Energy

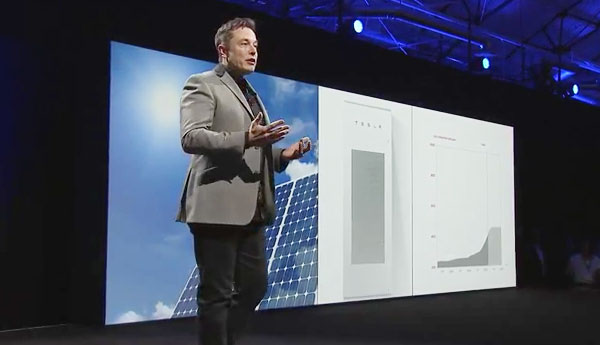

Bloomberg Says Tesla Powerwall Doesn’t Make Sense

Bloomberg News says the Tesla Powerwall doesn’t make sense. So why have 38,000 folks signed up to own or lease one when deliveries won’t start for 6 months?

Bloomberg News questions whether the Tesla Powerwall — introduced to great fanfare on April 30 — makes economic sense. Their answer? It doesn’t — at least not now. Here’s why.

The Powerwall comes in two versions — a 7 kWh (kilowatt-hour) model and a 10 kWh unit. The smaller battery is design specifically for daily use. The larger battery is strictly a backup power supply.

SolarCity, Tesla’s sister company, has decided not to offer the 7 kWh battery with its rooftop solar systems. That battery “doesn’t really make financial sense,” SolarCity spokesman Jonathan Bass tells Bloomberg. That’s because customers can make money selling their excess solar power back to the grid during the day when rates are high rather than using it to charge up a battery.

Of course, the economics will vary considerably across the country. Not all states require utilities to accept electricity from home solar systems and each electric company has its own rate structure.

SolarCity Offers Larger Powerwall

SolarCity says it will only offer the 10 kWh battery to new rooftop solar customers. “Our residential offering is battery backup,” Bass said in an e-mail. Unlike the smaller unit, which is intended for daily use, the 10 kWh battery is designed for no more than 50 discharge cycles a year. Homeowners can buy it outright for $7,140, including an inverter and installation, or lease it for $15 a month for 9 years with an upfront payment of $5,000.

The 10 kWh battery is rated at 2 kilowatts of continuous power. Does that sound like a lot? It’s not. That’s only enough to run a hair dryer or 2 small window air conditioners for about 5 hours. To provide enough electricity to power a typical home would take eight Powerwall units working together. According to Bloomberg, that would cost $45,000 (if the nine year lease option is selected). There are no known discounts for multiple purchases at this time.

“It’s a luxury good—really cool to have—but I don’t see an economic argument,” said Brian Warshay, an energy and smart technologies analyst with Bloomberg New Energy Finance. Bloomberg suggests you could get the same back up capability from a $3,700 generator available at Home Depot.

Demand Is “Crazy”

The Powerwall that has captured the public’s imagination has a long way to go before it makes economic sense for most people. Even in Germany, where solar power is abundant and electricity prices are high, the economics of an average home with rooftop solar “are not significantly enhanced by including the Tesla battery,” according to an analysis by Bloomberg New Energy Finance.

None of this has dampened the enthusiasm of prospective Powerwall users. Since Elon Musk’s announcement last week, the company has received inquiries from 38,000 people. Demand is so strong, Tesla is considering using its GigaFactory exclusively for residential and commercial storage batteries instead of batteries for its automobiles. There are even rumors it plans to expand the GigaFactory, which isn’t even built yet. Musk says demand has been “crazy off the hook.” He acknowledges that the Powerwall is more expensive than grid power, but says, “that doesn’t mean people won’t buy it.”

If the numbers don’t add up, why would people be in such a frenzy to get a Powerwall of their very own? SolarCity’s Bass says, “There’s a tremendous amount of interest in backup power that’s odorless, not noisy and completely clean.” But its more than that. Some observers call it “The Prius Effect”. Once you think someone else has something new and sexy, you want one for yourself. It’s just human nature.

Elon Musk is a master at creating buzz and then leveraging it. Everywhere you look this week, there are news stories about the Powerwall and what a huge leap forward it is. If all the people who signed up after last week’s announcement follow through, all those new orders will amount to $800 million in new business for the company. The orders are continuing to pour in like a flood tide into the Bay of Fundy.

Tesla Drives Costs Down

Is there anything truly remarkable about the Tesla Powerwall? Yes, there absolutely is. Based on the asking price for the Powerwall, Tesla has managed to get the cost of its batteries down to $250 per kilowatt-hour, something the “experts” claimed couldn’t happen before 2020. That gives Tesla a sizable marketing advantage over other battery companies and that’s before the GigaFactory starts production. Once that comes online, battery prices will undoubtedly fall even more. Musk’s faith in economies of scale seems to be paying off.

What’s Ahead For Tesla?

The truth is that Tesla is really not in the “off the grid” home battery market right now, although there is talk about offering batteries to residents of Hawaii, where electricity costs triple what it does on the mainland. Tesla really has its sights set on commercial and utility scale products. Utility companies often charge commercial and industrial customers their highest rates.

Business and industry can now charge their Tesla PowerPacks at night when rates are low. Or they can use solar panels to charge them during the day. Either way, they avoid buying electricity from utility companies at peak demand rates.

A battle is shaping up between energy makers and energy storage providers. The outcome will be nothing less than an upheaval in the way electricity is made and distributed. Battery storage is disruptive technology and there is no one who is more of a champion of disruptive technology than Elon Musk.

In 10 years, residential battery storage systems will be as common as stoves and refrigerators. No home will be without one. SolarCity’s Bass suggests that’s when the Tesla Powerwall will begin to make economic sense. Microgrids that soak up energy from the sun to charge grid scale batteries will be everywhere. Utility companies as we know them will become marginal players. The Rocky Mountain Institute predicts that demand for electricity from traditional utility companies will decline by 50% in the next 10 years.

As the market for electricity changes, there will be winners and losers. There is no question Elon Musk plans on being one of the winners.

Source: Bloomberg News

Energy

Tesla Megapack Megafactory in Texas advances with major property sale

Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet.

Tesla’s planned Megapack factory in Brookshire, Texas has taken a significant step forward, as two massive industrial buildings fully leased to the company were sold to an institutional investor.

In a press release, Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet. The properties are 100% leased to Tesla under a long-term agreement and were acquired by BGO on behalf of an institutional investor.

The two facilities, located at 100 Empire Boulevard in Brookshire, Texas, will serve as Tesla’s new Megafactory dedicated to manufacturing Megapack battery systems.

According to local filings previously reported, Tesla plans to invest nearly $200 million into the site. The investment includes approximately $44 million in facility upgrades such as electrical, utility, and HVAC improvements, along with roughly $150 million in manufacturing equipment.

Building 9, spanning roughly 1 million square feet, will function as the primary manufacturing floor where Megapacks are assembled. Building 10, covering approximately 600,000 square feet, will be dedicated to warehousing and logistics operations, supporting storage and distribution of completed battery systems.

Waller County Commissioners have approved a 10-year tax abatement agreement with Tesla, offering up to a 60% property-tax reduction if the company meets hiring and investment targets. Tesla has committed to employing at least 375 people by the end of 2026, increasing to 1,500 by the end of 2028, as noted in an Austin County News Online report.

The Brookshire Megafactory will complement Tesla’s Lathrop Megafactory in California and expand U.S. production capacity for the utility-scale energy storage unit. Megapacks are designed to support grid stabilization and renewable-energy integration, a segment that has become one of Tesla’s fastest-growing businesses.

Energy

Tesla meets Giga New York’s Buffalo job target amid political pressures

Giga New York reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease.

Tesla has surpassed its job commitments at Giga New York in Buffalo, easing pressure from lawmakers who threatened the company with fines, subsidy clawbacks, and dealership license revocations last year.

The company reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease at the state-built facility.

As per an employment report reviewed by local media, Tesla employed 2,399 full-time workers at Gigafactory New York and 1,060 additional employees across the state at the end of 2025. Part-time roles pushed the total headcount of Tesla’s New York staff above the 3,460-job target.

The gains stemmed in part from a new Long Island service center, a Buffalo warehouse, and additional showrooms in White Plains and Staten Island. Tesla also said it has invested $350 million in supercomputing infrastructure at the site and has begun manufacturing solar panels.

Empire State Development CEO Hope Knight said the agency was “very happy” with Giga New York’s progress, as noted in a WXXI report. The current lease runs through 2029, and negotiations over updated terms have included potential adjustments to job requirements and future rent payments.

Some lawmakers remain skeptical, however. Assemblymember Pat Burke questioned whether the reported job figures have been fully verified. State Sen. Patricia Fahy has also continued to sponsor legislation that would revoke Tesla’s company-owned dealership licenses in New York. John Kaehny of Reinvent Albany has argued that the project has not delivered the manufacturing impact originally promised as well.

Knight, for her part, maintained that Empire State Development has been making the best of a difficult situation.

“(Empire State Development) has tried to make the best of a very difficult situation. There hasn’t been another use that has come forward that would replace this one, and so to the extent that we’re in this place, the fact that 2,000 families at (Giga New York) are being supported through the activity of this employer. It’s the best that we can have happen,” the CEO noted.

Energy

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

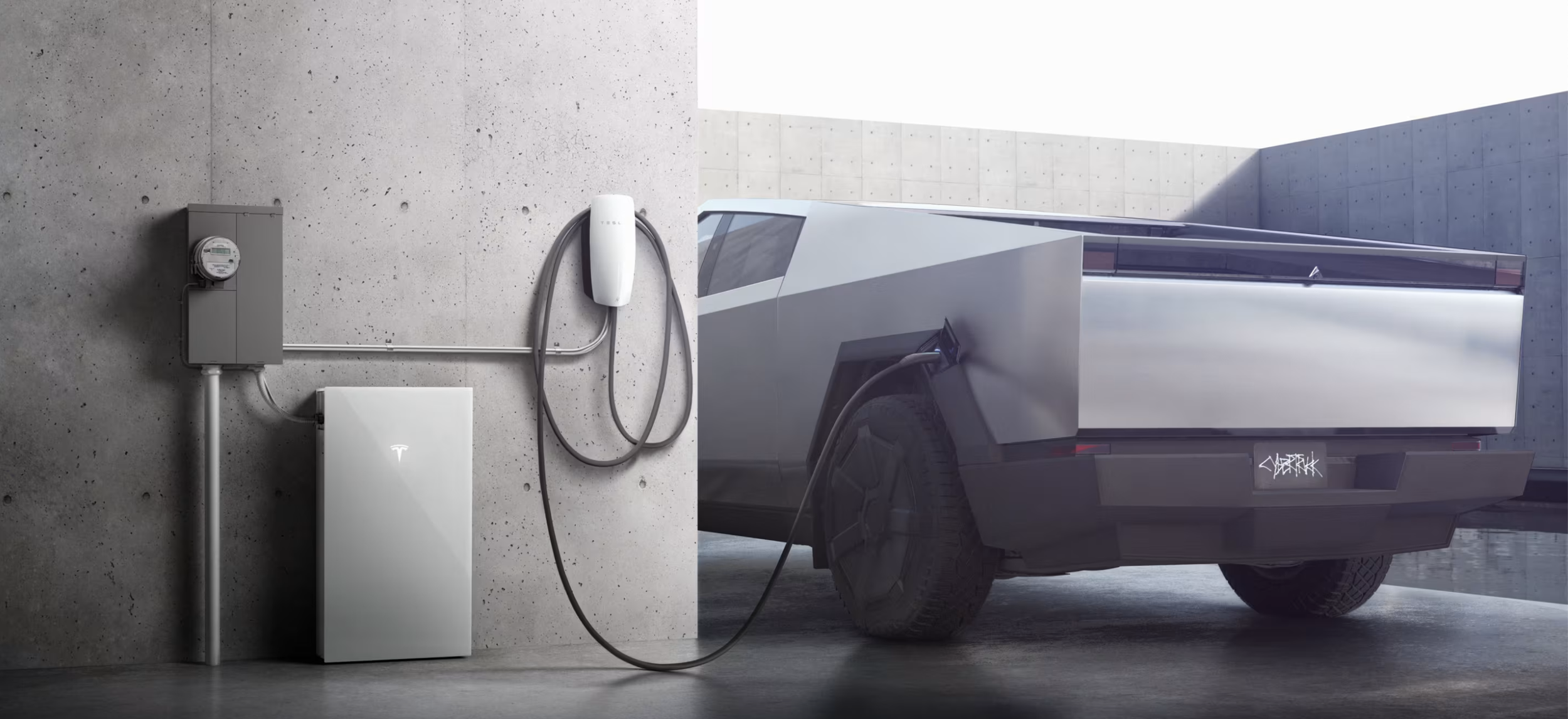

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.