News

Elon Musk pegs SpaceX BFR program at $5B as NASA’s rocket booster nears $5B in cost overruns

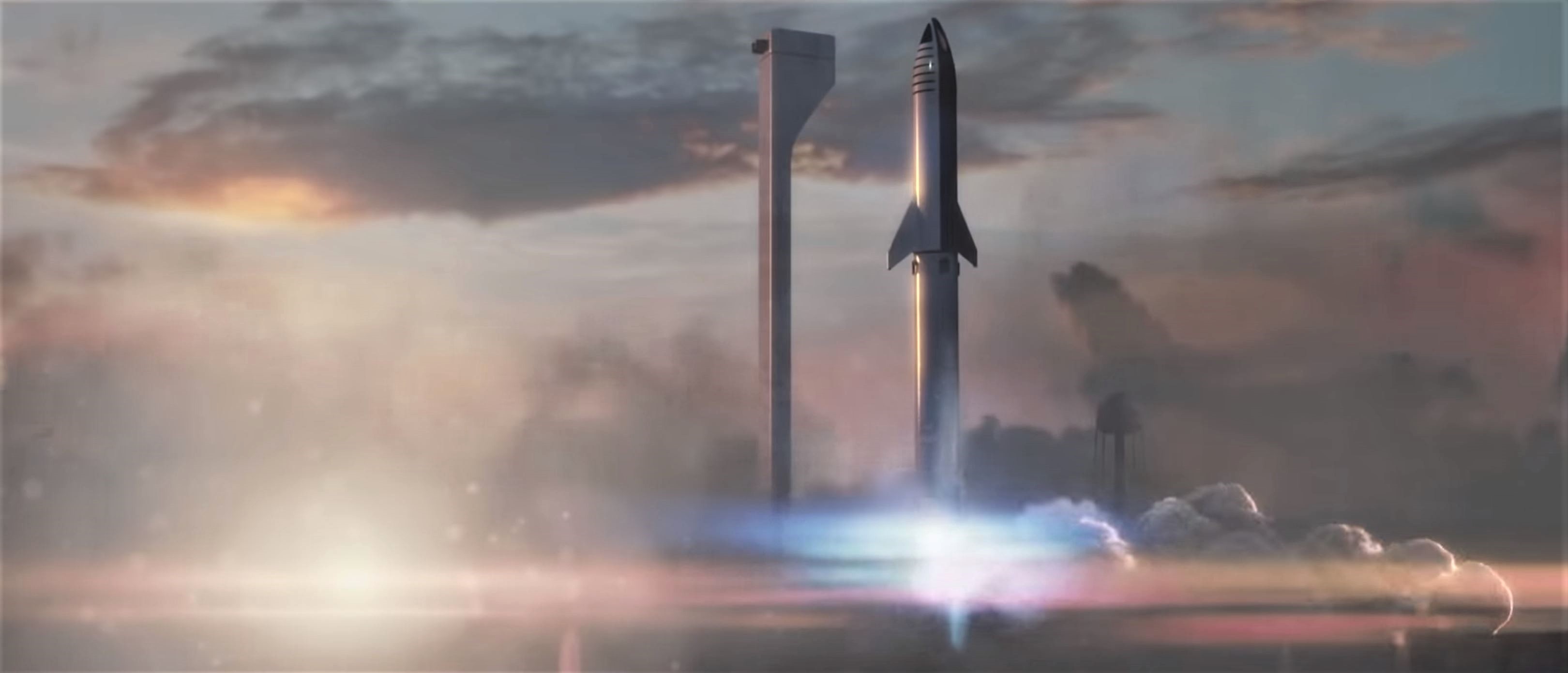

At the same time as NASA’s overrun-stricken Space Launch System (SLS) continues to limp towards its continuously delayed launch debut, now tentatively expected no earlier than (NET) 2021, SpaceX is forging ahead with the development of an equivalently capable launch vehicle known as BFR, comprised of a spaceship (BFS) and booster (BFB).

During a September 17th update to the next-gen SpaceX rocket’s steady progress, CEO Elon Musk offered a rough cost estimate of $5B to complete its development – no less than $2B and no more than $10B. According to NASA’s Office of the Inspector General (OIG), Boeing – primary contractor for NASA’s SLS “Core Stage” or booster – is all but guaranteed to burn through a minimum of $8.9B between 2012 and the rocket’s tentative 2021 launch debut.

NASA is finally (officially) acknowledging that EM-1, the maiden launch of SLS, will slip until at least June 2020. Sources tell us to expect another slip to 2021, official or not.https://t.co/CYf9SqbhBY

— Eric Berger (@SciGuySpace) October 3, 2018

Originally contracted in 2014 to complete SLS booster development, production, and preparation by 2018 at a cost of $4.2B, Boeing has overrun its budget by a bit less than 50% (up to $6.2B) and overshot its scheduled launch debut by more than 2.5 years. Per an October 10th audit of the SLS booster program, NASA OIG has reasonably concluded that Boeing will pass that $6.2B expenditure estimate – meant to last until 2021 – in December 2018, meaning that at least an additional $2.7B will be required from NASA between now and 2021 if SLS is to have a chance at launching that year.

In other words, compared to Boeing’s first serious 2014 contract for the SLS Core Stages – $4.2B to complete Core Stages 1 and 2 and launch EM-1 in Nov. 2017 – the company will ultimately end up 215% over-budget ($4.2B to $8.9B) and ~40 months behind schedule (42 months to 80+ months from contract award to completion). Meanwhile, as OIG notes, NASA has continued to give Boeing impossibly effusive and glowing performance reviews to the tune of $323 million in “award fees”, with grades that would – under the contracting book NASA itself wrote – imply that Boeing SLS Core Stage work has been reliably under budget and ahead of schedule (it’s not).

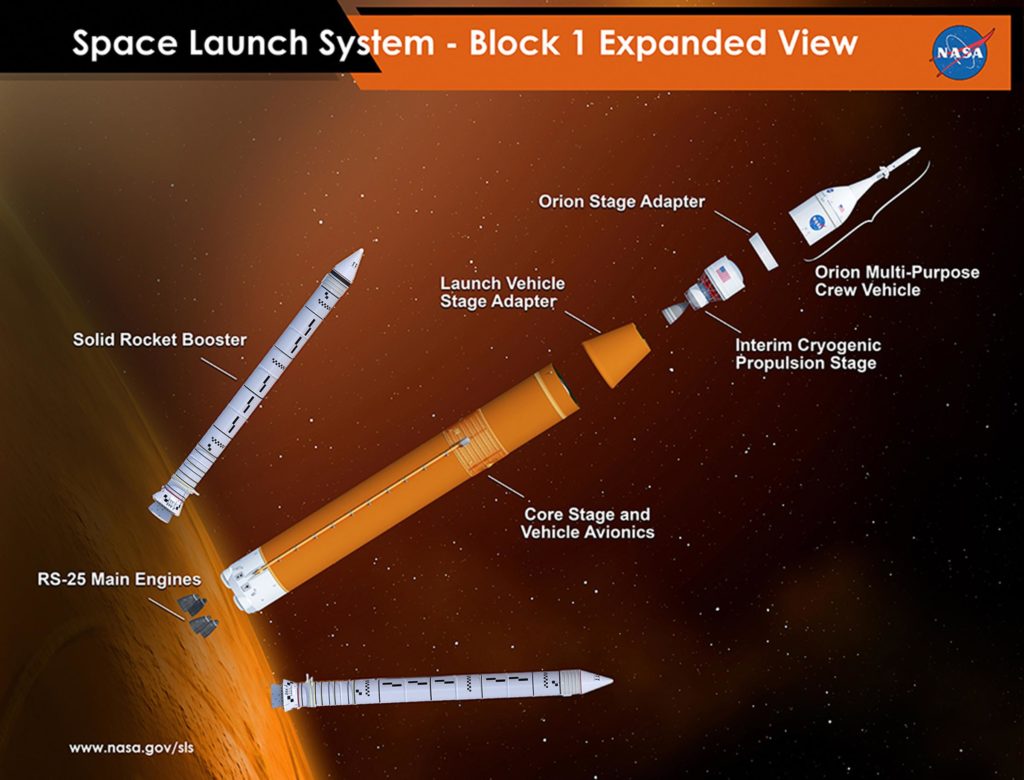

- SLS Block 1. (NASA)

- An overview of SLS. (NASA)

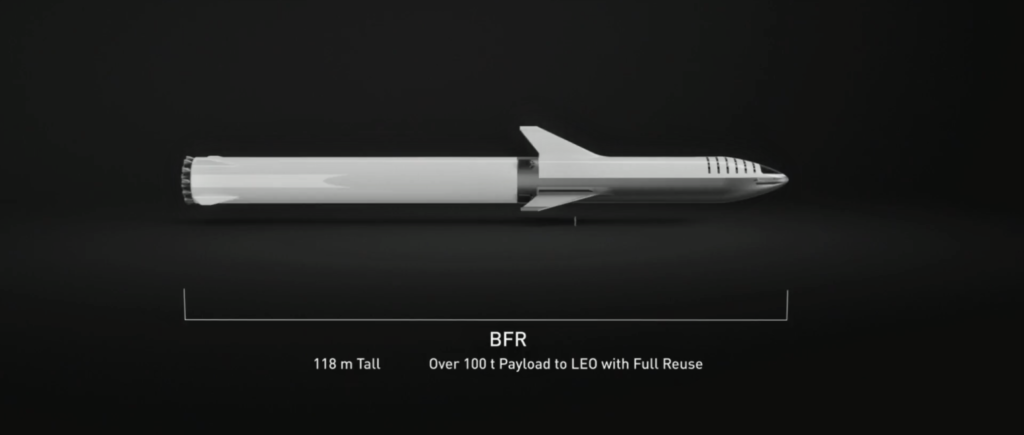

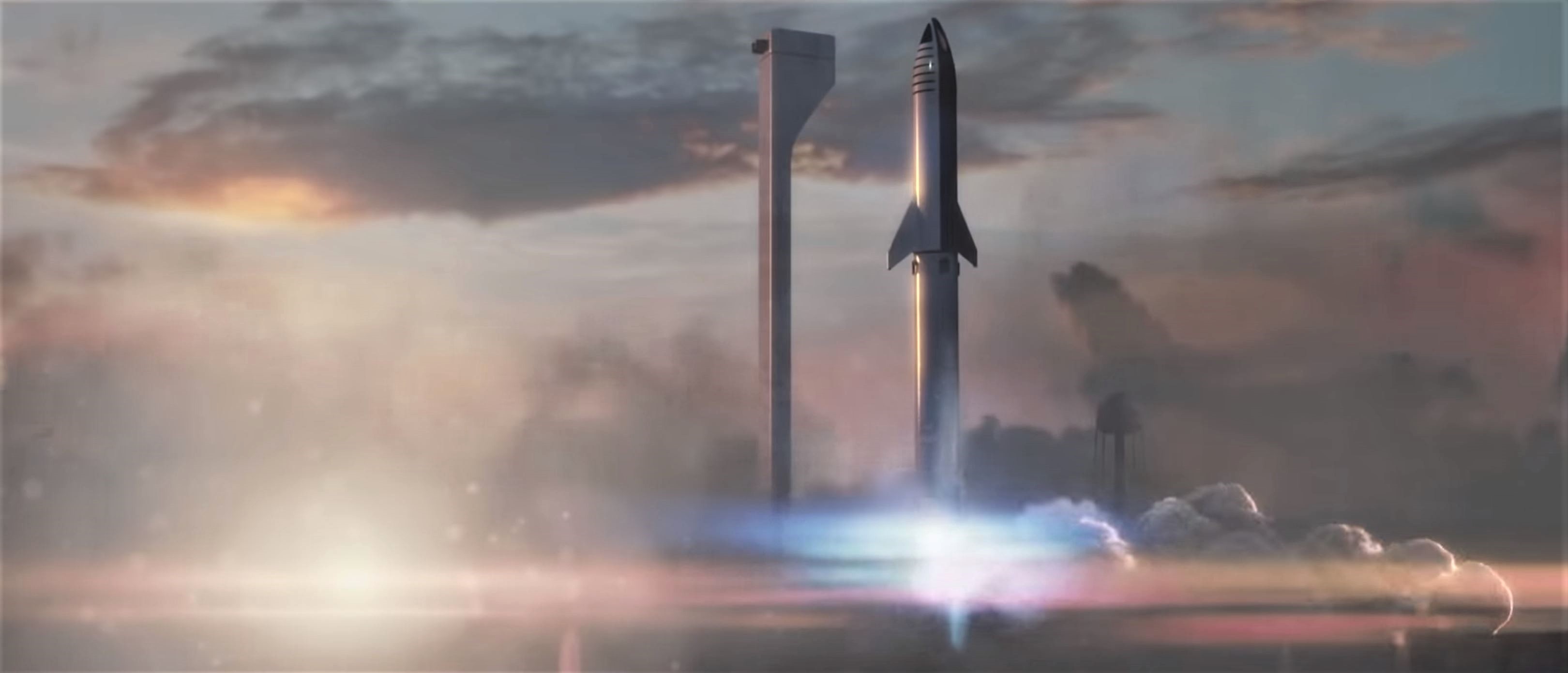

- Rockets are perhaps even more capital intensive. (SpaceX)

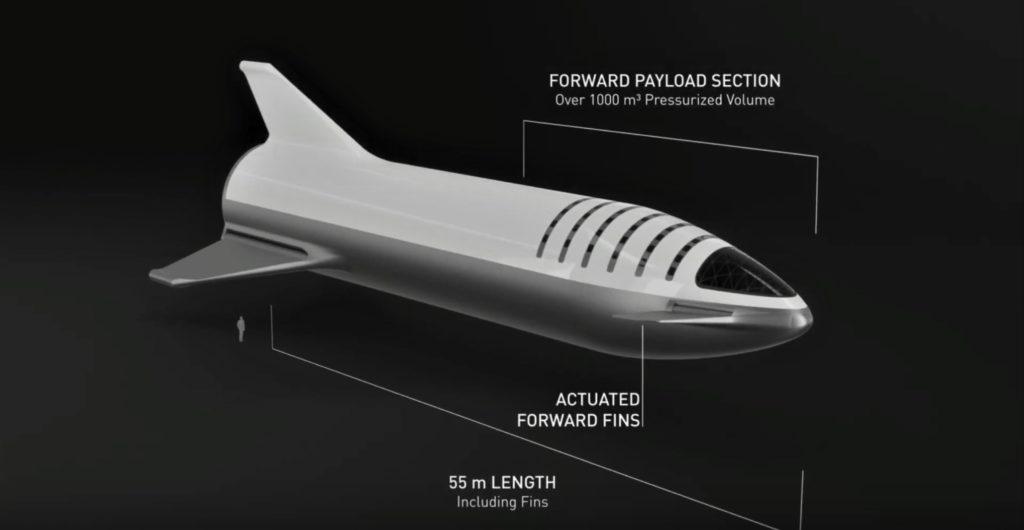

- BFR 2018’s Spaceship, BFS. (SpaceX)

The “Satisfactory” Stuff

In reality, Boeing has not once been under budget or ahead of schedule during any of 6+ NASA performance reviews.

“Boeing should have received a “satisfactory” rating for [two review periods]; a “good” rating for [one review period]; and an “unsatisfactory” rating (no award fee) for [the 2017 review period].”

Instead, NASA has given Boeing three “Very Good” (nearly perfect) reviews and three “Excellent” (perfect) reviews over the last 6 years, ultimately dispersing $323M of pure-profit “award fees” thanks to those grades, while the OIG firmly disputes Boing’s worthiness for at least $65M of that sum.

It is pretty pathetic when the only response that @BoeingSpace can muster via @BKingDC at its #politicospace PR effort in response to a damning @NASA_SLS report by @NASAOIG is to dump on the Saturn V – a rocket that actually flew – and worked – half a century ago. https://t.co/daN91bzwpC

— NASA Watch (@NASAWatch) October 12, 2018

Boeing – recently brought to light as the likely source of a spate of egregiously counterfactual op-eds published with the intention of dirtying SpaceX’s image – also took it upon itself to sponsor what could be described as responses to NASA OIG’s scathing October 10th SLS audit. Hilariously, a Politico newsletter sponsored by Boeing managed to explicitly demean and belittle the Apollo-era Saturn V rocket as a “rickety metal bucket built with 1960s technology”, of which Boeing was the core stage’s prime contractor.

At the same time, that newsletter described SLS as a rocket that will be “light years ahead of thespacecraft [sic] that NASA astronauts used to get to the moon 50 years ago.” At present, the only clear way SLS is or will be “light years” ahead – as much a measure of time as it is of distance – of Saturn V is by continuing the rocket’s trend of endless delays. Perhaps NASA astronomers will soon be able to judge exactly how many “light years ahead” SLS is by measuring the program’s redshift or blueshift with one of several ground- and space-based telescopes.

Ultimately, this is a particularly effective bit of self-mockery in the context of rationale lately used by Boeing and NASA to shrug off the jaw-dropping Core Stage contract’s underperformance, missteps, schedule slips, and budget overruns, namely that building big, complex rockets is hard. NASA and Boeing, neither of which have any meaningful experience building big, complex rockets – aside from Saturn IB, Saturn V, and the Space Shuttle – thus should be given a break for reliably and dramatically underestimating the difficulties of doing so in the 21st century.

One of the most breathtaking things about the new SLS report is the response by NASA's Gerstenmaier. Essentially, he says, this a is a big, complex rocket. And it's hard to build this stuff.https://t.co/ou8SFhji6a

— Eric Berger (@SciGuySpace) October 10, 2018

Simultaneously, Boeing and NASA still continue to act as if they are the foremost global experts of building extremely large rockets and continue to throw pile upon pile of taxpayer billions at overpromised attempts to prove as much. It’s no more than a masochistic dream to imagine what could have been or might be if NASA instead redirected those billions towards US aerospace companies with track records of success through fixed-cost contracts or straight-up private funding (SpaceX and Blue Origin, primarily), but it’s often hard not to at least think about the possibilities.

For prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket recovery fleet check out our brand new LaunchPad and LandingZone newsletters!

Elon Musk

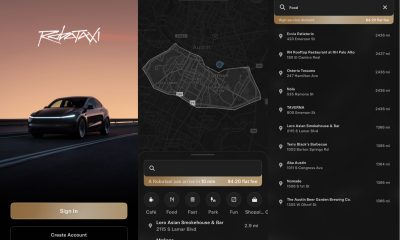

Tesla begins expanding Robotaxi access: here’s how you can ride

You can ride in a Tesla Robotaxi by heading to its website and filling out the interest form. The company is hand-picking some of those who have done this to gain access to the fleet.

Tesla has begun expanding Robotaxi access beyond the initial small group it offered rides to in late June, as it launched the driverless platform in Austin, Texas.

The small group of people enjoying the Robotaxi ride-hailing service is now growing, as several Austin-area residents are receiving invitations to test out the platform for themselves.

The first rides took place on June 22, and despite a very small number of very manageable and expected hiccups, Tesla Robotaxi was widely successful with its launch.

Tesla Robotaxi riders tout ‘smooth’ experience in first reviews of driverless service launch

However, Tesla is expanding the availability of the ride-hailing service to those living in Austin and its surrounding areas, hoping to gather more data and provide access to those who will utilize it on a daily basis.

Many of the people Tesla initially invited, including us, are not local to the Austin area.

There are a handful of people who are, but Tesla was evidently looking for more stable data collection, as many of those early invitees headed back to where they live.

The first handful of invitations in the second round of the Robotaxi platform’s Early Access Program are heading out to Austin locals:

I just got a @robotaxi invite! Super excited to go try the service out! pic.twitter.com/n9mN35KKFU

— Ethan McKanna (@ethanmckanna) July 1, 2025

Tesla likely saw an influx of data during the first week, as many traveled far and wide to say they were among the first to test the Robotaxi platform.

Now that the first week and a half of testing is over, Tesla is expanding invites to others. Many of those who have been chosen to gain access to the Robotaxi app and the ride-hailing service state that they simply filled out the interest form on the Robotaxi page of Tesla’s website.

That’s the easiest way you will also gain access, so be sure to fill out that form if you have any interest in riding in Robotaxi.

Tesla will continue to utilize data accumulated from these rides to enable more progress, and eventually, it will lead to even more people being able to hail rides from the driverless platform.

With more success, Tesla will start to phase out some of the Safety Monitors and Supervisors it is using to ensure things run smoothly. CEO Elon Musk said Tesla could start increasing the number of Robotaxis to monitors within the next couple of months.

Elon Musk

Tesla analyst issues stern warning to investors: forget Trump-Musk feud

A Tesla analyst today said that investors should not lose sight of what is truly important in the grand scheme of being a shareholder, and that any near-term drama between CEO Elon Musk and U.S. President Donald Trump should not outshine the progress made by the company.

Gene Munster of Deepwater Management said that Tesla’s progress in autonomy is a much larger influence and a significantly bigger part of the company’s story than any disagreement between political policies.

Munster appeared on CNBC‘s “Closing Bell” yesterday to reiterate this point:

“One thing that is critical for Tesla investors to remember is that what’s going on with the business, with autonomy, the progress that they’re making, albeit early, is much bigger than any feud that is going to happen week-to-week between the President and Elon. So, I understand the reaction, but ultimately, I think that cooler heads will prevail. If they don’t, autonomy is still coming, one way or the other.”

BREAKING: GENE MUNSTER SAYS — $TSLA AUTONOMY IS “MUCH BIGGER” THAN ANY FEUD 👀

He says robotaxis are coming regardless ! pic.twitter.com/ytpPcwUTFy

— TheSonOfWalkley (@TheSonOfWalkley) July 2, 2025

This is a point that other analysts like Dan Ives of Wedbush and Cathie Wood of ARK Invest also made yesterday.

On two occasions over the past month, Musk and President Trump have gotten involved in a very public disagreement over the “Big Beautiful Bill,” which officially passed through the Senate yesterday and is making its way to the House of Representatives.

Musk is upset with the spending in the bill, while President Trump continues to reiterate that the Tesla CEO is only frustrated with the removal of an “EV mandate,” which does not exist federally, nor is it something Musk has expressed any frustration with.

In fact, Musk has pushed back against keeping federal subsidies for EVs, as long as gas and oil subsidies are also removed.

Nevertheless, Ives and Wood both said yesterday that they believe the political hardship between Musk and President Trump will pass because both realize the world is a better place with them on the same team.

Munster’s perspective is that, even though Musk’s feud with President Trump could apply near-term pressure to the stock, the company’s progress in autonomy is an indication that, in the long term, Tesla is set up to succeed.

Tesla launched its Robotaxi platform in Austin on June 22 and is expanding access to more members of the public. Austin residents are now reporting that they have been invited to join the program.

Elon Musk

Tesla surges following better-than-expected delivery report

Tesla saw some positive momentum during trading hours as it reported its deliveries for Q2.

Tesla (NASDAQ: TSLA) surged over four percent on Wednesday morning after the company reported better-than-expected deliveries. It was nearly right on consensus estimations, as Wall Street predicted the company would deliver 385,000 cars in Q2.

Tesla reported that it delivered 384,122 vehicles in Q2. Many, including those inside the Tesla community, were anticipating deliveries in the 340,000 to 360,000 range, while Wall Street seemed to get it just right.

Tesla delivers 384,000 vehicles in Q2 2025, deploys 9.6 GWh in energy storage

Despite Tesla meeting consensus estimations, there were real concerns about what the company would report for Q2.

There were reportedly brief pauses in production at Gigafactory Texas during the quarter and the ramp of the new Model Y configuration across the globe were expected to provide headwinds for the EV maker during the quarter.

At noon on the East Coast, Tesla shares were up about 4.5 percent.

It is expected that Tesla will likely equal the number of deliveries it completed in both of the past two years.

It has hovered at the 1.8 million mark since 2023, and it seems it is right on pace to match that once again. Early last year, Tesla said that annual growth would be “notably lower” than expected due to its development of a new vehicle platform, which will enable more affordable models to be offered to the public.

These cars are expected to be unveiled at some point this year, as Tesla said they were “on track” to be produced in the first half of the year. Tesla has yet to unveil these vehicle designs to the public.

Dan Ives of Wedbush said in a note to investors this morning that the company’s rebound in China in June reflects good things to come, especially given the Model Y and its ramp across the world.

He also said that Musk’s commitment to the company and return from politics played a major role in the company’s performance in Q2:

“If Musk continues to lead and remain in the driver’s seat, we believe Tesla is on a path to an accelerated growth path over the coming years with deliveries expected to ramp in the back-half of 2025 following the Model Y refresh cycle.”

Ives maintained his $500 price target and the ‘Outperform’ rating he held on the stock:

“Tesla’s future is in many ways the brightest it’s ever been in our view given autonomous, FSD, robotics, and many other technology innovations now on the horizon with 90% of the valuation being driven by autonomous and robotics over the coming years but Musk needs to focus on driving Tesla and not putting his political views first. We maintain our OUTPERFORM and $500 PT.”

Moving forward, investors will look to see some gradual growth over the next few quarters. At worst, Tesla should look to match 2023 and 2024 full-year delivery figures, which could be beaten if the automaker can offer those affordable models by the end of the year.

-

Elon Musk2 days ago

Elon Musk2 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News1 week ago

News1 week agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

Elon Musk1 week ago

Elon Musk1 week agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla Robotaxis are becoming a common sight on Austin’s public roads

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoSpaceX President meets India Minister after Starlink approval

-

Elon Musk2 weeks ago

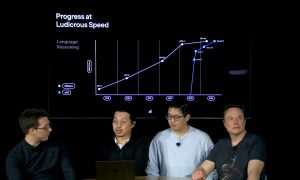

Elon Musk2 weeks agoxAI’s Grok 3 partners with Oracle Cloud for corporate AI innovation