Investor's Corner

Tesla Motors is More Like NASA than GM

5, 4, 3, 2, 1, We Have Liftoff

I never get too excited or depressed about Tesla’s stock price. Stock analysts worry, and a lot. I can’t imagine how they ever sleep at night knowing that during those hours they are completely off the influence grid. Because Tesla went public it made a new bed and as a consequence, has at least two major challenges it must constantly consider.

- Build a new kind of personal transportation that must compete with a 100+ year old industrial age vertical

- Fund itself through a traditional stock market model while not making what that model values as part of their mission

Disclaimer: I own a modest number of Tesla shares and have for years, but it’s not my retirement plan and never will be. For me the primary investment is the Mission of Tesla, which for now means the Model S. I’ve owned one since June 2013.

The idea that someone would have the courage (and smarts) to start a car company from scratch and be able to differentiate it from all other automakers, as well as their products in every way, was extremely attractive to me. Others have tried, Tucker, DeLorean, but they were trying to compete with essentially the same formula. That rarely works out. In this case we have disruption and not the bullying kind which is what we often see in tech sector firms.

Car Guys are Wired that Way

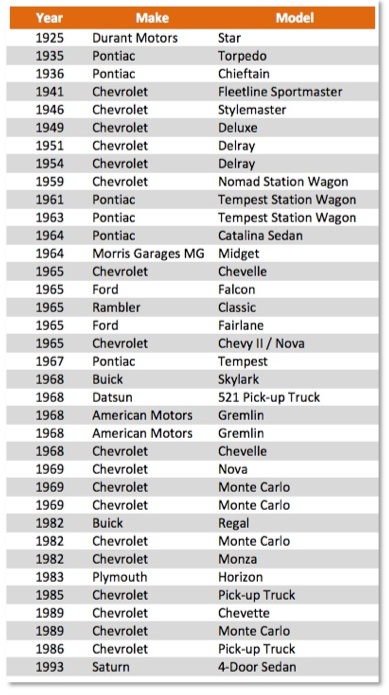

I was nearly born in a car. My mother used to regale me with the story of how she just barely made it to the hospital. Five more minutes and I would have emerged while in the back seat of a 1954 Chevrolet Delray. Growing up I was surrounded by relatives who raced cars, worked on automobile, both personal and commercial, and sold them to the public. I remember sitting in my Uncle’s Chevrolet sales room in Ohio while we were visiting one summer and seeing a sign that read, “A new Chevrolet is sold every minute.” Gasoline and oil ran through my veins and I inhaled more carbon monoxide helping my dad in the garage than was probably good for me. For the record, here’s a list of all the cars my father owned. I think it was all of them. The year column indicates when the car was manufactured, not when he purchased it.

Yes, there’s a very big gap between 1969 and 1982. Completely unexplained. Maybe we both failed to make entries in the diary. Never mind, it’s more fun to call “slacker.” We lost my father to cancer in 1992. He would have been proud to say he preceded his latest car in death by a full year. I frequently imagine what it would be like to pull up in his driveway with my Model S and take him for a ride.

As you can see, my father’s list is heavily weighted toward U.S. carmakers, especially GeneralMotors.The recent stories about how GM covered up defective parts for decades was disturbing to me as someone who rode in, drove and owned them as an adult. The last time I owned a GM car was 1989. I switched because I couldn’t afford to pay the maintenance fees.

Mission Control, We are Go for Launch

When President John F. Kennedy challenged America to “land a man on the moon and return him safely” in 1961, it was the catalyst for a series of missions meticulously planned and executed by NASA. Most had doubts we could do it successfully. The ones who believed worked at NASA. They developed a phased approach with three programs; Mercury, Gemini and Apollo. Mercury set out to successfully orbit the earth, study the ability to operate in space and recover both the astronaut and his craft. Gemini’s role was to study the effects of long term space missions on astronauts, perfect re-entry procedures and give astronauts extended practice time in a weightless environment. Once these were accomplished, the third program could begin. Apollo was about landing a man on the moon and returning him safely. I was enthralled with the space program growing up. I held my breath at every launch, was glued to the television for each mission and wondered what would come next.

When President John F. Kennedy challenged America to “land a man on the moon and return him safely” in 1961, it was the catalyst for a series of missions meticulously planned and executed by NASA. Most had doubts we could do it successfully. The ones who believed worked at NASA. They developed a phased approach with three programs; Mercury, Gemini and Apollo. Mercury set out to successfully orbit the earth, study the ability to operate in space and recover both the astronaut and his craft. Gemini’s role was to study the effects of long term space missions on astronauts, perfect re-entry procedures and give astronauts extended practice time in a weightless environment. Once these were accomplished, the third program could begin. Apollo was about landing a man on the moon and returning him safely. I was enthralled with the space program growing up. I held my breath at every launch, was glued to the television for each mission and wondered what would come next.

Palo Alto, We May Have a Problem

Tesla is on a similar path. They started with the Roadster as a commercial prototype that would tell them lots about the viability of an electric car. From that came the Model S, an amazing form of Personal Transportation that won Motor Trend’s Car of the Year in 2013 and was rated the safest automobile ever built in tests conducted by the National Highway Traffic Safety Administration (NHTSA) in the same year. I view the forthcoming Model X, a SUV version of the Model S, together as a stepping stone to the third stage; the Model III. A smaller, much more affordable car within reach of a large number of U.S. households. Assuming they can progress, the Model E will bring them closer to accomplishing the Tesla mission:

Tesla is on a similar path. They started with the Roadster as a commercial prototype that would tell them lots about the viability of an electric car. From that came the Model S, an amazing form of Personal Transportation that won Motor Trend’s Car of the Year in 2013 and was rated the safest automobile ever built in tests conducted by the National Highway Traffic Safety Administration (NHTSA) in the same year. I view the forthcoming Model X, a SUV version of the Model S, together as a stepping stone to the third stage; the Model III. A smaller, much more affordable car within reach of a large number of U.S. households. Assuming they can progress, the Model E will bring them closer to accomplishing the Tesla mission:

To accelerate the advent of sustainable transport by bringing compelling mass market electric cars to market as soon as possible.

The cost of the three NASA programs is hard to pin down, but many sources say that Mercury cost about cost $277 million in 1965 dollars, Gemini cost $1.3 Billion in 1967 dollars and Apollo $20.4 Billion in 1970 dollars. Obviously these number increase greatly when you convert them to today’s dollars. These missions were a stunning achievement and brought innovative technology to the private sector in numerous ways. In other words, we all gained benefit from these programs.

The point of quoting the cost figures is to bring perspective into the discussion. Today’s dollars always appear small when we look back a decade or two. The difference in these programs is that NASA was appropriated the funds from Congress, Tesla must navigate the murky waters of being a public company.

Elon Musk’s release of all of Tesla’s patents was a courageous move. He realizes that no single car company can deliver enough electric vehicles to make a real difference in the planet’s climate. The intellectual property is out there. Others can choose to assist or ignore.

BMW and Chevrolet have purchased, taken apart and reassembled the Model S in their war rooms. Why? Most likely to see how they can defeat Tesla. It’s a competitive game after all, including how Tesla sells its cars. A combined mission here, like the one NASA mounted would be an amazing feat of American collaborative engineering on a level never before achieved, this time on ground vehicles. Automakers coming together, including Tesla, could bring about a change much faster than we could even imagine. I know I’m describing a fantasy in the world of stocks and profits.

Can Tesla really do it? Well, they landed the real estate for the Gigafactory. A great start. I believe it can be done and am pulling for them to succeed. Actually more than pulling for them. I drive the car and and am an ambassador for the brand everyday. I wish them success, not just to disrupt, but to innovate on a grand scale. To change history. A chance like that doesn’t come along all that often.

Image Credits: NASA, Tesla Motors, ModelScoil.com

Originally posted on ModelScoil

Elon Musk

SpaceX IPO could push Elon Musk’s net worth past $1 trillion: Polymarket

The estimates were shared by the official Polymarket Money account on social media platform X.

Recent projections have outlined how a potential $1.75 trillion SpaceX IPO could generate historic returns for early investors. The projections suggest the offering would not only become the largest IPO in history but could also result in unprecedented windfalls for some of the company’s key investors.

The estimates were shared by the official Polymarket Money account on social media platform X.

As noted in a Polymarket Money analysis, Elon Musk invested $100 million into SpaceX in 2002 and currently owns approximately 42% of the company. At a $1.75 trillion valuation following SpaceX’s potential $1.75 trillion IPO, that stake would be worth roughly $735 billion.

Such a figure would dramatically expand Musk’s net worth. When combined with his holdings in Tesla Inc. and other ventures, a public debut at that level could position him as the world’s first trillionaire, depending on market conditions at the time of listing.

The Bloomberg Billionaires Index currently lists Elon Musk with a net worth of $666 billion, though a notable portion of this is tied to his TSLA stock. Tesla currently holds a market cap of $1.51 trillion, and Elon Musk’s currently holds about 13% to 15% of the company’s outstanding common stock.

Founders Fund, co-founded by Peter Thiel, invested $20 million in SpaceX in 2008. Polymarket Money estimates the firm owns between 1.5% and 3% of the private space company. At a $1.75 trillion valuation, that range would translate to approximately $26.25 billion to $52.5 billion in value.

That return would represent one of the most significant venture capital outcomes in modern Silicon Valley history, with a growth of 131,150% to 262,400%.

Alphabet Inc., Google’s parent company, invested $900 million into SpaceX in 2015 and is estimated to hold between 6% and 7% of the private space firm. At the projected IPO valuation, that stake could be worth between $105 billion and $122.5 billion. That’s a growth of 11,566% to 14,455%.

Other major backers highlighted in the post include Fidelity Investments, Baillie Gifford, Valor Equity Partners, Bank of America, and Andreessen Horowitz, each potentially sitting on multibillion-dollar gains.

Elon Musk

Elon Musk hints Tesla investors will be rewarded heavily

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet,” Musk said.

Elon Musk recently hinted that he believes Tesla investors will be rewarded heavily if they continue to hold onto their shares, and he reiterated that in a new interview that the company released on its social accounts this week.

Musk is one of the most successful CEOs in the modern era and has mammothed competitors on the Forbes Net Worth List over the past year as his holdings in his various companies have continued to swell.

Tesla investors, especially those who have been holding shares for several years, have also felt substantial gains in their portfolios. Over the past five years, the stock is up over 78 percent. Since February 2019, nearly seven years ago to the day, the stock is up over 1,800 percent.

Musk said in the interview:

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet.”

Elon Musk in new interview: “Hold on to your $TSLA stock. It’s going to be worth a lot, I think. That’s my bet.” pic.twitter.com/cucirBuhq0

— Sawyer Merritt (@SawyerMerritt) February 26, 2026

It’s no secret Musk has been extremely bullish on his own companies, but Tesla in particular, because it is publicly traded.

However, the company has so many amazing projects that have an opportunity to revolutionize their respective industries. There is certainly a path to major growth on Wall Street for Tesla through its various future projects, including Optimus, Cybercab, Semi, and Unsupervised FSD.

- Optimus (Tesla’s humanoid robot): Musk has discussed its potential for tasks like childcare, walking dogs, or assisting elderly parents, positioning it as a massive long-term driver of company value.

- Cybercab (Tesla’s robotaxi/autonomous ride-hailing vehicle): a fully autonomous vehicle geared specifically for Tesla’s ride-sharing ambitions.

- Semi (Tesla’s electric truck, with mentions of expansion, like in Europe): brings Tesla into the commercial logistics sector.

- Unsupervised FSD (Full Self-Driving software achieving full autonomy without human supervision): turns every Tesla owner’s vehicle into a fully-autonomous vehicle upon release

These projects specifically are some of the highest-growth pillars Tesla has ever attempted to develop, especially in Musk’s eyes, as he has said Optimus will be the best-selling product of all-time.

Many analysts agree, but the bullish ones, like Cathie Wood of ARK Invest, are perhaps the one who believes Tesla has incredible potential on Wall Street, predicting a $2,600 price target for 2030, but this is not even including Optimus.

She told Bloomberg last March that she believes that the project will present a potential additive if Tesla can scale faster than anticipated.

Elon Musk

Tesla stock gets latest synopsis from Jim Cramer: ‘It’s actually a robotics company’

“Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session,” Cramer said.

Tesla stock (NASDAQ: TSLA) got its latest synopsis from Wall Street analyst Jim Cramer, who finally realized something that many fans of the company have known all along: it’s not a car company. Instead, it’s a robotics company.

In a recent note that was released after Tesla reported Earnings in late January, Cramer seemed to recognize that the underwhelming financials and overall performance of the automotive division were not representative of the current state of affairs.

Instead, we’re seeing a company transition itself away from its early identity, essentially evolving like a caterpillar into a butterfly.

The narrative of the Earnings Call was simple: We’re not a car company, at least not from a birds-eye view. We’re an AI and Robotics company, and we are transitioning to this quicker than most people realize.

Tesla stock gets another analysis from Jim Cramer, and investors will like it

Tesla’s Q4 Earnings Call featured plenty of analysis from CEO Elon Musk and others, and some of the more minor details of the call were even indicative of a company that is moving toward AI instead of its cars. For example, the Model S and Model X will be no more after Q2, as Musk said that they serve relatively no purpose for the future.

Instead, Tesla is shifting its focus to the vehicles catered for autonomy and its Robotaxi and self-driving efforts.

Cramer recognizes this:

“…we got results from Tesla, which actually beat numbers, but nobody cares about the numbers here, as electric vehicles are the past. And according to CEO Elon Musk, the future of this company comes down to Cybercabs and humanoid robots. Stock fell more than 3% the next day. That may be because their capital expenditures budget was higher than expected, or maybe people wanted more details from the new businesses. At this point, I think Musk acolytes might be more excited about SpaceX, which is planning to come public later this year.”

He continued, highlighting the company’s true transition away from vehicles to its Cybercab, Optimus, and AI ambitions:

“I know it’s hard to believe how quickly this market can change its attitude. Last night, I heard a disastrous car company speak. Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session. I didn’t like it as a car company. Boy, I love it as a Cybercab and humanoid robot juggernaut. Call me a buyer and give me five robots while I’m at it.”

Cramer’s narrative seems to fit that of the most bullish Tesla investors. Anyone who is labeled a “permabull” has been echoing a similar sentiment over the past several years: Tesla is not a car company any longer.

Instead, the true focus is on the future and the potential that AI and Robotics bring to the company. It is truly difficult to put Tesla shares in the same group as companies like Ford, General Motors, and others.

Tesla shares are down less than half a percent at the time of publishing, trading at $423.69.