News

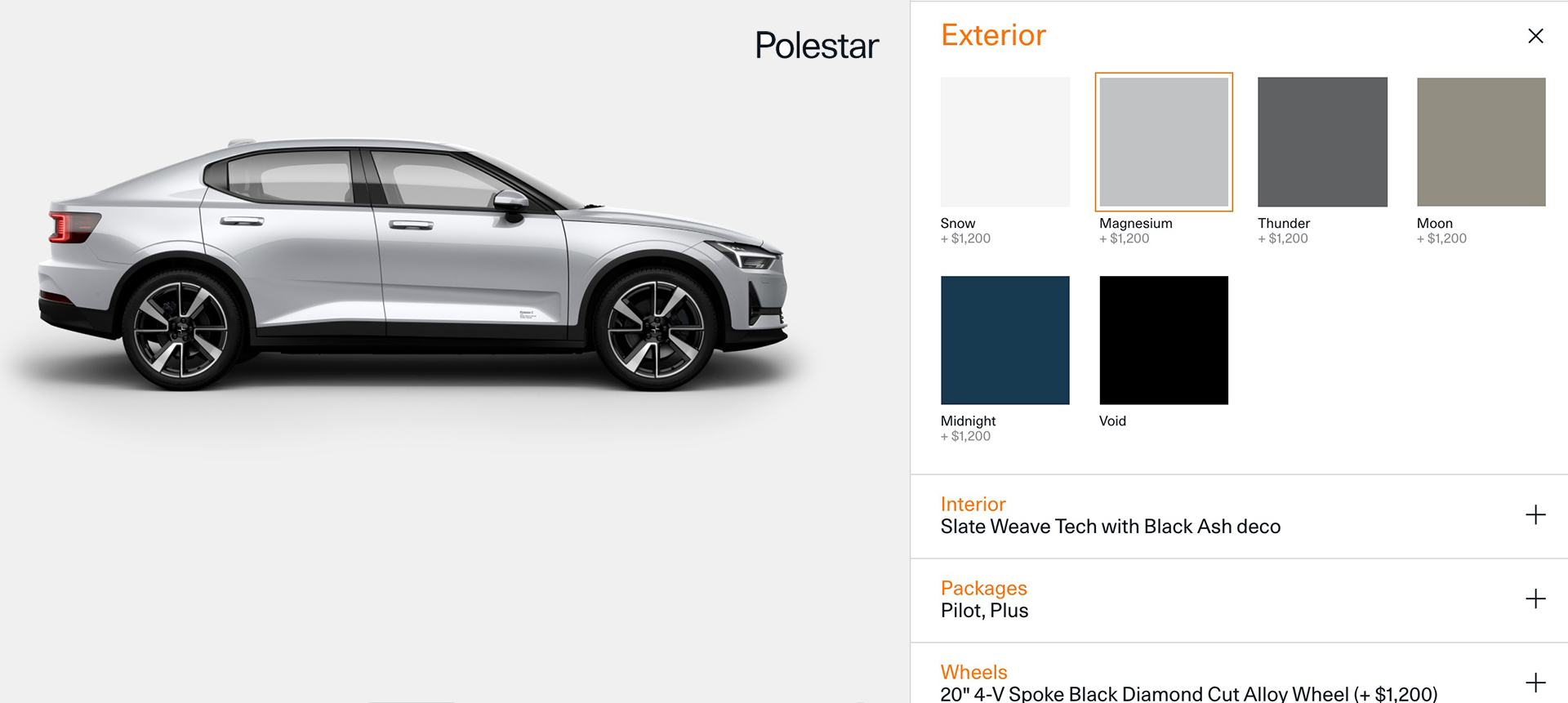

Polestar 2 with 275-mile range goes on sale in US via online configurator

Volvo and Geely-owned company Polestar has announced a $59,900 starting price for its Polestar 2 all-electric sedan.

The company announced European pricing for its electric car in October: £49,900 in the U.K. and €58,000 in Germany, Belgium, and the Netherlands. During the same press release, Polestar indicated a $63,000 price point for its vehicle in the U.S., but it managed to undercut this target by just over $3,000. Head of Polestar USA, Gregor Hembrough stated, “The MSRP is lower than we originally targeted, and will be extended to all of our current reservation holders.”

Additionally, the Polestar 2 will have multiple upgrades available for an additional cost. These include a $5,000 performance pack that upgrades suspension and braking within the vehicle, Nappa interior leather upgrades for $4,000, 20-inch alloy wheels for $1,200, and Premium Metallic paint colors for $1,200.

Production of the Polestar 2 began in late March 2020. U.S. deliveries will start in Summer 2020 for those who hold a reservation for the car, but it is unknown if the current COVID-19 pandemic will delay the timeframe for deliveries.

- Credit: Polestar

- (Credit: Polestar)

- Credit: Polestar

- Credit: Polestar

- (Credit: Polestar)

Polestar will offer one powertrain option for U.S. owners initially. With a 78 kWh battery pack powering a dual electric motor system, the car will produce 408 horsepower and 487 pound-feet of torque. The Polestar 2’s range is 275 miles, according to EPA tests.

The Polestar 2 will also utilize a built-in infotainment system powered by Android and Google Assistant, a first for an automaker. The car will also use Google Maps for GPS navigation and application downloads through the Google Play Store.

Polestar also launched a mobile app in March 2019 that aims to ease the pressure of the car buying process. “We are making it hassle-free and easier for customers to engage with the Polestar brand and enjoy their car. From finding out information about Polestar cars, through to subscribing for a new Polestar, all the way to starting your car using our Phone-as-Key technology – everything can be done through your mobile device,” Polestar CEO Thomas Ingenlath said.

The vehicle is currently available for purchase exclusively on Polestar.com. However, the company plans to begin opening physical retail showrooms, known as Polestar Spaces, where a specialist will give interested customers information on the Polestar 2. The stores will first be available on the West Coast and New York City around the same time as initial deliveries, but more locations will open in the future.

The car is available for purchase in all 50 states, and Polestar plans to release details that will describe leasing and financing options soon, according to a company release.

While some enthusiasts label the Polestar 2 as a rival of the Tesla Model 3, it is crucial to remember Elon Musk’s thoughts on competition within the electric car sector. While it is undoubtedly essential for companies to try and beat their competitors by offering more power, speed, range, or technology, Musk has always indicated that Tesla has no competitors who make electric cars.

The competition lies within companies that have no plans to initiate a transition into an electric future. Polestar plans to enter the electric car industry by offering a quality vehicle that could make the company a striking force within the BEV community.

Energy

Tesla Energy gains UK license to sell electricity to homes and businesses

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

Tesla Energy has received a license to supply electricity in the United Kingdom, opening the door for the company to serve homes and businesses in the country.

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

According to Ofgem, the license took effect at 6 p.m. local time on Wednesday and applies to Great Britain.

The approval allows Tesla’s energy business to sell electricity directly to customers in the region, as noted in a Bloomberg News report.

Tesla has already expanded similar services in the United States. In Texas, the company offers electricity plans that allow Tesla owners to charge their vehicles at a lower cost while also feeding excess electricity back into the grid.

Tesla already has a sizable presence in the UK market. According to price comparison website U-switch, there are more than 250,000 Tesla electric vehicles in the country and thousands of Tesla home energy storage systems.

Ofgem also noted that Tesla Motors Ltd., a separate entity incorporated in England and Wales, received an electricity generation license in June 2020.

The new UK license arrives as Tesla continues expanding its global energy business.

Last year, Tesla Energy retained the top position in the global battery energy storage system (BESS) integrator market for the second consecutive year. According to Wood Mackenzie’s latest rankings, Tesla held about 15% of global market share in 2024.

The company also maintained a dominant position in North America, where it captured roughly 39% market share in the region.

At the same time, competition in the energy storage sector is increasing. Chinese companies such as Sungrow have been expanding their presence globally, particularly in Europe.

Elon Musk

Elon Musk shares big Tesla Optimus 3 production update

According to Musk, Tesla is in the final stages of completing Optimus 3, which he described as one of the world’s most advanced humanoid robots.

Tesla CEO Elon Musk has stated that production of Optimus 3 could begin this summer. Musk shared the update in his interview at the Abundance Summit.

According to Musk, Tesla is in the final stages of completing Optimus 3, which he described as one of the world’s most advanced humanoid robots.

“We’re in the final stages of completion of Optimus 3, which is really going to be by far the most advanced robot in the world. Nothing’s even close. In fact, I haven’t even seen demos of robots that are as good as Optimus 3,” Musk said.

He also set expectations on the pace of Optimus 3’s production ramp, stating that the initial volumes of the humanoid robot will likely be very low. Musk did, however, also state that high production rates for Optimus 3 should be possible in 2027.

“I think we’ll start production on Optimus 3 this summer, but very slow at first, like sort of this classic S-curve ramp of manufacturing units versus time. And then, probably reach high volume production around summer next year,” he said.

Interestingly enough, the CEO hinted that Tesla is looking to iterate on the robot quickly, potentially releasing a new Optimus design every year.

“We’ll have Optimus 4 design complete next year. We’ll try to release a new robot design every year,” Musk stated.

Tesla has already outlined broader plans for scaling Optimus production beyond its first manufacturing line. Musk previously stated that Optimus 4 will be built at Gigafactory Texas at significantly higher production volumes.

Initial production lines for the robot are expected to be located at Tesla’s Fremont Factory, where the company plans to establish a line capable of producing up to 1 million robots per year.

A larger production ramp is expected to occur at Gigafactory Texas, where Musk has previously suggested could eventually support production of up to 10 million robots per year.

“We’re going to launch on the fastest production ramp of any product of any large complex manufactured product ever, starting with building a one-million-unit production line in Fremont. And that’s Line one. And then a ten million unit per year production line here,” Musk said previously.

The comments suggest that while Optimus 3 will likely begin production at Fremont, Tesla’s larger-scale manufacturing push could arrive with Optimus 4 at Gigafactory Texas.

Elon Musk

Tesla showcases Optimus humanoid robot at AWE 2026 in Shanghai

Tesla’s humanoid robot was presented as part of the company’s exhibit at the Shanghai electronics show.

Tesla showcased its Optimus humanoid robot at the 2026 Appliance & Electronics World Expo (AWE 2026) in Shanghai. The event opened Thursday and featured several Tesla products, including the company’s humanoid robot and the Cybertruck.

The display was reported by CNEV Post, citing information from local media outlet Cailian and on-site staff at the exhibition.

Tesla’s humanoid robot was presented as part of the company’s exhibit at the Shanghai electronics show. On-site staff reportedly stated that mass production of the robot could begin by the end of 2026.

Tesla previously indicated that it plans to manufacture its humanoid robots at scale once production begins, with its initial production line in the Fremont Factory reaching up to 1 million units annually. An Optimus production line at Gigafactory Texas is expected to produce 10 million units per year.

Tesla China previously shared a teaser image on Weibo showing a pair of highly detailed robotic hands believed to belong to Optimus. The image suggests a design with finger proportions and structures that closely resemble those of a human hand.

Robotic hands are widely considered one of the most difficult engineering challenges in humanoid robotics. For a system like Optimus to perform complex real-world tasks, from factory work to household activities, the robot would require highly advanced dexterity.

Elon Musk has previously stated that Optimus has the capability to eventually become the first real-world example of a Von Neumann machine, a self-replicating system capable of building copies of itself, even on other planets. “Optimus will be the first Von Neumann machine, capable of building civilization by itself on any viable planet,” Musk wrote in a post on X.