News

SpaceX Starlink Gen2 constellation weakened by “partial” FCC grant

More than two and a half years after SpaceX began the process of securing regulatory approval for its next-generation Starlink constellation, the US Federal Communications Commission (FCC) has finally granted the company a license – but only after drastically decreasing its scope.

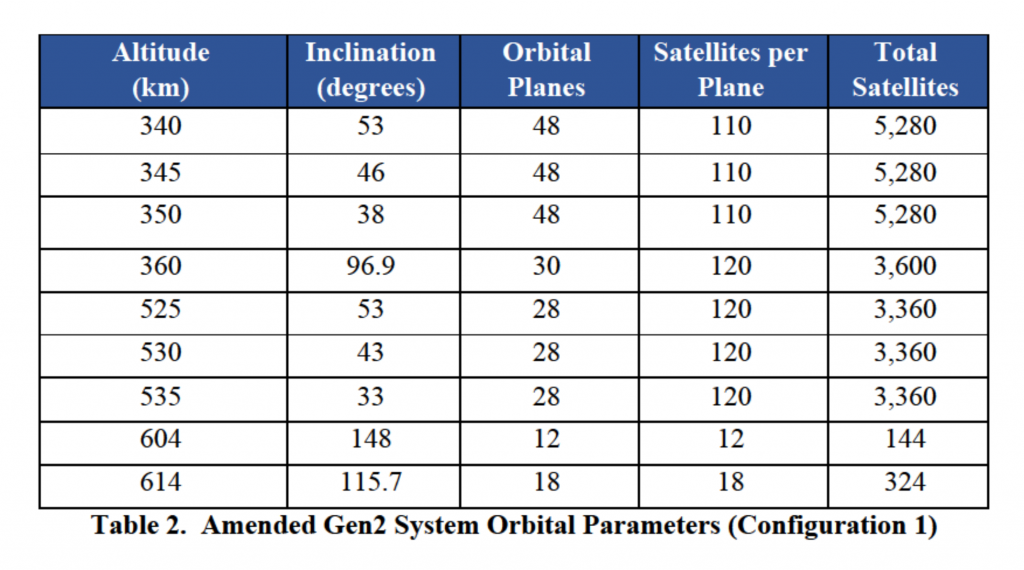

In May 2020, SpaceX filed its first FCC license application for Starlink Gen2, an upgraded constellation of 30,000 satellites. In the second half of 2021, SpaceX amended its Starlink Gen2 application to take full advantage of the company’s more powerful Starship rocket and further improve the constellation’s potential utility. Only in December 2021 did the FCC finally accept SpaceX’s Gen2 application for filing, kicking off the final review process.

On November 29th, 2022, the FCC completed that review and granted SpaceX permission to launch just 7,500 of the ~30,000 Starlink Gen2 satellites it had requested permission for more than 30 months prior. The FCC offered no explanation of how it arrived at its arbitrary 75% reduction, nor why the resulting number is slightly lower than a different 7,518-satellite Starlink Gen1 constellation SpaceX had already received a license to deploy in late 2018. Adding insult to injury, the FCC repeatedly acknowledges that “the total number of satellites SpaceX is authorized to deploy is not increased by our action today, and in fact is slightly reduced.”

The update that's rolling out to the fleet makes full use of the front and rear steering travel to minimize turning circle. In this case a reduction of 1.6 feet just over the air— Wes (@wmorrill3) April 16, 2024

That claimed reduction is thanks to the fact that shortly before this decision, SpaceX told the FCC in good faith that it would voluntarily avoid launching the dedicated V-band Starlink constellation it already received a license for in order “to significantly reduce the total number of satellites ultimately on orbit.” Instead, once Starlink Gen2 was approved, it would request permission to add V-band payloads to a subset of the 29,988 planned Gen2 satellites, achieving a similar result without the need for another 7,518 satellites.

In response, the FCC slashed the total number of Starlink Gen2 satellites permitted to less than the number of satellites approved by the FCC’s November 2018 Starlink V-band authorization; limited those satellites to middle-ground orbits, entirely precluding Gen2 launches to higher or lower orbits; and didn’t even structure its compromise in a way that would at least allow SpaceX to fully complete three Starlink Gen2 ‘shells.’ Worse, the FCC’s partial grant barely mentioned SpaceX’s detailed plans to use new E-band antennas on Starlink Gen2 satellites and next-generation ground stations, simply stating that it will “defer acting on” the request until “further review and coordination with Federal users.”

Throughout the partial grant, the FCC couches its decision to drastically downscale SpaceX’s Starlink Gen2 constellation in terms of needing more time “to evaluate the complex and novel issues on the record before [the Commission],” raising the question of what exactly the Commission was doing instead in the 30 months since SpaceX’s first Gen2 application and 15 months since its Gen2 modification. In comparison, SpaceX received a full license for its 7,518-satellite V-band constellation less than five months after applying. SpaceX’s 4,408-satellite Starlink Gen1 constellation – the first megaconstellation ever reviewed by the modern FCC – was licensed 16 months after its first application and eight months after a modified application was submitted.

Adding to the oddity of the unusual and inconsistent decision-making in this FCC ruling, the Commission openly acknowledges that the idea to grant SpaceX permission to launch a fraction of its Starlink Gen2 constellation came from Amazon’s Project Kuiper [PDF], a major prospective Starlink competitor. The FCC says it agreed with Amazon’s argument, stating that “the public interest would be served by taking this approach in order to permit monitoring of developments involving this large-scale deployment and permit additional consideration of issues unique to the other orbits SpaceX requests.”

The V-band Starlink constellation already approved by the FCC was for 7,518 satellites in very low Earth orbits (~340 km). In the first 4,425-satellite Starlink constellation licensed by the FCC, the Commission gave SpaceX permission to operate 2,814 satellites at orbits between 1100 and 1300 kilometers. Increasingly conscious of the consequences of space debris, which would last hundreds of years at 1000+ kilometers, SpaceX later requested permission in 2019 and 2020 to launch those 2,814 satellites to around 550 kilometers, where failed satellites would reenter in just five years. For unknown reasons, the FCC only fully approved the change two years later, in April 2021.

The “other orbits [requested by SpaceX]” that the FCC says create unique issues that demand “additional consideration” of Starlink Gen2 are for 19,400 satellites between 340 and 360 kilometers and 468 satellites between 604 and 614 kilometers. Starlink satellites are expected to be around four times heavier and feature a magnitude more surface area, but the fact remains that the FCC has already granted SpaceX permission to launch almost 3000 smaller satellites to orbits much higher than 604 kilometers and more than 7500 satellites to orbits lower than 360 kilometers. It’s thus hard not to conclude that the Commission’s claims that a partial license denial was warranted by “concerns about orbital debris and space safety,” and “issues unique to…other orbits” are incoherent at best.

Perhaps the strangest inclusion in the partial grant is a decision by the FCC to subject SpaceX to an arbitrary metric devised by another third-party, for-profit company LeoLabs. In a March 2022 letter, LeoLabs reportedly proposed that “SpaceX’s authorization to continue deploying satellites” be directly linked to an arbitrary metric measuring “the number of years each failed satellite remains in orbit, summed across all failed satellites.” The FCC apparently loved the suggestion and made it an explicit condition of its already harsh Starlink Gen2 authorization, even adopting the arbitrary limit of “100 object years” proposed by LeoLabs.

In other words, once the sum of the time required for all failed Starlink Gen2 satellites to naturally deorbit reaches 100 years, the FCC will force SpaceX to “cease satellite deployment” while it “[reviews] sources of satellite failure” and “determine[s] whether there are any adequate and reliable mitigation measures going forward.” The FCC acknowledges that the arbitrary 100-year limit means that the failure of just 20 Starlink satellites at operational orbits would force the company to halt launches. The Commission does not explain how it will decide when SpaceX can restart Starlink launches after a launch halt. SpaceX must simultaneously follow the FCC’s deployment schedule, which could see the company’s license revoked if it doesn’t deploy 3,750 Starlink Gen2 satellites by November 2028 and all 7,500 satellites by November 2031.

Based on the unofficial observations of astrophysicist Jonathan McDowell, SpaceX currently has more 30 failed Starlink Gen1 satellites at or close to their operational altitudes of 500+ kilometers, meaning that SpaceX would almost certainly be forced to stop launching Gen1 satellites if this arbitrary new rule were applied to other constellations. The same is true for competitor OneWeb, which had a single satellite fail at around 1200 kilometers in 2021. At that altitude, it will likely take hundreds of “object years” to naturally deorbit, easily surpassing LeoLabs’ draconian 100-year limit.

In theory, the FCC does make it clear that it will consider changing those restrictions and allowing SpaceX to launch more of its proposed Starlink Gen2 constellation in the future. But the Commission has also repeatedly demonstrated to SpaceX that it will happily take years to modify existing licenses or approve new ones – not a particularly reassuring foundation for investments as large and precarious as megaconstellations.

Ultimately, short of shady handshake deals in back rooms, the FCC’s partial grant leaves SpaceX’s Starlink Gen2 constellation in an undesirable position. For the company to proceed under the current license, it could be forced to redesign its satellites and ground stations to avoid the E-band, or gamble by continuing to build and deploy satellites and ground stations with E-band antennas without a guarantee that it’ll ever be able to use that hardware. There is also no guarantee that the FCC will permit SpaceX to launch any of the ~22,500 satellites left on the table by the partial grant, which will drastically change the financial calculus that determines whether the constellation is economically viable and how expansive associated infrastructure needs to be.

Additionally, if SpaceX accepts the gambit and launches all 7,500 approved Gen2 satellites only for the FCC to fail to approve expansions, Starlink Gen2 would be stuck with zero polar coverage, significantly reducing the constellation’s overall utility. Starlink Gen2 likely represents an investment of at least $30-60 billion (assuming an unprecedentedly low $1-2M to build and launch each 50-150 Gbps satellite). With its partial license denial and the addition of several new and arbitrary conditions, the FCC is effectively forcing SpaceX to take an even riskier gamble with the billions of dollars of brand new infrastructure it will need to build to manufacture, launch, operate, and utilize its Starlink Gen2 constellation.

Energy

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

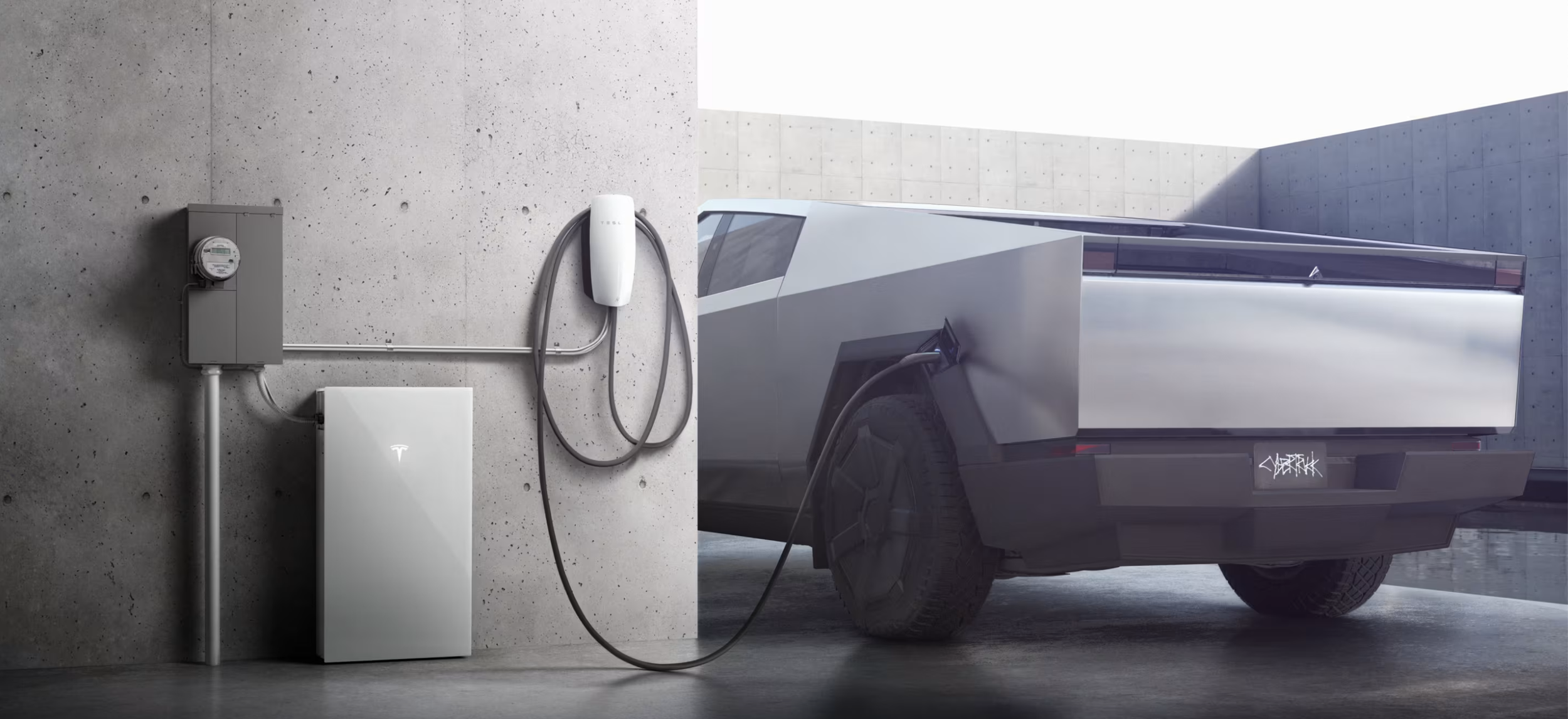

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.

News

Samsung nears Tesla AI chip ramp with early approval at TX factory

This marks a key step towards the tech giant’s production of Tesla’s next-generation AI5 chips in the United States.

Samsung has received temporary approval to begin limited operations at its semiconductor plant in Taylor, Texas.

This marks a key step towards the tech giant’s production of Tesla’s next-generation AI5 chips in the United States.

Samsung clears early operations hurdle

As noted in a report from Korea JoongAng Daily, Samsung Electronics has secured temporary certificates of occupancy (TCOs) for a portion of its semiconductor facility in Taylor. This should allow the facility to start operations ahead of full completion later this year.

City officials confirmed that approximately 88,000 square feet of Samsung’s Fab 1 building has received temporary approval, with additional areas expected to follow. The overall timeline for permitting the remaining sections has not yet been finalized.

Samsung’s Taylor facility is expected to manufacture Tesla’s AI5 chips once mass production begins in the second half of the year. The facility is also expected to produce Tesla’s upcoming AI6 chips.

Tesla CEO Elon Musk recently stated that the design for AI5 is nearly complete, and the development of AI6 is already underway. Musk has previously outlined an aggressive roadmap targeting nine-month design cycles for successive generations of its AI chips.

Samsung’s U.S. expansion

Construction at the Taylor site remains on schedule. Reports indicate Samsung plans to begin testing extreme ultraviolet (EUV) lithography equipment next month, a critical step for producing advanced 2-nanometer semiconductors.

Samsung is expected to complete 6 million square feet of floor space at the site by the end of this year, with an additional 1 million square feet planned by 2028. The full campus spans more than 1,200 acres.

Beyond Tesla, Samsung Foundry is also pursuing additional U.S. customers as demand for AI and high-performance computing chips accelerates. Company executives have stated that Samsung is looking to achieve more than 130% growth in 2-nanometer chip orders this year.

One of Samsung’s biggest rivals, TSMC, is also looking to expand its footprint in the United States, with reports suggesting that the company is considering expanding its Arizona facility to as many as 11 total plants. TSMC is also expected to produce Tesla’s AI5 chips.

News

Anti-Tesla union leader ditches X, urges use of Threads instead

Tesla Sweden and IF Metall have been engaged in a bitter dispute for over two years now.

Marie Nilsson, chair of Sweden’s IF Metall union and a prominent critic of Tesla, has left X and is urging audiences to follow the union on Meta’s Threads instead.

Tesla Sweden and IF Metall have been engaged in a bitter dispute for over two years now.

Anti-Tesla union leader exits X

In a comment to Dagens Arbete (DA), Nilsson noted that her exit from X is not formally tied to IF Metall’s long-running labor dispute with Tesla Sweden. Still, she stated that her departure is affected by changes to the platform under Elon Musk’s leadership.

“We have stayed because many journalists pick up news there. But as more and more people have left X, we have felt that the standard has now been reached on that platform,” she said.

Jesper Pettersson, press officer at IF Metall, highlighted that the union’s departure from X is only indirectly linked to Tesla Sweden and Elon Musk. “Indirectly it does, since there is a lot of evidence that his ownership has caused the change in the platform to be so significant.

“We have nevertheless assessed that the platform had value for reaching journalists, politicians and other opinion leaders. But it is a microscopic proportion of the public and our members who are there, and now that value has decreased,” Petterson added.

IF Metall sees Threads as an X alternative

After leaving X, IF Metall has begun using Threads, Meta’s alternative to the social media platform. The union described the move as experimental, noting that it is still evaluating how effective the platform will be for outreach and visibility.

Pettersson acknowledged that Meta also does not operate under Sweden’s collective bargaining model, but said the union sees little alternative if it wants to remain visible online.

“In a perfect world, all large international companies would be supporters of the Swedish model when they come here. But unfortunately, the reality is not like that. If we are to be visible at all in this social media world, we have to play by the rules of the game. The alternative would be to become completely invisible, and that would not benefit our members,” he said.