News

Automakers come to accept that the EV revolution has begun

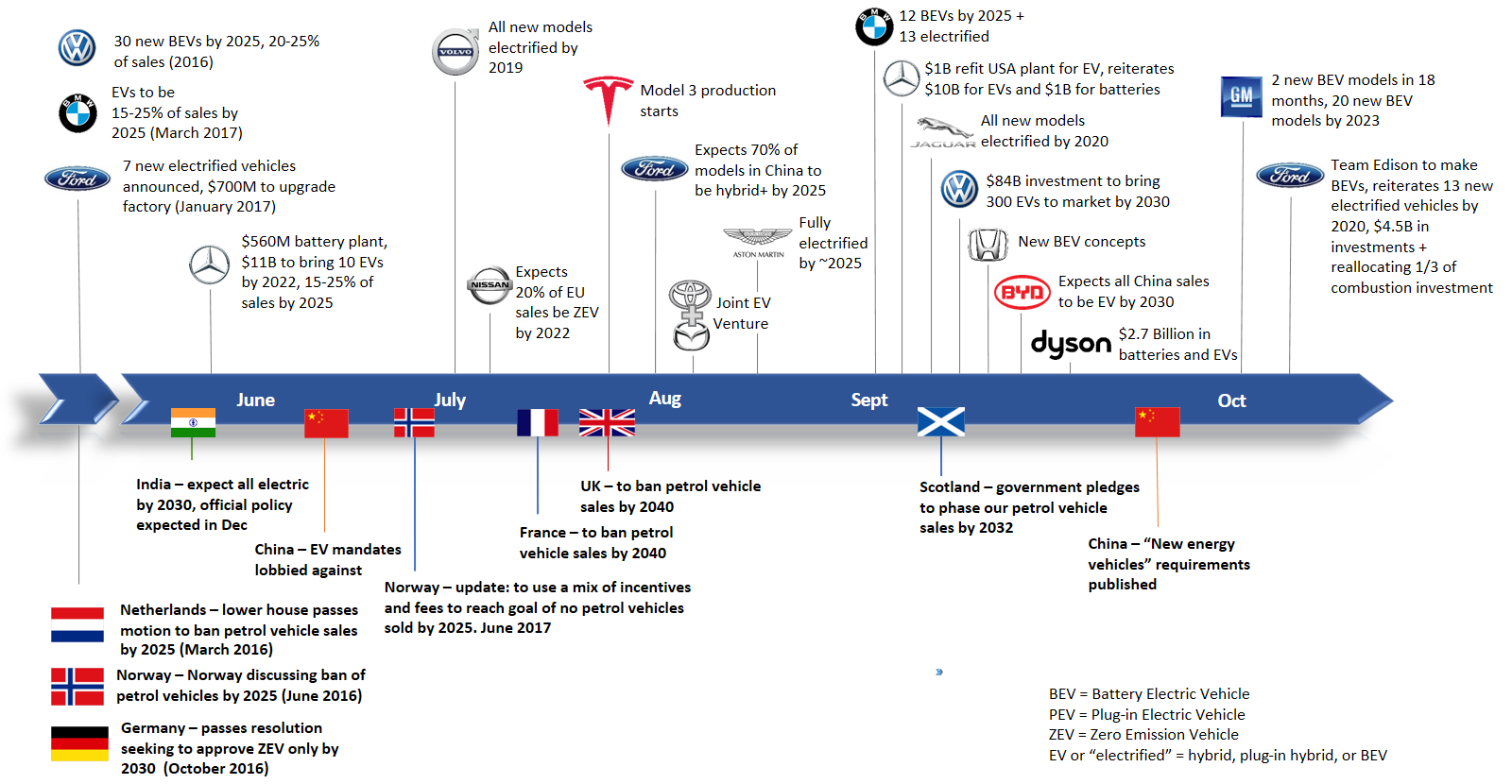

The last several months have been busy in the electric vehicle revolution. Governments have been announcing their phase out plans for petrol vehicles and automakers have committed billions of dollars to electrification programs. At this point automakers are practically falling over each other racing to get out their announcements. How many electric vehicles they’re developing, how much they’re investing, are they going fully electrified, and when. Suddenly no one wants to be perceived as falling behind in this revolution. And why should they? Nokia and Blackberry can attest to what happens if you do.

In the past, established automakers have been very cautious with electrification, with many simply watching to see how the situation developed. Generally, their investments could be best described as vague or immaterial to their core business of making cars. That’s clearly changed – take a look at the timeline of announcements below.

Taken as a whole these announcements are really quite striking. Most recently it was GM and Ford that released their competing declarations of electrification. GM with twenty new fully electric vehicles by 2023 and Ford quickly following up to say they had a new dedicated team for fully electric vehicles, while reiterating their previously committed $4.5 billion in investments for 13 new electrified vehicle options. Ford followed up the next day to say they were also diverting one third of their investments from combustion vehicle development.

The month prior was filled with even more announcements, including tweets between Elon Musk and Mercedes about the size of the latter’s investments. Volkswagen, BMW, Mercedes, Jaguar, Honda, BYD, and Dyson all made significant announcements about their EV programs that month, but it was Volvo’s “fully electrified” announcement that first caught the media’s attention back in July. It was a clever, if somewhat misleading PR move, but it did set important targets for their company and the competition. The fact that Tesla started producing their mass market Model 3 was almost lost amongst all this news. That’s an exaggeration of course, but only a year ago many believed their plans were impossible.

Government announcements have been another important part of the narrative, with targets that provide direction and impetus to the industry. Based on some of the lobbying it hasn’t been entirely welcome, but that’s to be expected. Anytime an entire country is talking about completely phasing out your current business model, it’s going give an industry pause. In this case there were multiple, with China, the UK, France, India, and several others weighing in with their plans to phase out combustion vehicles.

Looking at these announcements together suggests that a new phase in the electric vehicle revolution has begun. The fundamentals behind this shift are what I will argue here. My proposition is that the combined macro-economic drivers of regulation, competition, and market growth are pushing EVs to the mainstream. Be forewarned, it’s a long post, but analyzing any of these factors in isolation loses the bigger picture. Electric vehicles are coming, of that there can be no doubt.

Regulation, competition, and market growth.

You’ll notice the analysis below centers around plug-in electric vehicles (PEVs). Today a little more than 60% of new EV sales are pure battery electric vehicles (BEVs) and the rest are plug-in hybrid electric vehicles (PHEVs). PHEV’s are a transitionary technology, which currently offer some benefits that will disappear as battery costs continue to fall and range continues to increase. Note that the analysis doesn’t include hybrids without plugs, they’re old news. Also note that in talking about vehicles and vehicle sales, these are always in reference to passenger vehicles (i.e. no freight trucks). Annual passenger vehicles sales data was taken from the International Organization of Motor Vehicle Manufacturers and electric sales information is from the International Energy Agency.

Regulation:

The 2015 Paris climate agreement requires country specific greenhouse gas reductions by 2030 or sooner. As part of the agreement countries must also submit annual reports on their progress. Transport is a key part of each country’s emissions and it’s one that has a solution at hand, hence the plans to phase out combustion vehicles. France and UK announced for bans by 2040, Scotland by 2032, Netherlands 2025, Norway 2025, and India and China in development. There’s some subtlety to each. Norway for example is leaning towards economic levers to achieve their goals in lieu of outright restrictions, while India has said they expect all vehicles to be electric by 2030 without regulation being necessary, though their official policy is expected later this year.

Personally I tend to agree. I expect we will all be buying electric vehicles long before 2040 largely due to economics, especially with carbon pricing. That said, all of the government announcements are important. They provide both the public and automakers a framework in which to operate, while the more aggressive targets are actually moving the industry forward.

California and nine east coast states have long mandated a portion of sales be zero emission vehicles (ZEVs), administered through a credit system. The system gives partial credit to plug-in electric vehicles (PEVs) and more credits to long range zero emission vehicles (ZEVs). It’s basically the reason automakers have produced ZEVs in the USA. In quite possibly the biggest announcement of the year China is now doing something similar. They’ve mandated a ‘new energy vehicle’ credit requirement of 10% of sales in 2019 and 12% in 2020. Since one EV can be responsible for multiple credits it means that less than 12% of all vehicles sold will be required to be zero emission vehicles. For example, if the requirement was met with vehicles like the BMW i3, it would mean 4.6% of all vehicle sales in China would be ZEV in 2020, about 1.4 million that year. For reference there are about 2.5 million PEVs on the planet right now.

China is also looking at establishing a date for complete phase out of petrol vehicles, which has caught California’s attention. California is not eager to lose their leadership position in electric vehicles and is now looking to increase their own targets and establish their own timeline for complete phase out. I believe the quote from their governor was “Why haven’t we done something already?”. It seems that an EV target race has begun and that means mandated growth for the EV market.

source: BMW

Market Growth:

This one has always been a bit of ‘chicken or the egg’ scenario. Historically demand for electric vehicles was low, which automakers referenced as the reason for their limited offerings. Others argued that there could be no demand when so few options were available, especially when those that did exist had such weird aesthetics (which was an effective way to prevent scavenging from more profitable combustion sales). Tesla flipped this around with their preorders of the Model 3 and showed everyone the latent demand to the tune of nearly 400,000 preorders. Other automakers took notice. BMW even started having widespread video presentations depicting the threat of Tesla to motivate their employees.

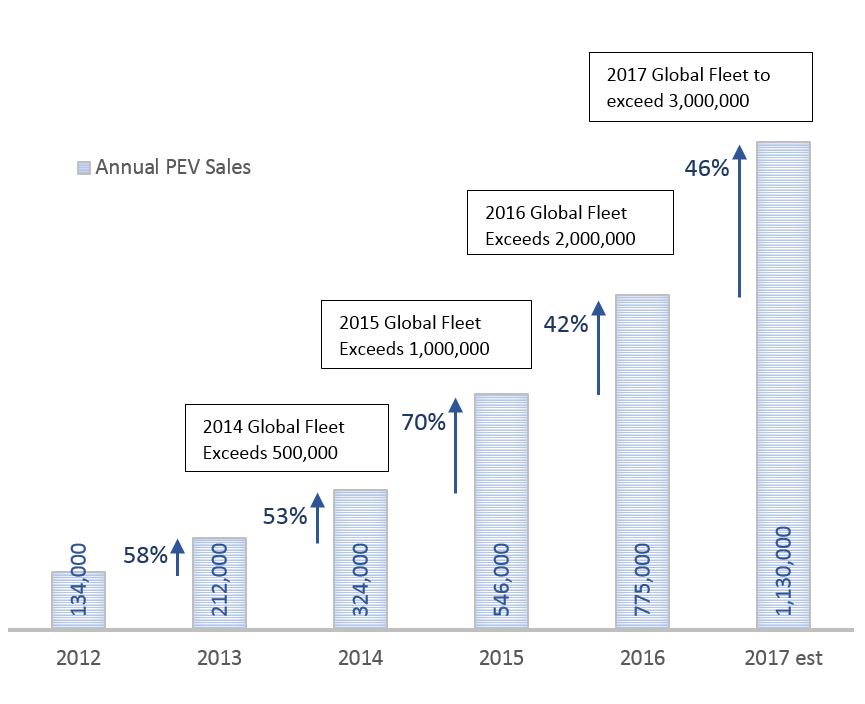

If you’ve only heard the rhetoric of how electric vehicles constitute a small fraction of the world’s annual sales, you might have missed something important. Exponential growth. Since 2012 growth of plug-in electric vehicles has been over 40% every year. Cumulatively that means 10x more PEVs will be sold in 2017 than 2012, as shown in the graph below.

Historical data from the IEA, 2017 estimate from EVvolumes.com

Don’t get me wrong, the existing market share is almost laughably low at 1.1% worldwide (2016 data from the IEA), but over the last three years sales have grown at an average 54.6% compound annual growth rate (CAGR).

To illustrate the effect of exponential growth consider the following example about bacteria in a jar. If the number of bacteria doubles every minute and after 1 hour the jar is full of bacteria, that means at 59 minutes the jar is half-full, at 58 minutes ¼ full, at 57 minutes 1/8 full, etc. At 54 minutes that jar is only 1.6% full and everyone is thinking that bacterial will never fill the jar. It’s simplistic and exaggerated but that’s where we are today, at 54 minutes.

The example shows the power of exponential growth but also the challenge in forecasting it. Over the long term, small changes in annual growth rates can have big impacts. Solar power projections were notoriously underestimated and each year forecasts had to be revised upwards. That’s not to disparage the forecasters, it’s incredibly difficult to do what they do and certainly some caution in forecasting is warranted. But it is worth considering that electric vehicles may be in a similar situation. For example, Bloomberg New Energy Finance (BNEF) posted an EV outlook report in 2016, estimating that annual sales in 2040 would be 35% of all vehicles sold and the total PEV fleet would be 410 million. This year they revised those projections up, to 54% and 600 million. That’s 200 million more EVs, on a starting estimate of 410 million, after one year of new data. Will the next years’ forecasts also be revised upwards?

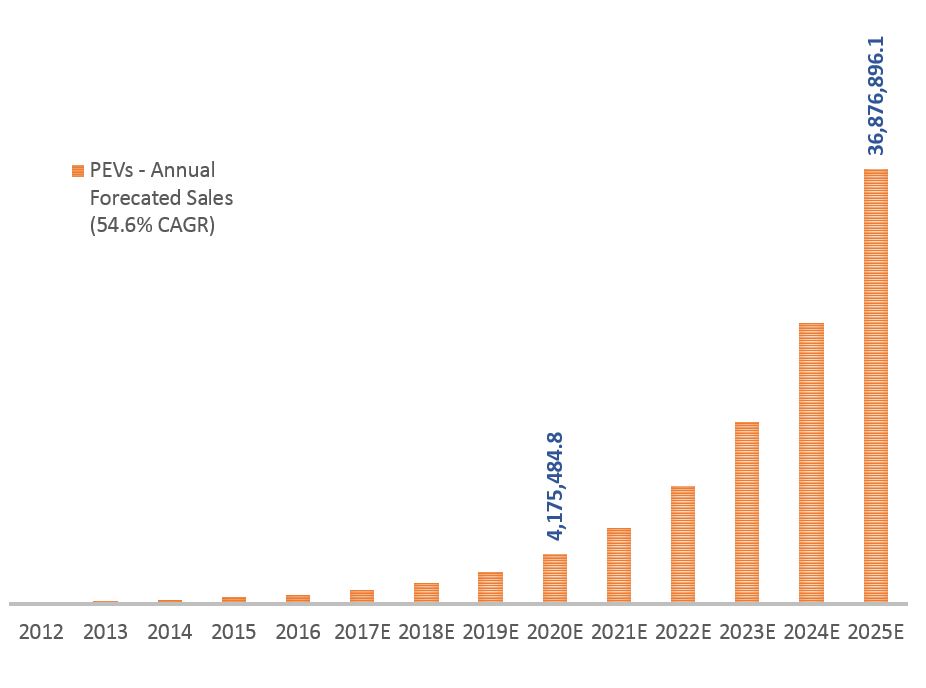

Shorter timeframes are usually more accurate, BNEF’s numbers indicate they expect approximately 2.5 million PEVs to be sold in 2020. That seems reasonable, but it would mean that PEV sales growth slows to 35% annually for the next few years. With more models coming that have better features and lower costs, and with governments now pushing the market with more aggressive targets, it seems unlikely growth will slow. So as an experiment what happens if the 54.6% growth rate over the last three years continues, to 2020 and 2025?

The impact would be impressive. The graph indicates that over 4 million PEVs would be sold in 2020, for 5% of total vehicle sales. That jumps to 37 million PEVs sold in 2025, nearly 40% of the total vehicle sales predicted. Contrast that with BNEF numbers, of 3% of sales in 2020 and 8% in 2025. Personally I think 8% is a low estimate for 2025, it works out to a compound annual growth rate of approximately 25%. Interestingly UBS increased their 2025 PEV estimate upwards by 50% this year (from 2016) to 14% of total sales – showing that short-term projections can be just as uncertain.

The impact would be impressive. The graph indicates that over 4 million PEVs would be sold in 2020, for 5% of total vehicle sales. That jumps to 37 million PEVs sold in 2025, nearly 40% of the total vehicle sales predicted. Contrast that with BNEF numbers, of 3% of sales in 2020 and 8% in 2025. Personally I think 8% is a low estimate for 2025, it works out to a compound annual growth rate of approximately 25%. Interestingly UBS increased their 2025 PEV estimate upwards by 50% this year (from 2016) to 14% of total sales – showing that short-term projections can be just as uncertain.

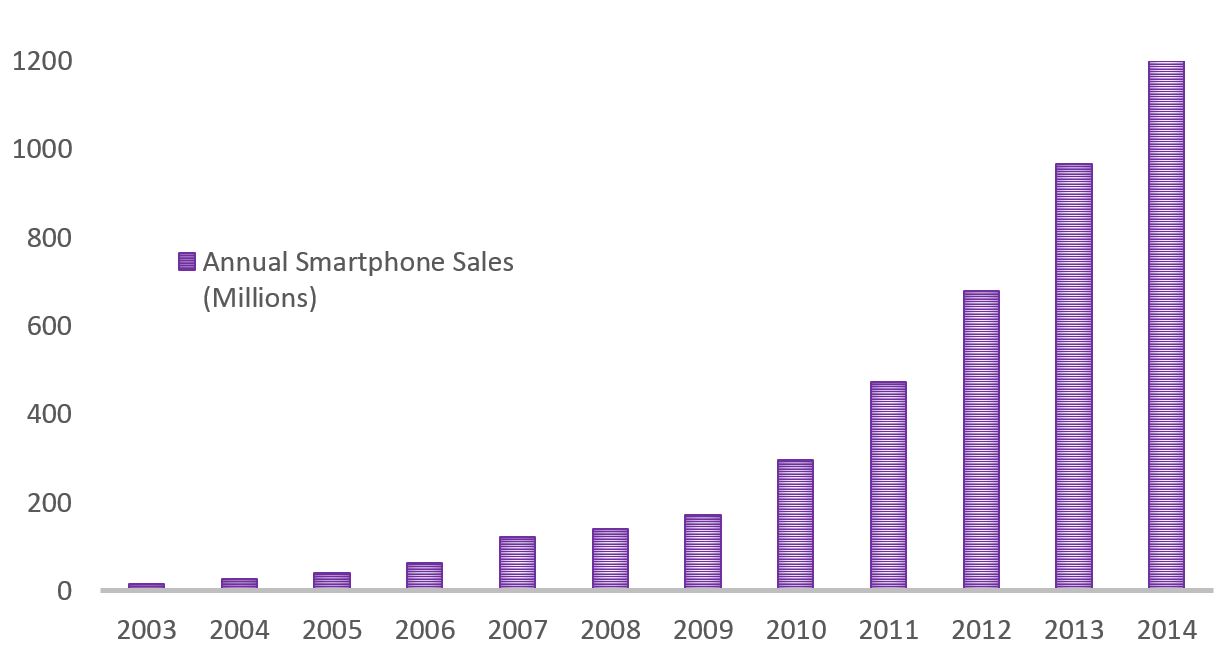

Perhaps 54.6% isn’t feasible, although Tesla has nearly managed it with a 47% growth rate since 2013. They did this while building up their staff, infrastructure, technology, and procedures virtually from scratch all at the same time. It’s also worth considering the history of smartphones. Globally smartphone sales grew at a rate of 46.4% year over year for ten years from 2004 to 2014, growing from sales of 27 million a year to over a billion. It was even more dramatic in China, where smartphone users accounted for about 5% of mobile subscribers in 2010 but were 70% by 2015 (Statista). That’s in just 5 years.

Data from www.gartner.com

Granted smartphones are not cars. The average smartphone costs orders or magnitude less and is traded in every two years, while the average car is traded in every 6.5 years (in the USA). A smartphone apparently has an average total lifespan of 4.7 years and a car can last to ~200,000 miles, approximately 15 years of average driving.

But electric cars do offer something cell phones never have. A lower cost. Cell phones provide a wealth of new functionality in our lives, but generally at a premium. Today, electric cars already cost less to operate than combustion vehicles, by 2018 they are expected to reach cost parity on total cost of ownership (UBS report), and by 2025 Bloomberg expects them to cost less upfront than combustion vehicles. That’s battery only electric vehicles (BEVs). Perhaps the changeover is longer than it was for cellphones, but once BEVs have an upfront cost less than petrol, why would anyone buy anything else?

Competition:

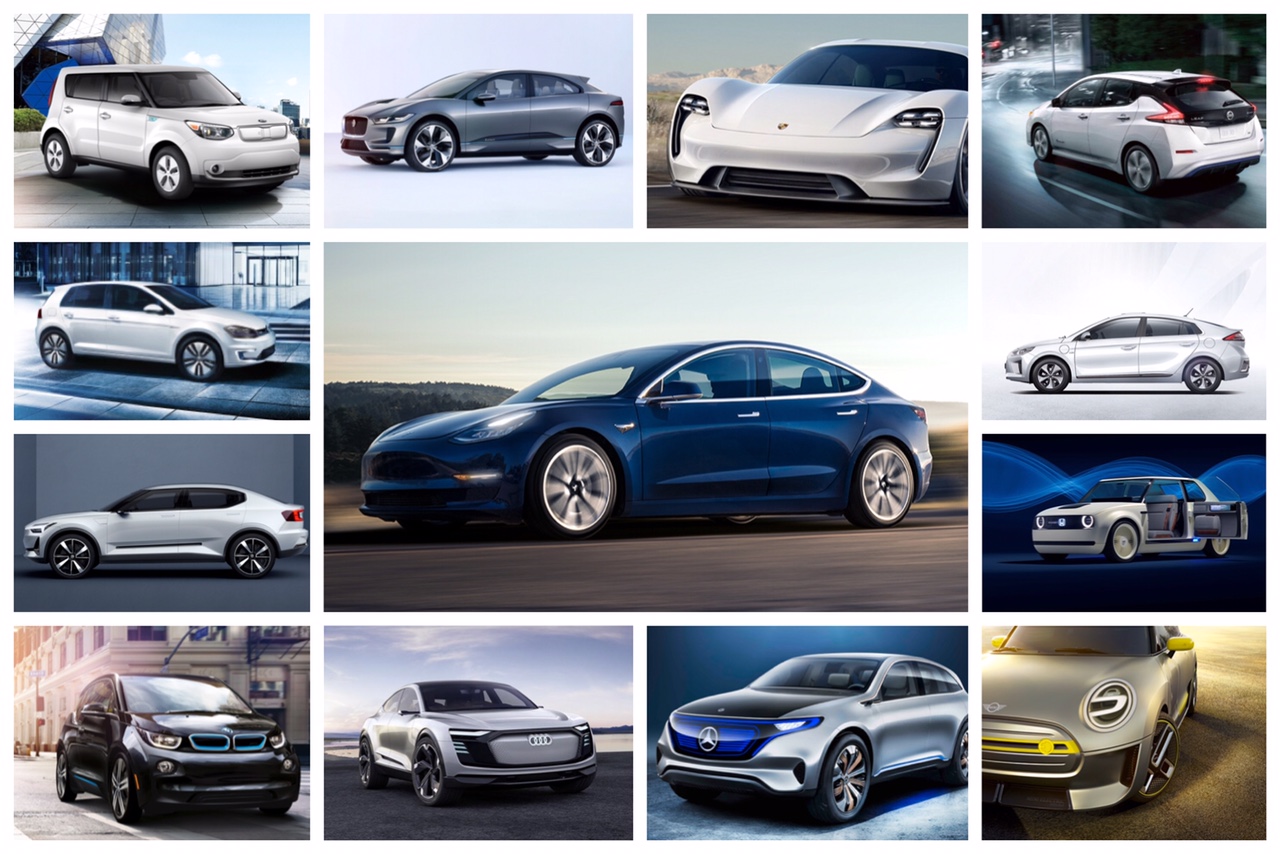

More and more manufacturers are entering the electric vehicle field with legitimate programs and their EVs are getting excellent reviews. At the end of 2016 the Chevy Bolt came out and won the North American and Motor Trend car of the year awards. Be prepared to see future EVs dominate the awards. VW already has a new e-Golf, Nissan a new Leaf, BMW an updated i3, Hyundai released their Ionic, and Audi, Porsche, and Jaguar are all coming out with pure EV models in 2018. Then there are the massive “electrification” shifts from the likes of Mercedes, BWM, Volvo, Austin Martin, VW, Ford, GM, and others. All now committing to reshaping their companies and the industry by moving to electric vehicles. There’s also that company Tesla which started making their game changing Model 3. Suddenly there’s a lot of competition and if your company isn’t one of those competing…. what are you doing? Those automakers on the sidelines are starting to look obsolete and it’s a short road from obsolete to ‘out of business’.

With automakers and governments committing to electrification of vehicles, we are going to see a significant ramp up in the electric vehicle market. More plug-in options are coming out, billions are being invested, and governments are seriously planning the end of combustion vehicles. It really is a paradigm shift. In large part we have Tesla to thank. If they hadn’t shown the world what was possible, who knows when this would have happened. Certainly the future would be a bit darker.

News

Tesla UK sales see 14% year-over-year rebound in June: SMMT data

The SMMT stated that Tesla sales grew 14% year-over-year to 7,719 units in June 2025.

Tesla’s sales in the United Kingdom rose in June, climbing 14% year-over-year to 7,719 units, as per data from the Society of Motor Manufacturers and Traders (SMMT). The spike in the company’s sales coincided with the first deliveries of the updated Model Y last month.

Model Y deliveries support Tesla’s UK recovery

Tesla’s June performance marked one of its strongest months in the UK so far this year, with new Model Y deliveries contributing significantly to the company’s momentum.

While the SMMT listed Tesla with 7,719 deliveries in June, independent data from New AutoMotive suggested that the electric vehicle maker registered 7,891 units during the month instead. However, year-to-date figures for Tesla remain 2% down compared to 2024, as per a report from Reuters.

While Tesla made a strong showing in June, rivals are also growing. Chinese automaker BYD saw UK sales rise nearly fourfold to 2,498 units, while Ford posted the highest EV growth among major automakers, with a more than fourfold increase in the first half of 2025.

Overall, the UK’s battery electric vehicle (BEV) demand surged 39% to to 47,354 units last month, helping push total new car sales in the UK to 191,316 units, up 6.7% from the same period in 2024.

EV adoption accelerates, but concerns linger

June marked the best month for UK car sales since 2019, though the SMMT cautioned that growth in the electric vehicle sector remains heavily dependent on discounting and support programs. Still, one in four new vehicle buyers in June chose a battery electric vehicle.

SMMT Chief Executive Mike Hawes noted that despite strong BEV demand, sales levels are still below regulatory targets. “Further growth in sales, and the sector will rely on increased and improved charging facilities to boost mainstream electric vehicle adoption,” Hawes stated.

Also taking effect this week was a new US-UK trade deal, which lowers tariffs on UK car exports to the United States from 27.5% to 10%. The agreement could benefit UK-based EV producers aiming to expand across the country.

News

Tesla Model 3 ranks as the safest new car in Europe for 2025, per Euro NCAP tests

Despite being on the market longer than many of its rivals, the Tesla Model 3 continues to set the bar for vehicle safety.

The Tesla Model 3 has been named the safest new car on sale in 2025, according to the latest results from the Euro NCAP. Among 20 newly tested vehicles, the Model 3 emerged at the top of the list, scoring an impressive 359 out of 400 possible points across all major safety categories.

Tesla Model 3’s safety systems

Despite being on the market longer than many of its rivals, the Tesla Model 3 continues to set the bar for vehicle safety. Under Euro NCAP’s stricter 2025 testing protocols, the electric sedan earned 90% for adult occupant protection, 93% for child occupant protection, 89% for pedestrian protection, and 87% for its Safety Assist systems.

The updated Model 3 received particular praise for its advanced driver assistance features, including Tesla’s autonomous emergency braking (AEB) system, which performed well across various test scenarios. Its Intelligent Speed Assistance and child presence detection system were cited as noteworthy features as well, as per a WhatCar report.

Other notable safety features include the Model 3’s pedestrian-friendly pop-up hood and robust crash protection for both front and side collisions. Euro NCAP also highlighted the Model 3’s ability to detect vulnerable road users during complex maneuvers, such as turning across oncoming traffic.

Euro NCAP’s Autopilot caution

While the Model 3’s safety scores were impressive across the board, Euro NCAP did raise concerns about driver expectations of Tesla’s Autopilot system. The organization warned that some owners may overestimate the system’s capabilities, potentially leading to misuse or inattention behind the wheel. Even so, the Model 3 remained the highest-scoring vehicle tested under Euro NCAP’s updated criteria this year.

The Euro NCAP’s concerns are also quite interesting because Tesla’s Full Self-Driving (FSD) Supervised, which is arguably the company’s most robust safety suite, is not allowed for public rollout in Europe yet. FSD Supervised would allow the Model 3 to navigate inner city streets with only minimal human supervision.

Other top scorers included the Volkswagen ID.7, Polestar 3, and Geely EX5, but none matched the Model 3’s total score or consistency across categories. A total of 14 out of 20 newly tested cars earned five stars, while several models, including the Kia EV3, MG ZS, and Renault 5, fell short of the top rating.

Elon Musk

Why Tesla’s Q3 could be one of its biggest quarters in history

Tesla could stand to benefit from the removal of the $7,500 EV tax credit at the end of Q3.

Tesla has gotten off to a slow start in 2025, as the first half of the year has not been one to remember from a delivery perspective.

However, Q3 could end up being one of the best the company has had in history, with the United States potentially being a major contributor to what might reverse a slow start to the year.

Earlier today, the United States’ House of Representatives officially passed President Trump’s “Big Beautiful Bill,” after it made its way through the Senate earlier this week. The bill will head to President Trump, as he looks to sign it before his July 4 deadline.

The Bill will effectively bring closure to the $7,500 EV tax credit, which will end on September 30, 2025. This means, over the next three months in the United States, those who are looking to buy an EV will have their last chance to take advantage of the credit. EVs will then be, for most people, $7,500 more expensive, in essence.

The tax credit is available to any single filer who makes under $150,000 per year, $225,000 a year to a head of household, and $300,000 to couples filing jointly.

Ending the tax credit was expected with the Trump administration, as his policies have leaned significantly toward reliance on fossil fuels, ending what he calls an “EV mandate.” He has used this phrase several times in disagreements with Tesla CEO Elon Musk.

Nevertheless, those who have been on the fence about buying a Tesla, or any EV, for that matter, will have some decisions to make in the next three months. While all companies will stand to benefit from this time crunch, Tesla could be the true winner because of its sheer volume.

If things are done correctly, meaning if Tesla can also offer incentives like 0% APR, special pricing on leasing or financing, or other advantages (like free Red, White, and Blue for a short period of time in celebration of Independence Day), it could see some real volume in sales this quarter.

You can now buy a Tesla in Red, White, and Blue for free until July 14 https://t.co/iAwhaRFOH0

— TESLARATI (@Teslarati) July 3, 2025

Tesla is just a shade under 721,000 deliveries for the year, so it’s on pace for roughly 1.4 million for 2025. This would be a decrease from the 1.8 million cars it delivered in each of the last two years. Traditionally, the second half of the year has produced Tesla’s strongest quarters. Its top three quarters in terms of deliveries are Q4 2024 with 495,570 vehicles, Q4 2023 with 484,507 vehicles, and Q3 2024 with 462,890 vehicles.

-

Elon Musk4 days ago

Elon Musk4 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News1 week ago

News1 week agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

News2 weeks ago

News2 weeks agoSpaceX and Elon Musk share insights on Starship Ship 36’s RUD

-

News2 weeks ago

News2 weeks agoWatch Tesla’s first driverless public Robotaxi rides in Texas

-

News1 week ago

News1 week agoWatch the first true Tesla Robotaxi intervention by safety monitor

-

News2 weeks ago

News2 weeks agoTesla has started rolling out initial round of Robotaxi invites

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla to launch in India in July with vehicles already arriving: report