Investor's Corner

Tesla stock (TSLA) one week after the Q1 2016 Report

Post Q1 Report Action

The technical response of the stock market to last week’s Tesla Q1 2016 report has been mostly negative. The stock lost quite a bit since last week, standing at around $208 when I write this, but overall 12-month Analyst Price Targets have actually increased with the average raising from $253 to $277, indicating that the Top Analysts did not see the report as negatively as this past week’s market action.

This is a small sample of the reactions from Top Analysts, noting that none of them changed their position to BUY, SELL or HOLD.

Adam Jonas of Morgan Stanley, reiterated a BUY with $333 price target, commenting that “we forecast ~70k units in 2016 (vs. the reiterated guidance of 80-90k shipments), which is composed of ~16k Model X and ~54k Model S units. In 2Q, we forecast ~17k deliveries–inline with the outlook.”

Charlie Anderson of Dougherty resumed coverage of TSLA with a BUY and price target of $500, noting that “the focus coming out of the Q1 report is on managements decision to pull-forward its production goal of 500K vehicles from 2020 to 2018. While this aggressive schedule certainly increases the risk of nearer-term stumbles, it also significantly pulls forward the earnings power. Tesla has set a goal to produce 1MM vehicles by 2020, roughly 2x what most observers previously believed. Our view is that demand is not the question; it is solving the manufacturing challenges deftly as they come.”

Brian Johnson of Barclays reiterated a SELL with $165 price target.

Ryan Brinkman of J.P. Morgan reiterated a SELL with $185 price target, as he “Doubts Tesla Motors Can Meet Accelerated Production Target.”

Colin Rusch or Oppenheimer reiterated a BUY with $385 price target, indicating that “we believe the critical characteristic of TSLAs business model over the next 24 months will be operating leverage. We believe the company can achieve 15%+ incremental operating margins as it ramps the Model 3. We modeling TSLA reaching 500k vehicles in 2019 vs. the target of 2018, noting the company has a history of setting nearly unachievable goals. Effectively we are accelerating ramp by a year from our previous expectations, but calculate that if the company reaches its 500k vehicle target in 2018 and 1M in 2020, our EPS estimates will prove ~30% too low.”

See the table below from TipRanks (tipranks.com) for a complete summary of the current top analyst ratings.

Swing Trading TSLA using the MACD

This is the first post where I will start outlining techniques that traders may want to use when trading TSLA stock.

I am mostly a “swing trader”. Swing Trading is a short term trading method that can be used when trading stocks and options. Whereas Day Trading positions last less than one day, Swing Trading positions typically last two to six days, but may last as long as two weeks (for TSLA sometime six-seven weeks). Swing traders use technical analysis to look for stocks with short-term price momentum. These traders aren’t interested in the fundamental or intrinsic value of stocks, but rather in their price trends and patterns.

There are a number of technical indicators that swing traders use. Today I will cover the MACD. The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. The Exponential Moving Average (EMA) is a type of moving average that is similar to a simple moving average, except that more weight is given to the latest data.

The good thing is that you really do not have to calculate any of these indicators yourself, as pretty much all trading platforms that I know of provide you with such indicators as an option when displaying the stock chart of a given security.

The following stock chart from Wall Street I/O shows the TSLA market data as “candlestick” (showing open, close, high and low of the day) for the past year, plus it also shows the MACD for the same period.

One technique that swing traders use is to enter a “long” trade when the MACD “crosses to the bulls”, and exit the trade when the MACD “crosses to the bears”. I have indicated these points in the chart for the huge run up between the February low and April high.

Micah Lamar is the CEO of Wall Street I/O (wallst.io), where together with his team of experts he helps people learn stock and option trading. Disclosure: I have been a subscriber to wallst.io for a few years.

This past weekend, Micah run a “MACD Validation” experiment on TSLA 1-year behavior up to last Friday close. The results are as follows.

Micah found that “if one had bought TSLA stock exactly a year ago, and held it for the full year, one would have incurred a $30 loss per share.

If one had bought and held TSLA stock while the MACD was bullish, one would be up $22 for the year.

If one had sold (short) TSLA stock while the MACD was bearish, one would be up $51 for the year.”

Someone trading both sides (long and short the stock) would be up a whopping $73, or a $30% gain.

Of course, trading the same entry and exit points based on the MACD with put or call options instead of stock would have resulted in returns 10 to 100 times or better than if just trading TSLA stock.

Micah indicates that “TSLA is a great stock for swing traders: the reason is that it has so much “beta.” A high beta indicates that a security is much more “volatile” than the rest of the market. Most high-tech stocks like TSLA have a beta of greater than 1, offering the possibility of a higher rate of return, but also posing more risk.

As far as where TSLA is today, it is still in “bearish” territory (as far as the MACD and other indicators are concerned), which for me it means that it is untouchable on long trades as “too risky”, and since I do not like to play on the downside for stocks of companies that are in my “buy what you know” list, I will not trade it again until the MACD crosses back to the bulls.

Elon Musk

Tesla analyst issues stern warning to investors: forget Trump-Musk feud

A Tesla analyst today said that investors should not lose sight of what is truly important in the grand scheme of being a shareholder, and that any near-term drama between CEO Elon Musk and U.S. President Donald Trump should not outshine the progress made by the company.

Gene Munster of Deepwater Management said that Tesla’s progress in autonomy is a much larger influence and a significantly bigger part of the company’s story than any disagreement between political policies.

Munster appeared on CNBC‘s “Closing Bell” yesterday to reiterate this point:

“One thing that is critical for Tesla investors to remember is that what’s going on with the business, with autonomy, the progress that they’re making, albeit early, is much bigger than any feud that is going to happen week-to-week between the President and Elon. So, I understand the reaction, but ultimately, I think that cooler heads will prevail. If they don’t, autonomy is still coming, one way or the other.”

BREAKING: GENE MUNSTER SAYS — $TSLA AUTONOMY IS “MUCH BIGGER” THAN ANY FEUD 👀

He says robotaxis are coming regardless ! pic.twitter.com/ytpPcwUTFy

— TheSonOfWalkley (@TheSonOfWalkley) July 2, 2025

This is a point that other analysts like Dan Ives of Wedbush and Cathie Wood of ARK Invest also made yesterday.

On two occasions over the past month, Musk and President Trump have gotten involved in a very public disagreement over the “Big Beautiful Bill,” which officially passed through the Senate yesterday and is making its way to the House of Representatives.

Musk is upset with the spending in the bill, while President Trump continues to reiterate that the Tesla CEO is only frustrated with the removal of an “EV mandate,” which does not exist federally, nor is it something Musk has expressed any frustration with.

In fact, Musk has pushed back against keeping federal subsidies for EVs, as long as gas and oil subsidies are also removed.

Nevertheless, Ives and Wood both said yesterday that they believe the political hardship between Musk and President Trump will pass because both realize the world is a better place with them on the same team.

Munster’s perspective is that, even though Musk’s feud with President Trump could apply near-term pressure to the stock, the company’s progress in autonomy is an indication that, in the long term, Tesla is set up to succeed.

Tesla launched its Robotaxi platform in Austin on June 22 and is expanding access to more members of the public. Austin residents are now reporting that they have been invited to join the program.

Elon Musk

Tesla surges following better-than-expected delivery report

Tesla saw some positive momentum during trading hours as it reported its deliveries for Q2.

Tesla (NASDAQ: TSLA) surged over four percent on Wednesday morning after the company reported better-than-expected deliveries. It was nearly right on consensus estimations, as Wall Street predicted the company would deliver 385,000 cars in Q2.

Tesla reported that it delivered 384,122 vehicles in Q2. Many, including those inside the Tesla community, were anticipating deliveries in the 340,000 to 360,000 range, while Wall Street seemed to get it just right.

Tesla delivers 384,000 vehicles in Q2 2025, deploys 9.6 GWh in energy storage

Despite Tesla meeting consensus estimations, there were real concerns about what the company would report for Q2.

There were reportedly brief pauses in production at Gigafactory Texas during the quarter and the ramp of the new Model Y configuration across the globe were expected to provide headwinds for the EV maker during the quarter.

At noon on the East Coast, Tesla shares were up about 4.5 percent.

It is expected that Tesla will likely equal the number of deliveries it completed in both of the past two years.

It has hovered at the 1.8 million mark since 2023, and it seems it is right on pace to match that once again. Early last year, Tesla said that annual growth would be “notably lower” than expected due to its development of a new vehicle platform, which will enable more affordable models to be offered to the public.

These cars are expected to be unveiled at some point this year, as Tesla said they were “on track” to be produced in the first half of the year. Tesla has yet to unveil these vehicle designs to the public.

Dan Ives of Wedbush said in a note to investors this morning that the company’s rebound in China in June reflects good things to come, especially given the Model Y and its ramp across the world.

He also said that Musk’s commitment to the company and return from politics played a major role in the company’s performance in Q2:

“If Musk continues to lead and remain in the driver’s seat, we believe Tesla is on a path to an accelerated growth path over the coming years with deliveries expected to ramp in the back-half of 2025 following the Model Y refresh cycle.”

Ives maintained his $500 price target and the ‘Outperform’ rating he held on the stock:

“Tesla’s future is in many ways the brightest it’s ever been in our view given autonomous, FSD, robotics, and many other technology innovations now on the horizon with 90% of the valuation being driven by autonomous and robotics over the coming years but Musk needs to focus on driving Tesla and not putting his political views first. We maintain our OUTPERFORM and $500 PT.”

Moving forward, investors will look to see some gradual growth over the next few quarters. At worst, Tesla should look to match 2023 and 2024 full-year delivery figures, which could be beaten if the automaker can offer those affordable models by the end of the year.

Investor's Corner

Tesla delivers 384,000 vehicles in Q2 2025, deploys 9.6 GWh in energy storage

The quarter’s 9.6 GWh energy storage deployment marks one of Tesla’s highest to date.

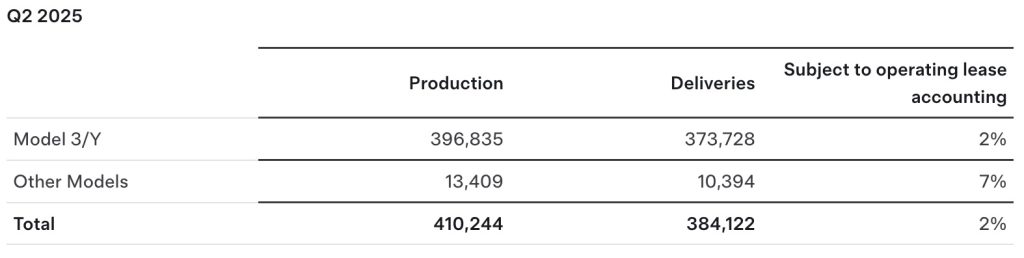

Tesla (NASDAQ: TSLA) has released its Q2 2025 vehicle delivery and production report. As per the report, the company delivered over 384,000 vehicles in the second quarter of 2025, while deploying 9.6 GWh in energy storage. Vehicle production also reached 410,244 units for the quarter.

Model 3/Y dominates output, ahead of earnings call

Of the 410,244 vehicles produced during the quarter, 396,835 were Model 3 and Model Y units, while 13,409 were attributed to Tesla’s other models, which includes the Cybertruck and Model S/X variants. Deliveries followed a similar pattern, with 373,728 Model 3/Ys delivered and 10,394 from other models, totaling 384,122.

The quarter’s 9.6 GWh energy storage deployment marks one of Tesla’s highest to date, signaling continued strength in the Megapack and Powerwall segments.

Year-on-year deliveries edge down, but energy shows resilience

Tesla will share its full Q2 2025 earnings results after the market closes on Wednesday, July 23, 2025, with a live earnings call scheduled for 4:30 p.m. CT / 5:30 p.m. ET. The company will publish its quarterly update at ir.tesla.com, followed by a Q&A webcast featuring company leadership. Executives such as CEO Elon Musk are expected to be in attendance.

Tesla investors are expected to inquire about several of the company’s ongoing projects in the upcoming Q2 2025 earnings call. Expected topics include the new Model Y ramp across the United States, China, and Germany, as well as the ramp of FSD in territories outside the US and China. Questions about the company’s Robotaxi business, as well as the long-referenced but yet to be announced affordable models are also expected.

-

Elon Musk5 days ago

Elon Musk5 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News1 week ago

News1 week agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

News2 weeks ago

News2 weeks agoWatch Tesla’s first driverless public Robotaxi rides in Texas

-

News2 weeks ago

News2 weeks agoWatch the first true Tesla Robotaxi intervention by safety monitor

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla to launch in India in July with vehicles already arriving: report

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla officially launches Robotaxi service with no driver

-

Elon Musk1 week ago

Elon Musk1 week agoA Tesla just delivered itself to a customer autonomously, Elon Musk confirms

![TSLA analyst coverage [Source: TipRanks] TSLA analyst coverage [Source: TipRanks]](http://www.teslarati.com/wp-content/uploads/2016/05/TipRanks-1.png)