Investor's Corner

Tesla delivers a whopping 24,500 vehicles in Q3, sets quarterly record

Tesla reported its production and deliveries for Q3 2016. According to the report, “Tesla delivered approximately 24,500 vehicles in Q3, of which 15,800 were Model S and 8,700 were Model X. This was an increase of just over 70% from last quarter’s deliveries of 14,402. Our Q3 delivery count should be viewed as slightly conservative, as we only count a car as delivered if it is transferred to the customer and all paperwork is correct.”

“In addition to Q3 deliveries, about 5,500 vehicles were in transit to customers at the end of the quarter. These will not be counted as deliveries until Q4. Production rose to 25,185 vehicles in Q3. This was an increase of 37% from Q2 production of 18,345″

One number that will looked at by Wall Street traders and investors on Monday was going to be “guidance” for the rest of the year. Guidance was good. Tesla stated in the press release that “we expect Q4 deliveries and production to be at or slightly above Q3, despite Q4 being a shorter quarter and the challenge of delivering vehicles in winter weather over holidays. Guidance of 50,000 vehicles for the second half of 2016 is maintained.” This number will make a lot of traders happy.

Elon must be happy, as he immediately retweeted an article from VentureBeat, positive on the reported numbers.

Source: Twitter

VentureBeat noted that “to encourage orders for its electric vehicles, Tesla has pulled out practically all the stops to encourage ordering, including offering a 2-year lease on Model S and X vehicles and even producing a new Model S sedan with a larger battery and faster acceleration. This is certainly good news for Tesla, perhaps showing that customers aren’t dissuaded by recent reports of accidents involving Tesla and its self-driving capabilities. ”

Another positive note came out from Bloomberg that noted in an article titled “Tesla Shipments Top Analysts’ Estimates as Musk Urges Sales Push”, that “the quarter was Tesla’s last chance to show that it can be profitable before it raises money to ramp up production of the new Model 3. The third-quarter deliveries were positive and beat most estimates, said Jeffrey Osborne, an analyst at Cowen & Co., who rates the stock underperform. “We were looking for 20,500 this quarter with an acceleration in 4Q to get to 50,000 for the second half,” Osborne said by e-mail. “We believe bullish investors were in the 22,000 to 23,000 range.”

With 24,500 vehicles delivered, Tesla beat even the expectations of the most bullish investors.

The Wall Street Journal’s MarketWatch was rather positive as well in a note titled “Tesla reports its best-ever quarterly vehicle sales”. The reporter noted that “the results suggest the revelation on June 30 that a Model S was involved in an earlier fatal crash in Florida involving the car’s Autopilot hasn’t affected sales. Federal regulators are investigating the crash, which the company said was the first known fatality involving the company’s semiautonomous feature that can take control of the car in certain driving conditions. Tesla has since begun rolling out software updates to Autopilot that Mr. Musk say would have prevented the crash.”

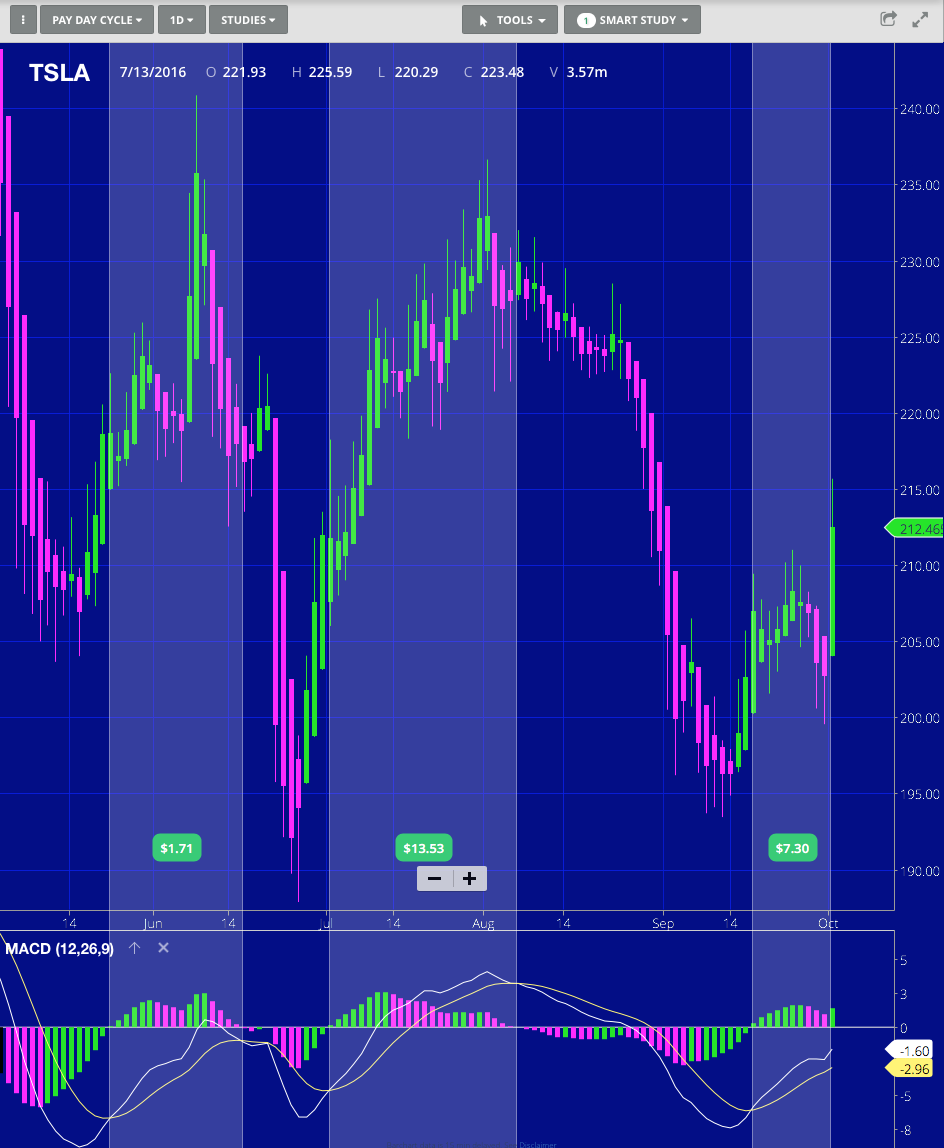

Trading Action

The stock has languished during the last 10 trading sessions, in what traders call “compression.” It will be interesting to see Monday’s opening as it will be highly influenced by the just reported results, and it may fuel back a positive rally on the stock.

Stock Market Update

As I predicted, TSLA stock is rallying at the opening on Monday. While the Dow is down over 70 points, TSLA was up was much as $10 or 5%. If the gain is staying into the close, it will be one of the best trading days of the year for TSLA.

Source: Wall Street I/O (wall street.io)

Investor's Corner

Tesla bear turns bullish for two reasons as stock continues boost

“I think from a trading perspective, it looks very interesting,” Nathan said, citing numerous signs of strength, such as holding its 200-day moving average and holding against its resistance level.

A Tesla bear is changing his tune, turning bullish for two reasons as the company’s stock has continued to get a boost over the past month.

Dan Nathan, a notorious skeptic of Tesla shares, said he is changing his tune, at least in the short term, on the company’s stock because of “technicals and sentiment,” believing the company is on track for a strong Q3, but also an investment story that will slowly veer away from its automotive business.

“I think from a trading perspective, it looks very interesting,” Nathan said, citing numerous signs of strength, such as holding its 200-day moving average and holding against its resistance level.

He also said he believes a rally for the stock could continue as it heads into the end of the quarter, especially as the $7,500 electric vehicle tax credit is coming to an end at the end of the month.

With that being said, he believes the consensus for Q3 deliveries is “probably low,” as he believes Wall Street is likely underestimating what Tesla will bring to the table on October 1 or 2 when it reports numbers for the quarter.

Tesla bear Dan Nathan has flipped his script on Tesla $TSLA shares, citing “technicals and sentiment”

— TESLARATI (@Teslarati) September 12, 2025

Tesla shares are already up over five percent today, with gains exceeding nine percent over the past five trading days, and more than fourteen percent in the past month.

While some analysts are looking at the performance of other Mag 7 stocks, movement on rates from the Federal Reserve, and other broader market factors as reasoning for Tesla’s strong performance, it appears some movement could be related to the company’s recent developments instead.

Over the past week, Tesla has made some strides in its Robotaxi program, including a new license to test the platform in the State of Nevada, which we reported on.

Tesla lands regulatory green light for Robotaxi testing in new state

Additionally, the company is riding the tails of the end of the EV tax credit, as inventory, both new and used, is running extremely low, generally speaking. Many markets do not have any vehicles to purchase as of right now, making delivery by September 30 extremely difficult.

However, there has been some adjustments to the guidelines by the IRS, which can be read here:

Tesla is trading at around $389 at 10:56 a.m. on the East Coast.

Elon Musk

Analyst: Elon Musk’s $1 trillion Tesla pay deal modest against robot market potential

Jonas highlighted Tesla’s longer-term ambitions in robotics as a key factor in his assessment.

Morgan Stanley analyst Adam Jonas, one of Wall Street’s most ardent Tesla (NASDAQ:TSLA) bulls today, has described Elon Musk’s newly proposed $1 trillion performance-based compensation package as a “good deal” for investors.

In a note shared this week, Jonas argued that the package helps align the interests of Musk and Tesla’s minority shareholders, despite its shockingly high headline number.

Future market opportunities

Jonas highlighted Tesla’s longer-term ambitions in robotics as a key factor in his assessment. “Yes, a trillion bucks is a big number, but (it) is rather modest compared to the size of the market opportunity,” Jonas wrote. He added that the humanoid robot market could ultimately surpass the size of today’s global labor market “by a significant multiple.”

“We have entertained scenarios where the humanoid robot market can exceed the size of today’s global labor market… by a significant multiple,” Jonas wrote, as shared on X by Tesla watcher Sawyer Merritt.

The analyst likened the arrival of AI-powered robotics to the transformative effect of electricity, noting that “contemplating future global GDP before AI robots is like contemplating global GDP before electricity.” The Morgan Stanley analyst’s insights align with the idea that as much as 80% of Tesla’s future valuation could be tied to its Optimus humanoid robot program.

Elon Musk’s pay package

Tesla’s board has tied Elon Musk’s proposed compensation package to some of the most ambitious targets in corporate history. The 2025 CEO Performance Award requires the automaker’s valuation to soar from roughly $1.1 trillion today to $8.5 trillion over the next decade, a level that would make Tesla the most valuable company in existence.

The plan also demands a leap in Tesla’s operating profit, from $17 billion in 2024 to $400 billion annually. It also ties the CEO’s compensation to a number of product milestones, including the delivery of 20 million vehicles in total, 10 million active Full Self-Driving subscriptions, 1 million Tesla Bots, and 1 million Robotaxis in operation. Tesla’s board emphasized that Musk’s leadership was fundamental to achieving such ambitious goals, with Chair Robyn Denholm noting the award would align the CEO’s incentives with long-term shareholder value.

Elon Musk

Tesla board reveals reasoning for CEO Elon Musk’s new $1 trillion pay package

“Yes, you read that correctly: in 2018, Elon had to grow Tesla by billions; in 2025, he has to grow Tesla by trillions — to be exact, he must create nearly $7.5 trillion in value for shareholders for him to receive the full award.”

Tesla’s Board of Directors has proposed a new pay package for company CEO Elon Musk that would result in $1 trillion in stock offerings if he is able to meet several lofty performance targets.

Musk, who has not been meaningfully compensated since 2017, completed his last pay package by delivering billions in shareholder value through a variety of performance-based “tranches,” which were met and resulted in the award of billions in stock.

Elon Musk’s new pay plan ties trillionaire status to Tesla’s $8.5 trillion valuation

However, Musk was unable to claim this award due to a ruling by the Delaware Chancery Court, which deemed the payout an “unfathomable sum.”

Now, the company is taking steps to ensure Musk gets paid, as the Board feels that it is crucial to retain its CEO, who has been responsible for much of the company’s success.

This is not a statement to undermine the work of all of Tesla’s terrific employees, but a ship needs to be captained by someone, and Musk has proven he is the right person for the job.

The Board also believes that, based on a statement made by the company in its proxy, various issues will be discussed during the upcoming Shareholder Meeting.

Robyn Denholm and Kathleen Wilson-Thompson recognized Musk’s contributions in a statement, which encouraged shareholders to vote to approve the payout:

“We’re asking you to approve the 2025 CEO Performance Award. In designing the new performance award, we explored numerous alternatives. Ultimately, the new award aims to build upon the success of the 2018 CEO Performance Award framework, which ensure that Elon was only paid for the performance delivered and incentivized to guide Tesla through a period of meteoric growth. The 2025 CEO Performance Award similarly challegnes Elon to again meet a series of even more aspirational goals, including operational milestones focused on reaching Adjusted EBITDA targets (thresholds that are up to 28 times higher than the 2108 CEO Performance Award’s top Adjusted EBITDA milestone) and rolling out new or expanded product offerings (including 1 million Robotaxis in commercial operation and delivery of 1 million AI Bots), all while growing the company’s market capitalization by trillions of dollars.

Yes, you read that correctly: in 2018, Elon had to grow Tesla by billions; in 2025, he has to grow Tesla by trillions — to be exact, he must create nearly $7.5 trillion in value for shareholders for him to receive the full award.

In addition to these unprecedented performance milestones, the 2025 CEO Performance Award also includes innovative structural features, born out of the special committee’s considered analysis and extensive shareholder feedback. These features include supercharged retention (at least seven and a half years and up to 10 years to vest in the full award), structural protections to minimize stock price volatility due to administration of this award and, thereafter, incentives for Elon to participate in the Board’s continued development of a framework for long-term CEO Succession. If Elon achieves all the performance milestones under this principle-based 2025 CEO Performance Award, his leadership will propel Tesla to become the most valuable company in history.”

Musk will have a lot of things to accomplish to receive the 423,743,904 shares, which are divided into 12 tranches.

However, the Board feels he is the right person for the job, and they want him to remain the CEO. This package should ensure that he stays with Tesla, as long as shareholders feel the same way.

-

News2 weeks ago

News2 weeks agoTesla is overhauling its Full Self-Driving subscription for easier access

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk shares unbelievable Starship Flight 10 landing feat

-

Elon Musk1 week ago

Elon Musk1 week agoTesla’s next-gen Optimus prototype with Grok revealed

-

News7 days ago

News7 days agoTesla launches new Supercharger program that business owners will love

-

Elon Musk7 days ago

Elon Musk7 days agoTesla Board takes firm stance on Elon Musk’s political involvement in pay package proxy

-

News2 weeks ago

News2 weeks agoTesla appears to be mulling a Cyber SUV design

-

News1 week ago

News1 week agoTesla deploys Unsupervised FSD in Europe for the first time—with a twist

-

News2 weeks ago

News2 weeks agoTesla expands crazy new lease deal for insane savings on used inventory