News

Tesla FSD’s vision-based approach critiqued by Waymo CEO: ‘Our sensors are orders of magnitude better’

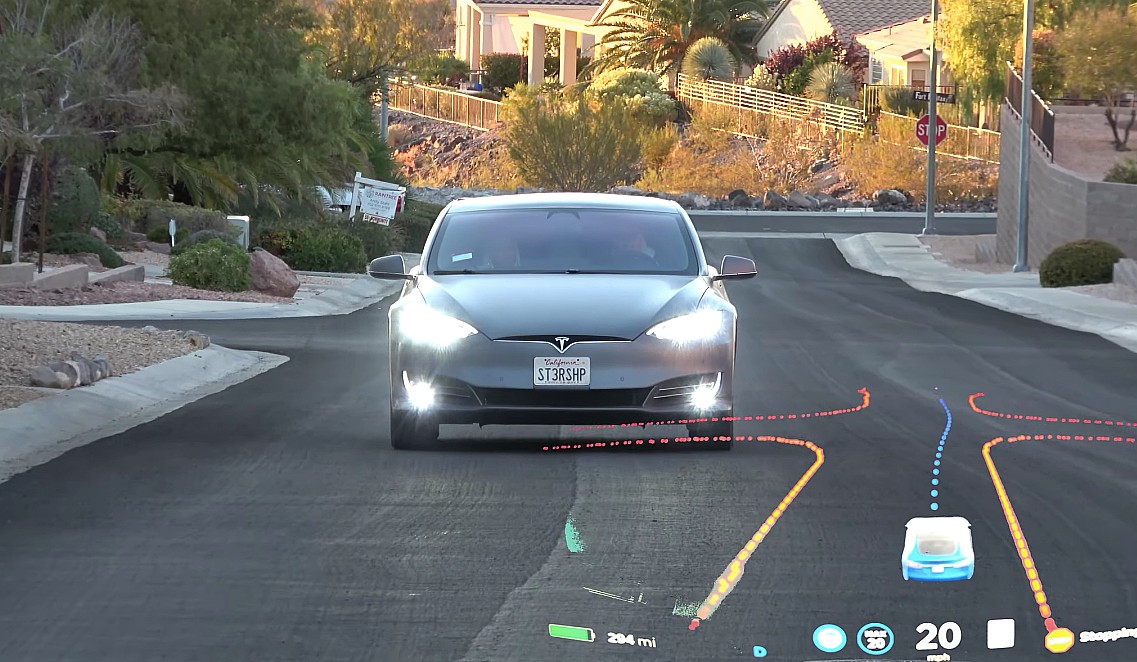

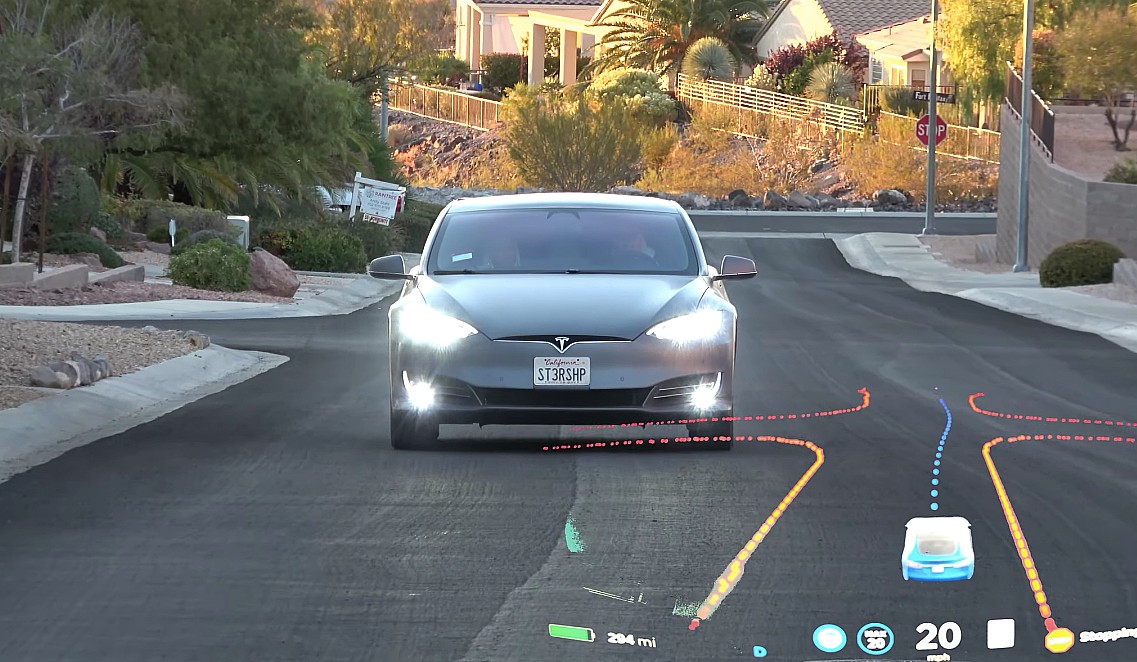

Tesla’s Full Self-Driving Beta may be improving at a rapid pace since its first iteration was released back in October, but Waymo CEO John Krafcik seems to be under the impression that there is a ceiling for the electric car maker’s current autonomous driving efforts. In an interview with German business publication manager magazin, Krafcik stated that Tesla is not a competitor to Waymo, as the EV maker’s tech is just a “really good driver assistance system.”

Waymo’s vehicles, which are equipped with a variety of sensors including LiDAR, are designed to be operated without a human driver. The company has even requested its passengers to not touch its autonomous cars’ steering wheel while the vehicles are operating. In comparison, Tesla’s Full Self-Driving Beta, as well as the company’s tech Navigate on Autopilot, still requires drivers to keep their hands on the steering wheel to prepare for manual intervention.

Tesla aims to develop a full self-driving suite through a vision-based system that relies on incremental improvements that are rolled out over time. Through constant updates that are built on real-world driving data gathered from its fleet, Tesla hopes to roll out a version of its FSD suite that would truly be a hands-off system. Once this is achieved, the EV maker aims to launch its own ride-hailing service, dubbed by Elon Musk as the Robotaxi Network.

This, according to the Waymo CEO, is a misconception. He also remarked that between Tesla’s camera-based approach and Waymo’s more robust sensor suite, his company’s sensors hold a massive advantage over Tesla’s electric cars. “It is a misconception that you can just keep developing a driver assistance system until one day you can magically leap to a fully autonomous driving system. In terms of robustness and accuracy, for example, our sensors are orders of magnitude better than what we see on the road from other manufacturers,” Krafcik said.

One of the notable arguments against Waymo’s autonomous vehicles is their cost, especially considering that their sensor suite includes expensive components. The CEO, however, notes that the cost of its vehicles is actually overestimated, especially as the price of sensors such as LiDAR has gotten significantly lower over the years. Today, Krafcik notes that the cost of a Waymo autonomous car is on the same ballpark as a moderately-equipped Mercedes-Benz S-Class.

“Let me paraphrase it like this: If we equip a Chrysler Pacifica Van or a Jaguar I-Pace with our sensors and computers, it costs no more than a moderately equipped Mercedes S-Class. So for the entire package, including the car – today. The costs for the technology are greatly overestimated – at least in our case” he said.

Krafcik noted that he expects the hardware cost per mile of Waymo’s autonomous vehicles to come in at around $0.30 per mile before maintenance and service costs, including fleet technicians and customer support representatives. In comparison, ride-hailing services today such as Uber and Lyft operate at around $2-$3 per mile. Tesla, on the other hand, expects an $0.18 per mile operating cost for its Robotaxi Network, as per the company’s estimates during its Autonomy Day presentation in 2019.

Don’t hesitate to contact us for news tips. Just send a message to tips@teslarati.com to give us a heads up.

News

Tesla launches in India with Model Y, showing pricing will be biggest challenge

Tesla finally got its Model Y launched in India, but it will surely come at a price for consumers.

Tesla has officially launched in India following years of delays, as it brought its Model Y to the market for the first time on Tuesday.

However, the launch showed that pricing is going to be its biggest challenge. The all-electric Model Y is priced significantly higher than in other major markets in which Tesla operates.

On Tuesday, Tesla’s Model Y went up for sale for 59,89,000 rupees for the Rear-Wheel Drive configuration, while the Long Range Rear-Wheel Drive was priced at 67,89,000.

This equates to $69,686 for the RWD and $78,994 for the Long Range RWD, a substantial markup compared to what these cars sell for in the United States.

🚨 Here’s the difference in price for the Tesla Model Y in the U.S. compared to India.

🚨 59,89,000 is $69,686

🚨 67,89,000 is $78,994 pic.twitter.com/7EUzyWLcED— TESLARATI (@Teslarati) July 15, 2025

Deliveries are currently scheduled for the third quarter, and it will be interesting to see how many units they can sell in the market at this price point.

The price includes tariffs and additional fees that are applied by the Indian government, which has aimed to work with foreign automakers to come to terms on lower duties that increase vehicle cost.

Tesla Model Y seen testing under wraps in India ahead of launch

There is a chance that these duties will be removed, which would create a more stable and affordable pricing model for Tesla in the future. President Trump and Indian Prime Minister Narendra Modi continue to iron out those details.

Maharashtra Chief Minister Devendra Fadnavis said to reporters outside the company’s new outlet in the region (via Reuters):

“In the future, we wish to see R&D and manufacturing done in India, and I am sure at an appropriate stage, Tesla will think about it.”

It appears to be eerily similar to the same “game of chicken” Tesla played with Indian government officials for the past few years. Tesla has always wanted to enter India, but was unable to do so due to these import duties.

India wanted Tesla to commit to building a Gigafactory in the country, but Tesla wanted to test demand first.

It seems this could be that demand test, and the duties are going to have a significant impact on what demand will actually be.

Elon Musk

Tesla ups Robotaxi fare price to another comical figure with service area expansion

Tesla upped its fare price for a Robotaxi ride from $4.20 to, you guessed it, $6.90.

Tesla has upped its fare price for the Robotaxi platform in Austin for the first time since its launch on June 22. The increase came on the same day that Tesla expanded its Service Area for the Robotaxi ride-hailing service, offering rides to a broader portion of the city.

The price is up from $4.20, a figure that many Tesla fans will find amusing, considering CEO Elon Musk has used that number, as well as ’69,’ as a light-hearted attempt at comedy over the past several years.

Musk confirmed yesterday that Tesla would up the price per ride from that $4.20 point to $6.90. Are we really surprised that is what the company decided on, as the expansion of the Service Area also took effect on Monday?

But the price is now a princely $6.90, as foretold in the prophecy 😂

— Elon Musk (@elonmusk) July 14, 2025

The Service Area expansion was also somewhat of a joke too, especially considering the shape of the new region where the driverless service can travel.

I wrote yesterday about how it might be funny, but in reality, it is more of a message to competitors that Tesla can expand in Austin wherever it wants at any time.

Tesla’s Robotaxi expansion wasn’t a joke, it was a warning to competitors

It was only a matter of time before the Robotaxi platform would subject riders to a higher, flat fee for a ride. This is primarily due to two reasons: the size of the access program is increasing, and, more importantly, the service area is expanding in size.

Tesla has already surpassed Waymo in Austin in terms of its service area, which is roughly five square miles larger. Waymo launched driverless rides to the public back in March, while Tesla’s just became available to a small group in June. Tesla has already expanded it, allowing new members to hail a ride from a driverless Model Y nearly every day.

The Robotaxi app is also becoming more robust as Tesla is adding new features with updates. It has already been updated on two occasions, with the most recent improvements being rolled out yesterday.

Tesla updates Robotaxi app with several big changes, including wider service area

News

Tesla Model Y and Model 3 dominate U.S. EV sales despite headwinds

Tesla’s two mainstream vehicles accounted for more than 40% of all EVs sold in the United States in Q2 2025.

Tesla’s Model Y and Model 3 remained the top-selling electric vehicles in the U.S. during Q2 2025, even as the broader EV market dipped 6.3% year-over-year.

The Model Y logged 86,120 units sold, followed by the Model 3 at 48,803. This means that Tesla’s two mainstream vehicles accounted for 43% of all EVs sold in the United States during the second quarter, as per data from Cox Automotive.

Tesla leads amid tax credit uncertainty and a tough first half

Tesla’s performance in Q2 is notable given a series of hurdles earlier in the year. The company temporarily paused Model Y deliveries in Q1 as it transitioned to the production of the new Model Y, and its retail presence was hit by protests and vandalism tied to political backlash against CEO Elon Musk. The fallout carried into Q2, yet Tesla’s two mass-market vehicles still outsold the next eight EVs combined.

Q2 marked just the third-ever YoY decline in quarterly EV sales, totaling 310,839 units. Electric vehicle sales, however, were still up 4.9% from Q1 and reached a record 607,089 units in the first half of 2025. Analysts also expect a surge in Q3 as buyers rush to qualify for federal EV tax credits before they expire on October 1, Cox Automotive noted in a post.

Legacy rivals gain ground, but Tesla holds its commanding lead

General Motors more than doubled its EV volume in the first half of 2025, selling over 78,000 units and boosting its EV market share to 12.9%. Chevrolet became the second-best-selling EV brand, pushing GM past Ford and Hyundai. Tesla, however, still retained a commanding 44.7% electric vehicle market share despite a 12% drop in in Q2 revenue, following a decline of almost 9% in Q1.

Incentives reached record highs in Q2, averaging 14.8% of transaction prices, roughly $8,500 per vehicle. As government support winds down, the used EV market is also gaining momentum, with over 100,000 used EVs sold in Q2.

Q2 2025 Kelley Blue Book EV Sales Report by Simon Alvarez on Scribd

-

News3 days ago

News3 days agoTesla debuts hands-free Grok AI with update 2025.26: What you need to know

-

Elon Musk1 week ago

Elon Musk1 week agoElon Musk confirms Grok 4 launch on July 9 with livestream event

-

Elon Musk5 days ago

Elon Musk5 days agoxAI launches Grok 4 with new $300/month SuperGrok Heavy subscription

-

News2 weeks ago

News2 weeks agoTesla Model 3 ranks as the safest new car in Europe for 2025, per Euro NCAP tests

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoxAI’s Memphis data center receives air permit despite community criticism

-

News5 days ago

News5 days agoTesla begins Robotaxi certification push in Arizona: report

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla reveals it is using AI to make factories more sustainable: here’s how

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla scrambles after Musk sidekick exit, CEO takes over sales