Investor's Corner

Tesla upsells Model 3 Performance as Musk ponders ‘mental scar tissue’ from production ramp

Tesla is starting to upsell the Model 3 Performance to reservation holders, with CEO Elon Musk announcing more exciting aspects of the vehicle on Twitter. Musk’s recent announcements describe the vehicle’s suspension and brakes, as well as the company’s ongoing test drive program for the compact electric car.

According to Musk, the Model 3 Performance will feature a lower ride height helped by the performance suspension system and stronger brakes than non-Performance variants, which would enhance the vehicles’ track capabilities. The upgrade would further bolster claims that Model 3 Performance will outperform all vehicles in its class on the race track, including the BMW M3.

Performance version suspension is 1cm lower & has stronger brakes in upgrade package

— Elon Musk (@elonmusk) July 13, 2018

Equipping larger brakes on the Model 3 Performance is definitely the right decision from Tesla. The car’s stock brakes, after all, are unable to handle hard track driving, as evidenced in a Laguna Seca run by a mostly stock Model 3 earlier this year. With upgraded brakes, the Model 3, even the single motor, non-Performance Long Range RWD version, becomes a formidable vehicle on the racecourse, recently beating Porsche to win a Time Attack challenge in a Canadian racing event.

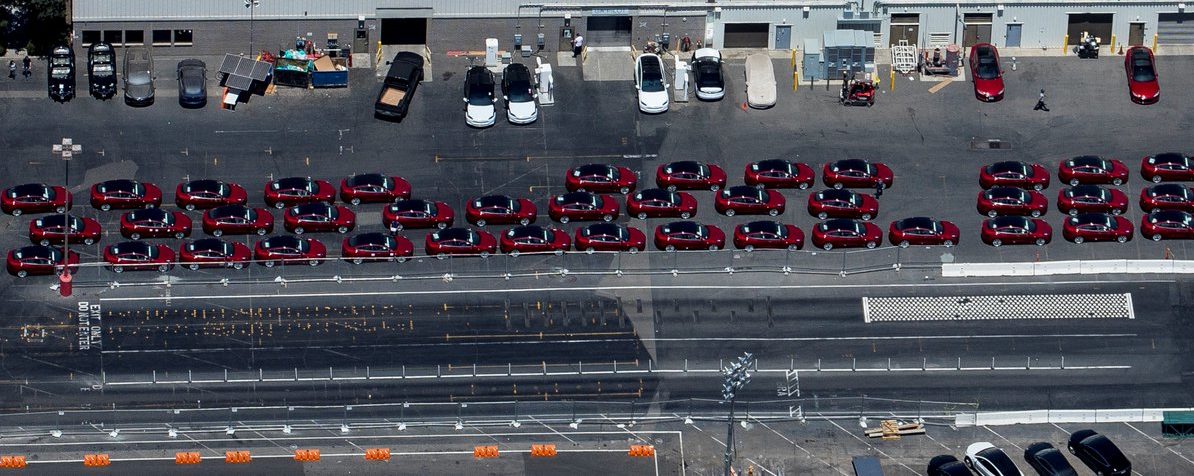

Overall, Musk’s recent Twitter statements for the Model 3 Performance comes amidst the company’s latest attempt to upsell the vehicle. Tesla, after all, has been putting some extra attention on the Model 3 Performance, with the electric car maker recently showcasing the car’s drifting capabilities in a skidpad testing video. Elon Musk also noted that the company had produced approximately 100 units of the Model 3 Performance to date, which would be used for test drive units in the company’s showrooms. In a recent Twitter announcement, Musk further encouraged reservation holders to test drive the Model 3 Performance regardless of whether they plan to buy the top trim variant or not.

These sure look like the ~100 performance #Model3 that $TSLA says were built for test drives. Question is when will they move off the lot into stores? Or have they already and these are leftovers? Images are from July 10th. https://t.co/PRuKZUvBtf #Tesla pic.twitter.com/SpU3ivTIA7

— RS Metrics (@RSMetrics) July 12, 2018

Tesla’s upselling of the Model 3 Performance comes amidst the company’s push to sustain mass production of its electric car. Since the company achieved its ever-elusive goal of producing 5,000 Model 3 per week during the end of Q2 2018, Tesla has been ramping the deliveries of the vehicle. Recent signs from Tesla also appear to be teasing that the company would be able to sustain a 5,000/week pace this Q3 2018. Among these are frequent mass VIN registrations, a new 5-minute Sign & Drive delivery program, and recent statements related by Senior Director of Investor Relations Aaron Chew, who reportedly stated in meeting with investors and analysts that the company is targeting a sustained 5,000-6,000/week production pace for the current quarter.

Whether you plan to buy a Dual Motor Performance Model 3 or not, take it for a test drive anyway. It’s like having pure fun jacked straight into your brain whenever you want.

— Elon Musk (@elonmusk) July 13, 2018

While Tesla appears to have broken through a massive roadblock with the Model 3, Elon Musk’s recent statements to Bloomberg reveal that the manufacturing feat came at a high price. As noted by Musk in a recent interview with the publication, the Model 3 ramp has been incredibly difficult for him and Tesla, to the point where he feels he developed permanent mental scars from the experience.

“It’s been super-hard. Like there is for sure some permanent mental scar tissue here. But I do feel good about the months to come. I think the results will speak for themselves,” Musk said.

Musk, however, noted that the risks Tesla took with the Model 3 ramp, such as betting the entire company on the vehicle’s success, will likely not be replicated in the future. According to Musk, he does not foresee any bet-the-company situations arising, regardless of Tesla’s upcoming projects and vehicles.

“To the best of my judgment, I do not think we have any future bet-the-company situations. We will still need to work hard and be vigilant and not be complacent because it is very difficult just to survive as a car company. But it will not be the same level of strain as getting to volume production of Model 3,” he said.

Elon Musk

Elon Musk hints Tesla investors will be rewarded heavily

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet,” Musk said.

Elon Musk recently hinted that he believes Tesla investors will be rewarded heavily if they continue to hold onto their shares, and he reiterated that in a new interview that the company released on its social accounts this week.

Musk is one of the most successful CEOs in the modern era and has mammothed competitors on the Forbes Net Worth List over the past year as his holdings in his various companies have continued to swell.

Tesla investors, especially those who have been holding shares for several years, have also felt substantial gains in their portfolios. Over the past five years, the stock is up over 78 percent. Since February 2019, nearly seven years ago to the day, the stock is up over 1,800 percent.

Musk said in the interview:

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet.”

Elon Musk in new interview: “Hold on to your $TSLA stock. It’s going to be worth a lot, I think. That’s my bet.” pic.twitter.com/cucirBuhq0

— Sawyer Merritt (@SawyerMerritt) February 26, 2026

It’s no secret Musk has been extremely bullish on his own companies, but Tesla in particular, because it is publicly traded.

However, the company has so many amazing projects that have an opportunity to revolutionize their respective industries. There is certainly a path to major growth on Wall Street for Tesla through its various future projects, including Optimus, Cybercab, Semi, and Unsupervised FSD.

- Optimus (Tesla’s humanoid robot): Musk has discussed its potential for tasks like childcare, walking dogs, or assisting elderly parents, positioning it as a massive long-term driver of company value.

- Cybercab (Tesla’s robotaxi/autonomous ride-hailing vehicle): a fully autonomous vehicle geared specifically for Tesla’s ride-sharing ambitions.

- Semi (Tesla’s electric truck, with mentions of expansion, like in Europe): brings Tesla into the commercial logistics sector.

- Unsupervised FSD (Full Self-Driving software achieving full autonomy without human supervision): turns every Tesla owner’s vehicle into a fully-autonomous vehicle upon release

These projects specifically are some of the highest-growth pillars Tesla has ever attempted to develop, especially in Musk’s eyes, as he has said Optimus will be the best-selling product of all-time.

Many analysts agree, but the bullish ones, like Cathie Wood of ARK Invest, are perhaps the one who believes Tesla has incredible potential on Wall Street, predicting a $2,600 price target for 2030, but this is not even including Optimus.

She told Bloomberg last March that she believes that the project will present a potential additive if Tesla can scale faster than anticipated.

Elon Musk

Tesla stock gets latest synopsis from Jim Cramer: ‘It’s actually a robotics company’

“Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session,” Cramer said.

Tesla stock (NASDAQ: TSLA) got its latest synopsis from Wall Street analyst Jim Cramer, who finally realized something that many fans of the company have known all along: it’s not a car company. Instead, it’s a robotics company.

In a recent note that was released after Tesla reported Earnings in late January, Cramer seemed to recognize that the underwhelming financials and overall performance of the automotive division were not representative of the current state of affairs.

Instead, we’re seeing a company transition itself away from its early identity, essentially evolving like a caterpillar into a butterfly.

The narrative of the Earnings Call was simple: We’re not a car company, at least not from a birds-eye view. We’re an AI and Robotics company, and we are transitioning to this quicker than most people realize.

Tesla stock gets another analysis from Jim Cramer, and investors will like it

Tesla’s Q4 Earnings Call featured plenty of analysis from CEO Elon Musk and others, and some of the more minor details of the call were even indicative of a company that is moving toward AI instead of its cars. For example, the Model S and Model X will be no more after Q2, as Musk said that they serve relatively no purpose for the future.

Instead, Tesla is shifting its focus to the vehicles catered for autonomy and its Robotaxi and self-driving efforts.

Cramer recognizes this:

“…we got results from Tesla, which actually beat numbers, but nobody cares about the numbers here, as electric vehicles are the past. And according to CEO Elon Musk, the future of this company comes down to Cybercabs and humanoid robots. Stock fell more than 3% the next day. That may be because their capital expenditures budget was higher than expected, or maybe people wanted more details from the new businesses. At this point, I think Musk acolytes might be more excited about SpaceX, which is planning to come public later this year.”

He continued, highlighting the company’s true transition away from vehicles to its Cybercab, Optimus, and AI ambitions:

“I know it’s hard to believe how quickly this market can change its attitude. Last night, I heard a disastrous car company speak. Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session. I didn’t like it as a car company. Boy, I love it as a Cybercab and humanoid robot juggernaut. Call me a buyer and give me five robots while I’m at it.”

Cramer’s narrative seems to fit that of the most bullish Tesla investors. Anyone who is labeled a “permabull” has been echoing a similar sentiment over the past several years: Tesla is not a car company any longer.

Instead, the true focus is on the future and the potential that AI and Robotics bring to the company. It is truly difficult to put Tesla shares in the same group as companies like Ford, General Motors, and others.

Tesla shares are down less than half a percent at the time of publishing, trading at $423.69.

Elon Musk

Tesla to a $100T market cap? Elon Musk’s response may shock you

There are a lot of Tesla bulls out there who have astronomical expectations for the company, especially as its arm of reach has gone well past automotive and energy and entered artificial intelligence and robotics.

However, some of the most bullish Tesla investors believe the company could become worth $100 trillion, and CEO Elon Musk does not believe that number is completely out of the question, even if it sounds almost ridiculous.

To put that number into perspective, the top ten most valuable companies in the world — NVIDIA, Apple, Alphabet, Microsoft, Amazon, TSMC, Meta, Saudi Aramco, Broadcom, and Tesla — are worth roughly $26 trillion.

Will Tesla join the fold? Predicting a triple merger with SpaceX and xAI

Cathie Wood of ARK Invest believes the number is reasonable considering Tesla’s long-reaching industry ambitions:

“…in the world of AI, what do you have to have to win? You have to have proprietary data, and think about all the proprietary data he has, different kinds of proprietary data. Tesla, the language of the road; Neuralink, multiomics data; nobody else has that data. X, nobody else has that data either. I could see $100 trillion. I think it’s going to happen because of convergence. I think Tesla is the leading candidate [for $100 trillion] for the reason I just said.”

Musk said late last year that all of his companies seem to be “heading toward convergence,” and it’s started to come to fruition. Tesla invested in xAI, as revealed in its Q4 Earnings Shareholder Deck, and SpaceX recently acquired xAI, marking the first step in the potential for a massive umbrella of companies under Musk’s watch.

SpaceX officially acquires xAI, merging rockets with AI expertise

Now that it is happening, it seems Musk is even more enthusiastic about a massive valuation that would swell to nearly four-times the value of the top ten most valuable companies in the world currently, as he said on X, the idea of a $100 trillion valuation is “not impossible.”

It’s not impossible

— Elon Musk (@elonmusk) February 6, 2026

Tesla is not just a car company. With its many projects, including the launch of Robotaxi, the progress of the Optimus robot, and its AI ambitions, it has the potential to continue gaining value at an accelerating rate.

Musk’s comments show his confidence in Tesla’s numerous projects, especially as some begin to mature and some head toward their initial stages.