Waymo has launched a transit credit pilot program in Los Angeles, following initial tests in San Francisco last year.

On Tuesday, Waymo announced in a press release that it is launching a two-month pilot program in the Southern California city, which will essentially pay $3.00 credits to riders who connect to seven eligible transit stations. The company, which is backed by Google’s parent company Alphabet, will run the program from February 4 through April 1, offering convenient routes to and from the Los Angeles International Airport (LAX).

In the announcement, the company says that credits will be added to rider accounts on the day following the ride, and they’ll then be usable for 60 days. Waymo also highlights the launch of the program arriving on Transit Equity Day, a holiday honoring civil rights hero Rosa Parks, whose birthday was on February 4.

The program will be used to study how Waymo One is used by riders as a first- and last-mile ride-hailing solution that it hopes to help integrate with public transportation options to make them more accessible. It says it also performed similar evaluations through its pilot program in San Francisco, which launched in October.

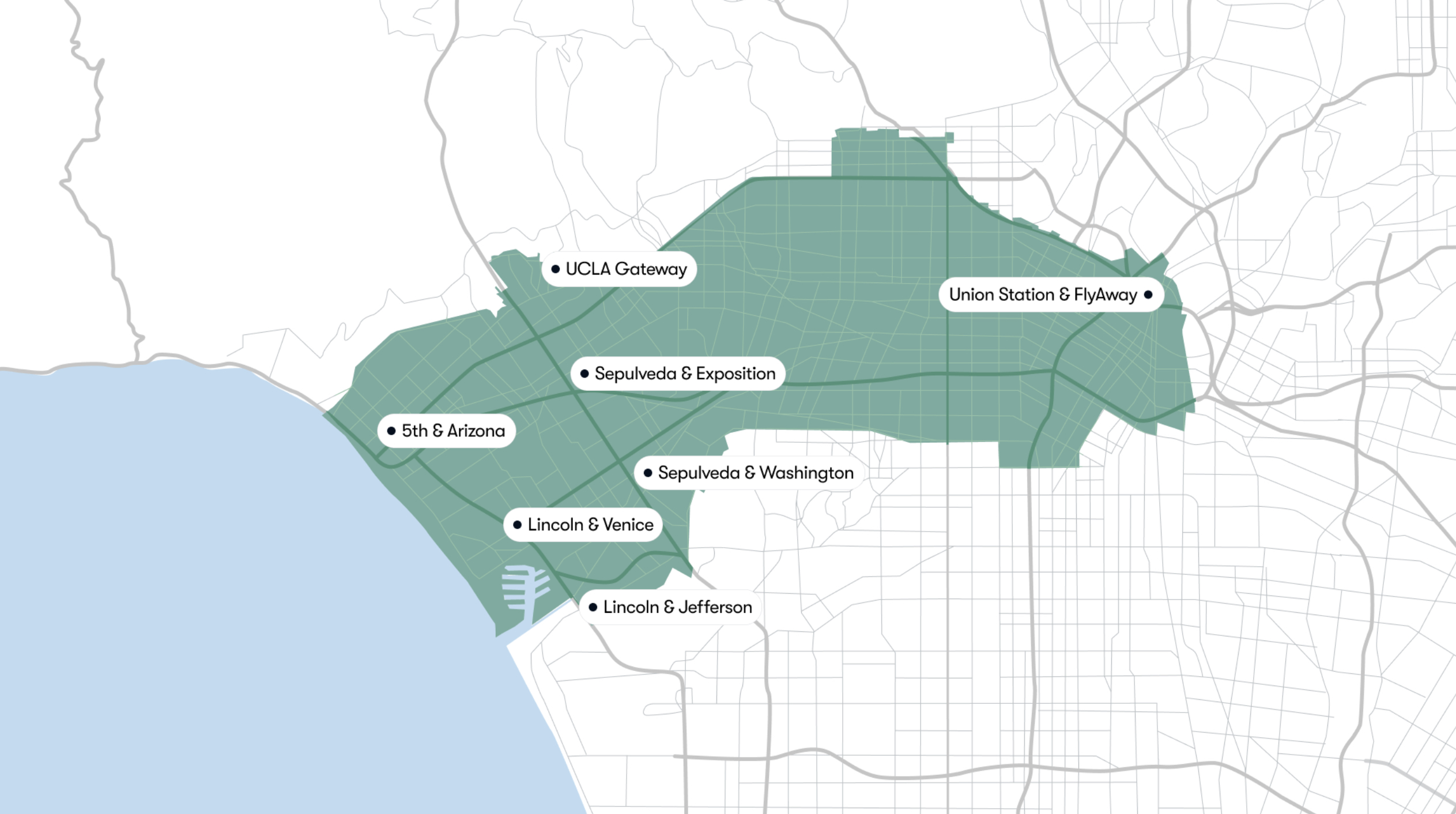

LA stations participating in the program are located at the following intersections/transit sites, as can also be seen on the map below:

- 5th and Arizona

- Lincoln and Jefferson

- Lincoln and Venice

- Sepulveda and Exposition

- Sepulveda and Washington

- Union Station and FlyAway

- UCLA Gateway

Credit: Waymo

READ MORE ON WAYMO: Waymo study analyzes collisions with vulnerable road users

Waymo, Tesla and commercial robotaxi services

Waymo One is the service and app the company uses for its driverless electric robotaxis, which currently offers paid rides to users in the Bay Area and around Los Angeles, as well as in Phoenix, Arizona and Austin, Texas. The company began paid LA rides in November, officially dropping the need for users to join a waitlist to ride.

In all of the aforementioned areas, users simply need to download the Waymo One app to hail a ride. The company has also announced plans to launch in Miami, Florida in the coming months.

Additionally, the firm says it’s operating 150,000 paid rides each week, resulting in a weekly reduction of over 220 tons of carbon emissions, and up from its 100,000 rides per week announced in August. In December, the company also announced plans to launch a pilot program in Japan, slated to begin this year.

Waymo is currently the only driverless ride-hailing company operating paid rides at such a large scale, with competitors like Amazon-owned Zoox rolling out initial services. Meanwhile, Tesla aims to begin offering unsupervised robotaxi services in June, following its unveiling of the steering wheel-less, two-seat Cybercab in October.

?: Our FULL first ride in the @Tesla Cybercab pic.twitter.com/6gR7OgKRCz

— TESLARATI (@Teslarati) October 11, 2024

In addition to the Cybercab, which is expected to offer a similar paid ride-hailing service to Waymo One, Tesla currently sells its Supervised Full Self-Driving (FSD) software, which the autonomous vehicle will utilize, as either a monthly subscription or one-time purchase to owners.

Tesla also teased a ride-hailing app interface as early as last April in its Q1 earnings Shareholder Deck, showing off a user’s ability to summon rides, set temperature controls in the vehicle, and follow along with navigation. Such a service has also been promised to Tesla owners for several years, and it’s eventually expected to let them deploy their own personal vehicles to autonomously give rides and generate income when not in use.

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send us tips at tips@teslarati.com.

Waymo valued at over $45 billion following latest financing round: report

Need accessories for your Tesla? Check out the Teslarati Marketplace:

Elon Musk

FCC chair criticizes Amazon over opposition to SpaceX satellite plan

Carr made the remarks in a post on social media platform X.

U.S. Federal Communications Commission (FCC) Chairman Brendan Carr criticized Amazon after the company opposed SpaceX’s proposal to launch a large satellite constellation that could function as an orbital data center network.

Carr made the remarks in a post on social media platform X.

Amazon recently urged the FCC to reject SpaceX’s application to deploy a constellation of up to 1 million low Earth orbit satellites that could serve as artificial intelligence data centers in space.

The company described the proposal as a “lofty ambition rather than a real plan,” arguing that SpaceX had not provided sufficient details about how the system would operate.

Carr responded by pointing to Amazon’s own satellite deployment progress.

“Amazon should focus on the fact that it will fall roughly 1,000 satellites short of meeting its upcoming deployment milestone, rather than spending their time and resources filing petitions against companies that are putting thousands of satellites in orbit,” Carr wrote on X.

Amazon has declined to comment on the statement.

Amazon has been working to deploy its Project Kuiper satellite network, which is intended to compete with SpaceX’s Starlink service. The company has invested more than $10 billion in the program and has launched more than 200 satellites since April of last year.

Amazon has also asked the FCC for a 24-month extension, until July 2028, to meet a requirement to deploy roughly 1,600 satellites by July 2026, as noted in a CNBC report.

SpaceX’s Starlink network currently has nearly 10,000 satellites in orbit and serves roughly 10 million customers. The FCC has also authorized SpaceX to deploy 7,500 additional satellites as the company continues expanding its global satellite internet network.

Energy

Tesla Energy gains UK license to sell electricity to homes and businesses

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

Tesla Energy has received a license to supply electricity in the United Kingdom, opening the door for the company to serve homes and businesses in the country.

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

According to Ofgem, the license took effect at 6 p.m. local time on Wednesday and applies to Great Britain.

The approval allows Tesla’s energy business to sell electricity directly to customers in the region, as noted in a Bloomberg News report.

Tesla has already expanded similar services in the United States. In Texas, the company offers electricity plans that allow Tesla owners to charge their vehicles at a lower cost while also feeding excess electricity back into the grid.

Tesla already has a sizable presence in the UK market. According to price comparison website U-switch, there are more than 250,000 Tesla electric vehicles in the country and thousands of Tesla home energy storage systems.

Ofgem also noted that Tesla Motors Ltd., a separate entity incorporated in England and Wales, received an electricity generation license in June 2020.

The new UK license arrives as Tesla continues expanding its global energy business.

Last year, Tesla Energy retained the top position in the global battery energy storage system (BESS) integrator market for the second consecutive year. According to Wood Mackenzie’s latest rankings, Tesla held about 15% of global market share in 2024.

The company also maintained a dominant position in North America, where it captured roughly 39% market share in the region.

At the same time, competition in the energy storage sector is increasing. Chinese companies such as Sungrow have been expanding their presence globally, particularly in Europe.

Elon Musk

Elon Musk shares big Tesla Optimus 3 production update

According to Musk, Tesla is in the final stages of completing Optimus 3, which he described as one of the world’s most advanced humanoid robots.

Tesla CEO Elon Musk has stated that production of Optimus 3 could begin this summer. Musk shared the update in his interview at the Abundance Summit.

According to Musk, Tesla is in the final stages of completing Optimus 3, which he described as one of the world’s most advanced humanoid robots.

“We’re in the final stages of completion of Optimus 3, which is really going to be by far the most advanced robot in the world. Nothing’s even close. In fact, I haven’t even seen demos of robots that are as good as Optimus 3,” Musk said.

He also set expectations on the pace of Optimus 3’s production ramp, stating that the initial volumes of the humanoid robot will likely be very low. Musk did, however, also state that high production rates for Optimus 3 should be possible in 2027.

“I think we’ll start production on Optimus 3 this summer, but very slow at first, like sort of this classic S-curve ramp of manufacturing units versus time. And then, probably reach high volume production around summer next year,” he said.

Interestingly enough, the CEO hinted that Tesla is looking to iterate on the robot quickly, potentially releasing a new Optimus design every year.

“We’ll have Optimus 4 design complete next year. We’ll try to release a new robot design every year,” Musk stated.

Tesla has already outlined broader plans for scaling Optimus production beyond its first manufacturing line. Musk previously stated that Optimus 4 will be built at Gigafactory Texas at significantly higher production volumes.

Initial production lines for the robot are expected to be located at Tesla’s Fremont Factory, where the company plans to establish a line capable of producing up to 1 million robots per year.

A larger production ramp is expected to occur at Gigafactory Texas, where Musk has previously suggested could eventually support production of up to 10 million robots per year.

“We’re going to launch on the fastest production ramp of any product of any large complex manufactured product ever, starting with building a one-million-unit production line in Fremont. And that’s Line one. And then a ten million unit per year production line here,” Musk said previously.

The comments suggest that while Optimus 3 will likely begin production at Fremont, Tesla’s larger-scale manufacturing push could arrive with Optimus 4 at Gigafactory Texas.