News

NASA head calls out SpaceX CEO Elon Musk over Starship event in bizarre statement

Roughly 24 hours before SpaceX CEO Elon Musk was scheduled to present an update on the company’s Starship launch vehicle development, NASA administrator Jim Bridenstine tweeted a bizarre and wholly unprovoked statement on the subject.

Seemingly equating SpaceX’s recent Crew Dragon delays with the distribution of Elon Musk’s public attention, the NASA administrator’s comment was almost universally criticized by the spaceflight community at large – and rightfully so.

First, some context. Created in 2010 and first supported with serious funding some 12-24 months later, NASA’s Commercial Crew Program (CCP) exists to replace the astronaut transport capabilities once offered by Space Shuttle and now achieved with contracts for seats on Russian Soyuz launches. Primarily the result of inept bureaucracy in NASA and Congress, the Space Shuttle was “retired” in 2011 in full knowledge that the US would have to rely on Russia to get NASA astronauts to the ISS until 2015 (at the absolute earliest).

Congress shut down multiple 2010 proposals to continue Shuttle flights until the late 2010s, choosing instead to kill the Shuttle and divert its associated funding to the expendable Ares V rocket (now the Space Launch System, SLS) and Orion crew capsule. More on that later...

Retweeted by Bridenstine’s official Twitter account, above is the absolute best-case interpretation of the NASA administrator’s comment. Although Eric Berger means well, the interpretation gives NASA far too much credit. Specifically, Bridenstine (or whoever fed him the statement) went out of his way to make it entirely one-sided in its focus on SpaceX. By all appearances, it would have never been posted if not for Elon Musk’s plans to present on Starship. Bridenstine additionally notes that “Commercial Crew is years behind schedule” and indicates that “NASA expects to see the same level of enthusiasm focused on [its] investments”.

Altogether, it’s simply impossible to interpret it as anything less than Bridenstine scolding SpaceX – and SpaceX alone – for not falling to the floor, kissing NASA’s feet, and pretending that Crew Dragon and Falcon 9 are the only things in existence. Absent from Bridenstine’s criticism was NASA’s other (and even more delay-complicit) Commercial Crew Partner, Boeing, who has yet to complete a pad abort or orbital flight test of its Starliner spacecraft. SpaceX completed Crew Dragon’s pad abort in 2015 and completed a flawless orbital flight test in March 2019.

In essence, Bridenstine is publicly implying that SpaceX needs to stop being (or appearing to be) distracted by Starship and focus 100% on Crew Dragon. Boeing was not mentioned, despite being a minimum of six months behind SpaceX and dramatically more ‘distracted’ in the Bridenstine-style interpretation of the word. For reference, Boeing is a publicly-traded company with 150,000 employees, annual revenue of more than $100B, and a market cap of $206B. Boeing has 14 subsidiaries, a handful of which are involved in spaceflight, and has no less than one or two dozen products that are each more fiscally important to shareholders and board members than Starliner.

Compared to Boeing’s annual ~$100B revenue, the entirety of the Starliner development program – from the drawing board in 2010 to crewed, orbital spaceflight sometime in 2020 – is ~$4.8B. On the scale of corporate focus, Starliner has likely been a blip at most in 2019, with the company probably far more focused on the systematic organizational failures that lead to the deaths of hundreds of people in two near-identical 737 MAX crashes. Alas, NASA administrator Jim Bridenstine did not release a statement publicly implying that Boeing needs to devote the “same level of enthusiasm” to Starliner after the second fatal 737 MAX crash in March 2019. Nor did Bridenstine release a statement charging Boeing with a lack of focus after continuous reports of issues with the company’s KC-46 Pegasus tanker program, nor Boeing’s recent $9.2B US Air Force trainer jet contract, or myriad other corporate focuses.

On the other hand, as Musk noted in his relatively subtle September 28th responses to Bridenstine’s implicitly derisive comment, something like 50-80% of the entirety of SpaceX’s workforce and resources are focused on Crew Dragon, the Falcon 9 rockets that will launch it, or a combination of both. At present, Starship is – at most – a side project, even if its strategic importance to SpaceX is hard to exaggerate. The same is largely true for Starlink, SpaceX’s ambitious internet satellite constellation program. It may be true that Starship will eventually make Crew and Cargo Dragon (as well as Falcon 9 and Falcon Heavy) wholly redundant, but that is likely years away and SpaceX will support NASA – as it is contractually required to – for as long as the space agency has vested interest in using Crew Dragon.

At the same time, NASA has explicitly and publicly chosen to prioritize safety over schedule with the Commercial Crew Program, accepting the possibility of delays and cost overruns to ensure that SpaceX and Boeing can build the safest spacecraft possible.

In a September 28th interview with CNN, Musk bluntly noted that the hardware was – at this point in time – more or less ready for flight and will be on-site at SpaceX’s Pad 39A Florida launch site within the next two months. According to Musk, from then on, any additional launch delays can almost entirely be attributed to the paperwork and reviews NASA must complete before giving SpaceX the go-ahead. If Bridenstine wants SpaceX to launch astronauts sooner, one – and possibly the only – solution is to tackle the roadblocks created by NASA’s own self-enforced red tape. The question, then, is whether Bridenstine wants to cut away red tape that may (or may not) be there for good reason.

When the pot calls the kettle black

Detached from whining about a contractor’s CEO presenting about a non-NASA program, complaining about Commercial Crew delays is at least slightly more reasonable. Originally intended to launch as early as 2015, Congress systematically underfunded the Commercial Crew Program by more than 50% for over half a decade, dispersing $2.4B of the $5.8B NASA requested from 2011 to 2016. Unsurprisingly, this completely upended Boeing and SpaceX development schedules. By September 2014, SpaceX aimed to have Crew Dragon certified by NASA for astronaut transport before the end of 2017, but even then, NASA already saw that schedule as overly optimistic.

It would be another two years before Congress began to seriously fund Commercial Crew at its requested levels, beginning in FY2016. In response to Bridenstine, former NASA deputy administrator Lori Garver noted that over the ~5 years Congress consistently withheld hundreds of millions of dollars of critical funds from Commercial Crew, NASA’s SLS rocket and Orion spacecraft were just as consistently overfunded above and beyond their budget requests. From 2011 to 2016 alone, SLS and Orion programs requested $11B and received an incredible $16.3B (148%) from Congress, while Commercial Crew requested $5.8B and received $2.4B (41%).

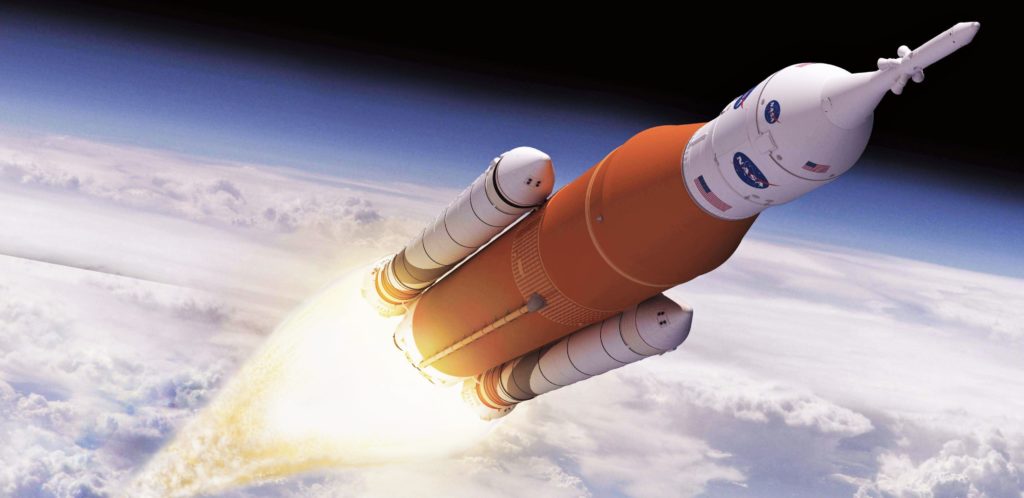

Ironically, despite literally receiving almost seven times as much funding as Crew Dragon and Starliner, SLS and Orion are arguably just as – if not more – delayed than their commercial brethren. Originally intended to launch an uncrewed test flight in 2017, there is now little to no chance that that mission (known then as EM-1 and now as Artemis-1) will launch before 2022, a delay of roughly half a decade. The cost of the SLS/Orion program recently crested $30B, a figure likely to grow to ~$40B before it has conducted a single launch. Of that funding, approximately a third has gone to Boeing, the primary contractor responsible for NASA’s comically-delayed SLS Core Stage – the orange booster pictured above.

The Commercial Crew development program will likely cost NASA $8B total over 9-10 years and produce two clean-sheet, high-performance, (relatively) low-cost crewed spacecraft. After their demonstration launches are completed, NASA will transition to fixed-price service contracts with SpaceX and Boeing to routinely send astronauts to the ISS several times per year.

Put simply, if Bridenstine actually cared about defending “the investments of the American taxpayer” more than wielding their sanctity as a political weapon, he wouldn’t have folded like a house of cards at the slightest resistance to his attempts to cull SLS/Orion delays and cost overruns, and he certainly wouldn’t be wasting breath complaining about what SpaceX’s CEO is or isn’t talking about.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

Elon Musk

Brazil Supreme Court orders Elon Musk and X investigation closed

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

Brazil’s Supreme Federal Court has ordered the closure of an investigation involving Elon Musk and social media platform X. The inquiry had been pending for about two years and examined whether the platform was used to coordinate attacks against members of the judiciary.

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

According to a report from Agencia Brasil, the investigation conducted by the Federal Police did not find evidence that X deliberately attempted to attack the judiciary or circumvent court orders.

Prosecutor-General Paulo Gonet concluded that the irregularities identified during the probe did not indicate fraudulent intent.

Justice Moraes accepted the prosecutor’s recommendation and ruled that the investigation should be closed. Under the ruling, the case will remain closed unless new evidence emerges.

The inquiry stemmed from concerns that content on X may have enabled online attacks against Supreme Court justices or violated rulings requiring the suspension of certain accounts under investigation.

Justice Moraes had previously taken several enforcement actions related to the platform during the broader dispute involving social media regulation in Brazil.

These included ordering a nationwide block of the platform, freezing Starlink accounts, and imposing fines on X totaling about $5.2 million. Authorities also froze financial assets linked to X and SpaceX through Starlink to collect unpaid penalties and seized roughly $3.3 million from the companies’ accounts.

Moraes also imposed daily fines of up to R$5 million, about $920,000, for alleged evasion of the X ban and established penalties of R$50,000 per day for VPN users who attempted to bypass the restriction.

Brazil remains an important market for X, with roughly 17 million users, making it one of the platform’s larger user bases globally.

The country is also a major market for Starlink, SpaceX’s satellite internet service, which has surpassed one million subscribers in Brazil.

Elon Musk

FCC chair criticizes Amazon over opposition to SpaceX satellite plan

Carr made the remarks in a post on social media platform X.

U.S. Federal Communications Commission (FCC) Chairman Brendan Carr criticized Amazon after the company opposed SpaceX’s proposal to launch a large satellite constellation that could function as an orbital data center network.

Carr made the remarks in a post on social media platform X.

Amazon recently urged the FCC to reject SpaceX’s application to deploy a constellation of up to 1 million low Earth orbit satellites that could serve as artificial intelligence data centers in space.

The company described the proposal as a “lofty ambition rather than a real plan,” arguing that SpaceX had not provided sufficient details about how the system would operate.

Carr responded by pointing to Amazon’s own satellite deployment progress.

“Amazon should focus on the fact that it will fall roughly 1,000 satellites short of meeting its upcoming deployment milestone, rather than spending their time and resources filing petitions against companies that are putting thousands of satellites in orbit,” Carr wrote on X.

Amazon has declined to comment on the statement.

Amazon has been working to deploy its Project Kuiper satellite network, which is intended to compete with SpaceX’s Starlink service. The company has invested more than $10 billion in the program and has launched more than 200 satellites since April of last year.

Amazon has also asked the FCC for a 24-month extension, until July 2028, to meet a requirement to deploy roughly 1,600 satellites by July 2026, as noted in a CNBC report.

SpaceX’s Starlink network currently has nearly 10,000 satellites in orbit and serves roughly 10 million customers. The FCC has also authorized SpaceX to deploy 7,500 additional satellites as the company continues expanding its global satellite internet network.

Energy

Tesla Energy gains UK license to sell electricity to homes and businesses

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

Tesla Energy has received a license to supply electricity in the United Kingdom, opening the door for the company to serve homes and businesses in the country.

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

According to Ofgem, the license took effect at 6 p.m. local time on Wednesday and applies to Great Britain.

The approval allows Tesla’s energy business to sell electricity directly to customers in the region, as noted in a Bloomberg News report.

Tesla has already expanded similar services in the United States. In Texas, the company offers electricity plans that allow Tesla owners to charge their vehicles at a lower cost while also feeding excess electricity back into the grid.

Tesla already has a sizable presence in the UK market. According to price comparison website U-switch, there are more than 250,000 Tesla electric vehicles in the country and thousands of Tesla home energy storage systems.

Ofgem also noted that Tesla Motors Ltd., a separate entity incorporated in England and Wales, received an electricity generation license in June 2020.

The new UK license arrives as Tesla continues expanding its global energy business.

Last year, Tesla Energy retained the top position in the global battery energy storage system (BESS) integrator market for the second consecutive year. According to Wood Mackenzie’s latest rankings, Tesla held about 15% of global market share in 2024.

The company also maintained a dominant position in North America, where it captured roughly 39% market share in the region.

At the same time, competition in the energy storage sector is increasing. Chinese companies such as Sungrow have been expanding their presence globally, particularly in Europe.