News

SpaceX launches tenth Starlink mission, nails booster’s fifth landing

Bringing more than six weeks of delays to a welcome end, SpaceX has – for the second time ever – successfully launched and landed the same Falcon 9 booster five times, sending a stack of Starlink satellites and two rideshare payloads on their way to orbit.

At 1:12 am EDT (05:12 UTC) on Friday, August 7th, Falcon 9 booster B1051, a fresh upper stage and payload fairing, 57 Starlink v1.0 satellites, and two BlackSky Earth imaging spacecraft successfully lifted off. Around nine minutes after departing Kennedy Space Center (KSC) Launch Complex 39A, better known as Pad 39A, booster B1051 completed a gentle landing aboard drone ship Of Course I Still Love You (OCISLY).

Located some 630 km (~390 mi) downrange, this was the fourth time the SpaceX drone ship had departed Florida’s Port Canaveral in support of Starlink V1 L9 (Starlink-9) launch attempts. Thankfully, especially for the recovery teams tasked with repeatedly sailing out and back empty-handed, B1051’s fifth successful landing brings that wild goose chase to an end.

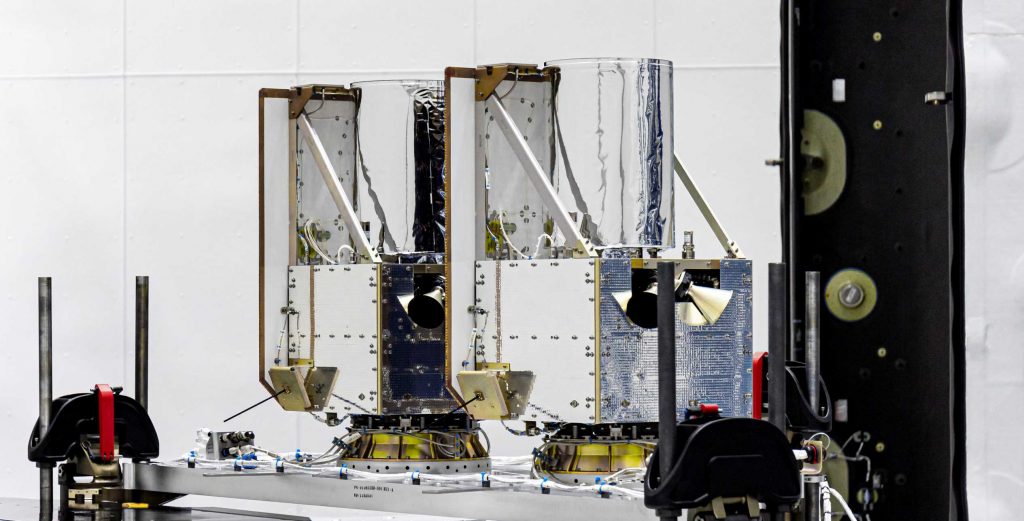

Around 45 minutes after launch, a SpaceX engineer and webcast host revealed that the company was, unfortunately, unable to complete two back-to-back Falcon 9 fairing catches, although recovery ships Ms. Tree and Ms. Chief should still be able to fish the Starlink-9 halves out of the water. About an hour after liftoff, Falcon 9’s upper stage successfully deployed both BlackSky rideshare payloads and followed that up with the successful deployment of 57 new Starlink satellites shortly thereafter.

While Starlink-9 was originally scheduled to launch as early as June 23rd, Principal Integration Engineer John Insprucker – a familiar fixture and voice on SpaceX webcasts – was quick to note that through the more than six subsequent weeks of delays, “Falcon 9 has been trouble-free.” He also partially answered the main question on everyone’s mind, noting that all of those delays could be traced back to bad weather and issues with the mission’s payloads.

He didn’t specify which payloads, suggesting that it may have primarily been related to BlackSky’s two satellites given that throwing a customer under the bus would be in extremely bad taste for a launch provider. Regardless, SpaceX has finally completed the mission and can now move on to greener Starlink pastures and a number of interesting upcoming missions.

Notably, the next two non-Starlink launches currently on SpaceX’s manifest are SAOCOM 1B – the first polar orbit launch from the East Coast in half a century – and Crew-1 – Crew Dragon’s first operational astronaut launch. Scheduled no earlier than late-August and late-September, respectively, both major customer missions are likely to be punctuated by several Starlink launches over the next two months. With Starlink-9 complete, SpaceX could be just 4-5 missions away from rolling out Starlink internet service according to a comment from COO/President Gwynne Shotwell that service could begin after the 14th Starlink launch.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

Elon Musk

SpaceX secures FAA approval for 44 annual Starship launches in Florida

The FAA’s environmental review covers up to 44 launches annually, along with 44 Super Heavy booster landings and 44 upper-stage landings.

SpaceX has received environmental approval from the Federal Aviation Administration (FAA) to conduct up to 44 Starship-Super Heavy launches per year from Kennedy Space Center Launch Complex 39A in Florida.

The decision allows the company to proceed with plans tied to its next-generation launch system and future satellite deployments.

The FAA’s environmental review covers up to 44 launches annually, along with 44 Super Heavy booster landings and 44 upper-stage landings. The approval concludes the agency’s public comment period and outlines required mitigation measures related to noise, emissions, wildlife, and airspace management.

Construction of Starship infrastructure at Launch Complex 39A is nearing completion. The site, previously used for Apollo and space shuttle missions, is transitioning to support Starship operations, as noted in a Florida Today report.

If fully deployed across Kennedy Space Center and nearby Cape Canaveral Space Force Station, Starship activity on the Space Coast could exceed 120 launches annually, excluding tests. Separately, the U.S. Air Force has authorized repurposing Space Launch Complex 37 for potential additional Starship activity, pending further FAA airspace analysis.

The approval supports SpaceX’s long-term strategy, which includes deploying a large constellation of satellites intended to power space-based artificial intelligence data infrastructure. The company has previously indicated that expanded Starship capacity will be central to that effort.

The FAA review identified likely impacts from increased noise, nitrogen oxide emissions, and temporary airspace closures. Commercial flights may experience periodic delays during launch windows. The agency, however, determined these effects would be intermittent and manageable through scheduling, public notification, and worker safety protocols.

Wildlife protections are required under the approval, Florida Today noted. These include lighting controls to protect sea turtles, seasonal monitoring of scrub jays and beach mice, and restrictions on offshore landings to avoid coral reefs and right whale critical habitat. Recovery vessels must also carry trained observers to prevent collisions with protected marine species.

Elon Musk

Texas township wants The Boring Company to build it a Loop system

The township’s board unanimously approved an application to The Boring Company’s “Tunnel Vision Challenge.”

The Woodlands Township, Texas, has formally entered The Boring Company’s tunneling sweepstakes.

The township’s board unanimously approved an application to The Boring Company’s “Tunnel Vision Challenge,” which offers up to one mile of tunnel construction at no cost to a selected community.

The Woodlands’ proposal, dubbed “The Current,” features two parallel 12-foot-diameter tunnels beneath the Town Center corridor near The Waterway. Teslas would shuttle passengers between Waterway Square, Cynthia Woods Mitchell Pavilion, Town Green Park and nearby hotels during concerts and large-scale events, as noted in a Chron report.

Township officials framed the tunnel as a solution for the township’s traffic congestion issues. The Pavilion alone hosts more than 60 shows each year and can accommodate crowds of up to 16,500, often straining Lake Robbins Drive and surrounding intersections.

“We know we have traffic impacts and pedestrian movement challenges, especially in the Town Center area,” Chris Nunes, chief operating officer of The Woodlands Township, stated during the meeting.

“The Current” mirrors the Loop system operating beneath the Las Vegas Convention Center, where Tesla vehicles transport passengers through underground tunnels between venues and resorts.

The Boring Company issued its request for proposals (RFP) in mid-January, inviting cities and districts to pitch local uses for its tunneling technology. The Woodlands must submit its application by Feb. 23, though no timeline has been provided for when a winning community will be announced.

Nunes confirmed that the board has authorized a submission for “The Current’s” proposal, though he emphasized that the project is still in its preliminary stages.

“The Woodlands Township Board of Directors has authorized staff to submit an application to The Boring Company, which has issued an RFP for communities interested in leveraging their technology to address community challenges,” he said in a statement.

“The Board believes that an underground tunnel would provide a safe and efficient means to transport people to and from various high-use community amenities in our Town Center.”

News

Tesla Model Y wins 2026 Drive Car of the Year award in Australia

The Model Y is already Australia’s best-selling EV in 2025 and the tenth best-selling vehicle overall.

The Tesla Model Y has been named 2026 Drive Car of the Year overall winner, taking the top honor after being judged as the vehicle that “moves the game forward the most for Australian new car buyers.”

The Model Y is already Australia’s best-selling EV in 2025 and the tenth best-selling vehicle overall, but the vehicle’s Juniper update strengthened its case with new ownership benefits and expanded software capability.

Drive’s overall award compares category winners and looks at which model most significantly advances the local new car market. In 2026, judges pointed to the Model Y’s five-year warranty and the availability of Full Self-Driving (Supervised) as a monthly subscription as key differentiators.

Priced from AU$58,900 before on-road costs, the all-electric crossover SUV offers a lot of value compared to similarly sized petrol and hybrid rivals. The ability to access Tesla’s Supercharger network across Australia also reduces friction for buyers moving to EV ownership.

Owners can add FSD (Supervised) for AU$149 per month. While it still requires driver oversight, the system expands the vehicle’s advanced driver-assistance capabilities and reflects Tesla’s software-first approach.

“The default choice for a reason. The Tesla Model Y makes the transition to electric both effortless and rewarding,” Drive wrote.

The 2025 Model Y facelift also sharpened the vehicle’s exterior, highlighted by a distinctive rear light bar that gives the crossover SUV a more modern road presence.

Drive described the Model Y as a benchmark for combining practicality, efficiency and technology at an accessible price point. With eligibility for federal Fringe Benefit Tax exemptions through novated leasing, its value proposition has improved for numerous buyers.

For 2026, the Model Y’s combination of range efficiency, charging access and software capability proved decisive. Ultimately, the award all but cements the Model Y’s position as one of the most influential vehicles in Australia’s evolving new-car market today.