Investor's Corner

Tesla could see a ~40% rally, but that doesn’t mean it’s a ‘Buy,’ claims analyst

In a rather interesting episode of CNBC‘s Trading Nation, Oppenheimer technical analyst Ari Wald mentioned that Tesla stock (NASDAQ:TSLA) could be poised to see some recovery. Despite this, the analyst mentioned during his segment that he does not consider Tesla stock a “Buy.”

The Oppenheimer analyst argued that Tesla stock has been notably volatile to the point where its price direction is nearly aimless. In the past 12 months alone, Tesla shares swung from prices as high as $387 per share to as low as $244.59 per share. With $250 being a big support range level, Wald estimated that TSLA shares could swing back to $360 per share.

“This is one we’ve been on the sidelines with, avoiding both on the long end and short side, just given how directionless and choppy it’s been, and that’s still the case. It’s paid to buy it when it’s ugly and sell it when it starts to look good, so with that in mind, it probably looks more positive than not, just considering how bad it’s performed; $250 is the big support range level, $360 is the upside there,” the analyst said.

If Tesla does move back to the $360 per share level, it will represent a nearly 40% upside from Monday’s $260.42 close. Yet, despite the potential recovery, Wald stated that this does not mean TSLA is a “Buy.” “You can see the flat 200-day that exemplifies that directionless action. If we allocate toward stocks that trend, this isn’t one of them,” he noted.

Tesla stock has been weighed down recently partly due to concerns over the Model 3’s alleged “meager” demand and the ongoing issues between CEO Elon Musk and the Securities and Exchange Commission (SEC). On Monday alone, RBC analyst Joseph Spak slashed his price target on Tesla by $35 to $210 each. JMP Securities analyst Joseph Osha also trimmed his price target for Tesla by 3% to $394 per share. Both analysts cited reservations over the Model 3’s demand this first quarter as among the drivers behind their more conservative estimates.

Tesla, for its part, appears to be drawing the curtains back for some good news. On Monday, Tesla proved victorious after a judge dismissed a lawsuit claiming that the company committed fraud during the initial months of the Model 3 production ramp. A recent update from Morgan Stanley analyst Adam Jonas also confirmed that Tesla is not under a Wells notice and is not legally prevented from issuing stock, putting to rest a persistent point that has been brought against the company by its critics. The average price target in Wall St for Tesla stock also remains at $335 per share, implying a ~30% upside from Monday’s close.

This Tuesday, Tesla’s shares appear to be getting a breather, trading (+2.90%) at $267.84 per share as of writing.

Disclosure: I have no ownership in shares of TSLA and have no plans to initiate any positions within 72 hours.

Elon Musk

Tesla analyst issues stern warning to investors: forget Trump-Musk feud

A Tesla analyst today said that investors should not lose sight of what is truly important in the grand scheme of being a shareholder, and that any near-term drama between CEO Elon Musk and U.S. President Donald Trump should not outshine the progress made by the company.

Gene Munster of Deepwater Management said that Tesla’s progress in autonomy is a much larger influence and a significantly bigger part of the company’s story than any disagreement between political policies.

Munster appeared on CNBC‘s “Closing Bell” yesterday to reiterate this point:

“One thing that is critical for Tesla investors to remember is that what’s going on with the business, with autonomy, the progress that they’re making, albeit early, is much bigger than any feud that is going to happen week-to-week between the President and Elon. So, I understand the reaction, but ultimately, I think that cooler heads will prevail. If they don’t, autonomy is still coming, one way or the other.”

BREAKING: GENE MUNSTER SAYS — $TSLA AUTONOMY IS “MUCH BIGGER” THAN ANY FEUD 👀

He says robotaxis are coming regardless ! pic.twitter.com/ytpPcwUTFy

— TheSonOfWalkley (@TheSonOfWalkley) July 2, 2025

This is a point that other analysts like Dan Ives of Wedbush and Cathie Wood of ARK Invest also made yesterday.

On two occasions over the past month, Musk and President Trump have gotten involved in a very public disagreement over the “Big Beautiful Bill,” which officially passed through the Senate yesterday and is making its way to the House of Representatives.

Musk is upset with the spending in the bill, while President Trump continues to reiterate that the Tesla CEO is only frustrated with the removal of an “EV mandate,” which does not exist federally, nor is it something Musk has expressed any frustration with.

In fact, Musk has pushed back against keeping federal subsidies for EVs, as long as gas and oil subsidies are also removed.

Nevertheless, Ives and Wood both said yesterday that they believe the political hardship between Musk and President Trump will pass because both realize the world is a better place with them on the same team.

Munster’s perspective is that, even though Musk’s feud with President Trump could apply near-term pressure to the stock, the company’s progress in autonomy is an indication that, in the long term, Tesla is set up to succeed.

Tesla launched its Robotaxi platform in Austin on June 22 and is expanding access to more members of the public. Austin residents are now reporting that they have been invited to join the program.

Elon Musk

Tesla surges following better-than-expected delivery report

Tesla saw some positive momentum during trading hours as it reported its deliveries for Q2.

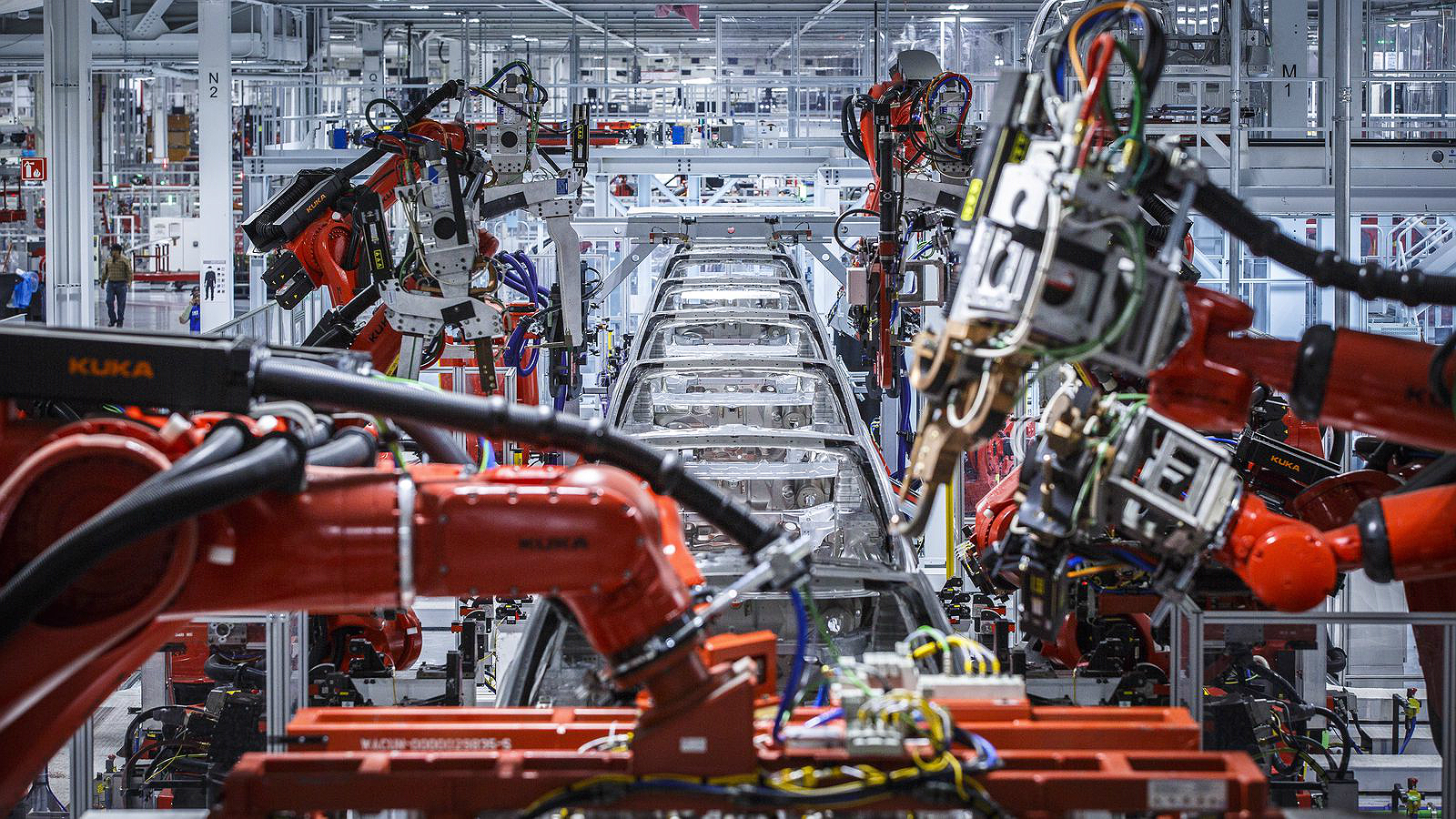

Tesla (NASDAQ: TSLA) surged over four percent on Wednesday morning after the company reported better-than-expected deliveries. It was nearly right on consensus estimations, as Wall Street predicted the company would deliver 385,000 cars in Q2.

Tesla reported that it delivered 384,122 vehicles in Q2. Many, including those inside the Tesla community, were anticipating deliveries in the 340,000 to 360,000 range, while Wall Street seemed to get it just right.

Tesla delivers 384,000 vehicles in Q2 2025, deploys 9.6 GWh in energy storage

Despite Tesla meeting consensus estimations, there were real concerns about what the company would report for Q2.

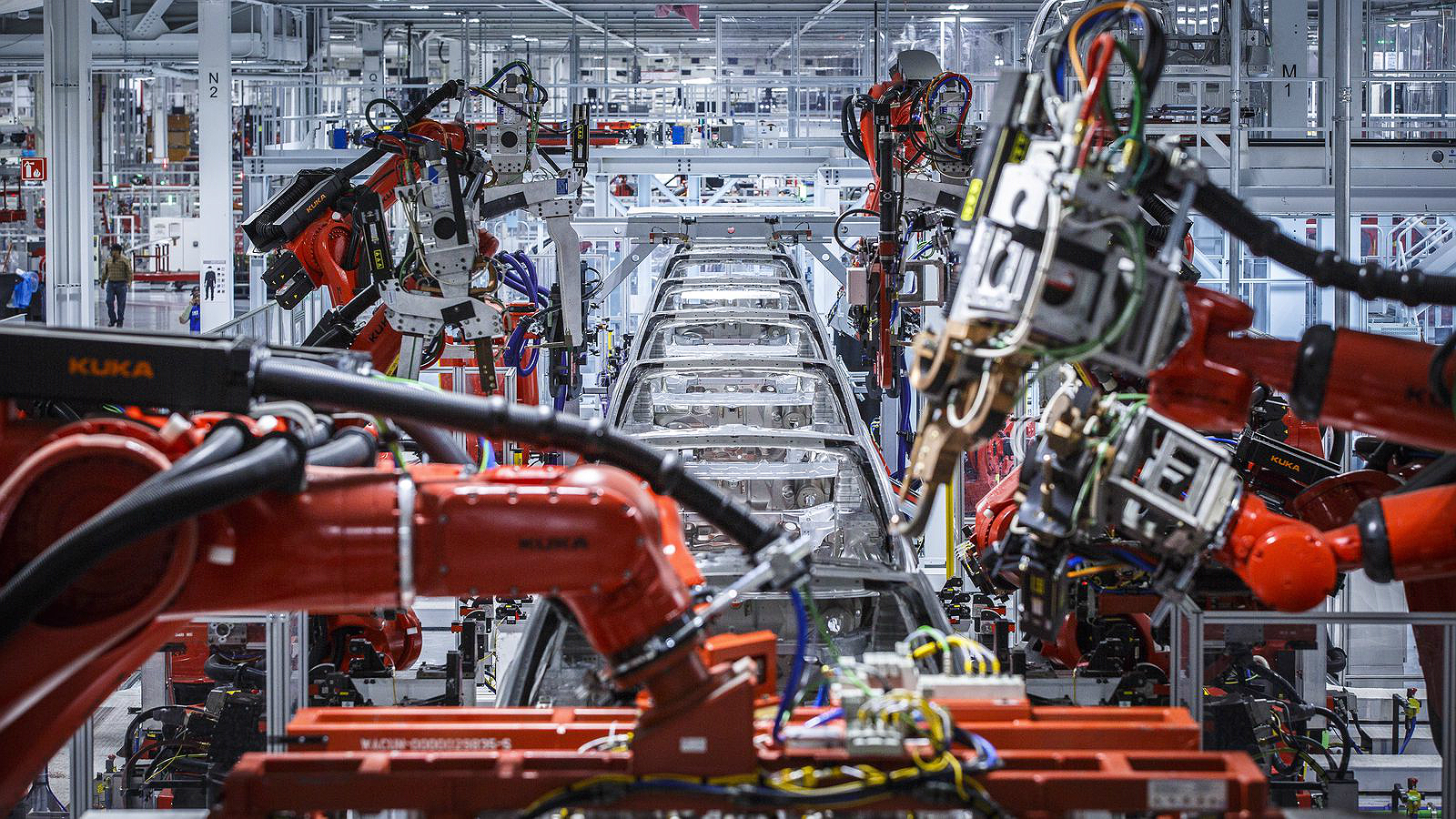

There were reportedly brief pauses in production at Gigafactory Texas during the quarter and the ramp of the new Model Y configuration across the globe were expected to provide headwinds for the EV maker during the quarter.

At noon on the East Coast, Tesla shares were up about 4.5 percent.

It is expected that Tesla will likely equal the number of deliveries it completed in both of the past two years.

It has hovered at the 1.8 million mark since 2023, and it seems it is right on pace to match that once again. Early last year, Tesla said that annual growth would be “notably lower” than expected due to its development of a new vehicle platform, which will enable more affordable models to be offered to the public.

These cars are expected to be unveiled at some point this year, as Tesla said they were “on track” to be produced in the first half of the year. Tesla has yet to unveil these vehicle designs to the public.

Dan Ives of Wedbush said in a note to investors this morning that the company’s rebound in China in June reflects good things to come, especially given the Model Y and its ramp across the world.

He also said that Musk’s commitment to the company and return from politics played a major role in the company’s performance in Q2:

“If Musk continues to lead and remain in the driver’s seat, we believe Tesla is on a path to an accelerated growth path over the coming years with deliveries expected to ramp in the back-half of 2025 following the Model Y refresh cycle.”

Ives maintained his $500 price target and the ‘Outperform’ rating he held on the stock:

“Tesla’s future is in many ways the brightest it’s ever been in our view given autonomous, FSD, robotics, and many other technology innovations now on the horizon with 90% of the valuation being driven by autonomous and robotics over the coming years but Musk needs to focus on driving Tesla and not putting his political views first. We maintain our OUTPERFORM and $500 PT.”

Moving forward, investors will look to see some gradual growth over the next few quarters. At worst, Tesla should look to match 2023 and 2024 full-year delivery figures, which could be beaten if the automaker can offer those affordable models by the end of the year.

Investor's Corner

Tesla delivers 384,000 vehicles in Q2 2025, deploys 9.6 GWh in energy storage

The quarter’s 9.6 GWh energy storage deployment marks one of Tesla’s highest to date.

Tesla (NASDAQ: TSLA) has released its Q2 2025 vehicle delivery and production report. As per the report, the company delivered over 384,000 vehicles in the second quarter of 2025, while deploying 9.6 GWh in energy storage. Vehicle production also reached 410,244 units for the quarter.

Model 3/Y dominates output, ahead of earnings call

Of the 410,244 vehicles produced during the quarter, 396,835 were Model 3 and Model Y units, while 13,409 were attributed to Tesla’s other models, which includes the Cybertruck and Model S/X variants. Deliveries followed a similar pattern, with 373,728 Model 3/Ys delivered and 10,394 from other models, totaling 384,122.

The quarter’s 9.6 GWh energy storage deployment marks one of Tesla’s highest to date, signaling continued strength in the Megapack and Powerwall segments.

Year-on-year deliveries edge down, but energy shows resilience

Tesla will share its full Q2 2025 earnings results after the market closes on Wednesday, July 23, 2025, with a live earnings call scheduled for 4:30 p.m. CT / 5:30 p.m. ET. The company will publish its quarterly update at ir.tesla.com, followed by a Q&A webcast featuring company leadership. Executives such as CEO Elon Musk are expected to be in attendance.

Tesla investors are expected to inquire about several of the company’s ongoing projects in the upcoming Q2 2025 earnings call. Expected topics include the new Model Y ramp across the United States, China, and Germany, as well as the ramp of FSD in territories outside the US and China. Questions about the company’s Robotaxi business, as well as the long-referenced but yet to be announced affordable models are also expected.

-

Elon Musk5 days ago

Elon Musk5 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News1 week ago

News1 week agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

News2 weeks ago

News2 weeks agoSpaceX and Elon Musk share insights on Starship Ship 36’s RUD

-

News2 weeks ago

News2 weeks agoWatch Tesla’s first driverless public Robotaxi rides in Texas

-

News1 week ago

News1 week agoWatch the first true Tesla Robotaxi intervention by safety monitor

-

News2 weeks ago

News2 weeks agoTesla has started rolling out initial round of Robotaxi invites

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla to launch in India in July with vehicles already arriving: report