News

SpaceX’s surprise Falcon 9 drone ship landing explained ahead of Cargo Dragon launch

Speaking in a press briefing prior to NASA’s next Cargo Dragon launch, a SpaceX official shed some light on a surprise Falcon 9 drone ship landing planned for Wednesday, revealing the circumstances behind the unique decision.

A few days ago, it became clear that SpaceX and NASA and decided to perform a drone ship booster landing attempt after Cargo Dragon’s CRS-19 launch, an unusual trajectory compared to the more typical return-to-launch-site (RTLS) Landing Zone recoveries. Teslarati discussed this quandary earlier today.

“As it turns out, this Falcon 9 landing is a bit of mystery: it’s unclear why exactly SpaceX has decided to land the booster at sea instead of the usual Landing Zone recoveries that have followed most recent Cargo Dragon launches. Typically, the low insertion orbit (~200 km x ~390 km) and relatively low mass of Cargo Dragon (less than 10 tons or 22,000 lb) means that Falcon 9 has (literally) tons of propellant left over, giving it the margins needed to flip around, cancel out a huge amount of horizontal velocity, and boost 100+ km (62+ mi) back to shore.

Instead, new Falcon 9 booster B1058 is scheduled to land aboard drone ship OCISLY some 350 km (220 mi) downrange, an unusual distance. For reference, SpaceX’s May 2019 CRS-17 mission is the only time Falcon 9 has landed at sea after a CRS launch since CRS-8, the rocket’s first successful drone ship recovery. That scenario was forced because LZ-1/2 had coincidently been showered in Crew Dragon debris after C201 exploded during testing. Even then, OCISLY was stationed just 20 or so kilometers offshore, meaning that Falcon 9 B1056 still performed a routine Return To Launch Site (RTLS) landing in spirit.”

Teslarati.com — December 3rd

According to Jessica Jensen, SpaceX’s director of Dragon mission management, the actual reason behind Falcon 9 B1058’s surprise drone ship landing is relatively simple and was more or less one of the possibilities posed earlier today at Teslarati.

“[It’s] also possible that CRS-19 will follow in the footsteps of CRS-18, which sported a prototype Falcon 9 upper stage designed to push the enveloped of its orbital longevity. Falcon 9 B1056 still managed to land at LZ-1 after CRS-18, but a more ambitious follow-on test could potentially require much more propellant, accounting for the drone ship’s position further downrange “

Much as predicted, SpaceX is essentially going to perform an even more ambitious coast test, requiring significantly larger propellant margins that took away from Falcon 9’s own landing propellant budget. For whatever reason, the gray coating covering the CRS-18 upper stage’s RP-1 (refined kerosene) tank is not present on Falcon 9. Based on a picture taken of the horizontal rocket by a NASA Social CRS-19 attendee, CRS-19’s upper stage looks no different than any other.

Jensen says that the coast test will be performed for unspecified “other” customers, presumably referring to the US Air Force (USAF) and other commercial customers interested in direct-to-geostationary (GEO) launch services. Direct GEO launches require rocket upper stages to perform extremely long coasts in orbit, all while fighting the hostile vacuum environment’s temperature swings and radiation belts and attempting to prevent cryogenic propellant from boiling off or freezing solid. In simple terms, it’s incredibly difficult to build a reliable, high-performance upper stage capable of remaining fully functional after 6-12+ hours in orbit.

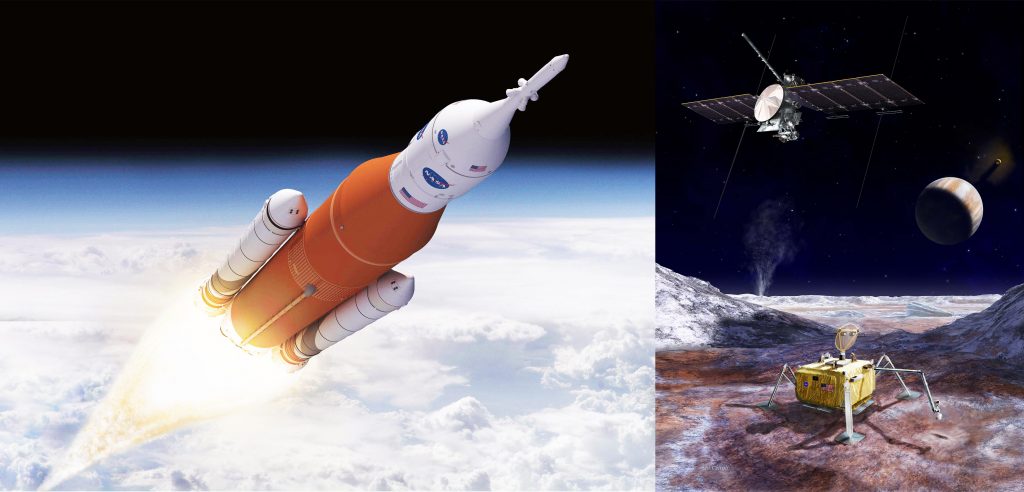

Although SpaceX said that the test was for “other” customers, that may well have been a cryptic way to avoid indicating that one such customer might be NASA itself. NASA is in the midst of a political battle for the Europa Clipper spacecraft’s launch contract, which is currently legally obligated to launch on NASA’s SLS rocket. Said rocket will likely cost on the order of >$2 billion per launch, meaning that simply using Falcon Heavy or Delta IV Heavy could save no less than ~$1.5 billion. Incredibly, that means that simply using a commercial launch vehicle could save NASA enough money to fund an entire Curiosity-sized Mars rover or even a majority of the cost of building a dedicated Europa lander. Such a launch would demand every ounce of Falcon Heavy’s performance, including a very long orbital coast.

Regardless of the prospective beneficiaries of SpaceX’s planned Falcon 9 upper stage test, CRS-19 is scheduled to launch no earlier than 12:51 pm EST (16:51 UTC), December 4th. High upper-level winds may delay the mission 24 hours to December 5th but for now, it remains on track for Wednesday.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

News

Tesla Full Self-Driving likely to expand to yet another Asian country

“We are aiming for implementation in 2026. [We are] doing everything in our power [to achieve this],” Richi Hashimoto, president of Tesla’s Japanese subsidiary, said.

Tesla Full Self-Driving is likely to expand to yet another Asian country, as one country seems primed for the suite to head to it for the first time.

The launch of Full Self-Driving in yet another country this year would be a major breakthrough for Tesla as it continues to expand the driver-assistance program across the world. Bureaucratic red tape has held up a lot of its efforts, but things are looking up in some regions.

Tesla is poised to transform Japan’s roads with Full Self-Driving (FSD) technology by 2026.

Richi Hashimoto, president of Tesla’s Japanese subsidiary, announced the ambitious timeline, building on successful employee test drives that began in 2025 and earned positive media reviews. Test drives, initially limited to the Model 3 since August 2025, expanded to the Model Y on March 5.

Once regulators approve, Over-the-Air (OTA) software updates could activate FSD across roughly 40,000 Teslas already on Japanese roads. Japan’s orderly traffic and strict safety culture make it an ideal testing ground for autonomous driving.

Hashimoto said:

“We are aiming for implementation in 2026. [We are] doing everything in our power [to achieve this].”

The push aligns with Hashimoto’s leadership, which has been credited for Tesla’s sales turnaround.

In 2025, Tesla delivered a record 10,600 vehicles in Japan — a nearly 90% jump from the prior year and the first time exceeding 10,000 units annually.

BREAKING 🇯🇵 FSD IS LIKELY LAUNCHING IN JAPAN IN 2026 🚨

Richi Hashimoto, President of Tesla’s Japanese subsidiary, stated: “We are aiming for implementation in 2026” and added that they are “doing everything in our power” to achieve this 🔥

Test drives in Japan began in August… pic.twitter.com/jkkrJLszXN

— Ming (@tslaming) March 5, 2026

The strategy shifted from online-only sales to adding 29 physical showrooms in high-traffic malls, plus staff training and attractive financing offers launched in January 2026. Tesla also plans to expand its Supercharger network to over 1,000 points by 2027, boosting accessibility.

This Japanese momentum reflects Tesla’s broader international expansion. In Europe, Giga Berlin produced more than 200,000 vehicles in 2025 despite a temporary halt, supplying over 30 markets with plans for sequential production growth in 2026 and battery cell manufacturing by 2027.

While regional EV sales faced headwinds, the factory remains a cornerstone for Model Y deliveries across the continent.

In Asia, Giga Shanghai continues to be recognized as Tesla’s powerhouse. China, the company’s largest market, saw January 2026 deliveries from the plant rise 9 percent year-over-year to 69,129 units, with affordable new models expected later this year.

FSD advancements, already progressing in the U.S. and South Korea, are slated for Europe and further Asian rollout, complementing plans to expand Cybercab and Optimus to new markets as well.

With OTA-enabled autonomy on the horizon and retail strategies paying dividends, Tesla is strengthening its footprint from Tokyo showrooms to Berlin assembly lines and Shanghai exports. As Hashimoto continues to push Tesla forward in Japan, the company’s global vision for sustainable, self-driving mobility gains traction across Europe and Asia.

News

Tesla ships out update that brings massive change to two big features

“This change only updates the name of certain features and text in your vehicle,” the company wrote in Release Notes for the update, “and does not change the way your features behave.”

Tesla has shipped out an update for its vehicles that was caused specifically by a California lawsuit that threatened the company’s ability to sell cars because of how it named its driver assistance suite.

Tesla shipped out Software Update 2026.2.9 starting last week; we received it already, and it only brings a few minor changes, mostly related to how things are referenced.

“This change only updates the name of certain features and text in your vehicle,” the company wrote in Release Notes for the update, “and does not change the way your features behave.”

The following changes came to Tesla vehicles in the update:

- Navigate on Autopilot has now been renamed to Navigate on Autosteer

- FSD Computer has been renamed to AI Computer

Tesla faced a 30-day sales suspension in California after the state’s Department of Motor Vehicles stated the company had to come into compliance regarding the marketing of its automated driving features.

The agency confirmed on February 18 that it had taken a “corrective action” to resolve the issue. That corrective action was renaming certain parts of its ADAS.

Tesla discontinued its standalone Autopilot offering in January and ramped up the marketing of Full Self-Driving Supervised. Tesla had said on X that the issue with naming “was a ‘consumer protection’ order about the use of the term ‘Autopilot’ in a case where not one single customer came forward to say there’s a problem.”

This was a “consumer protection” order about the use of the term “Autopilot” in a case where not one single customer came forward to say there’s a problem.

Sales in California will continue uninterrupted.

— Tesla North America (@tesla_na) December 17, 2025

It is now compliant with the wishes of the California DMV, and we’re all dealing with it now.

This was the first primary dispute over the terminology of Full Self-Driving, but it has undergone some scrutiny at the federal level, as some government officials have claimed the suite has “deceptive” names. Previous Transportation Secretary Pete Buttigieg was one of those federal-level employees who had an issue with the names “Autopilot” and “Full Self-Driving.”

Tesla sued the California DMV over the ruling last week.

News

Tesla workers push back against Giga Berlin unionization

“IG Metall did not succeed in Giga Berlin‘s works council election earlier today. The union share was reduced from nearly 40% in 2024 to 31% in 2026! This is a clear message by the Giga Berlin team towards an independent co-determination! The list called Giga United, led by the current chairwoman, Michaela Schmitz, received the most votes with more than 40%! Good news for Giga Berlin!”

Tesla workers pushed back against unionization efforts at Gigafactory Berlin, and over the past few years, there has been a dramatic decrease in interest to unionize at the German plant.

Gigafactory Berlin Plant Manager André Thierig announced on Wednesday that IG Metall, the European union group, saw its share reduce from 40 to 31 percent in 2026 as employees eligible to vote on the issue. Instead, the Giga Berlin team, known as Giga United, received the most votes with more than 40 percent.

BREAKING! 🚨

IG Metall did not succeed in Giga Berlin‘s works council election earlier today. The union share was reduced from nearly 40% in 2024 to 31% in 2026!

This is a clear message by theGiga Berlin team towards an independent co-determination!

The list called Giga…

— André Thierig (@AndrThie) March 4, 2026

Thierig gave specific details in a post on X:

“IG Metall did not succeed in Giga Berlin‘s works council election earlier today. The union share was reduced from nearly 40% in 2024 to 31% in 2026! This is a clear message by the Giga Berlin team towards an independent co-determination! The list called Giga United, led by the current chairwoman, Michaela Schmitz, received the most votes with more than 40%! Good news for Giga Berlin!”

There were over 10,700 total employees who were eligible to vote, with 87 percent of them turning out to cast what they wanted. There were three key outcomes: Giga United, IG Metall, and other notable groups, with the most popular being the Polish Initiative.

The 37-seat council remains dominated by non-unionized representatives, preserving Giga Berlin as Germany’s only major auto plant without a collective bargaining agreement.

Thierig and Tesla framed the outcome as employee support for an “independent, flexible, and unbureaucratic” future, enabling acceleration on projects like potential expansions or new models. IG Metall expressed disappointment, accusing management of intimidation tactics and an “unfair” campaign.

The first election of this nature happened back in 2022. In 2024, IG Metall emerged as the largest single faction with 39.4 percent, but non-union lists coalesced for a majority.

But this year was different. There was some extra tension at Giga Berlin this year, as just two weeks ago, an IG Metall rep was accused by Tesla of secretly recording a council meeting. The group countersued for defamation.

Tesla Giga Berlin plant manager faces defamation probe after IG Metall union complaint

This result from the 2026 vote reinforced Tesla’s model of direct employee-management alignment over traditional German union structures, amid ongoing debates about working conditions. IG Metall views it as a setback but continues advocacy. Tesla sees it as validation of its approach in a competitive EV market.

This outcome may influence future labor dynamics at Giga Berlin, including any revival of expansion plans or product lines, which Musk has talked about recently.