News

Twitter Board must preserve all records of Elon Musk’s acquisition offer: House Republicans

Eighteen House Republicans are asking Twitter’s Board of Directors to preserve all records of Tesla CEO Elon Musk’s acquisition offer for the social media company.

Addressed to Board Chairman Bret Taylor and other members of the social media company’s Board, the House Republicans stated in the letters that Twitter has a tendency to engage in “heavy-handed censorship.” The group then noted that the Twitter Board must “take all reasonable steps” to prevent the “destruction or alteration” of documents and communications related to the Tesla CEO’s buyout offer.

Pertinent sections of the letters, which were shared with CNBC, are as follows.

Decisions regarding Twitter’s future governance will undoubtedly be consequential for public discourse in the United States and could give rise to renewed efforts to legislate in furtherance of preserving free expression online. Among other things, the Board’s reactions to Elon Musk’s offer to purchase Twitter, and outsider opposition to Musk’s role in Twitter’s future are concerning.

Twitter’s Board Members have fiduciary duties to the company’s shareholders. These duties apply despite how many corporations’ leaders increasingly pursue progressive policy goals divorced from shareholder interests.

As Congress continues to examine Big Tech and how to best protect Americans’ free speech rights, this letter serves as a formal request that you preserve all records and materials relating to Musk’s offer to purchase Twitter, including Twitter’s consideration and response to this offer, and Twitter’s evaluation of its shareholder interests with respect to Musk’s offer.

You should construe this preservation notice as an instruction to take all reasonable steps to prevent the destruction or alteration, whether intentionally or negligently, of all documents, communications, and other information, including electronic information and metadata, that is or may be potentially responsive to this congressional inquiry. This instruction includes all electronic messages sent using official and personal accounts or devices, including records created using text messages, phone-based message applications, or encryption software.

In a way, the House Republicans’ letter hints that the party, if it takes back the majority of the House in the upcoming 2022 midterm elections, might initiate an investigation into Twitter. This would be a notable development, especially if Twitter’s Board of Directors decides to reject Elon Musk’s acquisition offer. The House Judiciary Committee, at least if it shifts to Republican control, may decide to subpoena records about the deliberations of Twitter’s Board.

Elon Musk expressed his desire to acquire Twitter last week, offering to purchase the company at $54.20 per share. Twitter’s Board of Directors has neither accepted nor rejected Musk’s offer, though it opted to adopt a “poison pill” strategy, which makes it significantly harder for the CEO to take over the company. Recently, however, a 13D filing from Musk revealed that he had received commitments for $46.5 billion to help finance a potential Twitter buyout. Musk also indicated that he is exploring the idea of a tender offer to purchase some or all of Twitter stock directly from the company’s shareholders.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.

News

Tesla FSD user in China shares insights after months of use: “Not a single safety intervention”

Tesla FSD users in China tend to push the system to its absolute limits.

Tesla’s Full Self-Driving (FSD) system appears to be quietly winning over drivers in China. Although its rollout in February 2025 has not been followed by additional notable updates, recent accounts from local drivers suggest that Tesla’s approach to full self-driving may be outperforming its rivals on Chinese roads.

Tesla’s FSD exhibits smooth and cautious performance on real roads

As noted in a post shared by EV watcher @ray4tesla, a driver who has used Tesla’s FSD in China for two months described a well-calibrated, human-like driving experience. The driver also noted that Tesla’s FSD system is very cautious, perhaps even too careful at times.

“On narrow roads, it slows down appropriately; on major roads, it picks up speed. When there are a lot of pedestrians or electric scooters, it’s overly cautious — almost too polite,” the driver wrote.

Even more interestingly, the driver emphasized that despite frequent usage, there has been zero safety interventions since FSD was enabled in the vehicle. “In the two months I’ve been using FSD, I haven’t had even a single safety intervention,” the driver wrote.

Huawei ADS test triggers multiple safety takeovers

The user compared FSD to Huawei’s ADS system, which they tested for about 90 minutes in an Aito M9 SUV. According to the driver, Huawei’s ADS struggled to deliver consistent performance.

“Then I tried the M9 (Huawei ADS) for an hour and a half. When it needed to speed up, it lagged; and on tight, narrow roads, it suddenly accelerated — honestly, it was pretty scary. The acceleration and braking felt jerky, and you could clearly tell it was being driven by a machine (robotic vibe),” the driver wrote.

The user reported four safety interventions with Huawei’s ADS system within just 30 minutes while driving on rough, construction-heavy roads. “In construction zones and on rough roads, there were four safety interventions in just 30 minutes. And if you know what a ‘safety intervention’ means — that’s essentially four near-collisions,” the driver added.

While anecdotal, the account from the Tesla owner is quite significant since FSD users in China tend to push the system to its absolute limits. Since its rollout earlier this year, Tesla drivers in China have been recorded testing FSD on unpaved mountain roads, extremely narrow streets, busy cities, and wooded paths that barely have any road at all, among others.

Elon Musk

Tesla begins expanding Robotaxi access: here’s how you can ride

You can ride in a Tesla Robotaxi by heading to its website and filling out the interest form. The company is hand-picking some of those who have done this to gain access to the fleet.

Tesla has begun expanding Robotaxi access beyond the initial small group it offered rides to in late June, as it launched the driverless platform in Austin, Texas.

The small group of people enjoying the Robotaxi ride-hailing service is now growing, as several Austin-area residents are receiving invitations to test out the platform for themselves.

The first rides took place on June 22, and despite a very small number of very manageable and expected hiccups, Tesla Robotaxi was widely successful with its launch.

Tesla Robotaxi riders tout ‘smooth’ experience in first reviews of driverless service launch

However, Tesla is expanding the availability of the ride-hailing service to those living in Austin and its surrounding areas, hoping to gather more data and provide access to those who will utilize it on a daily basis.

Many of the people Tesla initially invited, including us, are not local to the Austin area.

There are a handful of people who are, but Tesla was evidently looking for more stable data collection, as many of those early invitees headed back to where they live.

The first handful of invitations in the second round of the Robotaxi platform’s Early Access Program are heading out to Austin locals:

I just got a @robotaxi invite! Super excited to go try the service out! pic.twitter.com/n9mN35KKFU

— Ethan McKanna (@ethanmckanna) July 1, 2025

Tesla likely saw an influx of data during the first week, as many traveled far and wide to say they were among the first to test the Robotaxi platform.

Now that the first week and a half of testing is over, Tesla is expanding invites to others. Many of those who have been chosen to gain access to the Robotaxi app and the ride-hailing service state that they simply filled out the interest form on the Robotaxi page of Tesla’s website.

That’s the easiest way you will also gain access, so be sure to fill out that form if you have any interest in riding in Robotaxi.

Tesla will continue to utilize data accumulated from these rides to enable more progress, and eventually, it will lead to even more people being able to hail rides from the driverless platform.

With more success, Tesla will start to phase out some of the Safety Monitors and Supervisors it is using to ensure things run smoothly. CEO Elon Musk said Tesla could start increasing the number of Robotaxis to monitors within the next couple of months.

Elon Musk

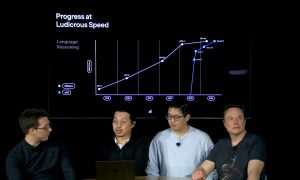

Tesla analyst issues stern warning to investors: forget Trump-Musk feud

A Tesla analyst today said that investors should not lose sight of what is truly important in the grand scheme of being a shareholder, and that any near-term drama between CEO Elon Musk and U.S. President Donald Trump should not outshine the progress made by the company.

Gene Munster of Deepwater Management said that Tesla’s progress in autonomy is a much larger influence and a significantly bigger part of the company’s story than any disagreement between political policies.

Munster appeared on CNBC‘s “Closing Bell” yesterday to reiterate this point:

“One thing that is critical for Tesla investors to remember is that what’s going on with the business, with autonomy, the progress that they’re making, albeit early, is much bigger than any feud that is going to happen week-to-week between the President and Elon. So, I understand the reaction, but ultimately, I think that cooler heads will prevail. If they don’t, autonomy is still coming, one way or the other.”

BREAKING: GENE MUNSTER SAYS — $TSLA AUTONOMY IS “MUCH BIGGER” THAN ANY FEUD 👀

He says robotaxis are coming regardless ! pic.twitter.com/ytpPcwUTFy

— TheSonOfWalkley (@TheSonOfWalkley) July 2, 2025

This is a point that other analysts like Dan Ives of Wedbush and Cathie Wood of ARK Invest also made yesterday.

On two occasions over the past month, Musk and President Trump have gotten involved in a very public disagreement over the “Big Beautiful Bill,” which officially passed through the Senate yesterday and is making its way to the House of Representatives.

Musk is upset with the spending in the bill, while President Trump continues to reiterate that the Tesla CEO is only frustrated with the removal of an “EV mandate,” which does not exist federally, nor is it something Musk has expressed any frustration with.

In fact, Musk has pushed back against keeping federal subsidies for EVs, as long as gas and oil subsidies are also removed.

Nevertheless, Ives and Wood both said yesterday that they believe the political hardship between Musk and President Trump will pass because both realize the world is a better place with them on the same team.

Munster’s perspective is that, even though Musk’s feud with President Trump could apply near-term pressure to the stock, the company’s progress in autonomy is an indication that, in the long term, Tesla is set up to succeed.

Tesla launched its Robotaxi platform in Austin on June 22 and is expanding access to more members of the public. Austin residents are now reporting that they have been invited to join the program.

-

Elon Musk3 days ago

Elon Musk3 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News1 week ago

News1 week agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla Robotaxis are becoming a common sight on Austin’s public roads

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoxAI’s Grok 3 partners with Oracle Cloud for corporate AI innovation

-

News2 weeks ago

News2 weeks agoSpaceX and Elon Musk share insights on Starship Ship 36’s RUD