News

Tesla bull calls battery cost declines “good deflation” that could boost EV sales

Longtime Tesla bull ARK invest recently identified battery cost declines as a form of “good deflation” that could lead to a boost in EV sales.

To support its observations, ARK Invest used the 2022 Nissan Leaf EV’s price as an example. A few years ago, Nissan announced that the 2016 Leaf SV and SL variants would come standard with its 30kWh battery pack for an EPA-rated 107 miles of range. Nissan’s suggested manufacturer’s prices for the SV and SL were $34,200 and $36,790, respectively. ARK calculated that the 2016 Nissan Leaf would cost ~$39,000 in today’s dollars.

Today, the 2022 Leaf with a 40 kWh battery pack costs $27,400, that’s $11,600 less than the 2016 version with an additional range of 42 miles. The Nissan Leaf’s pricing reveals that it costs less to produce an EV with more milage today than five years ago.

Battery cost declines could decrease EV production costs and improve range, which may boost electric vehicle sales in the long run. An increase in electric vehicle sales could lead to growth in the EV market.

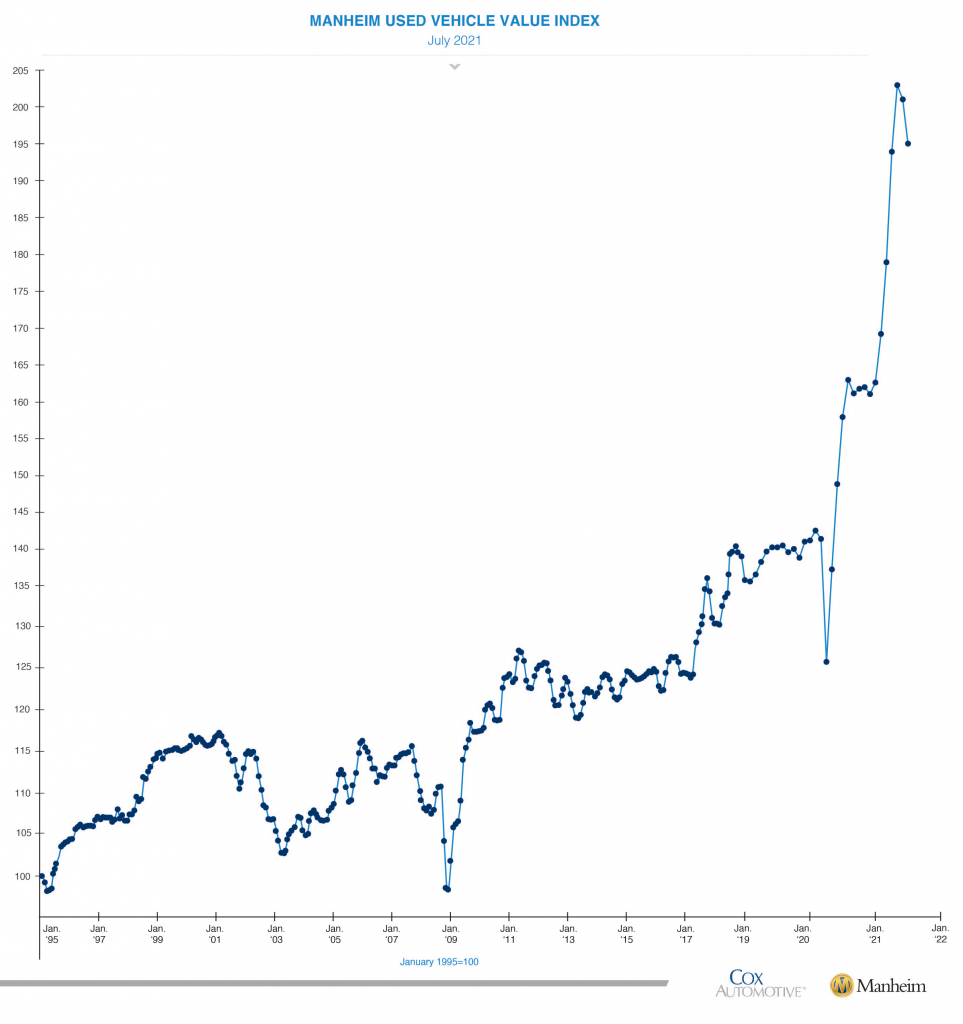

In contrast to “good deflation,” ARK also identified an example of “bad deflation” in the auto industry, specifically in the used car market. The investment management firm noted a decline in used car prices over the past few months, indicated by the Manheim Used Vehicle Index.

“While [ARK Invest] believe[s] the decline in battery costs is likely to translate into lower prices, boosting EV sales, the drop in used car prices could be signaling weakening demand for traditional gas-powered cars,” wrote Sam Korus in ARK’s newsletter.

In its July 2021 publication, The Manheim Market Report (MMR) stated there were declines in prices every week last month. The used car market saw price declines accelerating through mid-July that slowed over the last two weeks. The MMR did not differentiate between used gas-powered vehicles or second-hand cars.

However, the used car market for EVs seems to be growing. Some countries, including the United States and Canada, are already considering tax credits and rebates for second-hand EVs.

As a frontrunner in the latest EV revolution, Tesla seems to be leading the charge in the used car market for electric vehicles as well. After making headways in the new passenger car market, the Tesla Model 3 had become a dominating force in the used car market in countries like the United States and the United Kingdom.

Given everything discussed above, it seems both forms of deflation ARK Invest discussed suggest that EV sales will increase, both in the new and used car market. More governments worldwide are readily committing to decreasing carbon emissions and transitioning to clean energy sources which would greatly affect the future of the auto market as well.

The Teslarati team would appreciate hearing from you. If you have any tips, reach out to me at maria@teslarati.com or via Twitter @Writer_01001101.

News

Tesla’s Apple CarPlay ambitions are not dead, they’re still in the works

For what it’s worth, as a Tesla owner, I don’t particularly see the need for CarPlay, as I have found the in-car system that the company has developed to be superior. However, many people are in love with CarPlay simply because, when it’s in a car that is capable, it is really great.

Tesla’s Apple CarPlay ambitions appeared to be dead in the water after a large amount of speculation late last year that the company would add the user interface seemed to cool down after several weeks of reports.

However, it appears that CarPlay might make its way to Tesla vehicles after all, as a recent report seems to indicate that it is still being worked on by software teams for the company.

The real question is whether it is truly needed or if it is just a want by so many owners that Tesla is listening and deciding to proceed with its development.

Back in November, Bloomberg reported that Tesla was in the process of testing Apple CarPlay within its vehicles, which was a major development considering the company had resisted adopting UIs outside of its own for many years.

Nearly one-third of car buyers considered the lack of CarPlay as a deal-breaker when buying their cars, a study from McKinsey & Co. outlined. This could be a driving decision in Tesla’s inability to abandon the development of CarPlay in its vehicles, especially as it lost a major advantage that appealed to consumers last year: the $7,500 EV tax credit.

Tesla owners propose interesting theory about Apple CarPlay and EV tax credit

Although we saw little to no movement on it since the November speculation, Tesla is now reportedly in the process of still developing the user interface. Mark Gurman, a Bloomberg writer with a weekly newsletter, stated that CarPlay is “still in the works” at Tesla and that more concrete information will be available “soon” regarding its development.

While Tesla already has a very capable and widely accepted user interface, CarPlay would still be an advantage, considering many people have used it in their vehicles for years. Just like smartphones, many people get comfortable with an operating system or style and are resistant to using a new one. This could be a big reason for Tesla attempting to get it in their own cars.

Tesla gets updated “Apple CarPlay” hack that can work on new models

For what it’s worth, as a Tesla owner, I don’t particularly see the need for CarPlay, as I have found the in-car system that the company has developed to be superior. However, many people are in love with CarPlay simply because, when it’s in a car that is capable, it is really great.

It holds one distinct advantage over Tesla’s UI in my opinion, and that’s the ability to read and respond to text messages, which is something that is available within a Tesla, but is not as user-friendly.

With that being said, I would still give CarPlay a shot in my Tesla. I didn’t particularly enjoy it in my Bronco Sport, but that was because Ford’s software was a bit laggy with it. If it were as smooth as Tesla’s UI, which I think it would be, it could be a really great addition to the vehicle.

News

Tesla brings closure to Model Y moniker with launch of new trim level

With the launch of a new trim level for the Model Y last night, something almost went unnoticed — the loss of a moniker that Tesla just recently added to a couple of its variants of the all-electric crossover.

Tesla launched the Model Y All-Wheel-Drive last night, competitively priced at $41,990, but void of the luxurious features that are available within the Premium trims.

Upon examination of the car, one thing was missing, and it was noticeable: Tesla dropped the use of the “Standard” moniker to identify its entry-level offerings of the Model Y.

The Standard Model Y vehicles were introduced late last year, primarily to lower the entry price after the U.S. EV tax credit changes were made. Tesla stripped some features like the panoramic glass roof, premium audio, ambient lighting, acoustic-lined glass, and some of the storage.

Last night, it simply switched the configurations away from “Standard” and simply as the Model Y Rear-Wheel-Drive and Model Y All-Wheel-Drive.

There are three plausible reasons for this move, and while it is minor, there must be an answer for why Tesla chose to abandon the name, yet keep the “Premium” in its upper-level offerings.

“Standard” carried a negative connotation in marketing

Words like “Standard” can subtly imply “basic,” “bare-bones,” or “cheap” to consumers, especially when directly contrasted with “Premium” on the configurator or website. Dropping it avoids making the entry-level Model Y feel inferior or low-end, even though it’s designed for affordability.

Tesla likely wanted the base trim to sound neutral and spec-focused (e.g., just “RWD” highlights drivetrain rather than feature level), while “Premium” continues to signal desirable upgrades, encouraging upsells to higher-margin variants.

Simplifying the overall naming structure for less confusion

The initial “Standard vs. Premium” split (plus Performance) created a somewhat clunky hierarchy, especially as Tesla added more variants like Standard Long Range in some markets or the new AWD base.

Removing “Standard” streamlines things to a more straightforward progression (RWD → AWD → Premium RWD/AWD → Performance), making the lineup easier to understand at a glance. This aligns with Tesla’s history of iterative naming tweaks to reduce buyer hesitation.

Elevating brand perception and protecting perceived value

Keeping “Premium” reinforces that the bulk of the Model Y lineup (especially the popular Long Range models) remains a premium product with desirable features like better noise insulation, upgraded interiors, and tech.

Eliminating “Standard” prevents any dilution of the Tesla brand’s upscale image—particularly important in a competitive EV market—while the entry-level variants can quietly exist as accessible “RWD/AWD” options without drawing attention to them being decontented versions.

You can check out the differences between the “Standard” and “Premium” Model Y vehicles below:

@teslarati There are some BIG differences between the Tesla Model Y Standard and Tesla Model Y Premium #tesla #teslamodely ♬ Sia – Xeptemper

Elon Musk

Tesla bull sees odds rising of Tesla merger after Musk confirms SpaceX-xAI deal

Dan Ives of Wedbush Securities wrote on Tuesday that there is a growing chance Tesla could be merged in some form with SpaceX and xAI over the next 12 to 18 months.

A prominent Tesla (NASDAQ:TSLA) bull has stated that the odds are rising that Tesla could eventually merge with SpaceX and xAI, following Elon Musk’s confirmation that the private space company has combined with his artificial intelligence startup.

Dan Ives of Wedbush Securities wrote on Tuesday that there is a growing chance Tesla could be merged in some form with SpaceX and xAI over the next 12 to 18 months.

“In our view there is a growing chance that Tesla will eventually be merged in some form into SpaceX/xAI over time. The view is this growing AI ecosystem will focus on Space and Earth together…..and Musk will look to combine forces,” Ives wrote in a post on X.

Ives’ comments followed confirmation from Elon Musk late Monday that SpaceX has merged with xAI. Musk stated that the merger creates a vertically integrated platform that combines AI, rockets, satellite internet, communications, and real-time data.

In a post on SpaceX’s official website, Elon Musk added that the combined company is aimed at enabling space-based AI compute, stating that within two to three years, space could become the lowest-cost environment for generating AI processing power. The transaction reportedly values the combined SpaceX-xAI entity at roughly $1.25 trillion.

Tesla, for its part, has already increased its exposure to xAI, announcing a $2 billion investment in the startup last week in its Q4 and FY 2025 update letter.

While merger speculation has intensified, notable complications could emerge if SpaceX/xAI does merge with Tesla, as noted in a report from Investors Business Daily.

SpaceX holds major U.S. government contracts, including with the Department of Defense and NASA, and xAI’s Grok is being used by the U.S. Department of War. Tesla, for its part, maintains extensive operations in China through Gigafactory Shanghai and its Megapack facility.