Investor's Corner

LIVE BLOG: Tesla (TSLA) Q2 2019 earnings call updates

Tesla’s (NASDAQ:TSLA) second-quarter earnings call comes at a pivotal point for the electric car maker. Following a challenging first quarter that saw the company weighed down by lower-than-expected production and delivery figures, Q2 proved to be a comeback for Tesla. Seemingly highlighting CEO Elon Musk’s statement that there is absolutely no demand problem with its electric cars, Tesla set all-time records by producing a total of 87,048 vehicles and delivering around 95,200 in both the United States and the international markets.

Tesla announced a net loss of $408 million for the second quarter, translating to a loss of $2.31 per share. The company also listed $6.3 billion in revenue, which is below Wall Street expectations.

For today’s earnings call, Elon Musk and Tesla’s executives are expected to address questions surrounding the company’s financials and CEO Elon Musk’s goal of returning to profitability in the third and fourth quarter. Updates on the company’s production forecast for 2019 are also expected to be discussed. Other inquiries surrounding upcoming vehicles such as the Tesla Pickup Truck, projects such as Gigafactory 3, and features such as Full Self-Driving will likely be addressed as well.

The following are live updates from Tesla’s Q2 2019 earnings call. Fellow Teslarati reporter Dacia Ferris and I will be updating this article in real-time, so please keep refreshing the page to view the latest updates on this story.

Dacia 16:35 PT – Aaaand done! Maybe less script reading next time, guys. 😉

Simon 16:35 PT – And that’s a wrap! Thanks for joining us in today’s earnings call, everyone. Till the next!

Dacia 16:34 PT – “Is there anything silly that we’re doing that we should fix?” Elon asked during his trip to China. He was told that parts made in China were being shipped to New Jersey, then back to China. That’s a silly thing to be stopped, he said.

Dacia 16:33 PT – Parts availability? Moving parts from warehouses and moving them to the service centers addresses the availability issue, Elon says. He compares the stocking to a grocery store keeping Cocoa Puffs on the shelves. Anything used more frequently than every 6 weeks is kept local at the centers.

Dacia 16:31 PT – “I think at the end of the day, regulators will answer to the public,” Elon comments regarding European FSD permissions.

Simon 16:30 PT – RBC Capital Markets asks if Elon Musk expects to offer the full FSD suite in Europe and China, considering regulations? Elon notes that yes, he is expecting a worldwide FSD release. EU will likely be an exception though, as the region’s regulations are quite notable.

Dacia 16:29 PT – Supercharging is incredibly important… You can’t just have like 80% of a journey, you have to have 100%. Driving is freedom to travel, so you have to be able to drive there to have that freedom, Elon remarks as an additional component that’s important for sales.

Dacia 16:28 PT – “We’re rolling out service centers like crazy. Service centers are the key to sales, not retail locations,” Elon says.

Simon 16:27 PT – New Street Research asks about Tesla’s initiatives at maintaining an online-only business model. Elon notes that Tesla’s word of mouth is formidable, and that’s really what drives sales. A retail location is like a viral seed in an area, growing organically. They’re not needed, but they’re more like an accelerant, Elon says.

Dacia 16:25 PT – “I think there’s too much focus on S and X… They’re nice, but without them, we couldn’t spell S3XY…,” Elon jokes. “That’s A reason to continue selling S and X… They’ll be like 4-5% of Model 3 and Y… They’re not all that important in the long term.”

Simon 16:25 PT – Tesla’s story is fundamentally the Model 3 and Model Y. As for the Model S and X, well, Elon jokingly notes that they’re there *partly* to make sure that the lineup spell “S3XY.” That has to be kept.

Dacia 16:22 PT – Battery expectations? “We don’t expect to be self-constrained in China for the next year,” Elon says. “We have agreement in place…we’re good for the next year,” Drew concurs. “In some respects ‘Battery Day’ will be ‘Master Plan, Part 3’,” Elon says.

Simon 16:21 PT – Oppenheimer asks about Gigafactory 3’s battery supplier. Elon notes that while nothing is finalized yet, Tesla does not expect to be cell constrained in Gigafactory 3 for at least a year. Drew adds that Tesla has agreements in place to ensure that the initial Model 3 production run in the Shanghai-based facility will be without complications.

Simon 16:20 PT – Credit Suisse asks about Tesla’s ZEV credits. Is there any quarterly cadence to think about this? Is this going to European automakers? Zach notes that the ZEV Sales credits are a combination of short-term and long-term deals. “We generally try not to run the business based on regulatory credits revenue.” Elon adds that these credits are a relatively small part of Tesla’s revenue.

Dacia 16:16 PT – “Model S and X parts warehousing is taking up space in Fremont, and it’s not needed. Can use space for Model Y needs, Elon comments regarding space constraints at Tesla’s factory. “Just the rate of improvement, which is not slowing down, has been incredible.” The balance of S and X per week is the expected output from Fremont soon, according to Elon. Totaling 10k.

Simon 16:15 PT – JMP Securities asks if there is some potential to reconfigure Fremont’s floor space considering that the Model S and X are single shift. Elon agrees, stating that these spaces that are being freed will be allotted for Model Y production. Fremont’s improvement is radical, to the point where one can get lost in the factory every few months due to the sheer number of changes happening inside.

Dacia 16:14 PT – “From a core financial health standpoint… Tesla’s fiscal discipline is dramatically better than times in the past,” Elon says.

Dacia 16:10 PT – “Elon, do you believe M3 is cannibalizing S and X sales? Why else would demand levels step down?” Elon says they’re not quite sure themselves, some cannibalization possible. There’s also market expectation that there’s a refresh of S, X coming, which he’s emphasized is NOT the case. People don’t realize how much better the S and X are now… We need to address that communications issue, Elon says in reference to lower sales compared to M3.

Dacia 16:08 PT – Demand in Q3 will exceed Q2, Elon says. “I think we’ll see some acceleration of that…I think Q4 will be very strong…Q over Q improvements… Q3 and Q4 next year will be incredible.”

Simon 16:07 PT – Bernstein asks a question is Musk is confident that Q3 deliveries can still improve moving forward. Elon notes that so far, demand in Q3 is exceeding that of Q2. He also noted that Q4 will be “very strong.” “Expect quarter-to-quarter improvements,” Musk said, stating that Q1 2020 will be “tough,” and so will Q2 2020 be, though to a lesser degree. Zach explains that in the auto business, there’s this thing called seasonality.

Dacia 16:06 PT – Any updates on Giga China? Model 3 production? Seen anything RE order flow and demand? Elon says long term demand for M3 in greater China is about 5,000 per week. Globally, perhaps 15,000 Model 3 per week, as per Elon’s personal estimate.

Simon 16:05 PT – Wolfe Research asks about Gigafactory 3’s targets in China. Elon won’t go into details, though he states that he believes the long-term demand for the Model 3 in the greater China region will be around 5,000 a week. When asked if Tesla would source cars to Europe from China, Elon stated that Europe’s vehicles will be coming from Fremont instead, at least until Gigafactory 4 in Europe is online.

Dacia 16:04 PT – Any improvements on Gigafactory capacity? “We have seen improvements…we’re in the high 20s in Gigawatt hours and that’s increasing,” Drew responds.

Dacia 16:03 PT – Customer service as a personal priority – what steps are you taking? Elon cites current real-time service updates and increases in service centers and mobile service. Elon also discusses service visits. “A lot of service visits are just questions about the car,” Elon says. “Our number one question is how to use the Autopilot.” “How do I turn it on?”

Simon 15:58 PT – The question and answer portion begins. Here’s one for the battery and powertrain day. Elon notes that the event will be a comprehensive review of Tesla’s battery tech and manufacturing, including a roadmap for a terawatt-hour per year rate.

Dacia 15:57 PT – As the FSD features roll out, demand will increase. Right now, it’s expectedly limited and the full value isn’t completely realized, Elon says.

Simon 15:51 PT – Elon notes that CTO JB Straubel will be transitioning to an advisory role in the company. JB explains that he is not disappearing out of lack of confidence in the company. He has total confidence in Drew Baglino, who will be taking his place as Tesla’s CTO. JB notes that he is excited to keep working on the company’s new technologies, though Elon sounds notably emotional while reminiscing the CTO’s time with Tesla. They go way back, after all.

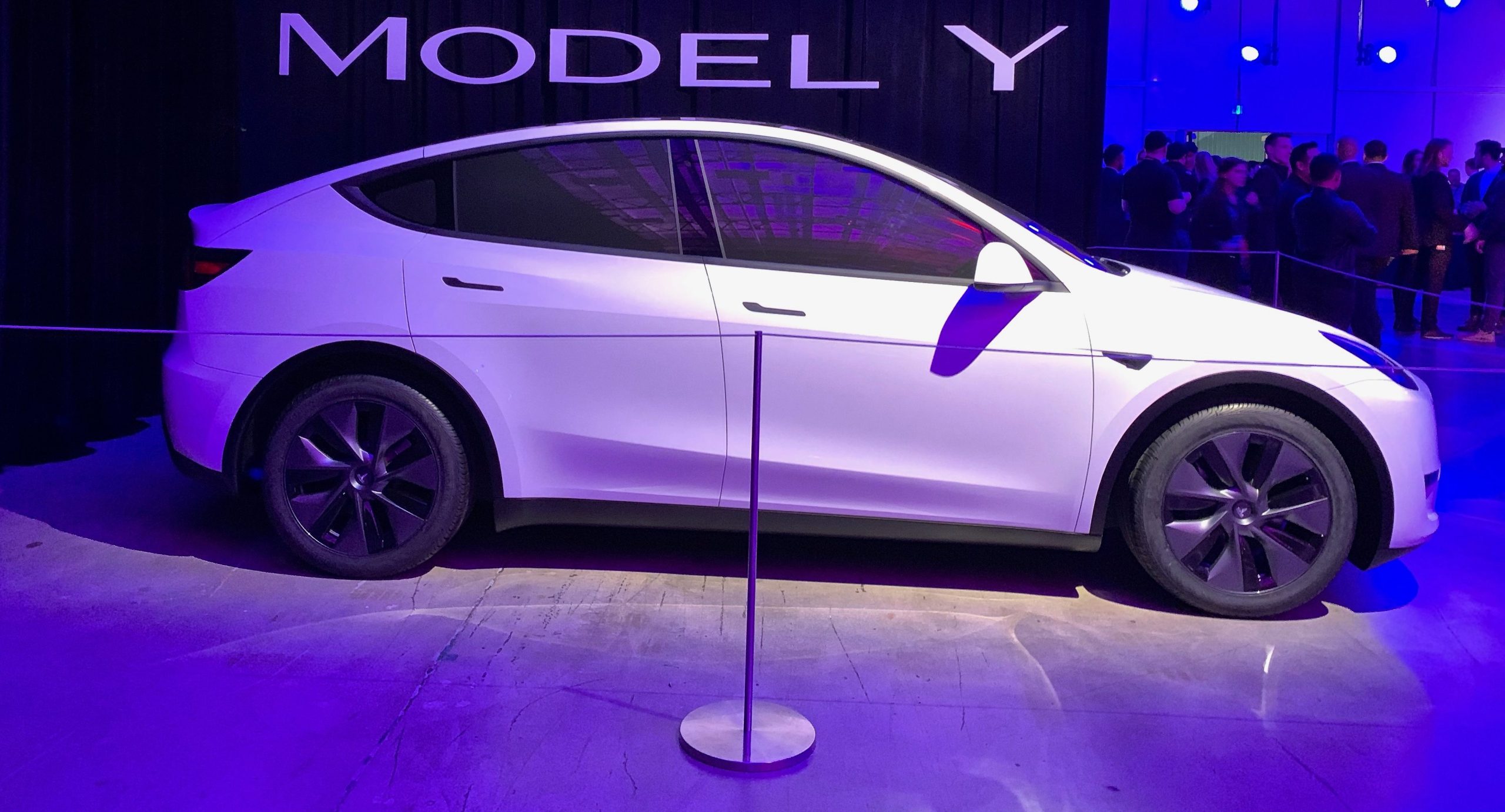

Simon 15:50 PT – Zach addresses the elephant in the room. It is easy to forget that Tesla is playing a long-term game, he says. The Model 3 was a bet, and it’s starting to pay off. Gigafactory 3 is about to be complete. Gigafactory 4 in Europe is underway. Model Y is coming for the automotive market’s most lucrative segment. Indeed, it’s a long-term play.

Simon 15:45 PT – CFO Zach Kirkhorn takes the stage. He runs down Tesla’s accomplishments, highlighting the record deliveries in vehicles and increasing volume of energy projects. “Adjusting for the impact of credits, Automotive gross margins improved significantly,” he said.

Simon 15:43 PT – Tesla is now at a point where it is close to self-funding, says Elon Musk. He also noted that Tesla could break-even this quarter and be back to profitability in the following quarter.

Simon 15:40 PT – Elon discusses the Model S’ Ultimate Car of the Year award from MotorTrend and Model 3’s stellar safety ratings. Musk appears to be reading from a pre-prepared script at this point, though he did state that the Model Y ramp will be far easier than that of the Model 3. He’s also taking some time explaining how pertinent Tesla’s growth is.

Simon 15:35 PT – Elon starts off by saying how proud he is of Tesla’s team, particularly in light of the Tesla team’s growth and accomplishments in the second quarter. Delivering 95,200 vehicles in three months is no joke, after all. “Achieving a record number of deliveries is a milestone. This was achieved thanks to the tremendous work by the Tesla team,” he said.

Simon 15:33 PT – Ooh, look what we have here. The earnings call is starting on time. Martin Viecha takes the floor. Elon, JB and Zach are in attendance.

Simon 15:30 PT – And here we go. Here’s the classic music.

Simon 15:25 PT – Last five minutes before the earnings call begins. We’re about to find out if the event will begin on time or not.

Simon 15:20 PT – Something that’s particularly interesting in Tesla’s Q2 Update Letter also lies in a section for Model Y production. Finally, after all the way, Tesla has confirmed where the all-electric SUV will be made. Just as expected, the Model 3’s SUV sibling will be manufactured in the Fremont factory.

Simon 15:15 PT – I get it. Tesla’s Q2 loss is a bit disheartening since the company did reach record deliveries in the second quarter. I guess I was hoping for Tesla to show a small profit somehow. Then again, Elon did say that Q2 will likely end at a loss. So I shouldn’t really get that surprised.

Simon 15:10 PT – The Q2 Update Letter mentioned a number of gems, I must say. For one, Tesla has $5 billion in cash, the largest it’s been in the company’s history. Higher-margin Model 3s continue to sell well, and this absolute unit of a factory in China is progressing at a stupidly fast pace. Everyone knows Gigafactory 3 will be built fast. But not this fast. This. Is. Insane.

- Gigafactory 3’s interior.

- The Tesla Gigafactory 3 site as of July 2019. (Credit: Jason Yang/YouTube)

Pretty crazy that the image on the left is already installed somewhere in the image on the right, right?

Simon 15:05 PT – So here we are again at another Tesla earnings call. The call should start in around 30 minutes not accounting for Elon Time. TSLA stock is currently being battered in after-hours trading due to the electric car maker falling short of Wall Street’s estimates. With record numbers in Q2 though, Tesla shares are likely not done being volatile today.

Elon Musk

Tesla stock gets latest synopsis from Jim Cramer: ‘It’s actually a robotics company’

“Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session,” Cramer said.

Tesla stock (NASDAQ: TSLA) got its latest synopsis from Wall Street analyst Jim Cramer, who finally realized something that many fans of the company have known all along: it’s not a car company. Instead, it’s a robotics company.

In a recent note that was released after Tesla reported Earnings in late January, Cramer seemed to recognize that the underwhelming financials and overall performance of the automotive division were not representative of the current state of affairs.

Instead, we’re seeing a company transition itself away from its early identity, essentially evolving like a caterpillar into a butterfly.

The narrative of the Earnings Call was simple: We’re not a car company, at least not from a birds-eye view. We’re an AI and Robotics company, and we are transitioning to this quicker than most people realize.

Tesla stock gets another analysis from Jim Cramer, and investors will like it

Tesla’s Q4 Earnings Call featured plenty of analysis from CEO Elon Musk and others, and some of the more minor details of the call were even indicative of a company that is moving toward AI instead of its cars. For example, the Model S and Model X will be no more after Q2, as Musk said that they serve relatively no purpose for the future.

Instead, Tesla is shifting its focus to the vehicles catered for autonomy and its Robotaxi and self-driving efforts.

Cramer recognizes this:

“…we got results from Tesla, which actually beat numbers, but nobody cares about the numbers here, as electric vehicles are the past. And according to CEO Elon Musk, the future of this company comes down to Cybercabs and humanoid robots. Stock fell more than 3% the next day. That may be because their capital expenditures budget was higher than expected, or maybe people wanted more details from the new businesses. At this point, I think Musk acolytes might be more excited about SpaceX, which is planning to come public later this year.”

He continued, highlighting the company’s true transition away from vehicles to its Cybercab, Optimus, and AI ambitions:

“I know it’s hard to believe how quickly this market can change its attitude. Last night, I heard a disastrous car company speak. Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session. I didn’t like it as a car company. Boy, I love it as a Cybercab and humanoid robot juggernaut. Call me a buyer and give me five robots while I’m at it.”

Cramer’s narrative seems to fit that of the most bullish Tesla investors. Anyone who is labeled a “permabull” has been echoing a similar sentiment over the past several years: Tesla is not a car company any longer.

Instead, the true focus is on the future and the potential that AI and Robotics bring to the company. It is truly difficult to put Tesla shares in the same group as companies like Ford, General Motors, and others.

Tesla shares are down less than half a percent at the time of publishing, trading at $423.69.

Elon Musk

Tesla to a $100T market cap? Elon Musk’s response may shock you

There are a lot of Tesla bulls out there who have astronomical expectations for the company, especially as its arm of reach has gone well past automotive and energy and entered artificial intelligence and robotics.

However, some of the most bullish Tesla investors believe the company could become worth $100 trillion, and CEO Elon Musk does not believe that number is completely out of the question, even if it sounds almost ridiculous.

To put that number into perspective, the top ten most valuable companies in the world — NVIDIA, Apple, Alphabet, Microsoft, Amazon, TSMC, Meta, Saudi Aramco, Broadcom, and Tesla — are worth roughly $26 trillion.

Will Tesla join the fold? Predicting a triple merger with SpaceX and xAI

Cathie Wood of ARK Invest believes the number is reasonable considering Tesla’s long-reaching industry ambitions:

“…in the world of AI, what do you have to have to win? You have to have proprietary data, and think about all the proprietary data he has, different kinds of proprietary data. Tesla, the language of the road; Neuralink, multiomics data; nobody else has that data. X, nobody else has that data either. I could see $100 trillion. I think it’s going to happen because of convergence. I think Tesla is the leading candidate [for $100 trillion] for the reason I just said.”

Musk said late last year that all of his companies seem to be “heading toward convergence,” and it’s started to come to fruition. Tesla invested in xAI, as revealed in its Q4 Earnings Shareholder Deck, and SpaceX recently acquired xAI, marking the first step in the potential for a massive umbrella of companies under Musk’s watch.

SpaceX officially acquires xAI, merging rockets with AI expertise

Now that it is happening, it seems Musk is even more enthusiastic about a massive valuation that would swell to nearly four-times the value of the top ten most valuable companies in the world currently, as he said on X, the idea of a $100 trillion valuation is “not impossible.”

It’s not impossible

— Elon Musk (@elonmusk) February 6, 2026

Tesla is not just a car company. With its many projects, including the launch of Robotaxi, the progress of the Optimus robot, and its AI ambitions, it has the potential to continue gaining value at an accelerating rate.

Musk’s comments show his confidence in Tesla’s numerous projects, especially as some begin to mature and some head toward their initial stages.

Elon Musk

Tesla director pay lawsuit sees lawyer fees slashed by $100 million

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

The Delaware Supreme Court has cut more than $100 million from a legal fee award tied to a shareholder lawsuit challenging compensation paid to Tesla directors between 2017 and 2020.

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

Delaware Supreme Court trims legal fees

As noted in a Bloomberg Law report, the case targeted pay granted to Tesla directors, including CEO Elon Musk, Oracle founder Larry Ellison, Kimbal Musk, and Rupert Murdoch. The Delaware Chancery Court had awarded $176 million to the plaintiffs. Tesla’s board must also return stock options and forego years worth of pay.

As per Chief Justice Collins J. Seitz Jr. in an opinion for the Delaware Supreme Court’s full five-member panel, however, the decision of the Delaware Chancery Court to award $176 million to a pension fund’s law firm “erred by including in its financial benefit analysis the intrinsic value” of options being returned by Tesla’s board.

The justices then reduced the fee award from $176 million to $70.9 million. “As we measure it, $71 million reflects a reasonable fee for counsel’s efforts and does not result in a windfall,” Chief Justice Seitz wrote.

Other settlement terms still intact

The Supreme Court upheld the settlement itself, which requires Tesla’s board to return stock and options valued at up to $735 million and to forgo three years of additional compensation worth about $184 million.

Tesla argued during oral arguments that a fee award closer to $70 million would be appropriate. Interestingly enough, back in October, Justice Karen L. Valihura noted that the $176 award was $60 million more than the Delaware judiciary’s budget from the previous year. This was quite interesting as the case was “settled midstream.”

The lawsuit was brought by a pension fund on behalf of Tesla shareholders and focused exclusively on director pay during the 2017–2020 period. The case is separate from other high-profile compensation disputes involving Elon Musk.