Energy

Tesla co-founder’s battery recycling firm gets a cushy $700M investment round

Redwood Materials, a battery recycling company founded by Tesla co-founder J.B. Straubel, has announced a $700 million investment round from external investors. The round was led by funds and accounts advised by T. Rowe Price Associates, Inc., and includes contributions from Goldman Sachs Asset Management, Baillie Gifford, Canada Pension Plan Investment Board, and Fidelity. Additionally, Series B investors included Amazon’s Climate Pledge Fund, Capricorn’s Technology Impact Fund, Breakthrough Energy Ventures, Valor Equity Partners, Emerson Collective, and Franklin Templeton.

In an attempt to keep up with the growing market of car manufacturers and other transportation companies transitioning to electrification, Redwood knows that the demand for lithium-ion batteries and other materials crucial to their operation will need to be reused. Redwood’s ultimate goal is to create a “closed-loop supply chain for electric vehicles and energy products, making them truly sustainable and continuing to drive down the costs for batteries,” the company said.

Credit: Redwood Materials

After opening up a new facility near Tesla’s Gigafactory Nevada earlier this year, Redwood plans to expand its recycling efforts to make batteries more Earth-friendly and cost-effective, a plan that Straubel outlined.

“With this capital, Redwood will be able to accelerate our mission to make battery materials sustainable and affordable, accomplishing the change we need in the world with a circular economy,” Straubel, CEO of Redwood Materials, said. “We’re grateful for these strategic investors who bring decades of experience investing in and supporting companies that build transformative technology and who understand the mission and value of what Redwood is working to achieve.”

Battery manufacturing efforts are expanding through third-party suppliers and automotive manufacturers. Tesla is one of the most notable, holding several partnerships with companies like Panasonic, LG Chem, and CATL for its battery needs. Other companies, like Volkswagen, have also outlined massive battery cell manufacturing goals through the next decade and beyond, preparing for a large-scale offensive as the race for EVs continues.

However, Redwood’s recycling efforts would only improve the situation for these automakers. Instead of scraping hazardous materials from batteries after their lifespan ends, the batteries can be reused and implemented into packs after being recycled. Not only would this improve the availability of battery cells for carmakers, but it would also create a more sustainable environment in the battery manufacturing field and improve the cost of electric cars. The most expensive part of an electric vehicle is the battery pack, and due to the limited availability of battery cells, costs will only improve when more are available. With the production of new cells from various manufacturers and the recycling of old cells from companies like Redwood, costs will decrease, making electric vehicles more affordable in the long run.

“We are excited to begin this investment in the talented and accomplished team at Redwood as they expand their pursuit of building a world-class sustainable, closed-loop battery supply chain for electric vehicles,” T. Rowe Price Growth Stock Fund portfolio manager Joe Fath said. “In our view, the need for these materials will grow exponentially over time as we enter the era of de-carbonization. We believe Redwood is well-positioned to be at the forefront of tackling this emerging and critically important problem.”

Redwood’s current workload includes developing processes to produce battery materials that can be resold into the battery supply chain, making elements of the cell more readily available. Redwood has a currently active partnership with Panasonic at the Tesla Gigafactory in Nevada, along with other collaborations with Envision AESC in Tennessee, the company responsible for the Nissan LEAF battery packs, and Amazon for recycling lithium-ion batteries and other e-waste from their massive business.

Don’t hesitate to contact us with tips! Email us at tips@teslarati.com, or you can email me directly at joey@teslarati.com.

Energy

Tesla meets Giga New York’s Buffalo job target amid political pressures

Giga New York reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease.

Tesla has surpassed its job commitments at Giga New York in Buffalo, easing pressure from lawmakers who threatened the company with fines, subsidy clawbacks, and dealership license revocations last year.

The company reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease at the state-built facility.

As per an employment report reviewed by local media, Tesla employed 2,399 full-time workers at Gigafactory New York and 1,060 additional employees across the state at the end of 2025. Part-time roles pushed the total headcount of Tesla’s New York staff above the 3,460-job target.

The gains stemmed in part from a new Long Island service center, a Buffalo warehouse, and additional showrooms in White Plains and Staten Island. Tesla also said it has invested $350 million in supercomputing infrastructure at the site and has begun manufacturing solar panels.

Empire State Development CEO Hope Knight said the agency was “very happy” with Giga New York’s progress, as noted in a WXXI report. The current lease runs through 2029, and negotiations over updated terms have included potential adjustments to job requirements and future rent payments.

Some lawmakers remain skeptical, however. Assemblymember Pat Burke questioned whether the reported job figures have been fully verified. State Sen. Patricia Fahy has also continued to sponsor legislation that would revoke Tesla’s company-owned dealership licenses in New York. John Kaehny of Reinvent Albany has argued that the project has not delivered the manufacturing impact originally promised as well.

Knight, for her part, maintained that Empire State Development has been making the best of a difficult situation.

“(Empire State Development) has tried to make the best of a very difficult situation. There hasn’t been another use that has come forward that would replace this one, and so to the extent that we’re in this place, the fact that 2,000 families at (Giga New York) are being supported through the activity of this employer. It’s the best that we can have happen,” the CEO noted.

Energy

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

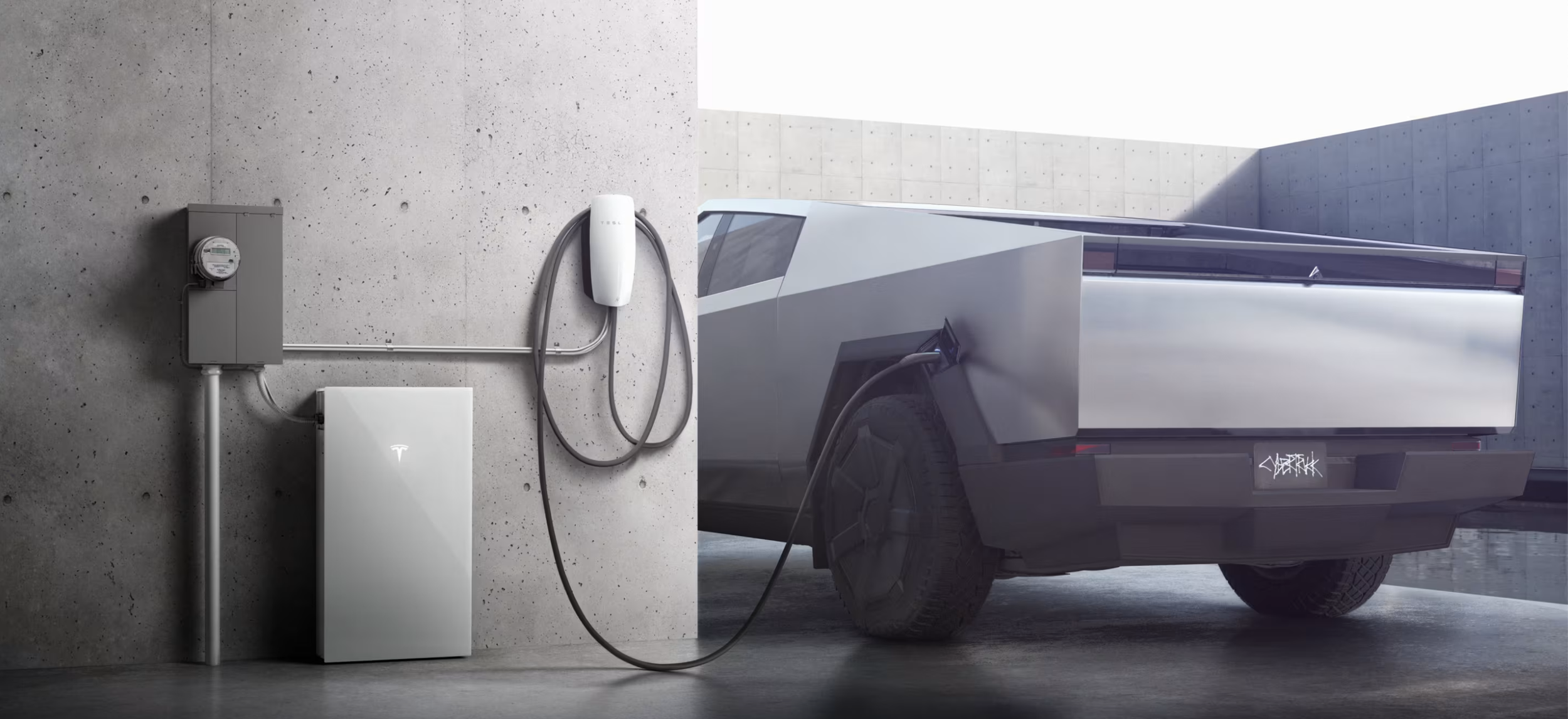

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.

Cybertruck

Tesla updates Cybertruck owners about key Powershare feature

Tesla is updating Cybertruck owners on its timeline of a massive feature that has yet to ship: Powershare with Powerwall.

Powershare is a bidirectional charging feature exclusive to Cybertruck, which allows the vehicle’s battery to act as a portable power source for homes, appliances, tools, other EVs, and more. It was announced in late 2023 as part of Tesla’s push into vehicle-to-everything energy sharing, and acting as a giant portable charger is the main advantage, as it can provide backup power during outages.

Cybertruck’s Powershare system supports both vehicle-to-load (V2L) and vehicle-to-home (V2H), making it flexible and well-rounded for a variety of applications.

However, even though the feature was promised with Cybertruck, it has yet to be shipped to vehicles. Tesla communicated with owners through email recently regarding Powershare with Powerwall, which essentially has the pickup act as an extended battery.

Powerwall discharge would be prioritized before tapping into the truck’s larger pack.

However, Tesla is still working on getting the feature out to owners, an email said:

“We’re writing to let you know that the Powershare with Powerwall feature is still in development and is now scheduled for release in mid-2026.

This new release date gives us additional time to design and test this feature, ensuring its ability to communicate and optimize energy sharing between your vehicle and many configurations and generations of Powerwall. We are also using this time to develop additional Powershare features that will help us continue to accelerate the world’s transition to sustainable energy.”

Owners have expressed some real disappointment in Tesla’s continuous delays in releasing the feature, as it was expected to be released by late 2024, but now has been pushed back several times to mid-2026, according to the email.

Foundation Series Cybertruck buyers paid extra, expecting the feature to be rolled out with their vehicle upon pickup.

Cybertruck’s Lead Engineer, Wes Morrill, even commented on the holdup:

As a Cybertruck owner who also has Powerwall, I empathize with the disappointed comments.

To their credit, the team has delivered powershare functionality to Cybertruck customers who otherwise have no backup with development of the powershare gateway. As well as those with solar…

— Wes (@wmorrill3) December 12, 2025

He said that “it turned out to be much harder than anticipated to make powershare work seamlessly with existing Powerwalls through existing wall connectors. Two grid-forming devices need to negotiate who will form and who will follow, depending on the state of charge of each, and they need to do this without a network and through multiple generations of hardware, and test and validate this process through rigorous certifications to ensure grid safety.”

It’s nice to see the transparency, but it is justified for some Cybertruck owners to feel like they’ve been bait-and-switched.