News

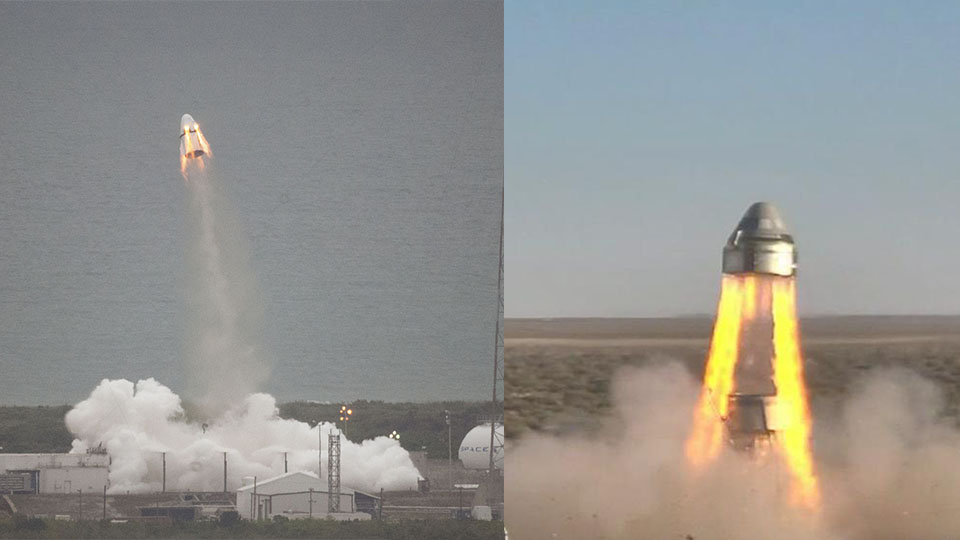

Boeing Starliner abort test (mostly) a success as SpaceX nears Crew Dragon static fire

On November 4th, Boeing completed a crucial pad abort test of its reusable Starliner spacecraft, successful in spite of an unintentional partial failure of its parachute recovery system. Three days later, Boeing revealed what it believed to be the cause of that anomaly in a November 7th press conference.

Meanwhile, SpaceX – having completed Crew Dragon’s pad abort test in 2015 – is preparing for an equally important In-Flight Abort (IFA) test and is perhaps just a day or two away from static firing the Crew Dragon capsule assigned to the test flight.

According to a NASA press release after the test, it “was designed to verify [that] each of Starliner’s systems will function not only separately, but in concert, to protect astronauts by carrying them safely away from the launch pad in the unlikely event of an emergency prior to liftoff.” Although the test wasn’t without flaws, the pad abort test successfully demonstrated the ability of the four launch abort engines and control thrusters to safely extricate astronauts from a failing rocket.

Those theoretical astronauts would have almost certainly survived the ordeal unharmed despite the failed deployment of one of Starliner’s three main parachutes, testing the spacecraft’s abort capabilities and redundancy quite a bit more thoroughly than Boeing intended. To put it bluntly, Boeing’s above tweet and PR claim that the failed deployment of 1/3 parachutes is “acceptable for the test parameters and crew safety” is an aggressive spin on a partial failure that NASA undoubtedly did not sign off on.

Boeing and SpaceX have both suffered failures while testing parachutes, leading NASA to require significantly more testing. However, in a November 7th press conference, Boeing revealed that Starliner’s parachute anomaly wasn’t the result of hardware failing unexpectedly under planned circumstances, but rather a consequence of a lack of quality assurance that failed to catch a major human error. Boeing says that a critical mechanical linkage (a pin) was improperly installed by a technician and then not verified prior to launch, causing one of Starliner’s three drogue chutes to simply detach from the spacecraft instead of deploying its respective main parachute.

Space is Parachutes are hard

Parachutes have been a major area of concern for the Commercial Crew Program. Both SpaceX and Boeing have now suffered failures during testing and have since been required to perform a range of additional tests to verify that upgraded and improved parachutes are ready to reliably return NASA astronauts to Earth. Although the Starliner pad abort test did indeed demonstrate the ability to land the capsule safely under two main chutes, an inadvertent test of redundancy, the series of Boeing actions that lead to the failure will almost certainly be scrutinized by NASA to avoid reoccurrences.

Boeing believes that the parachute failure won’t delay the launch of Starliner’s Orbital Flight Test (OFT), currently targeting a launch no earlier than (NET) December 17th. However, it can be said with some certainty that it will delay Starliner’s crewed launch debut (CFT), at least until Boeing can prove to NASA that it has corrected the fault(s) that allowed it to happen. SpaceX is similarly working to qualify upgraded Crew Dragon parachutes for astronaut launches, although the company has thus far only suffered anomalies related to the structural failure of parachute rigging/seams/fabric.

Abort tests galore

Boeing’s Starliner pad abort test occurred just days prior to a different major abort test milestone – this time for SpaceX. SpaceX Crew Dragon capsule C205 will perform a static fire test of its upgraded SuperDraco abort system, as well as its Draco maneuvering thrusters.

SpaceX has made alterations to the SuperDraco engines to prevent a failure mode that abruptly reared its head in April 2019, when a leaky valve and faulty design resulted in a catastrophic explosion milliseconds before a SuperDraco static fire test. Prior to its near-total destruction, Crew Dragon capsule C201 was assigned to SpaceX’s In-Flight Abort test, and its loss (and the subsequent failure investigation) delayed the test’s launch by at least six months. Crew Dragon’s design has since been fixed by replacing reusable check valves with single-use burst discs, nominally preventing propellant or oxidizer leaks.

If capsule C205’s static fire testing – scheduled no earlier than November 9th – goes as planned, SpaceX may be able to launch Crew Dragon’s in-flight abort (IFA) test before the end of 2019e. Likely to be a bit of a spectacle, Crew Dragon will launch atop a flight-proven Falcon 9 booster and a second stage with a mass simulator in place of its Merlin Vacuum engine, both of which will almost certainly be destroyed when Dragon departs the rocket during peak aerodynamic pressure.

NASA made in-flight abort tests an optional step for its Commercial Crew providers and Boeing decided to perform a pad abort only and rely on modeling and simulations to verify that Starliner’s in-flight abort safety. Assuming that NASA is happy with the results of Starliner’s pad abort and Boeing can alleviate concerns about the parachute anomaly suffered during the test, Starliner’s uncrewed orbital flight test (OFT) could launch as early as December 17th. Starliner’s crewed flight test (CFT) could occur some 3-6 months after that if all goes as planned during the OFT.

If SpaceX’s In-Flight Abort (IFA) also goes as planned and NASA is content with the results, Crew Dragon could be ready for its crewed launch debut (Demo-2) as early as February or March 2020.

Check out Teslarati’s newsletters for prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket launch and recovery processes.

News

Tesla’s most wanted Model Y heads to new region with no sign of U.S. entry

Unlike the standard Model Y, the “L” stretches the wheelbase by roughly 150 mm and the overall length by about 177 mm to 4,976 mm. The result is a genuine 2-2-2 seating layout that gives six adults proper legroom and cargo space — a true family hauler without the cramped third-row compromises of many three-row SUVs.

Tesla’s most wanted Model Y configuration is heading to a new region, and although U.S. fans and owners have requested the vehicle since its release last year, it appears the company has no plans to bring it to the market.

According to fresh regulatory filings, the six-seat Model Y L is coming to South Korea with signs indicating an imminent launch. The extended-wheelbase configuration, already a hit in China, just cleared energy-efficiency certification from the Korea Energy Agency, paving the way for deliveries as early as the first half of 2026.

The vehicle is already built at Tesla’s Giga Shanghai facility in China, making it an ideal candidate for the Asian market, as well as the European one, as the factory has been known as a bit of an export hub in the past.

$TSLA

BREAKING: The official launch of Tesla Model Y L in S.Korea seems to be quite imminent.Additional credentials related to Model YL were released today.

✅ Battery Manufacturer: LG Energy Solutions

✅ Number of passengers: 6 people

✅ Total battery capacity: 97.25 kWh… pic.twitter.com/hmy64XYi80— Tsla Chan (@Tslachan) March 6, 2026

It seems like Tesla was prepping for this release anyway, as the timing was no accident. A camouflaged Model Y L prototype was spotted testing on Korean highways the same day the certification dropped. Tesla has already secured similar approvals for Australia and New Zealand, with both markets expecting the larger Model Y in 2026.

Unlike the standard Model Y, the “L” stretches the wheelbase by roughly 150 mm and the overall length by about 177 mm to 4,976 mm. The result is a genuine 2-2-2 seating layout that gives six adults proper legroom and cargo space — a true family hauler without the cramped third-row compromises of many three-row SUVs.

South Korean filings list it as an all-wheel-drive imported electric passenger vehicle with a 97.25 kWh total battery capacity supplied by LG Energy Solution. Local tests show an impressive 543 km (337 miles) combined range at room temperature and 454 km (282 miles) in colder conditions, easing one of the biggest concerns for Korean EV buyers.

Tesla Model Y lineup expansion signals an uncomfortable reality for consumers

But for U.S. fans, things are not looking good for a launch in the market.

CEO Elon Musk has been blunt. The six-seater “wouldn’t arrive in the U.S. until late 2026, if ever,” he said, pointing to the company’s heavy bet on unsupervised Full Self-Driving and robotaxi platforms like the Cybercab. With the Model X slated for discontinuation, many families hoped the stretched Model Y would slide into the lineup as an affordable three-row bridge. So far, that hope remains unfulfilled.

For now, South Korean drivers will be among the first buyers outside China to enjoy the spacious, efficient Model Y L. Tesla continues its global rollout strategy, tailoring vehicles to regional tastes while North American customers keep refreshing their apps and crossing their fingers.

The Model Y L proves the appetite for practical, family-sized electric SUVs is stronger than ever. Hopefully, Tesla will listen to its fans and bring the vehicle to the U.S. where it would likely sell well.

Elon Musk

Tesla is ramping up its advertising strategy on social media

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

Tesla seems to be ramping up its advertising strategy on social media once again. Marketing and advertising have not been a major focus of Tesla’s, something that has brought some criticism to the company from its fans.

However, the company looks to be making adjustments to that narrative, as it has at times in the past, as ads were spotted on several different platforms over the past few days.

On Facebook and YouTube, ads were spotted that were evidently placed by Tesla. On Facebook, Tesla was advertising Full Self-Driving, and on YouTube, an ad for its Energy Division was spotted:

Tesla also threw up some ads on YouTube for Energy https://t.co/19DGQMjBsA pic.twitter.com/XQRfgaDKxY

— TESLARATI (@Teslarati) March 9, 2026

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

In 2022, Tesla’s U.S. ad spend was roughly $152,000, a rounding error compared to General Motors’ $3.6 billion the following year.

Traditional automakers averaged about $495 per vehicle on ads; Tesla spent $0. CEOElon Musk’s stance was explicit: “Tesla does not advertise or pay for endorsements,” he posted on X in 2019. “Instead, we use that money to make the product great.”

The strategy relied on word-of-mouth from delighted owners, Elon’s massive X following, viral product launches, media frenzy, and customer referrals. A great product, Musk argued, sells itself. It does not need Super Bowl spots or billboards. Resources poured into R&D instead, with Tesla investing nearly $3,000 per car, far more than rivals.

Tesla counters jab at lack of advertising with perfect response

This reluctance wasn’t arrogance; it was philosophy, and Musk made it clear that the money was better spent on the product. Heavy spending on ads was seen as wasteful when innovation and authenticity drove organic demand. Shareholder calls for marketing budgets were ignored.

The current shift, paid Facebook ads promoting Full Self-Driving (Supervised) and YouTube Shorts offering up to $1,000 back on Powerwall batteries, marks a pragmatic evolution.

These targeted campaigns coincide with the end of one-time FSD purchases and a March 31 deadline for FSD transfer eligibility on new vehicles.

This move likely signals Tesla adapting to scale, as well as a more concerted effort to stop misinformation regarding its platform. As EV competition intensifies and the company bets big on robotaxis and energy storage, pure organic buzz may not suffice to hit adoption targets. Selective digital ads allow precise, cost-effective reach without abandoning core principles.

If successful, it could foreshadow measured expansion into marketing, boosting high-margin software and home energy revenue while preserving Tesla’s innovative edge. But, it’s nice to see the strategy return, especially as Tesla has been reluctant to change its mind in the past.

News

Tesla Model Y outsells everything in three states, but Ford dominates

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

The Tesla Model Y was the best-selling vehicle in three different states in the U.S. last year, according to new data that shows the all-electric crossover outsold every other car in a few places. However, Ford widely dominated the sales figures with its popular F-Series of pickups.

According to new vehicle registration data compiled by Edmunds and visualized by Visual Capitalist, the Ford F-Series, encompassing models like the F-150, F-250, F-350, and F-450, claimed the title of best-selling vehicle in 29 states.

This dominance underscores the pickup truck’s unbreakable appeal across much of the country, particularly in rural, Midwestern, Southern, and Western states, where towing capacity, durability, and utility for work or recreation remain top priorities.

The Tesla Model Y is the best-selling vehicle in California, Washington, and Nevada

How many states will it dominate next year? https://t.co/ERyoyce42D

— TESLARATI (@Teslarati) March 9, 2026

The F-Series has held the crown as America’s overall best-selling vehicle for decades, a streak that continued strong into 2025 despite broader market shifts.

Yet, amid this truck-heavy reality, Tesla made a notable breakthrough. The Model Y emerged as the top-selling vehicle, not just the leading EV, but the outright best-seller in three key states: California, Nevada, and Washington.

These West Coast strongholds reflect regions with robust EV infrastructure, high environmental awareness, generous incentives, and tech-savvy populations. In California alone, nearly 50 percent of new vehicle registrations were electrified, far outpacing the national average of around 25 percent.

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

Elon Musk: Tesla Model Y is world’s best-selling car for 3rd year in a row

Elsewhere, Japanese crossovers filled many gaps: Toyota’s RAV4 and Honda’s CR-V topped charts in several urban and densely populated Northeastern and Midwestern states, where fuel efficiency, reliability, and family-friendly features win out over larger trucks.

While Ford’s broad reach shows traditional preferences persist, at least for now, Tesla’s Model Y victories in high-population, influential states signal a gradual but undeniable transition toward electrification. As charging networks expand and battery technology improves, more states could follow the West Coast’s lead in the coming years.

This 2025 map captures a pivotal moment: pickup trucks still rule the majority, but EVs are carving out meaningful territory where consumer priorities align with sustainability and innovation. The road ahead promises continued competition between legacy giants and electric disruptors.