Polestar has unveiled the fastest production vehicle it has ever made, the Polestar 4 SUV Coupe.

The SUV Coupe segment is easily one of the most unique on the market. While sleeker than a traditional SUV offering, these vehicles retain the higher ground clearance of their SUV siblings and often come with a laundry list of quirks. That is precisely the case with Polestar’s newest offering, the Polestar 4 SUV Coupe.

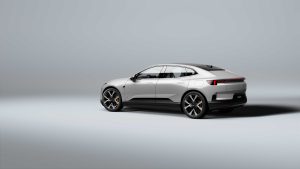

As stated above, the Polestar 4 retains the ground clearance of its Polestar 3 full-size SUV cousin. Still, its profile is more similar to its Polestar 2 sedan and Precept Concept vehicle siblings. Moreover, in following the trend of the segment, the Polestar 4 is chock-full of design quirkiness.

As noted by many an automotive journalist, the Polestar 4 lacks a rear window, instead opting for a system of cameras that provide the driver a complete view around the vehicle. Further, looking at the vehicle’s side, it has some of the most aggressively carved door panels on the market, second only to the Ford Mustang Mach-E, which has famously used the aggressive angularity between the wheels to “visually slim” the vehicle.

“With Polestar 4, we have taken a fundamental new approach to SUV coupé design,” says Thomas Ingenlath, Polestar CEO. “Rather than simply modifying an existing SUV, giving it a faster roofline and, as a result, compromising elements like rear headroom and comfort, we have designed Polestar 4 from the ground up as a new breed of SUV coupé that celebrates rear occupant comfort and experience.”

Moving on from Polestar’s intriguing design language, the Swedish automaker’s offering packs an impressive set of specs, backing the company’s statement; “our fastest production vehicle to date.” The Polestar 4 will be available in either dual-motor all-wheel-drive or single-motor rear-wheel-drive, and with its top trim (dual-motor), the SUV Coupe will rocket to 60mph in just 3.8 seconds. This rapid acceleration is made possible by 544 horsepower and 506 pound-feet of torque.

For those looking for the more tame single-motor option, the Polestar 4 provides an ample 272 horsepower and 253 pound-feet of torque.

Doubling down on its performance chops, the dual-motor equipped high-performance variant also comes with a “semi-active” suspension system, allowing the driver to tweak settings between performance and comfort.

The final option that buyers will choose from is between standard range or long range battery sizes. With the massive 102kWh battery, drivers can expect a max range of 335 miles with the dual motor variant or 373 miles with the single motor. Polestar has not yet released specifications for its standard range version but is expected to do so shortly, ahead ovehicle’sicle’s production launch in China.

The Polestar 4 will first be available in China during the fourth quarter of this year, while the rest of the world will need to wait until the first half of 2024. Polestar is beginning production of the vehicle in China but expects to expand production to other locations as it expands the regions it will sell in.

Besides the eye-watering performance metricsvehicle’sicle’s price may be the most surprising specification announced by Polestar today. Starting at $60,000 when it finally makes its way to the United States, or 60,000 Euros when it eventually becomes available across the pond, the Polestar 4 is quite aggressively priced, putting it essentially in line with the higher performance Tesla Model Y, Ford Mustang Mach-E, and significantly below larger offerings such as Polestar’s own 3 (full-size SUV), the Tesla Model X, or Rivian R1S.

What do you think of the article? Do you have any comments, questions, or concerns? Shoot me an email at william@teslarati.com. You can also reach me on Twitter @WilliamWritin. If you have news tips, email us at tips@teslarati.com!

News

Tesla China exports 50,644 vehicles in January, up sharply YoY

The figure also places Tesla China second among new energy vehicle exporters for the month, behind BYD.

Tesla China exported 50,644 vehicles in January, as per data released by the China Passenger Car Association (CPCA).

This marks a notable increase both year-on-year and month-on-month for the American EV maker’s Giga Shanghai-built Model 3 and Model Y. The figure also places Tesla China second among new energy vehicle exporters for the month, behind BYD.

The CPCA’s national passenger car market analysis report indicated that total New Energy Vehicle exports reached 286,000 units in January, up 103.6% from a year earlier. Battery electric vehicles accounted for 65% of those exports.

Within that total, Tesla China shipped 50,644 vehicles overseas. By comparison, exports of Giga Shanghai-built Model 3 and Model Y units totaled 29,535 units in January last year and just 3,328 units in December.

This suggests that Tesla China’s January 2026 exports were roughly 1.7 times higher than the same month a year ago and more than 15 times higher than December’s level, as noted in a TechWeb report.

BYD still led the January 2026 export rankings with 96,859 new energy passenger vehicles shipped overseas, though it should be noted that the automaker operates at least nine major production facilities in China, far outnumering Tesla. Overall, BYD’s factories in China have a domestic production capacity for up to 5.82 million units annually as of 2024.

Tesla China followed in second place, ahead of Geely, Chery, Leapmotor, SAIC Motor, and SAIC-GM-Wuling, each of which exported significant volumes during the month. Overall, new energy vehicles accounted for nearly half of China’s total passenger vehicle exports in January, hinting at strong overseas demand for electric cars produced in the country.

China remains one of Tesla China’s most important markets. Despite mostly competing with just two vehicles, both of which are premium priced, Tesla China is still proving quite competitive in the domestic electric vehicle market.

News

Tesla adds a new feature to Navigation in preparation for a new vehicle

After CEO Elon Musk announced earlier this week that the Semi’s mass production processes were scheduled for later this year, the company has been making various preparations as it nears manufacturing.

Tesla has added a new feature to its Navigation and Supercharger Map in preparation for a new vehicle to hit the road: the Semi.

After CEO Elon Musk announced earlier this week that the Semi’s mass production processes were scheduled for later this year, the company has been making various preparations as it nears manufacturing.

Elon Musk confirms Tesla Semi will enter high-volume production this year

One of those changes has been the newly-released information regarding trim levels, as well as reports that Tesla has started to reach out to customers regarding pricing information for those trims.

Now, Tesla has made an additional bit of information available to the public in the form of locations of Megachargers, the infrastructure that will be responsible for charging the Semi and other all-electric Class 8 vehicles that hit the road.

Tesla made the announcement on the social media platform X:

We put Semi Megachargers on the map

→ https://t.co/Jb6p7OPXMi pic.twitter.com/stwYwtDVSB

— Tesla Semi (@tesla_semi) February 10, 2026

Although it is a minor development, it is a major indication that Tesla is preparing for the Semi to head toward mass production, something the company has been hinting at for several years.

Nevertheless, this, along with the other information that was released this week, points toward a significant stride in Tesla’s progress in the Semi project.

Now that the company has also worked toward completion of the dedicated manufacturing plant in Sparks, Nevada, there are more signs than ever that the vehicle is finally ready to be built and delivered to customers outside of the pilot program that has been in operation for several years.

For now, the Megachargers are going to be situated on the West Coast, with a heavy emphasis on routes like I-5 and I-10. This strategy prioritizes major highways and logistics hubs where freight traffic is heaviest, ensuring coverage for both cross-country and regional hauls.

California and Texas are slated to have the most initially, with 17 and 19 sites, respectively. As the program continues to grow, Florida, Georgia, Illinois, Washington, New York, and Nevada will have Megacharger locations as well.

For now, the Megachargers are available in Lathrop, California, and Sparks, Nevada, both of which have ties to Tesla. The former is the location of the Megafactory, and Sparks is where both the Tesla Gigafactory and Semifactory are located.

Elon Musk

Tesla stock gets latest synopsis from Jim Cramer: ‘It’s actually a robotics company’

“Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session,” Cramer said.

Tesla stock (NASDAQ: TSLA) got its latest synopsis from Wall Street analyst Jim Cramer, who finally realized something that many fans of the company have known all along: it’s not a car company. Instead, it’s a robotics company.

In a recent note that was released after Tesla reported Earnings in late January, Cramer seemed to recognize that the underwhelming financials and overall performance of the automotive division were not representative of the current state of affairs.

Instead, we’re seeing a company transition itself away from its early identity, essentially evolving like a caterpillar into a butterfly.

The narrative of the Earnings Call was simple: We’re not a car company, at least not from a birds-eye view. We’re an AI and Robotics company, and we are transitioning to this quicker than most people realize.

Tesla stock gets another analysis from Jim Cramer, and investors will like it

Tesla’s Q4 Earnings Call featured plenty of analysis from CEO Elon Musk and others, and some of the more minor details of the call were even indicative of a company that is moving toward AI instead of its cars. For example, the Model S and Model X will be no more after Q2, as Musk said that they serve relatively no purpose for the future.

Instead, Tesla is shifting its focus to the vehicles catered for autonomy and its Robotaxi and self-driving efforts.

Cramer recognizes this:

“…we got results from Tesla, which actually beat numbers, but nobody cares about the numbers here, as electric vehicles are the past. And according to CEO Elon Musk, the future of this company comes down to Cybercabs and humanoid robots. Stock fell more than 3% the next day. That may be because their capital expenditures budget was higher than expected, or maybe people wanted more details from the new businesses. At this point, I think Musk acolytes might be more excited about SpaceX, which is planning to come public later this year.”

He continued, highlighting the company’s true transition away from vehicles to its Cybercab, Optimus, and AI ambitions:

“I know it’s hard to believe how quickly this market can change its attitude. Last night, I heard a disastrous car company speak. Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session. I didn’t like it as a car company. Boy, I love it as a Cybercab and humanoid robot juggernaut. Call me a buyer and give me five robots while I’m at it.”

Cramer’s narrative seems to fit that of the most bullish Tesla investors. Anyone who is labeled a “permabull” has been echoing a similar sentiment over the past several years: Tesla is not a car company any longer.

Instead, the true focus is on the future and the potential that AI and Robotics bring to the company. It is truly difficult to put Tesla shares in the same group as companies like Ford, General Motors, and others.

Tesla shares are down less than half a percent at the time of publishing, trading at $423.69.