Doubts may still linger about the potential of battery electric vehicles for mainstream transportation, but EVs are getting progressively better. And if the data from the Tesla Model 3 and Model Y fleet is any indication, it appears that these improvements could result, at least to some degree, in an all-electric crossover being more efficient than the early production versions of an all-electric sedan.

In a recent conversation with Teslarati, David Hodge, the founder and CEO of Embark — a transportation app company that was sold to Apple in 2013 — explained that his work on a little passion project has shown something incredibly interesting about the Model 3 and Model Y’s efficiency. Hodge is currently working on the Nikola app, a service that he hopes will eventually grow to be the CarFax for EVs. So far, users of the app have driven about 7,000,000 miles, and over 2,000 Model 3s are registered in the fleet.

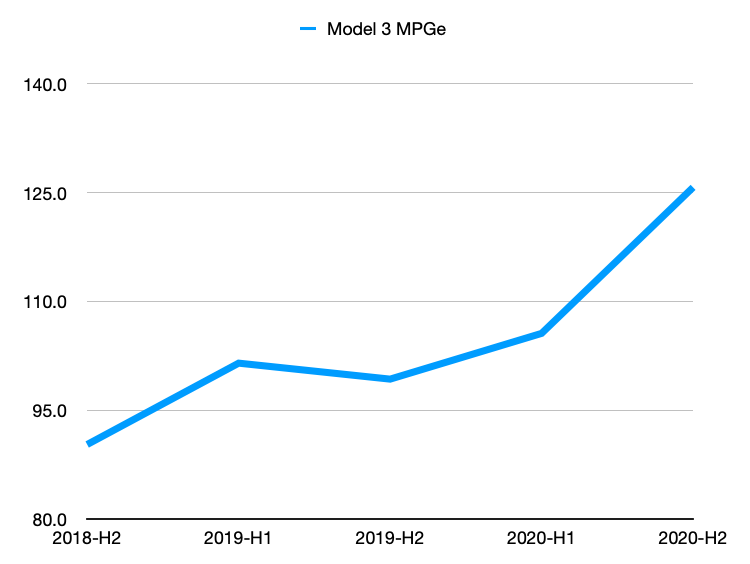

These Model 3s are comprised of vehicles that were produced from the beginning of Elon Musk’s first “alien dreadnought” attempt to cars that rolled off the line this quarter. Based on data that the Nikola app proprietor shared, it is evident that the Model 3 has gotten significantly more efficient over the years. Users of the app with vehicles produced in 2018, for example, showed a real-world average MPGe of 90.3, while cars that were produced in 2019 had a real-world average of 100.4.

These efficiency improvements continued in the first half of 2020, when Nikola app users who owned Model 3s showed a real-world average MPGe of 105.2. Interestingly enough, Tesla appears to have rolled out a major improvement to the Model 3’s efficiency in the second half of the year, as vehicles produced after June 2020 have shown a real-world average MPGe of 125.7. That’s the biggest improvement in the Model 3’s efficiency yet, at least as reflected in data from the Nikola app’s users.

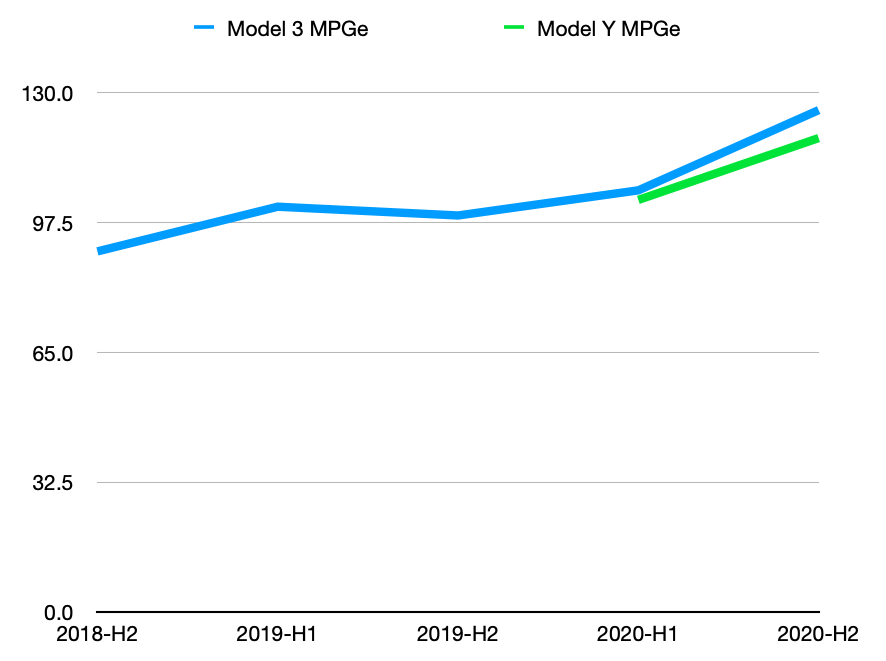

Inasmuch as the improvements in the Model 3’s MPGe are notable, the efficiency of the Model Y appears to be even more noteworthy. The Model Y is the newest vehicle in Tesla’s lineup today, having started deliveries earlier this year. But even with its early ramp, it is becoming quite evident that Tesla did something special with the all-electric crossover.

Nikola app users who owned Model Ys that were produced in the first half of 2020 showed a real-world average MPGe of 103.2, which was very close to the MPGe of Model 3s that were manufactured in the same period. And just like the Model 3s, Model Ys that were produced after June 2020 exhibited a significant improvement in efficiency, with the vehicles having a real-world average MPGe of 118.7. That’s higher than the MPGe of Model 3s that were produced just last year.

As noted by Hodge, such efficiency figures from the Model Y are extremely impressive, especially considering that it is larger and significantly heftier than the Model 3. This is also a pretty unique situation considering that the company’s flagship sedan, the Model S, has always been significantly more efficient than its SUV counterpart, the Model X.

“This is pretty impressive considering the obvious aerodynamic differences in the Y and the fact that the S has always outperformed the X by about 15. If you just look at cars made since June, the Model Y MPGe climbed to 119 on average, but it looks like some of the tech improvements made it over to the 3, which is seeing 125.6 MPGe average in that period,” Hodge noted.

Tesla has a habit of rolling out improvements to its vehicles as soon as they are available. The latest Teslas are therefore expected to have the best tech that the company has to offer at the time of their production. With this in mind, and as per the findings of auto teardown expert Sandy Munro, the Model Y is indeed equipped with Tesla’s best, both in tech and in design. And considering that the all-electric crossover is expected to share components with its sedan sibling, it is not very surprising to see the Model 3 experience efficiency gains as soon as the Model Y started ramping up. Such is simply the nature of Tesla.

News

Tesla’s most wanted Model Y heads to new region with no sign of U.S. entry

Unlike the standard Model Y, the “L” stretches the wheelbase by roughly 150 mm and the overall length by about 177 mm to 4,976 mm. The result is a genuine 2-2-2 seating layout that gives six adults proper legroom and cargo space — a true family hauler without the cramped third-row compromises of many three-row SUVs.

Tesla’s most wanted Model Y configuration is heading to a new region, and although U.S. fans and owners have requested the vehicle since its release last year, it appears the company has no plans to bring it to the market.

According to fresh regulatory filings, the six-seat Model Y L is coming to South Korea with signs indicating an imminent launch. The extended-wheelbase configuration, already a hit in China, just cleared energy-efficiency certification from the Korea Energy Agency, paving the way for deliveries as early as the first half of 2026.

The vehicle is already built at Tesla’s Giga Shanghai facility in China, making it an ideal candidate for the Asian market, as well as the European one, as the factory has been known as a bit of an export hub in the past.

$TSLA

BREAKING: The official launch of Tesla Model Y L in S.Korea seems to be quite imminent.Additional credentials related to Model YL were released today.

✅ Battery Manufacturer: LG Energy Solutions

✅ Number of passengers: 6 people

✅ Total battery capacity: 97.25 kWh… pic.twitter.com/hmy64XYi80— Tsla Chan (@Tslachan) March 6, 2026

It seems like Tesla was prepping for this release anyway, as the timing was no accident. A camouflaged Model Y L prototype was spotted testing on Korean highways the same day the certification dropped. Tesla has already secured similar approvals for Australia and New Zealand, with both markets expecting the larger Model Y in 2026.

Unlike the standard Model Y, the “L” stretches the wheelbase by roughly 150 mm and the overall length by about 177 mm to 4,976 mm. The result is a genuine 2-2-2 seating layout that gives six adults proper legroom and cargo space — a true family hauler without the cramped third-row compromises of many three-row SUVs.

South Korean filings list it as an all-wheel-drive imported electric passenger vehicle with a 97.25 kWh total battery capacity supplied by LG Energy Solution. Local tests show an impressive 543 km (337 miles) combined range at room temperature and 454 km (282 miles) in colder conditions, easing one of the biggest concerns for Korean EV buyers.

Tesla Model Y lineup expansion signals an uncomfortable reality for consumers

But for U.S. fans, things are not looking good for a launch in the market.

CEO Elon Musk has been blunt. The six-seater “wouldn’t arrive in the U.S. until late 2026, if ever,” he said, pointing to the company’s heavy bet on unsupervised Full Self-Driving and robotaxi platforms like the Cybercab. With the Model X slated for discontinuation, many families hoped the stretched Model Y would slide into the lineup as an affordable three-row bridge. So far, that hope remains unfulfilled.

For now, South Korean drivers will be among the first buyers outside China to enjoy the spacious, efficient Model Y L. Tesla continues its global rollout strategy, tailoring vehicles to regional tastes while North American customers keep refreshing their apps and crossing their fingers.

The Model Y L proves the appetite for practical, family-sized electric SUVs is stronger than ever. Hopefully, Tesla will listen to its fans and bring the vehicle to the U.S. where it would likely sell well.

Elon Musk

Tesla is ramping up its advertising strategy on social media

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

Tesla seems to be ramping up its advertising strategy on social media once again. Marketing and advertising have not been a major focus of Tesla’s, something that has brought some criticism to the company from its fans.

However, the company looks to be making adjustments to that narrative, as it has at times in the past, as ads were spotted on several different platforms over the past few days.

On Facebook and YouTube, ads were spotted that were evidently placed by Tesla. On Facebook, Tesla was advertising Full Self-Driving, and on YouTube, an ad for its Energy Division was spotted:

Tesla also threw up some ads on YouTube for Energy https://t.co/19DGQMjBsA pic.twitter.com/XQRfgaDKxY

— TESLARATI (@Teslarati) March 9, 2026

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

In 2022, Tesla’s U.S. ad spend was roughly $152,000, a rounding error compared to General Motors’ $3.6 billion the following year.

Traditional automakers averaged about $495 per vehicle on ads; Tesla spent $0. CEOElon Musk’s stance was explicit: “Tesla does not advertise or pay for endorsements,” he posted on X in 2019. “Instead, we use that money to make the product great.”

The strategy relied on word-of-mouth from delighted owners, Elon’s massive X following, viral product launches, media frenzy, and customer referrals. A great product, Musk argued, sells itself. It does not need Super Bowl spots or billboards. Resources poured into R&D instead, with Tesla investing nearly $3,000 per car, far more than rivals.

Tesla counters jab at lack of advertising with perfect response

This reluctance wasn’t arrogance; it was philosophy, and Musk made it clear that the money was better spent on the product. Heavy spending on ads was seen as wasteful when innovation and authenticity drove organic demand. Shareholder calls for marketing budgets were ignored.

The current shift, paid Facebook ads promoting Full Self-Driving (Supervised) and YouTube Shorts offering up to $1,000 back on Powerwall batteries, marks a pragmatic evolution.

These targeted campaigns coincide with the end of one-time FSD purchases and a March 31 deadline for FSD transfer eligibility on new vehicles.

This move likely signals Tesla adapting to scale, as well as a more concerted effort to stop misinformation regarding its platform. As EV competition intensifies and the company bets big on robotaxis and energy storage, pure organic buzz may not suffice to hit adoption targets. Selective digital ads allow precise, cost-effective reach without abandoning core principles.

If successful, it could foreshadow measured expansion into marketing, boosting high-margin software and home energy revenue while preserving Tesla’s innovative edge. But, it’s nice to see the strategy return, especially as Tesla has been reluctant to change its mind in the past.

News

Tesla Model Y outsells everything in three states, but Ford dominates

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

The Tesla Model Y was the best-selling vehicle in three different states in the U.S. last year, according to new data that shows the all-electric crossover outsold every other car in a few places. However, Ford widely dominated the sales figures with its popular F-Series of pickups.

According to new vehicle registration data compiled by Edmunds and visualized by Visual Capitalist, the Ford F-Series, encompassing models like the F-150, F-250, F-350, and F-450, claimed the title of best-selling vehicle in 29 states.

This dominance underscores the pickup truck’s unbreakable appeal across much of the country, particularly in rural, Midwestern, Southern, and Western states, where towing capacity, durability, and utility for work or recreation remain top priorities.

The Tesla Model Y is the best-selling vehicle in California, Washington, and Nevada

How many states will it dominate next year? https://t.co/ERyoyce42D

— TESLARATI (@Teslarati) March 9, 2026

The F-Series has held the crown as America’s overall best-selling vehicle for decades, a streak that continued strong into 2025 despite broader market shifts.

Yet, amid this truck-heavy reality, Tesla made a notable breakthrough. The Model Y emerged as the top-selling vehicle, not just the leading EV, but the outright best-seller in three key states: California, Nevada, and Washington.

These West Coast strongholds reflect regions with robust EV infrastructure, high environmental awareness, generous incentives, and tech-savvy populations. In California alone, nearly 50 percent of new vehicle registrations were electrified, far outpacing the national average of around 25 percent.

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

Elon Musk: Tesla Model Y is world’s best-selling car for 3rd year in a row

Elsewhere, Japanese crossovers filled many gaps: Toyota’s RAV4 and Honda’s CR-V topped charts in several urban and densely populated Northeastern and Midwestern states, where fuel efficiency, reliability, and family-friendly features win out over larger trucks.

While Ford’s broad reach shows traditional preferences persist, at least for now, Tesla’s Model Y victories in high-population, influential states signal a gradual but undeniable transition toward electrification. As charging networks expand and battery technology improves, more states could follow the West Coast’s lead in the coming years.

This 2025 map captures a pivotal moment: pickup trucks still rule the majority, but EVs are carving out meaningful territory where consumer priorities align with sustainability and innovation. The road ahead promises continued competition between legacy giants and electric disruptors.