News

SpaceX will launch its Mars spaceship into orbit as early as 2020

First spaceship prototype already under construction

Speaking on a launch industry round-table at the Satellite 2018 conference, SpaceX President and COO Gwynne Shotwell revealed that the company intends to conduct the first orbital launches of BFR as early as 2020, with suborbital spaceship tests beginning in the first half of 2019.

Only six months after CEO Elon Musk first debuted the Interplanetary Transport System in Adelaide, Australia, a flood of recent comments from both executives have made it overwhelmingly clear that SpaceX intends to have its first spaceship ready for short suborbital test flights at the beginning of 2019. Considering Musk’s unprovoked acknowledgment at SXSW 2018 of his tendency towards overly optimistic timelines, the repeated affirmations of BFS test flights beginning in 2019 and now an orbital launch of the full BFR booster and ship in 2020 hold a fair deal more water than they did in 2017.

SpaceX’s subscale Raptor engine conducting a 40-second test in Texas. This engine will power both BFR and BFS. (SpaceX)

Breaking it down

These past few weeks have been filled with a number of similar statements from SpaceX executives like Shotwell, Musk, and others; all focused in part on the company’s next-generation launch vehicle, BFR (Big __ Rocket). Composed of a single massive booster and an equally massive second stage/spaceship (BFS), the rocket is meant to enable the affordable expansion of permanent human outposts on Mars and throughout the inner solar system by making good on the decades-old promise of fully reusable launch vehicles.

In order to succeed, the company will need to solve the problems that NASA and its Shuttle contractors never could.

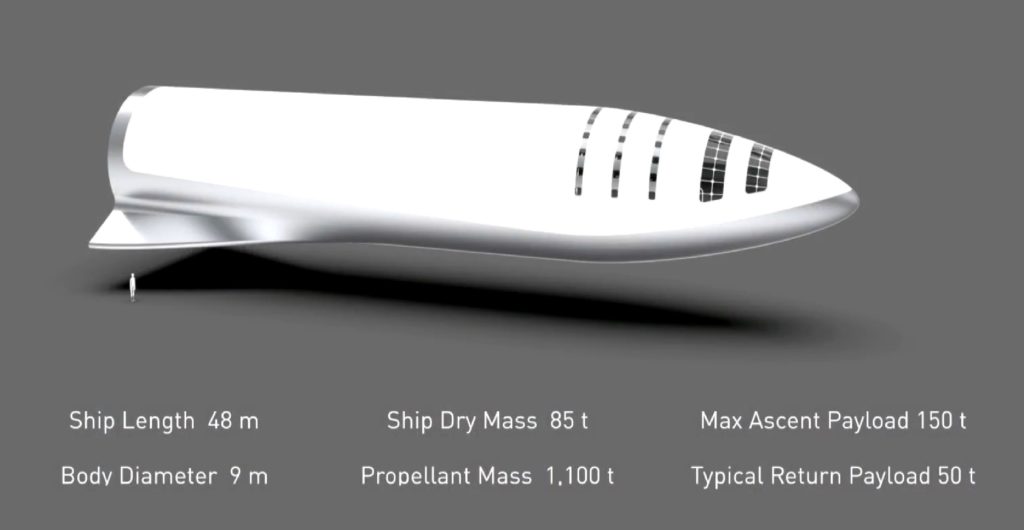

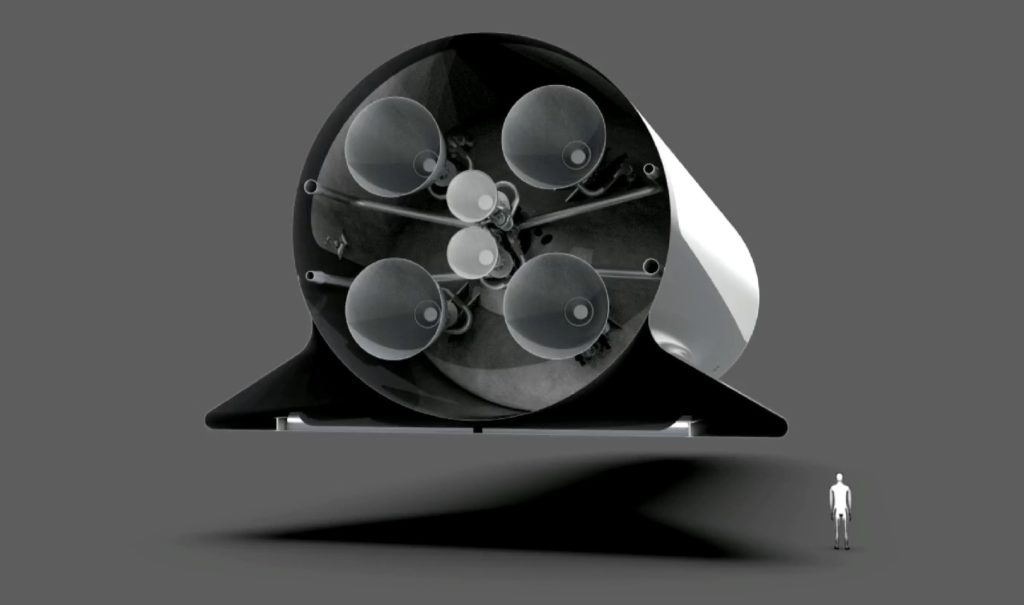

- The relatively cylindrical BFS reduces complexity and lowers weight. (SpaceX)

- BFS (circa 2017) shows off its complement of SL and Vacuum Raptor engines. SpaceX is moving back to something similar to this. (SpaceX)

- SpaceX’s 2017 BFS (now Starship) delivers cargo to a large lunar base. (SpaceX)

To an extent, SpaceX has already matured the principles and technologies needed to reliably recover and reuse the booster stage of two-stage rockets, demonstrated by their incredible success with Falcon 9.

BFR is a whole different animal, partly owing to its massive size, huge thrust, and new propellant and tankage systems, but those problems are more technical than conceptual. SpaceX already knows how to reuse boosters, and that will apply to BFR once its several technological hurdles have been overcome. Designing and building the orbital spaceship (BFS), however, will undoubtedly be the most difficult task SpaceX has yet to take on. The safety and cost records of the only other orbital-class reusable second stage in existence, the Space Shuttle, are at least partially indicative of the difficulty of the challenges ahead of SpaceX.

In order to succeed, the company will need to solve the problems that NASA and its Shuttle contractors never could – they will need to build an orbital, crewed spaceship that can be reused with minimal refurbishment, can launch for little more than the cost of its propellant, and does so with safety and reliability comparable to the records of modern commercial airliners – perhaps the safest form of transport humans have ever created.

Space Shuttle Atlantis docked with the beginnings of the International Space Station. The Shuttle suffered several deadly failures and cost more than the expendable Saturn V moon rocket it replaced. (NASA)

Rockets do not easily lend themselves to such incredible standards of safety or reliability – airliners average a single death per 16 million flights – but SpaceX will need to reach similar levels of reusability and reliability if they hope to enable even moderately affordable spaceflight or Earth-to-Earth transport by rocket. Still, there can be little doubt that SpaceX employs some of the absolute best engineering expertise to have ever existed in the US, and their extraordinary personal investment in the company’s goal of making humanity multi-planetary bode about as well as could be asked for such an ambitious endeavor. According to Musk and Shotwell, the first spaceship is already being built and suborbital tests will begin as soon as 2019, while full-up orbital launches – presumably involving both the booster and spaceship – might occur just a single year later in 2020.

SpaceX's Shotwell: BFR will probably be orbital in 2020, but you should start seeing hops in 2019. (Grasshopper reference?) #satshow

— Caleb Henry (@ChenrySpace) March 12, 2018

Musk: People have told me that my timelines historically have been optimistic. I am trying to recalibrate. What I do know is we are building the first ship. We will be able to do do short flights in the first half of next year. It's a big booster and ship. Saturn V thrust x2.

— Michael Baylor (@MichaelBaylor_) March 11, 2018

It appears that we will find out sooner, rather than later, if SpaceX has truly found a way to lower the cost to orbit by several orders of magnitudes. Follow us for live updates, behind-the-scenes sneak peeks, and a sea of beautiful photos from our East and West coast photographers.

Teslarati – Instagram – Twitter

Tom Cross – Twitter

Pauline Acalin – Twitter

Eric Ralph – Twitter

News

Tesla VP explains latest updates in trade secret theft case

Tesla reportedly caught Matthews copying the tech into machines that were sold to competitors, claiming they lied about doing so for three years, and continued to ship it. That is when Tesla chose to sue Matthews in July 2024 in Federal court, demanding over $1 billion in damages due to trade secret theft.

Tesla Vice President Bonne Eggleston explained the latest updates in a trade secret theft case the company has against a former manufacturing equipment supplier, Matthews International.

Back in 2024, Tesla had filed a lawsuit against Matthews International, alleging that the firm stole trade secrets about battery manufacturing and shared those details with some of Tesla’s competitors.

Early last year, a U.S. District Court Judge denied Tesla’s request to block Matthews International from selling its dry battery electrode (DBE) technology across the world. The judge, Edward Davila, said that the patent for the tech was due to Matthews’ “extensive research and development.”

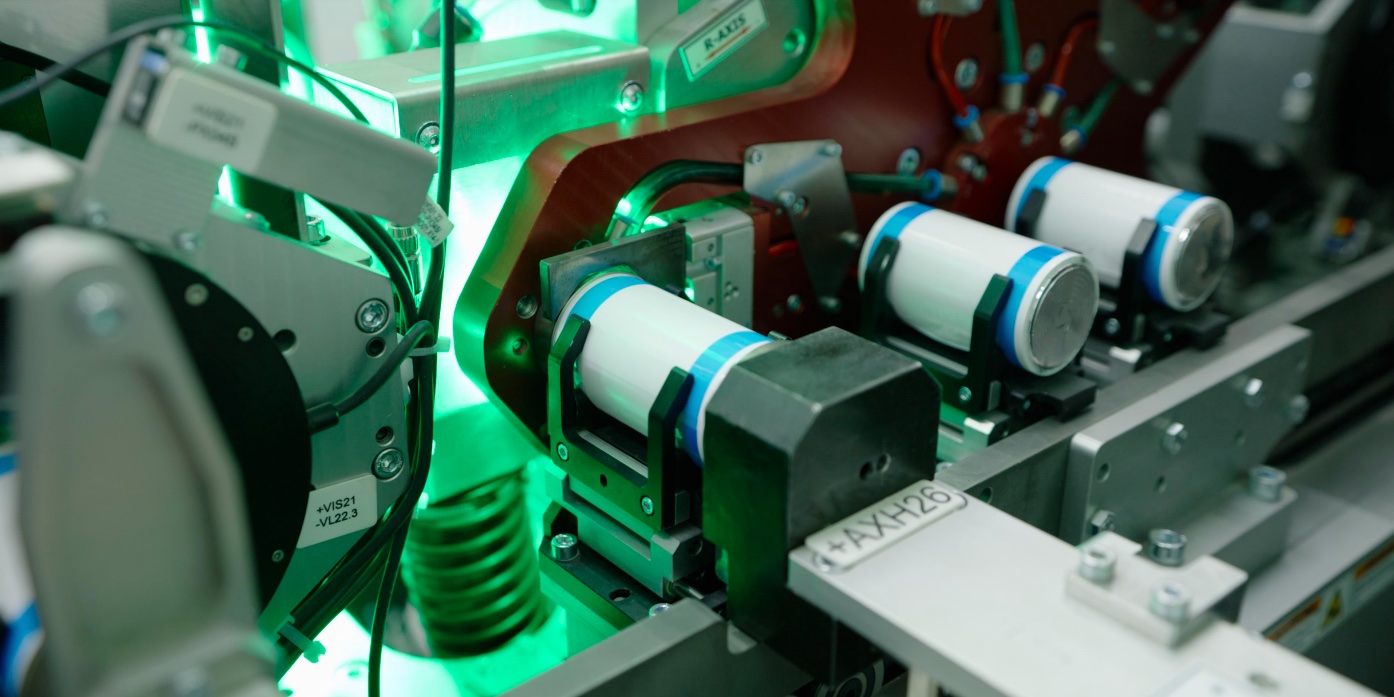

The two companies’ relationship began back in 2019, as Tesla hired Matthews to help build the equipment for its 4680 battery cell. Tesla shared confidential software, designs, and know-how under strict secrecy rules.

Fast forward a few years, and Tesla reportedly caught Matthews copying the tech into machines that were sold to competitors, claiming they lied about doing so for three years, and continued to ship it. That is when Tesla chose to sue Matthews in July 2024 in Federal court, demanding over $1 billion in damages due to trade secret theft.

Now, the latest twist, as this month, a Judge issued a permanent injunction—a court order banning Matthews from using certain stolen Tesla parts or designs in their machines. Matthews is also officially “liable” for damages. The exact amount would still to be calculated later.

Bonne Eggleston, a VP for Tesla, said on X today that Matthews is a supplier who “exploited customer IP through theft or deception,” and has no place in Tesla’s ecosystem:

Buyer beware: Matthews International stole Tesla’s DBE technology and is now subject to an injunction and liable for damages.

During our work with Matthews, we caught them red-handed copying our technology—including proprietary software and sensitive mechanical designs—into… https://t.co/Toc8ilakeM

— Bonne Eggleston (@BonneEggleston) March 10, 2026

Tesla calls this a big win and warns other companies: “Buyer beware—don’t buy from thieves.”

Matthews hit back with a press release claiming victory. They say an arbitrator ruled they can keep selling their own DBE equipment to anyone and rejected Tesla’s request for a total sales ban. They call Tesla’s claims “nonsense” and insist their 20-year-old tech is independent. Both sides are spinning the same narrow ruling: Matthews can sell their version, but they’re blocked from using Tesla’s specific secrets.

What are Tesla’s Current Legal Options

The case isn’t over—it’s moving to the damages phase. Tesla can:

- Push forward in court or arbitration to calculate and collect huge financial penalties (potentially $1 billion+ if willful theft is proven).

- Enforce the permanent injunction with contempt charges, fines, or even jail time if Matthews violates it.

- Challenge Matthews’ new patents that allegedly copy Tesla’s work, asking courts to invalidate them or add Tesla as co-inventor.

- Seek extra damages, lawyer fees, and possibly punitive awards under the federal Defend Trade Secrets Act and California law.

Tesla could also refer evidence to federal prosecutors for possible criminal trade-secret charges (rare but serious). Settlement is always possible, but Tesla’s fiery public response suggests they want full accountability.

This isn’t just corporate drama. It shows why trade secrets matter even when Tesla open-sources some patents, confidential know-how shared in trust must stay protected. For the EV industry, it’s a reminder: steal from your biggest customer, and you risk losing everything.

News

Tesla Cybercab includes this small but significant feature

The Cybercab is Tesla’s big plan to introduce fully autonomous ride-sharing in a seamless fashion. In fact, the Full Self-Driving suite was geared toward alleviating the need to manually drive vehicles.

Tesla Cybercab manufacturing is strikingly close, as the company is still aiming for an April start date. But small and significant features are still being identified for the first time as production units appear all over the country for testing and for regulatory events, like one yesterday in Washington, D.C.

The Cybercab is Tesla’s big plan to introduce fully autonomous ride-sharing in a seamless fashion. In fact, the Full Self-Driving suite was geared toward alleviating the need to manually drive vehicles.

This was for everyone, including the disabled, who are widely reliant on ride-sharing platforms, family members, and medical shuttles for transportation of any kind. Cybercab aims to change that, and Tesla evidently put a focus on those riders while developing the vehicle, evident in a small but significant feature revealed during its appearance in the Nation’s Capital.

Tesla Cybercab display highlights interior wizardry in the small two-seater

Tesla has implemented Braille within the Cybercab to make it easier for blind passengers to utilize the vehicle. On both the ‘Stop/Hazard Lights’ button and the Door Releases, Tesla has placed Braille so that blind passengers can navigate their way through the vehicle:

The hazard lights button will be used as an emergency stop. Smart pic.twitter.com/vkYBioqmKm

— Whole Mars Catalog (@wholemars) March 10, 2026

We have braille on the interior door releases as well

— Eric (@EricETesla) March 11, 2026

This is a great addition to the Cybercab, especially as Full Self-Driving has been partially pointed at as a solution for those with disabilities that would keep them from driving themselves from place to place.

It truly is a great addition and just another way that Tesla is showing they are making this massive product inclusive for everyone out there, including those who have not been able to drive due to not having vision.

The Cybercab is set to enter mass production sometime in April, and it will be responsible for launching Tesla’s massive plans for an autonomous ride-sharing program.

Elon Musk

Tesla and xAI team up on massive new project

It is the latest move by a Musk company to automate, streamline, and reduce the manual, monotonous, and tedious work currently performed by humans through AI and robotics development. Digital Optimus will be capable of processing and actioning the past five seconds of a real-time computer screen video and keyboard and mouse actions.

Elon Musk teased a massive new project, to be developed jointly by Tesla and xAI, called “Digital Optimus” or “Macrohard,” the first development under Tesla’s investment agreement with xAI.

Musk announced on X that Digital Optimus will “be capable of emulating the function of entire companies.”

Macrohard or Digital Optimus is a joint xAI-Tesla project, coming as part of Tesla’s investment agreement with xAI.

Grok is the master conductor/navigator with deep understanding of the world to direct digital Optimus, which is processing and actioning the past 5 secs of…

— Elon Musk (@elonmusk) March 11, 2026

It is the latest move by a Musk company to automate, streamline, and reduce the manual, monotonous, and tedious work currently performed by humans through AI and robotics development. Digital Optimus will be capable of processing and actioning the past five seconds of a real-time computer screen video and keyboard and mouse actions.

Essentially, it will be an AI version of a desk worker in many capacities, including accounting, HR tasks, and others.

Musk said:

“Grok is the master conductor/navigator with deep understanding of the world to direct digital Optimus, which is processing and actioning the past 5 secs of real-time computer screen video and keyboard/mouse actions. Grok is like a much more advanced and sophisticated version of turn-by-turn navigation software. You can think of it as Digital Optimus AI being System 1 (instinctive part of the mind) and Grok being System 2. (thinking part of the mind).”

Its key applications would be used for enterprise automation, simulating entire companies, high-volume repetitive tasks, and potentially, future hybrid use with the Optimus robot, which would handle physical tasks, while Digital Optimus would handle the clerical work.

The creation of a digital AI suite like Digital Optimus would help companies save time and money, as well as become more efficient in their operations through massive scalability. However, there will undoubtedly be concerns from people who are skeptical of a fully-integrated AI workhorse like this one.

From an energy consumption perspective and just a general concern for the human workforce, these types of AI projects are polarizing in nature.

However, Digital Optimus would be a great digital counterpart to Tesla’s physical Optimus robot, as it would be a hyper-efficient addition to any company that is looking for more production for less cost.

Musk maintains that there is no other company on Earth that will be able to do this.