News

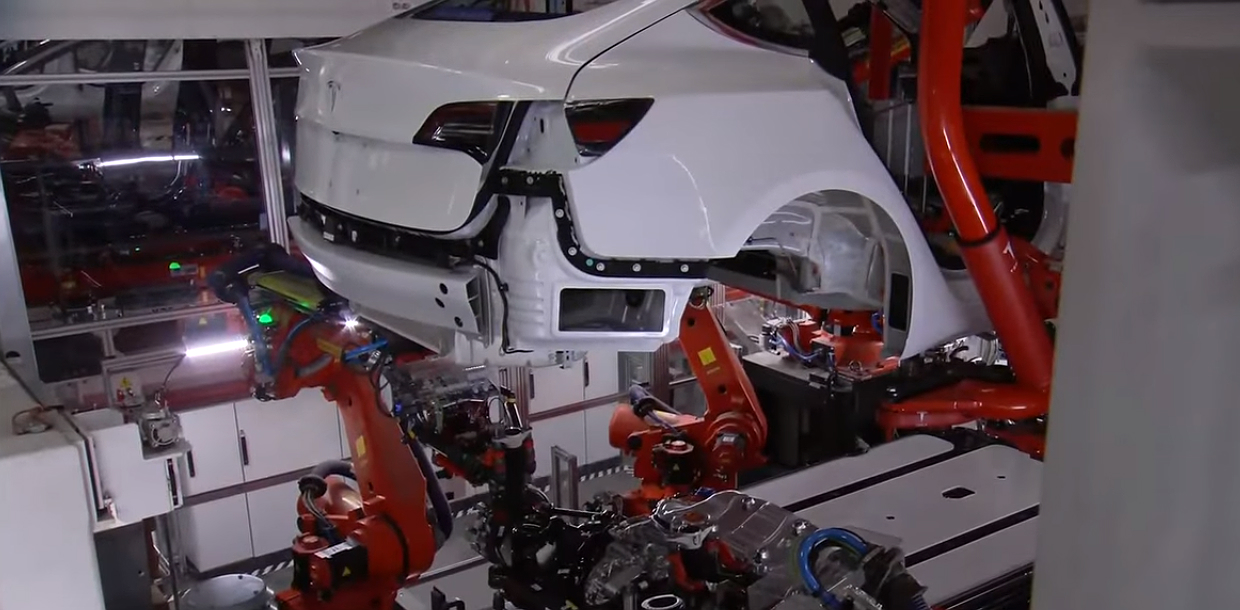

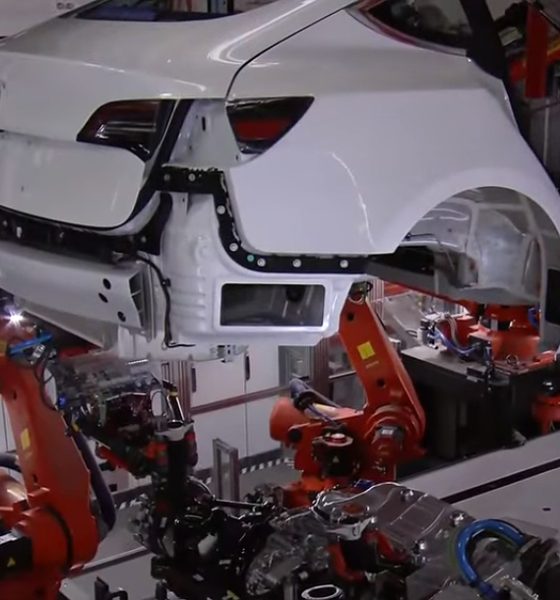

Tesla Model 3 production is reportedly closing in on 4,000 per week

After the scheduled shutdown in April, the Tesla Model 3 production line is reportedly closing in on 4,000 vehicles per week.

The figures were first reported by Tesla Motors Club member bkmxp100d, a Tesla owner who stated that they were informed of the numbers by a friend working at the Fremont factory. The production shutdown last month reportedly had a positive effect on the pace of the Model 3 line, allowing the electric car maker to manufacture 4,290 Model 3 in 7 days, with a peak of 638 vehicles in 24 hours. The next scheduled shutdown for the Model 3 line is reportedly scheduled for the May 26-May 27 weekend as well.

While the numbers provided by the Tesla enthusiast appear to be optimistic speculations, the ramp to 4,000 Model 3 per week is roughly in line with the estimates of Bloomberg‘s online tracker. Currently, the tracker shows that Tesla is pacing towards a rate of 4,000 vehicles per week. Other members of the forum community also stated that their own sources from Tesla are reporting Model 3 production figures hovering slightly below or just above the ~4,000/week range. VIN registrations from last week were encouraging as well, with Tesla filing more than 8,000 VINs in a single week.

Bloomberg‘s Model 3 tracker as of 05/14/18. [Credit: Bloomberg]

During the first-quarter earnings call, Elon Musk mentioned that what he is “most excited about” was the rapid increase in the production output of the Model 3 line. Musk even noted that the Model 3’s peak hours already correspond to 5,000 vehicles per week.

“The thing I’m most excited about is the rapid increase in output. We got just in the last 24 hours at the Gigafactory managed to achieve a sustained rate of over 3,000 packs per day – sorry, per week, and actually reached a peak hour with extrapolated outward would be a rate of about 5,000 cars per week.”

“We also saw enormous improvement in zone four of module production. This, I should point out, is a fully automated zone, and we’re able to also achieve sustained rates of 3,000 vehicles a week. So, we’re actually slightly ahead in factory module and pack production than expected. And with some work at the Fremont vehicle plant, primarily in the general assembly area, I’m confident we will very soon exceed the 3,000 mark in Fremont.”

Responding to an article published by Ars Technica about how the company’s issues with its machinery were reflective of GM’s struggles back in the 1980s, Musk recently tweeted that the company is currently working on the Model 3 line’s “worst production choke points.” Musk also noted that a “Hackathon” — a fast-paced programming session that sometimes lasts for days — is currently ongoing, in order to address bottlenecks in the Model 3 line.

Fair criticism, but we’re fixing it fast. Hackathon going on right now to fix 2 worst robot production chokepoints. Looks promising.

— Elon Musk (@elonmusk) May 14, 2018

Since the first-quarter earnings call, Elon Musk has doubled down on his rhetoric about the Model 3’s production numbers and Tesla’s profitability by the third or fourth quarter of 2018. Just a couple of days after the earnings call, Musk stated that the “short burn of the century” is about to come.

“Oh and uh short burn of the century coming soon. Flamethrowers should arrive just in time. It will be next level. These are really big numbers,” Musk tweeted.

Musk also took the battle to the company’s short-sellers, buying 27,097 Telsa shares, which correspond to an investment of nearly $10 million in TSLA.

Elon Musk

Lufthansa Group to equip Starlink on its 850-aircraft fleet

Under the collaboration, Lufthansa Group will install Starlink technology on both its existing fleet and all newly delivered aircraft, as noted by the group in a press release.

Lufthansa Group has announced a partnership with Starlink that will bring high-speed internet connectivity to every aircraft across all its carriers.

This means that aircraft across the group’s brands, from Lufthansa, SWISS, and Austrian Airlines to Brussels Airlines, would be able to enjoy high-speed internet access using the industry-leading satellite internet solution.

Starlink in-flight internet

Under the collaboration, Lufthansa Group will install Starlink technology on both its existing fleet and all newly delivered aircraft, as noted by the group in a press release.

Starlink’s low-Earth orbit satellites are expected to provide significantly higher bandwidth and lower latency than traditional in-flight Wi-Fi, which should enable streaming, online work, and other data-intensive applications for passengers during flights.

Starlink-powered internet is expected to be available on the first commercial flights as early as the second half of 2026. The rollout will continue through the decade, with the entire Lufthansa Group fleet scheduled to be fully equipped with Starlink by 2029. Once complete, no other European airline group will operate more Starlink-connected aircraft.

Free high-speed access

As part of the initiative, Lufthansa Group will offer the new high-speed internet free of charge to all status customers and Travel ID users, regardless of cabin class. Chief Commercial Officer Dieter Vranckx shared his expectations for the program.

“In our anniversary year, in which we are celebrating Lufthansa’s 100th birthday, we have decided to introduce a new high-speed internet solution from Starlink for all our airlines. The Lufthansa Group is taking the next step and setting an essential milestone for the premium travel experience of our customers.

“Connectivity on board plays an important role today, and with Starlink, we are not only investing in the best product on the market, but also in the satisfaction of our passengers,” Vranckx said.

Elon Musk

Tesla locks in Elon Musk’s top problem solver as it enters its most ambitious era

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla has granted Senior Vice President of Automotive Tom Zhu more than 520,000 stock options, tying a significant portion of his compensation to the company’s long-term performance.

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla secures top talent

According to a Form 4 filing with the U.S. Securities and Exchange Commission, Tom Zhu received 520,021 stock options with an exercise price of $435.80 per share. Since the award will not fully vest until March 5, 2031, Zhu must remain at Tesla for more than five years to realize the award’s full benefit.

Considering that Tesla shares are currently trading at around the $445 to $450 per share level, Zhu will really only see gains in his equity award if Tesla’s stock price sees a notable rise over the years, as noted in a Sina Finance report.

Still, even at today’s prices, Zhu’s stock award is already worth over $230 million. If Tesla reaches the market cap targets set forth in Elon Musk’s 2025 CEO Performance Award, Zhu would become a billionaire from this equity award alone.

Tesla’s problem solver

Zhu joined Tesla in April 2014 and initially led the company’s Supercharger rollout in China. Later that year, he assumed the leadership of Tesla’s China business, where he played a central role in Tesla’s localization efforts, including expanding retail and service networks, and later, overseeing the development of Gigafactory Shanghai.

Zhu’s efforts helped transform China into one of Tesla’s most important markets and production hubs. In 2023, Tesla promoted Zhu to Senior Vice President of Automotive, placing him among the company’s core global executives and expanding his influence beyond China. He has since garnered a reputation as the company’s problem solver, being tapped by Elon Musk to help ramp Giga Texas’s vehicle production.

With this in mind, Tesla’s recent filing seems to suggest that the company is locking in its top talent as it enters its newest, most ambitious era to date. As could be seen in the targets of Elon Musk’s 2025 pay package, Tesla is now aiming to be the world’s largest company by market cap, and it is aiming to achieve production levels that are unheard of. Zhu’s talents would definitely be of use in this stage of the company’s growth.

News

Tesla counters Norway’s VAT hike with dedicated consumer bonus

The move follows Tesla Norway’s stunning finish in 2025, where the company saw substantial sales during the final weeks of the year.

Tesla has rolled out a price incentive in Norway, effectively offsetting a notable VAT increase that hit electric vehicle buyers at the start of 2026.

The move follows Tesla Norway’s stunning finish in 2025, where the company saw substantial sales during the final weeks of the year.

A “Tesla bonus”

Once the VAT increase kicked in at the start of 2026, Tesla Norway’s sales cooled almost immediately, as noted in a CarUp report. Tesla’s response was swift, with the electric vehicle maker rolling out what it calls a “Tesla bonus.”

This bonus effectively cuts prices by up to 50,000 kronor across eight model variants. All versions of the Tesla Model Y qualify for the incentive, along with most Tesla Model 3 trims, save for the base entry-level model.

This means that for Tesla Norway’s best-selling vehicles, the bonus effectively restores pricing to pre-VAT levels. This blunts the impact of the new tax and makes Tesla’s vehicle offerings competitive again in Europe’s most EV-saturated market.

Stabilizing demand

In addition to the “Tesla bonus,” the electric car maker is also offering a promotional interest rate for up to three years, with terms varying by model. The incentive applies to orders placed between January 9 and March 31, 2026, with delivery required by the end of the first quarter.

The stakes are high in Norway, where electric vehicles dominate new-car registrations. From the vehicles that were sold in 2025, 96% of new cars sold were fully electric. And from this number, Tesla and its Model Y made their dominance felt. This was highlighted by Geir Inge Stokke, director of OFV, who noted that Tesla was able to achieve its stellar results despite its small vehicle lineup.

“Taking almost 20% market share during a year with record-high new car sales is remarkable in itself. When a brand also achieves such volumes with so few models, it says a lot about both demand and Tesla’s impact on the Norwegian market,” Stokke stated.