Investor's Corner

LIVE BLOG: Tesla (TSLA) Q2 2021 earnings call summary

With its second-quarter results that include $11.958 billion in revenue and $1.1 billion of GAAP net income, Tesla (NASDAQ:TSLA) has all but proven that it could be a sustainable business. With Q2 2021 in the bag, after all, Tesla has now posted eight profitable quarters in a row, and that’s despite an ongoing chip shortage and supply chain issues.

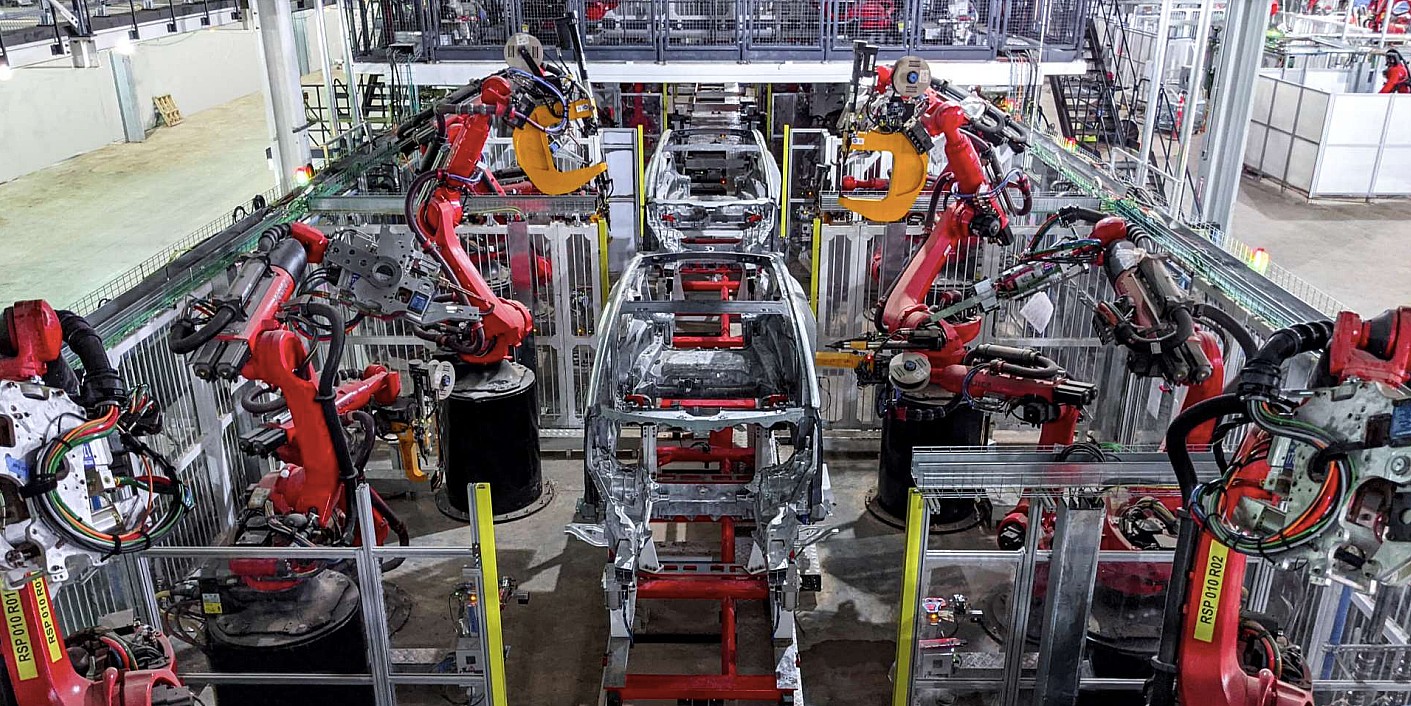

As discussed in the company’s Q2 2021 Update Letter, Tesla achieved some milestones in the second quarter. Commissioning has started in some areas of Gigafactory Texas, and Giga Berlin is also moving forward. What’s more, Gigafactory Shanghai has also completed its transition as the company’s primary vehicle export hub. The development of 4680 cells has also moved forward. Even Tesla Energy hit some stride in Q2 2021, with battery storage deployments tripling year-over-year in the second quarter. The same was true for Solar Roof deployments.

The following are live updates from Tesla’s Q2 2021 earnings call. I will be updating this article in real-time, so please keep refreshing the page to view the latest updates on this story. The first entry starts at the bottom of the page.

15:40 PT: And that’s a wrap, everyone! I gotta admit, it’s kind of sad that this may one of Elon Musk’s last regular earnings call appearances. It does make sense, though, as Tesla is in a much better place now compared to before. We can never forget Elon’s most memorable earnings call moments, though. Those will live in Tesla history.

Anyway, thanks for staying with us for our Live Blog once more. Until the next time!

15:38 PT: Elon mentions a number of key tidbits about Tesla Energy. With enough cells, Tesla could hi an annualized production of 1 million Powerwall’s next year. Long-term, Musk also noted that Tesla and its suppliers would have to produce 1,000-2,000 GWh worth of batteries per year.

When asked about the company’s FSD subscription program, Musk highlighted that Tesla has to make the system work very well first. Until then, it would be difficult to forecast just how well FSD would do. “Once we have FSD fully deployed, then the value question will be clear,” Musk said.

15:30 PT: Pierre Ferragu News Street Research inquires about sourcing the company’s 4680 cells. Elon confirms that Tesla is working with its existing suppliers to produce 4680 cells for its vehicles. He also noted that Tesla’s iron-based vehicles will not use 4680 cylindrical cells, as predicted by some of the company’s more ardent bulls. Elon believes it would be ideal to do 1-3 cell formats, especially considering the massive backlog in demand for the company’s product lineup.

15:25 PT: Rod Lache of Wolfe Research asks about Tesla’s estimates for innovations such as rear castings and 4680 cells. Musk notes that making predictions is difficult. “You need a lot of crystal balls to predict exactly what it would be,” the CEO said. A follow-up question on the company’s advances in cell manufacturing technology was asked. Tesla notes that the company is making progress, but there are still challenges. Tesla notes that more than 90% of the processes have been proven, but things are still limited by the ones that have not been proven. The company, however, is happy with its dry electrode process.

15:20 PT: When asked about other services that Tesla could offer, Elon Musk noted that FSD would be the main service that the company would offer. The CEO did note that Tesla is the leader in electrification and autonomy. This is an accurate statement, regardless of the controversy that surrounds the company.

Investor questions begin. First up is Colin Rusch from Oppenheimer. He asks about the take rates for FSD. Musk notes that it’s not worth promising on this right now, as it’s not meaningful. Tesla is focused on making FSD widely available. The analyst asks about any developments with regulators and their understanding of FSD technology. Musk responds that Tesla does not see a fundamental inhibitor in this light.

Musk reiterates his previous point, noting that once autonomous driving systems are proven to be safer than human drivers, regulators would likely be more welcome. He also reiterates his previous example of elevators, which used to be manual but are now fully automated. The same thing will likely happen with autonomous driving.

15:15 PT: Last retail question for retail investors asked if Elon Musk would be open to interviews every so often on prolific TSLA bulls’ YouTube channels. “I would do it annually,” Musk said, seemingly after pondering the point. He also noted that over time, he would not be speaking in Tesla earnings calls anymore unless there’s something really important that he has to address. Elon would likely only speak during the Annual Shareholders’ Meeting.

15:12 PT: Elon notes that Tesla has a massive amount of equipment that will be coming for the mass production of 4680 cells. “Most likely, we’ll hit an annualized rate of 100 GWh per year by the end of next year,” Musk said.

15:10 PT: A question about the progress of the 4680 cells was asked. Musk noted that in limited volumes, the 4680 cells are reliable enough for vehicles already. It’s just a matter of overcoming challenges that are present when mass manufacturing the 4680 cells. “We will definitely make 4680 reliable enough for vehicles. There are a number of challenges when transitioning from small-scale production to large-scale production,” Musk said. The 4680 cells’ reliability has been validated, though, with cells having been tested for the *equivalent* of 1 million miles.

15:07 PT: A question about Tesla’s plan to open the Supercharger Network to other EVs was brought up. Elon Musk notes that the process would be simple and app-based for non-Tesla owners. He did state that there will be a time constraint. “The biggest constraint to Superchargers is time,” Musk said, adding that there are times when charging stations are packed and other times when they are empty. “Tesla will also be smarter in terms of how it charges for electricity,” Musk added, noting that Tesla will use time-based pricing for non-Tesla EVs.

Non-Tesla EVs would have to use a Supercharger adapter, which Musk jokes would be available on Supercharger Stations. “Our goal is to support the advent of sustainable energy. Our intention is not to create a walled garden that we can use to bludgeon our competitors,” Musk jested. It was also highlighted that opening the Supercharger Network to other EVs would result in the system to grow even faster than ever before.

15:02 PT: Musk noted that Tesla is looking to strengthen its raw material supply chain. He states that Tesla no longer uses cobalt in its LFP packs, and the company may even shift to iron-based cells in the future as opposed to nickel-based cells. “We expect to have zero cobalt in the future,” Musk said. The CEO added that all stationary energy storage like Powerwalls and Megapacks will use iron-based battery cells.

15:00 PT: The Tesla executive noted that the company plans to overshoot on cell for vehicles and routing cell output to Megapack and Powerwall if there is excess. And just like its present strategy, shortages in cells would likely result in a reduction in the production of the Powerwall and the Megapack.

14:58 PT: Say questions from retail investors begin. First question is about the Cybertruck production. The company noted that it would be looking to ramp Cybertruck production in Gigafactory Texas after the Model Y production starts in the TX-based facility.

Elon Musk highlights the complexity of producing vehicles, and how each EV is comprised of thousands of parts. He notes that Tesla is fastest in history for scaling large manufactured objects, comparable to the Model T. He also noted that the Cybertruck and the Semi’s volume production would be greatly affected by cell availability.

However, Tesla is expecting to see a big boost in cell availability next year. “Maybe not in January,” Musk said, but sometime in the coming year. Musk hints at Tesla having twice as many cells next year compared to 2021. This is impressive considering that this year is already record-breaking.

Seemingly avoiding his typical over-optimistic estimates, Musk emphasizes that these are just current predictions and his estimates could change depending on challenges or obstacles that might come up.

14:53 PT: Musk concludes with a statement about Full Self-Driving, and how he is confident that Tesla could achieve autonomous driving.

Tesla Chief Finance Officer Zachary Kirkhorn takes the floor, noting that the company’s financials even without credits improved substantially. He highlights Tesla’s decreasing ASP while maintaining margins for its vehicles, which was made possible by optimizing the company’s operations to a significant degree.

The CFO confirms that Tesla’s numbers for the year would be more notable in the third and fourth quarter. “Our 2021 volumes will skew for the second half of the year,” Kirkhorn said.

14:48 PT: Elon discusses the Model Y line in Giga Berlin, which would be different from the Model Ys produced thus far. He still maintains that Giga Berlin and Giga Texas could go live with Model Y production later this year.

“The Model Y line in Texas and Berlin will look mostly like the Model Ys we make, but there will be substantial differences. The Model Y in Berlin will have a cast rear body and cast front body. We’re going to structural packs,” Musk said. The CEO did state that Tesla has a backup plan with a non-structural pack and 2170 cells, but 4680 cells will definitely be used for scale production.

14:45 PT: Musk discusses how Tesla rolled out contingencies to handle the challenges brought about by the chip shortage. He credits Tesla’s team and the company’s suppliers for helping the company resolve the material shortages. The CEO also discusses the release of FSD subscriptions, which would likely have high take rates as the advanced driver-assist system becomes more mature.

Musk notes that he is in Giga Texas, and he congratulates the team building its factories. “There’s nothing a year ago, and there’s a mostly complete large factory a year later,” Musk said, lauding Giga Texas’ team.

14:40 PT: Martin Viecha takes the stage and opens with the basics. Elon and other executives are present for the earnings call. Elon starts his opening remarks. He highlights that Q2 2021 was a record quarter, in deliveries, production, and income. He also noted that electric vehicles are now at an inflection point, and that the market is now being more aware that EVs are the way forward.

14:38 PT: And we’re starting!

14:35 PT: A 5-minute delay is nothing to a Tesla veteran.

14:30 PT: And here we go. We’re at standby. 🙂 This is very on-character for Tesla.

14:25 PT: Every Tesla bull remembers, after all, those days when TSLA stock was the very picture of volatility. As someone who has watched Tesla over the years, I’m not really sure which one I prefer. The understated consistency of a mature EV maker or the drama and excitement of a disruptor trying to find its wings?

14:20 PT: Strangely enough, Tesla stock has only risen 2.28% despite the company beating Wall Street’s expectations. I wonder if TSLA shares would see a boost in the coming months once more, just like in previous years? Still, it almost feels strange seeing Tesla only move this much after an impressive earnings report.

14:15 PT: Good day, everyone, and welcome to another live blog of Tesla’s earnings call! It’s pretty amazing that just a couple of years ago, there were still big questions whether Tesla could be a sustainable business. Back then, thinking that Tesla would be profitable for a year straight already seemed like a longshot. And now we have eight consecutive profitable quarters. Anyway, we’re 15 minutes away from the Q2 2021 earnings call. Perhaps this will be a memorable one as well.

Don’t hesitate to contact us for news tips. Just send a message to tips@teslarati.com to give us a heads up.

Investor's Corner

Tesla gets tip of the hat from major Wall Street firm on self-driving prowess

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet,” BoA wrote.

Tesla received a tip of the hat from major Wall Street firm Bank of America on Wednesday, as it reinitiated coverage on Tesla shares with a bullish stance that comes with a ‘Buy’ rating and a $460 price target.

In a new note that marks a sharp reversal from its neutral position earlier in 2025, the bank declared Tesla’s Full Self-Driving (FSD) technology the “leading consumer autonomy solution.”

Analysts highlighted Tesla’s camera-only architecture, known as Tesla Vision, as a strategic masterstroke. While technically more challenging than the multi-sensor setups favored by rivals, the vision-based approach is dramatically cheaper to produce and maintain.

This cost edge, combined with Tesla’s rapidly expanding real-world data engine, positions the company to scale robotaxis far more profitably than competitors, BofA argues in the new note:

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet.”

The bank now attributes roughly 52% of Tesla’s total valuation to its Robotaxi ambitions. It also flagged meaningful upside from the Optimus humanoid robot program and the fast-growing energy storage business, suggesting the auto segment’s recent headwinds, including expired incentives, are being eclipsed by these higher-margin opportunities.

Tesla’s own data underscores exactly why Wall Street is waking up to FSD’s potential. According to Tesla’s official safety reporting page, the FSD Supervised fleet has now surpassed 8.4 billion cumulative miles driven.

Tesla FSD (Supervised) fleet passes 8.4 billion cumulative miles

That total ballooned from just 6 million miles in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and a staggering 4.25 billion in 2025 alone. In the first 50 days of 2026, owners added another 1 billion miles — averaging more than 20 million miles per day.

This avalanche of real-world, camera-captured footage, much of it on complex city streets, gives Tesla an unmatched training dataset. Every mile feeds its neural networks, accelerating improvement cycles that lidar-dependent rivals simply cannot match at scale.

Tesla owners themselves will tell you the suite gets better with every release, bringing new features and improvements to its self-driving project.

The $460 target implies roughly 15 percent upside from recent trading levels around $400. While regulatory and safety hurdles remain, BofA’s endorsement signals growing institutional conviction that Tesla’s data advantage is not hype; it’s a tangible moat already delivering billions of miles of proof.

Elon Musk

SpaceX IPO could push Elon Musk’s net worth past $1 trillion: Polymarket

The estimates were shared by the official Polymarket Money account on social media platform X.

Recent projections have outlined how a potential $1.75 trillion SpaceX IPO could generate historic returns for early investors. The projections suggest the offering would not only become the largest IPO in history but could also result in unprecedented windfalls for some of the company’s key investors.

The estimates were shared by the official Polymarket Money account on social media platform X.

As noted in a Polymarket Money analysis, Elon Musk invested $100 million into SpaceX in 2002 and currently owns approximately 42% of the company. At a $1.75 trillion valuation following SpaceX’s potential $1.75 trillion IPO, that stake would be worth roughly $735 billion.

Such a figure would dramatically expand Musk’s net worth. When combined with his holdings in Tesla Inc. and other ventures, a public debut at that level could position him as the world’s first trillionaire, depending on market conditions at the time of listing.

The Bloomberg Billionaires Index currently lists Elon Musk with a net worth of $666 billion, though a notable portion of this is tied to his TSLA stock. Tesla currently holds a market cap of $1.51 trillion, and Elon Musk’s currently holds about 13% to 15% of the company’s outstanding common stock.

Founders Fund, co-founded by Peter Thiel, invested $20 million in SpaceX in 2008. Polymarket Money estimates the firm owns between 1.5% and 3% of the private space company. At a $1.75 trillion valuation, that range would translate to approximately $26.25 billion to $52.5 billion in value.

That return would represent one of the most significant venture capital outcomes in modern Silicon Valley history, with a growth of 131,150% to 262,400%.

Alphabet Inc., Google’s parent company, invested $900 million into SpaceX in 2015 and is estimated to hold between 6% and 7% of the private space firm. At the projected IPO valuation, that stake could be worth between $105 billion and $122.5 billion. That’s a growth of 11,566% to 14,455%.

Other major backers highlighted in the post include Fidelity Investments, Baillie Gifford, Valor Equity Partners, Bank of America, and Andreessen Horowitz, each potentially sitting on multibillion-dollar gains.

Elon Musk

Elon Musk hints Tesla investors will be rewarded heavily

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet,” Musk said.

Elon Musk recently hinted that he believes Tesla investors will be rewarded heavily if they continue to hold onto their shares, and he reiterated that in a new interview that the company released on its social accounts this week.

Musk is one of the most successful CEOs in the modern era and has mammothed competitors on the Forbes Net Worth List over the past year as his holdings in his various companies have continued to swell.

Tesla investors, especially those who have been holding shares for several years, have also felt substantial gains in their portfolios. Over the past five years, the stock is up over 78 percent. Since February 2019, nearly seven years ago to the day, the stock is up over 1,800 percent.

Musk said in the interview:

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet.”

Elon Musk in new interview: “Hold on to your $TSLA stock. It’s going to be worth a lot, I think. That’s my bet.” pic.twitter.com/cucirBuhq0

— Sawyer Merritt (@SawyerMerritt) February 26, 2026

It’s no secret Musk has been extremely bullish on his own companies, but Tesla in particular, because it is publicly traded.

However, the company has so many amazing projects that have an opportunity to revolutionize their respective industries. There is certainly a path to major growth on Wall Street for Tesla through its various future projects, including Optimus, Cybercab, Semi, and Unsupervised FSD.

- Optimus (Tesla’s humanoid robot): Musk has discussed its potential for tasks like childcare, walking dogs, or assisting elderly parents, positioning it as a massive long-term driver of company value.

- Cybercab (Tesla’s robotaxi/autonomous ride-hailing vehicle): a fully autonomous vehicle geared specifically for Tesla’s ride-sharing ambitions.

- Semi (Tesla’s electric truck, with mentions of expansion, like in Europe): brings Tesla into the commercial logistics sector.

- Unsupervised FSD (Full Self-Driving software achieving full autonomy without human supervision): turns every Tesla owner’s vehicle into a fully-autonomous vehicle upon release

These projects specifically are some of the highest-growth pillars Tesla has ever attempted to develop, especially in Musk’s eyes, as he has said Optimus will be the best-selling product of all-time.

Many analysts agree, but the bullish ones, like Cathie Wood of ARK Invest, are perhaps the one who believes Tesla has incredible potential on Wall Street, predicting a $2,600 price target for 2030, but this is not even including Optimus.

She told Bloomberg last March that she believes that the project will present a potential additive if Tesla can scale faster than anticipated.