an attempt to catch up.

News

Tesla China breaks 8-month slump by selling 71,599 vehicles wholesale in June

Tesla China’s June numbers were released by the China Passenger Car Association (CPCA) on Tuesday.

Tesla China was able to sell 71,599 vehicles wholesale in June 2025, reversing eight consecutive months of year-over-year declines. The figure marks a 0.83% increase from the 71,599 vehicles sold wholesale in June 2024 and a 16.1% jump compared to the 61,662 vehicles sold wholesale in May.

Tesla China’s June numbers were released by the China Passenger Car Association (CPCA) on Tuesday.

Tesla China’s June results in focus

Tesla produces both the Model 3 and Model Y at its Shanghai Gigafactory, which serves as the company’s primary vehicle export hub. Earlier this year, Tesla initiated a changeover for its best-selling vehicle, the Model Y, resulting in a drop in vehicle sales during the first and second quarters.

Tesla’s second-quarter China sales totaled 191,720 units including exports. While these numbers represent a 6.8% year-over-year decline for Tesla China, Q2 did show sequential improvement, rising about 11% from Q1 2025, as noted in a CNEV Post report.

For the first half of the year, Tesla sold 364,474 vehicles wholesale. This represents a 14.6% drop compared to the 426,623 units sold wholesale in the first half of 2024.

China’s competitive local EV market

Tesla’s position in China is notable, especially as the new Model Y is gaining ground in the country’s BEV segment. That being said, Tesla is also facing competition from impressive local brands such as Xiaomi, whose new YU7 electric SUV is larger and more affordable than the Model Y.

The momentum of the YU7 is impressive, as the vehicle was able to secure 200,000 firm orders within three minutes and over 240,000 locked-in orders within 18 hours. Xiaomi’s previous model, the SU7 electric sedan, which is aimed at the Tesla Model 3, also remains popular, with June deliveries surpassing 25,000 units for the ninth straight month.

While China’s EV market is getting more competitive, Tesla’s new Model Y is also ramping its production and deliveries. Needless to say, Tesla China’s results for the remaining two quarters of 2025 will be very interesting.

Elon Musk

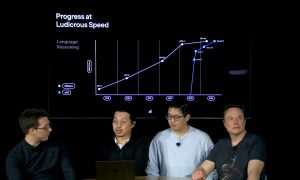

Tesla reveals it is using AI to make factories more sustainable: here’s how

Tesla is using AI in its Gigafactory Nevada factory to improve HVAC efficiency.

Tesla has revealed in its Extended Impact Report for 2024 that it is using Artificial Intelligence (AI) to enable its factories to be more sustainable. One example it used was its achievement of managing “the majority of the HVAC infrastructure at Gigafactory Nevada is now AI-controlled” last year.

In a commitment to becoming more efficient and making its production as eco-friendly as possible, Tesla has been working for years to find solutions to reduce energy consumption in its factories.

For example, in 2023, Tesla implemented optimization controls in the plastics and paint shops located at Gigafactory Texas, which increased the efficiency of natural gas consumption. Tesla plans to phase out natural gas use across its factories eventually, but for now, it prioritizes work to reduce emissions from that energy source specifically.

It also uses Hygrometric Control Logic for Air Handling Units at Giafactory Berlin, resulting in 17,000 MWh in energy savings each year. At Gigafactory Nevada, Tesla saves 9.5 GWh of energy through the use of N-Methylpyrrolidone refineries when extracting critical raw material.

Perhaps the most interesting way Tesla is conserving energy is through the use of AI at Gigafactory Nevada, as it describes its use of AI to reduce energy demand:

“In 2023, AI Control for HVAC was expanded from Nevada and Texas to now include our Berlin-Brandenburg and Fremont factories. AI Control policy enables HVAC systems within each factory to work together to process sensor data, model factory dynamics, and apply control actions that safely minimize the energy required to support production. In 2024, this system achieved two milestones: the majority of HVAC infrastructure at Gigafactory Nevada is now AI-controlled, reducing fan and thermal energy demand; and the AI algorithm was extended to manage entire chiller plants, creating a closed-loop control system that optimizes both chilled water consumption and the energy required for its generation, all while maintaining factory conditions.”

Tesla utilizes AI Control “primarily on systems that heat or cool critical factory production spaces and equipment.” AI Control communicates with the preexisting standard control logic of each system, and any issues can be resolved by quickly reverting back to standard control. There were none in 2024.

Tesla says that it is utilizing AI to drive impact at its factories, and it has proven to be a valuable tool in reducing energy consumption at one of its facilities.

Elon Musk

Tesla analysts believe Musk and Trump feud will pass

Tesla CEO Elon Musk and U.S. President Donald Trump’s feud shall pass, several bulls say.

Tesla analysts are breaking down the current feud between CEO Elon Musk and U.S. President Donald Trump, as the two continue to disagree on the “Big Beautiful Bill” and its impact on the country’s national debt.

Musk, who headed the Department of Government Efficiency (DOGE) under the Trump Administration, left his post in May. Soon thereafter, he and President Trump entered a very public and verbal disagreement, where things turned sour. They reconciled to an extent, and things seemed to be in the past.

However, the second disagreement between the two started on Monday, as Musk continued to push back on the “Big Beautiful Bill” that the Trump administration is attempting to sign into law. It would, by Musk’s estimation, increase spending and reverse the work DOGE did to trim the deficit.

Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their head in shame!

And they will lose their primary next year if it is the last thing I do on this Earth.

— Elon Musk (@elonmusk) June 30, 2025

President Trump has hinted that DOGE could be “the monster” that “eats Elon,” threatening to end the subsidies that SpaceX and Tesla receive. Musk has not been opposed to ending government subsidies for companies, including his own, as long as they are all abolished.

How Tesla could benefit from the ‘Big Beautiful Bill’ that axes EV subsidies

Despite this contentious back-and-forth between the two, analysts are sharing their opinions now, and a few of the more bullish Tesla observers are convinced that this feud will pass, Trump and Musk will resolve their differences as they have before, and things will return to normal.

ARK Invest’s Cathie Wood said this morning that the feud between Musk and Trump is another example of “this too shall pass:”

BREAKING: CATHIE WOOD SAYS — ELON AND TRUMP FEUD “WILL PASS” 👀 $TSLA

She remains bullish ! pic.twitter.com/w5rW2gfCkx

— TheSonOfWalkley (@TheSonOfWalkley) July 1, 2025

Additionally, Wedbush’s Dan Ives, in a note to investors this morning, said that the situation “will settle:”

“We believe this situation will settle and at the end of the day Musk needs Trump and Trump needs Musk given the AI Arms Race going on between the US and China. The jabs between Musk and Trump will continue as the Budget rolls through Congress but Tesla investors want Musk to focus on driving Tesla and stop this political angle…which has turned into a life of its own in a roller coaster ride since the November elections.”

Tesla shares are down about 5 percent at 3:10 p.m. on the East Coast.

-

Elon Musk2 days ago

Elon Musk2 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News7 days ago

News7 days agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

News2 weeks ago

News2 weeks agoTesla’s Grok integration will be more realistic with this cool feature

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTesla China roars back with highest vehicle registrations this Q2 so far

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

News2 weeks ago

News2 weeks agoTesla dominates Cars.com’s Made in America Index with clean sweep

-

Elon Musk1 week ago

Elon Musk1 week agoFirst Look at Tesla’s Robotaxi App: features, design, and more