Investor's Corner

Elon Musk makes a rare appearance on SolarCity’s Q2 conference call

SolarCity reported its Q2 quarterly results on Tuesday August 9, 2016, but unlike calls from the past where CEO Lyndon Rive’s provides a financial outlook for the nation’s largest full-service solar provider, Tesla CEO and SolarCity Chairman Elon Musk took stage to discuss future plans for the company. This marks a rare occasion for Musk and arrives at a time when discussions for the impending merger between Tesla and SolarCity is the hot topic among shareholders and analysts.

SolarCity provided shareholders with a Q2 2016 Shareholder Letter and accompanying Slide Presentation. While there might be little interest in the earnings report for Tesla owners and fans, quite a few interesting tidbits were provided during the afternoon SolarCity Analysts conference call by Musk.

Tesla Acquisition

Philip Lee-Wei Shen of ROTH Capital Partners asked why “the final deal and offer price was actually lower than the original price.”

Elon responded that “this is a negotiation of the independent board members. I actually wasn’t part of – and part of it was simply what they came up after, I think, a quite exhaustive discussion that lasted a week or two. So I’ve not inquired about the details and I’m not privy to the details, but it was ultimately what they concluded was fair between the independent board members of SolarCity and the board members of Tesla. Obviously, this is now up to the shareholder votes, independent shareholder votes where, I would say, I’m recusing myself. I’m not legally obligated to recuse myself, I’m just doing so, because I think it’s morally the right thing to do and so is Lyndon and Pete and JB Straubel.”

A new Product: Solar Roof

SolarCity is going to enter the “solar roof” market.

“We’re going to be making a pretty interesting product and I’m excited to kind of reveal to you all at some point, but it is not just your typical module, it is both very efficient and it looks really, really good,” said Peter Rive (CTO).

Elon elaborated that “It’s a solar roof as opposed to a module on a roof. I think, this is really a fundamental part of achieving a differentiated product strategy – it’s not a beautiful roof, that it is a solar roof, it’s not a thing on a roof, it is the roof. That’s – which is quite a difficult engineering challenge, and not something that is available really anywhere else that is at all good. I think this will be something that’s quite a standout. So one of the things I’m really very excited about the future.”

“It’s just addressing a really big market segment, so just in the U.S., there is 5 million new roofs installed every year,” said Lyndon Rive (CEO).

“The interesting thing about this is that it actually doesn’t cannibalize the existing product of putting solar on roof, because essentially if your roof is nearing end-of-life, you definitely don’t want to put solar panels on it, because you’re going to have to replace the roof,” said Elon Musk (Chairman). “So, there is a huge market segment that is currently inaccessible to SolarCity, because people know they’re going to have to replace their roof, you don’t want to put solar panels on top of a roof you’re going to replace. However, if you are close – if your roof is nearing end-of-life, well, you’ve got to get a new roof anyway, there’s 5 million new roofs a year just in the U.S. And so, why not have a solar roof that’s better in many others ways as well. We don’t want to show all of our cards right now, but I think people are going to be really excited about what they see.”

Notice that roof solar is a business where there are players already: Luma Resources, CertainTeed and Integrated Solar Technology, in particular and one that DOW Chemical just exited.

The solar roof product will be manufactured in Buffalo, NY. Elon added that “it’s really important to manufacturing in-house because its panels control the aesthetics and ideally really design – it’s kind of like making a custom car, like when somebody orders a car from Tesla, they’ll pick a wide array of options, that car will be custom made to their preferences, and you really want the roof custom-made to the individual customer as a kit and then sent to, that will be, the delivery team to get installed.”

Home Energy Management

Colin Rusch of Oppenheimer inquired “how long is it going to be before the combined entity [Tesla Motors + SolarCity] introduces a home energy management system or some sort of robust energy efficiency offering?”

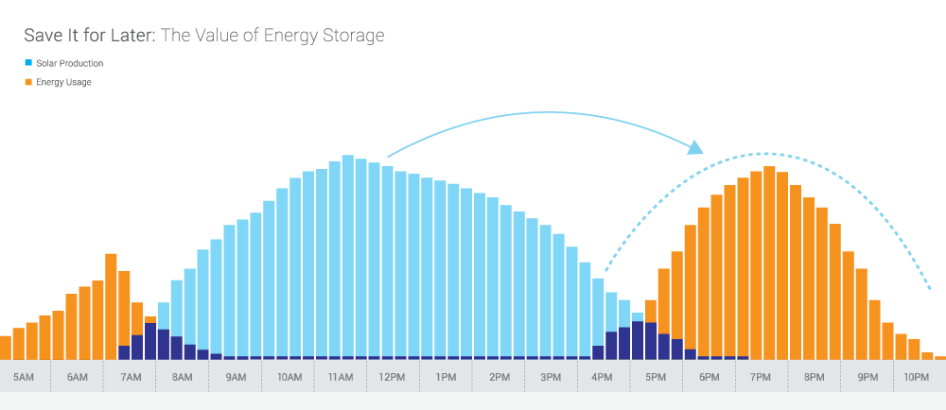

To which Elon joked that “solar and battery go together like peanut butter and jelly. You obviously need the battery, particularly as you get to scale and you want to have solar be a bigger and bigger percentage of the grid. If you don’t have the batteries there to balance the grid and buffer the power, you really can’t go beyond a certain percentage of solar in a particular neighborhood. Maybe you can go up to about 20% solar, but more than that, it starts to unbalance the grid and you need to buffer it, because the energy generation is low at dawn and dusk, it’s high in middle of the day, and it’s at zero during at night. So you got to smooth that out.”

Elon reiterated the usual “sustainable energy” mantra he has been preaching for a decade: “if you like sort of fast forward to where do we want the world eventually to be is want the world to have a sustainable energy generation, a sustainable energy consumption, so that it really requires the three critical ingredients for that, there is the solar panels, the stationary batteries, and electric vehicles.”

Who is going to Win? Rooftop or centralized generation?

“You’ll have millions of these batteries, you’ve got to manage that and integrate it with the utility,” said Elon. “I do want to emphasize, there’s still a very important role for utilities here, sometimes people think that this is an either/or thing, it’s like either rooftops are going to win or centralized generation is going to win and actually both are going to win, because the electricity usage is going to increase dramatically as we transition away from burning old dinosaurs to electric cars, and then to electric transport, we would see roughly a doubling of electricity consumption as all transport moves to electric. And then, there is a tripling of electricity usage if you take all heating and make that electric as well, because obviously most heating is from oil and natural gas particularly.”

Combining battery and rooftop solar

Gordon Johnson of Axiom Capital Management inquired what was the rationale behind the acquisition [of SolarCity by Tesla] when “combining a battery and a rooftop solar company didn’t make a ton of sense because when you have a rooftop solar company with net metering, the grid acts as, effectively, a battery, ruling out the need for a battery technology.”

“Where we see net metering evolving over the next few years, I think this is a really important part of how storage is a combination with the solar,” answered Peter Rive (CTO). “A case that I’d like everybody to review is what just recently happened in New York. This is a collaboration of the local utilities and the solar industry. And the collaboration is net metering for the next three years and then a phasing to more of a grid services model, where you combine solar, storage, smart inverters and provide all these additional grid services, and you phase that in and then essentially you phase-out net metering into that grid services model.”

Peter concluded that “we see that probably happening as a standard policy and we’re going to promote that across all the different states. But you – we have to get to a point where it is the grid services, so that, actually it recognizes the value that solar and storage can provide you to grid.”

I think Peter Rive indeed sees the writing on the wall for “net metering” as being phased out over time. Net metering has disappeared already from states like Nevada, and while it has been retained in California, at least until 2019, all local utilities are switching gradually to TOD (Time-of-Day) billing (the “grid services” model Peter references above), where a “smart battery storage” product that provides “time-shifting” will solve the solar basic dilemma: while solar production peaks during midday, energy consumption is highest in the morning and evening. With storage, you can save the energy you produce for when you need it most, and at the same time you limit the output to the grid, a benefit to the local utility.

Investor's Corner

Tesla gets tip of the hat from major Wall Street firm on self-driving prowess

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet,” BoA wrote.

Tesla received a tip of the hat from major Wall Street firm Bank of America on Wednesday, as it reinitiated coverage on Tesla shares with a bullish stance that comes with a ‘Buy’ rating and a $460 price target.

In a new note that marks a sharp reversal from its neutral position earlier in 2025, the bank declared Tesla’s Full Self-Driving (FSD) technology the “leading consumer autonomy solution.”

Analysts highlighted Tesla’s camera-only architecture, known as Tesla Vision, as a strategic masterstroke. While technically more challenging than the multi-sensor setups favored by rivals, the vision-based approach is dramatically cheaper to produce and maintain.

This cost edge, combined with Tesla’s rapidly expanding real-world data engine, positions the company to scale robotaxis far more profitably than competitors, BofA argues in the new note:

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet.”

The bank now attributes roughly 52% of Tesla’s total valuation to its Robotaxi ambitions. It also flagged meaningful upside from the Optimus humanoid robot program and the fast-growing energy storage business, suggesting the auto segment’s recent headwinds, including expired incentives, are being eclipsed by these higher-margin opportunities.

Tesla’s own data underscores exactly why Wall Street is waking up to FSD’s potential. According to Tesla’s official safety reporting page, the FSD Supervised fleet has now surpassed 8.4 billion cumulative miles driven.

Tesla FSD (Supervised) fleet passes 8.4 billion cumulative miles

That total ballooned from just 6 million miles in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and a staggering 4.25 billion in 2025 alone. In the first 50 days of 2026, owners added another 1 billion miles — averaging more than 20 million miles per day.

This avalanche of real-world, camera-captured footage, much of it on complex city streets, gives Tesla an unmatched training dataset. Every mile feeds its neural networks, accelerating improvement cycles that lidar-dependent rivals simply cannot match at scale.

Tesla owners themselves will tell you the suite gets better with every release, bringing new features and improvements to its self-driving project.

The $460 target implies roughly 15 percent upside from recent trading levels around $400. While regulatory and safety hurdles remain, BofA’s endorsement signals growing institutional conviction that Tesla’s data advantage is not hype; it’s a tangible moat already delivering billions of miles of proof.

Elon Musk

SpaceX IPO could push Elon Musk’s net worth past $1 trillion: Polymarket

The estimates were shared by the official Polymarket Money account on social media platform X.

Recent projections have outlined how a potential $1.75 trillion SpaceX IPO could generate historic returns for early investors. The projections suggest the offering would not only become the largest IPO in history but could also result in unprecedented windfalls for some of the company’s key investors.

The estimates were shared by the official Polymarket Money account on social media platform X.

As noted in a Polymarket Money analysis, Elon Musk invested $100 million into SpaceX in 2002 and currently owns approximately 42% of the company. At a $1.75 trillion valuation following SpaceX’s potential $1.75 trillion IPO, that stake would be worth roughly $735 billion.

Such a figure would dramatically expand Musk’s net worth. When combined with his holdings in Tesla Inc. and other ventures, a public debut at that level could position him as the world’s first trillionaire, depending on market conditions at the time of listing.

The Bloomberg Billionaires Index currently lists Elon Musk with a net worth of $666 billion, though a notable portion of this is tied to his TSLA stock. Tesla currently holds a market cap of $1.51 trillion, and Elon Musk’s currently holds about 13% to 15% of the company’s outstanding common stock.

Founders Fund, co-founded by Peter Thiel, invested $20 million in SpaceX in 2008. Polymarket Money estimates the firm owns between 1.5% and 3% of the private space company. At a $1.75 trillion valuation, that range would translate to approximately $26.25 billion to $52.5 billion in value.

That return would represent one of the most significant venture capital outcomes in modern Silicon Valley history, with a growth of 131,150% to 262,400%.

Alphabet Inc., Google’s parent company, invested $900 million into SpaceX in 2015 and is estimated to hold between 6% and 7% of the private space firm. At the projected IPO valuation, that stake could be worth between $105 billion and $122.5 billion. That’s a growth of 11,566% to 14,455%.

Other major backers highlighted in the post include Fidelity Investments, Baillie Gifford, Valor Equity Partners, Bank of America, and Andreessen Horowitz, each potentially sitting on multibillion-dollar gains.

Elon Musk

Elon Musk hints Tesla investors will be rewarded heavily

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet,” Musk said.

Elon Musk recently hinted that he believes Tesla investors will be rewarded heavily if they continue to hold onto their shares, and he reiterated that in a new interview that the company released on its social accounts this week.

Musk is one of the most successful CEOs in the modern era and has mammothed competitors on the Forbes Net Worth List over the past year as his holdings in his various companies have continued to swell.

Tesla investors, especially those who have been holding shares for several years, have also felt substantial gains in their portfolios. Over the past five years, the stock is up over 78 percent. Since February 2019, nearly seven years ago to the day, the stock is up over 1,800 percent.

Musk said in the interview:

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet.”

Elon Musk in new interview: “Hold on to your $TSLA stock. It’s going to be worth a lot, I think. That’s my bet.” pic.twitter.com/cucirBuhq0

— Sawyer Merritt (@SawyerMerritt) February 26, 2026

It’s no secret Musk has been extremely bullish on his own companies, but Tesla in particular, because it is publicly traded.

However, the company has so many amazing projects that have an opportunity to revolutionize their respective industries. There is certainly a path to major growth on Wall Street for Tesla through its various future projects, including Optimus, Cybercab, Semi, and Unsupervised FSD.

- Optimus (Tesla’s humanoid robot): Musk has discussed its potential for tasks like childcare, walking dogs, or assisting elderly parents, positioning it as a massive long-term driver of company value.

- Cybercab (Tesla’s robotaxi/autonomous ride-hailing vehicle): a fully autonomous vehicle geared specifically for Tesla’s ride-sharing ambitions.

- Semi (Tesla’s electric truck, with mentions of expansion, like in Europe): brings Tesla into the commercial logistics sector.

- Unsupervised FSD (Full Self-Driving software achieving full autonomy without human supervision): turns every Tesla owner’s vehicle into a fully-autonomous vehicle upon release

These projects specifically are some of the highest-growth pillars Tesla has ever attempted to develop, especially in Musk’s eyes, as he has said Optimus will be the best-selling product of all-time.

Many analysts agree, but the bullish ones, like Cathie Wood of ARK Invest, are perhaps the one who believes Tesla has incredible potential on Wall Street, predicting a $2,600 price target for 2030, but this is not even including Optimus.

She told Bloomberg last March that she believes that the project will present a potential additive if Tesla can scale faster than anticipated.