Energy

Tesla partner Panasonic says 30% energy density increase in lithium-ion batteries possible

The market for lithium-ion batteries (LIBs) is expected to exceed $33 billion by 2019 and $26 billion by 2023, according to global market research firm SIS International Research. The success of Tesla and its Nevada-based Gigafactory facility has generated a lot of excitement in the LIB industry. Panasonic’s automobile battery sales are forecast to grow to $4 billion a year by March 2019, largely due to their partnership with Tesla.

“We think the existing technology can still extend the energy density of LIBs by 20% to 30%,” Panasonic’s President Kazuhiro Tsuga said. “But there is a trade-off between energy density and safety. So, if you look for even more density, you have to think about additional safety technology as well. Solid-state batteries are one [possible] answer.” These safety concerns about LIBs are also pushing Panasonic to look at alternative battery power sources.

Solid state batteries use a solid electrolyte instead of the electrolytic solution that is essential in transporting the positive lithium ions between the cathode and anode in today’s batteries. Researchers have succeeded in developing an efficient electrolytic solid material that significantly improves lithium ion conductance, raising hopes that batteries with much higher power densities are edging closer to practical applications.

“For decades now we have been pushing the limits of our Li-ion batteries in terms of energy density,” Naoaki Yabuuchi, an associate professor at Tokyo Denki University, acknowledged. “Today’s best Li-ion cells can put out about 300 watts per kilogram; a package of Li-ion cells can give off from 150 watts to 250 watts per kilogram. These levels are already close to the theoretical maximum.”

Yabuuchi is an expert on various types of rechargeable batteries. In his view, LIBs will reach the limit of their desirability as early as the first half of 2020 if their development continues to rely on existing technologies. But he has hope that new research can open up more capacity. “Existing LIBs still have room to improve their energy density because you can raise the density by introducing a nickel-based cathode material, so you can expect the batteries will still be used in the next few years.”

It’s not just Tesla and its partners like Panasonic that are interested in LIB capacity. Range anxiety continues to plague possible Tesla and other EV brand buyers, as they fear an inability to travel far enough between vehicle charges and not having access to convenient charging facilities. “We want our electric cars to go 500 km [on a single charge],” said Shinji Nakanishi, a battery researcher at Toyota, via EVannex. “And for this, we want rechargeable batteries that can generate 800 to 1,000 watt-hours per liter.”

Battery research into alternatives to LIBs is quickly evolving. The Battery Symposium in Japan, once a showcase for fuel cells and LIB cathode materials, has seen a significant shift in recent years to industry presentations on solid-state, lithium-air, and non-Li-ion batteries.

Another possible LIB alternative, lithium-air batteries, has the ability to greatly improve energy density. At this point, however, researchers are stymied because lithium-air batteries suffer from poor cycle life. But researchers haven’t given up hope. They’ve been attempting to raise the density close to theoretically expected levels, even if it occurs only for a single charge cycle.

And an entirely different alternative to the LIB doesn’t even use lithium: a cathode material for the sodium-ion battery has a discharge capacity that beats LIBs and enables the power packs to be recharged upward of 500 times. That would circumvent one of the existing weakness that now limits this technology. Two nickel-based cathode materials, lithium nickel cobalt aluminum oxide and lithium nickel manganese cobalt oxide, are sometimes mentioned in these discussions, but neither seem to have a clear potential for practical use within the next decade, according to Yabuuchi.

Tesla is leading the global shift in the automotive industry from traditional gasoline powered vehicles to more fuel-efficient, environmentally responsible modes of transport. Musk has exclaimed that the 2170 cell is “the highest energy density cell in the world and also the cheapest.” Yet, as an industry disrupter, part of Tesla’s vision has been to constantly evaluate new battery technologies. Back in 2013, Ted Merendino, a Tesla product planner, noted that “Tesla has one of the largest cell characterization laboratories in the world. We have just about every cell you can imagine on test.”

That constant inquiry behind the scenes into cell characterization at Tesla may become prudent in previously unforeseen ways. Recently, for example, with the lithium market in its most severe shortage in modern memory, Musk insisted that the amount of lithium in a LIB is about 2% of its total volume and that “lithium in a salt form is virtually everywhere… there is definitely no supply issues with lithium.” Some in the industry disagree with lithium’s resource stability, however, so that alternative battery research may end up offering good karma.

In 2016, sales of LIBs for electric vehicles increased by some 66%, up from 12.3 GWh of capacity to 20.4 GWh. LIBs are the go-to source for EV power right now. Many other products use LIBs: chainsaws, mini-cameras, solar window chargers, wheelchairs, bicycles, portable self-charging desks.

But, with safety issues surrounding LIBs, the limitations of their charge capacity, and lithium market limitations, will Tesla invest in R&D toward alternative battery development so it sooner-than-later adds battery alternatives to its catalog?

Of course, advances from R&D take years to make their way to the marketplace, but should one or more of these promising technologies be translated for commercial means, then we may see innovative improvements in batteries, which could also enhance the performance and cost of our beloved Teslas.

Source: Nikkei Asian Review via EVannex

Energy

Tesla Energy gains UK license to sell electricity to homes and businesses

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

Tesla Energy has received a license to supply electricity in the United Kingdom, opening the door for the company to serve homes and businesses in the country.

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

According to Ofgem, the license took effect at 6 p.m. local time on Wednesday and applies to Great Britain.

The approval allows Tesla’s energy business to sell electricity directly to customers in the region, as noted in a Bloomberg News report.

Tesla has already expanded similar services in the United States. In Texas, the company offers electricity plans that allow Tesla owners to charge their vehicles at a lower cost while also feeding excess electricity back into the grid.

Tesla already has a sizable presence in the UK market. According to price comparison website U-switch, there are more than 250,000 Tesla electric vehicles in the country and thousands of Tesla home energy storage systems.

Ofgem also noted that Tesla Motors Ltd., a separate entity incorporated in England and Wales, received an electricity generation license in June 2020.

The new UK license arrives as Tesla continues expanding its global energy business.

Last year, Tesla Energy retained the top position in the global battery energy storage system (BESS) integrator market for the second consecutive year. According to Wood Mackenzie’s latest rankings, Tesla held about 15% of global market share in 2024.

The company also maintained a dominant position in North America, where it captured roughly 39% market share in the region.

At the same time, competition in the energy storage sector is increasing. Chinese companies such as Sungrow have been expanding their presence globally, particularly in Europe.

Energy

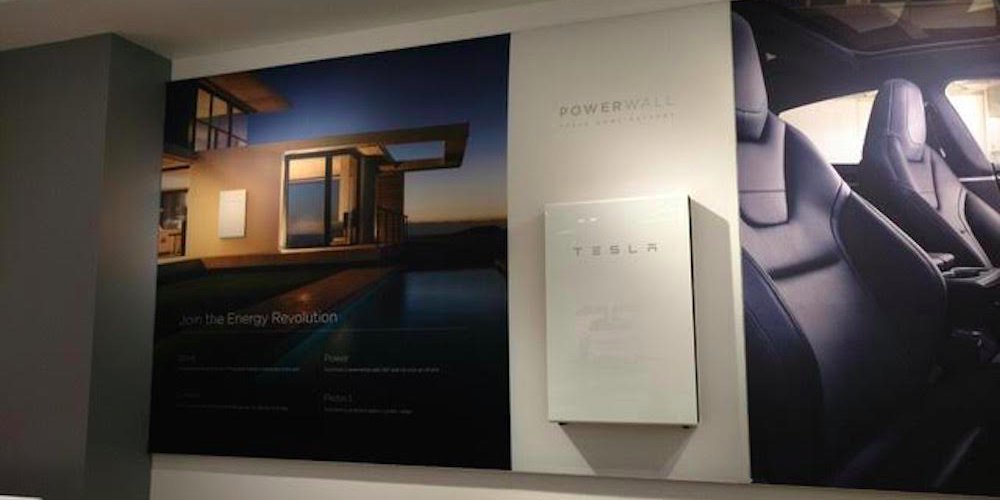

Tesla Powerwall distribution expands in Australia

Inventory is expected to arrive in late February and official sales are expected to start mid-March 2026.

Supply Partners Group has secured a distribution agreement for the Tesla Powerwall in Australia, with inventory expected to arrive in late February and official sales beginning in mid-March 2026.

Under the new agreement, Supply Partners will distribute Tesla Powerwall units and related accessories across its national footprint, as noted in an ecogeneration report. The company said the addition strengthens its position as a distributor focused on premium, established brands.

“We are proud to officially welcome Tesla Powerwall into the Supply Partners portfolio,” Lliam Ricketts, Co-Founder and Director of Innovation at Supply Partners Group, stated.

“Tesla sets a high bar, and we’ve worked hard to earn the opportunity to represent a brand that customers actively ask for. This partnership reflects the strength of our logistics, technical services and customer experience, and it’s a win for installers who want premium options they can trust.”

Supply Partners noted that initial Tesla Powerwall stock will be warehoused locally before full commercial rollout in March. The distributor stated that the timing aligns with renewed growth momentum for the Powerwall, supported by competitive installer pricing, consumer rebates, and continued product and software updates.

“Powerwall is already a category-defining product, and what’s ahead makes it even more compelling,” Ricketts stated. “As pricing sharpens and capability expands, we see a clear runway for installers to confidently spec Powerwall for premium residential installs, backed by Supply Partners’ national distribution footprint and service model.”

Supply Partners noted that a joint go-to-market launch is planned, including Tesla-led training for its sales and technical teams to support installers during the home battery system’s domestic rollout.

Energy

Tesla Megapack Megafactory in Texas advances with major property sale

Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet.

Tesla’s planned Megapack factory in Brookshire, Texas has taken a significant step forward, as two massive industrial buildings fully leased to the company were sold to an institutional investor.

In a press release, Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet. The properties are 100% leased to Tesla under a long-term agreement and were acquired by BGO on behalf of an institutional investor.

The two facilities, located at 100 Empire Boulevard in Brookshire, Texas, will serve as Tesla’s new Megafactory dedicated to manufacturing Megapack battery systems.

According to local filings previously reported, Tesla plans to invest nearly $200 million into the site. The investment includes approximately $44 million in facility upgrades such as electrical, utility, and HVAC improvements, along with roughly $150 million in manufacturing equipment.

Building 9, spanning roughly 1 million square feet, will function as the primary manufacturing floor where Megapacks are assembled. Building 10, covering approximately 600,000 square feet, will be dedicated to warehousing and logistics operations, supporting storage and distribution of completed battery systems.

Waller County Commissioners have approved a 10-year tax abatement agreement with Tesla, offering up to a 60% property-tax reduction if the company meets hiring and investment targets. Tesla has committed to employing at least 375 people by the end of 2026, increasing to 1,500 by the end of 2028, as noted in an Austin County News Online report.

The Brookshire Megafactory will complement Tesla’s Lathrop Megafactory in California and expand U.S. production capacity for the utility-scale energy storage unit. Megapacks are designed to support grid stabilization and renewable-energy integration, a segment that has become one of Tesla’s fastest-growing businesses.