Tesla’s (NASDAQ:TSLA) first-quarter earnings call comes on the heels of an impressive quarter that saw the electric car maker post $10.389 billion in revenue and non-GAAP earnings per share of $0.93, beating Wall Street’s expectations. With these results, Tesla has now maintained its profitability for seven straight consecutive quarters.

As revealed in the company’s Q1 2021 Update Letter, the company hit some notable milestones in the first quarter. The Model 3 became the world’s best-selling premium sedan, electric or otherwise. The Model Y is also showing a lot of potential, with the vehicle’s production ramp going well in Gigafactory Shanghai. Deliveries for the Model S Plaid are expected shortly as well, and the Tesla Semi, a Class 8 truck that has seen delays, is now poised for a 2021 release.

The following are live updates from Tesla’s Q1 2021 earnings call. I will be updating this article in real-time, so please keep refreshing the page to view the latest updates on this story. The first entry starts at the bottom of the page.

15:41 PT – And that wraps up Tesla’s Q1 2021 earnings call! Overall, Elon Musk and team seemed to be a bit cautious this time around, with timeframes for projects like the 4680 cells being conservative. Tesla also did not provide a specific forecast for 2021’s vehicle deliveries. But considering the ongoing supply challenges, this may not be a bad strategy at all.

Anyway, thanks for staying with us for another live blog! These are always fun. Until the next time!

15:40 PT – Dan Levy from Credit Suisse asked about Tesla and its ongoing cost reductions. Tesla notes that building cars is a complex process, though if one were to look at the advancements in the production of the company’s vehicles like the Model Y, there are a lot of innovations happening there, which should improve COGS.

When asked about Fremont vs the Gigafactories, the analyst asked about how Tesla’s new capacity would differ from the previous NUMMI plant. Musk notes that Tesla does not talk much about future product developments. “We’ll get there. We’ll provide it later,” Musk said.

15:34 PT – Rod Lache of Wolfe Research LLC asks about the FSD rollout, such as the subscription model and its impact. Kirkhorn noted that Tesla is working on rolling out FSD subscriptions, though there are some aspects of the service that still need work. “We’re hoping to get this launch pretty soon, and see what the response is to it,” he said.

15:33 PT – Ferragu asks a follow up about Tesla’s energy business. According to Musk, Tesla has comparable margins in energy and vehicles though it should be noted that the company’s EV business is more mature than the energy segment. Powerwall is mature, however, so the margins there are pretty good. “We have a clear runway for improving the cost of the Megapack,” Musk said.

15:30 PT – Analyst questions start. First up is New Street Research’s Pierre Ferragu. He asks about the 4680 battery line (YES!). He asks about capacity, as well as where the company stands in its ramp.

Musk notes that Tesla has a small pilot plant for the 4680 cells with a 10 GWh per year capacity. “We’re not yet at a point where we think the cells are reliable enough to be put in cars. We think we’re close to that point. We’ve already ordered the equipment for battery production in Berlin and Austin as well. We’re down to the nitty gritty on this. I’m confident that we’d achieve volume production of the 4680 next year,” Musk said.

Musk also added that it appears that Tesla is about 12 or not more than 18 months away from volume production of the 4680 cells. At the same time, Tesla is also looking to ramp the 4680 cells with its existing suppliers. The 4680 revolution is not a Tesla-only thing. It will involve CATL and LG and Panasonic as well. Ultimately, Tesla is on track to more than double the output from suppliers.

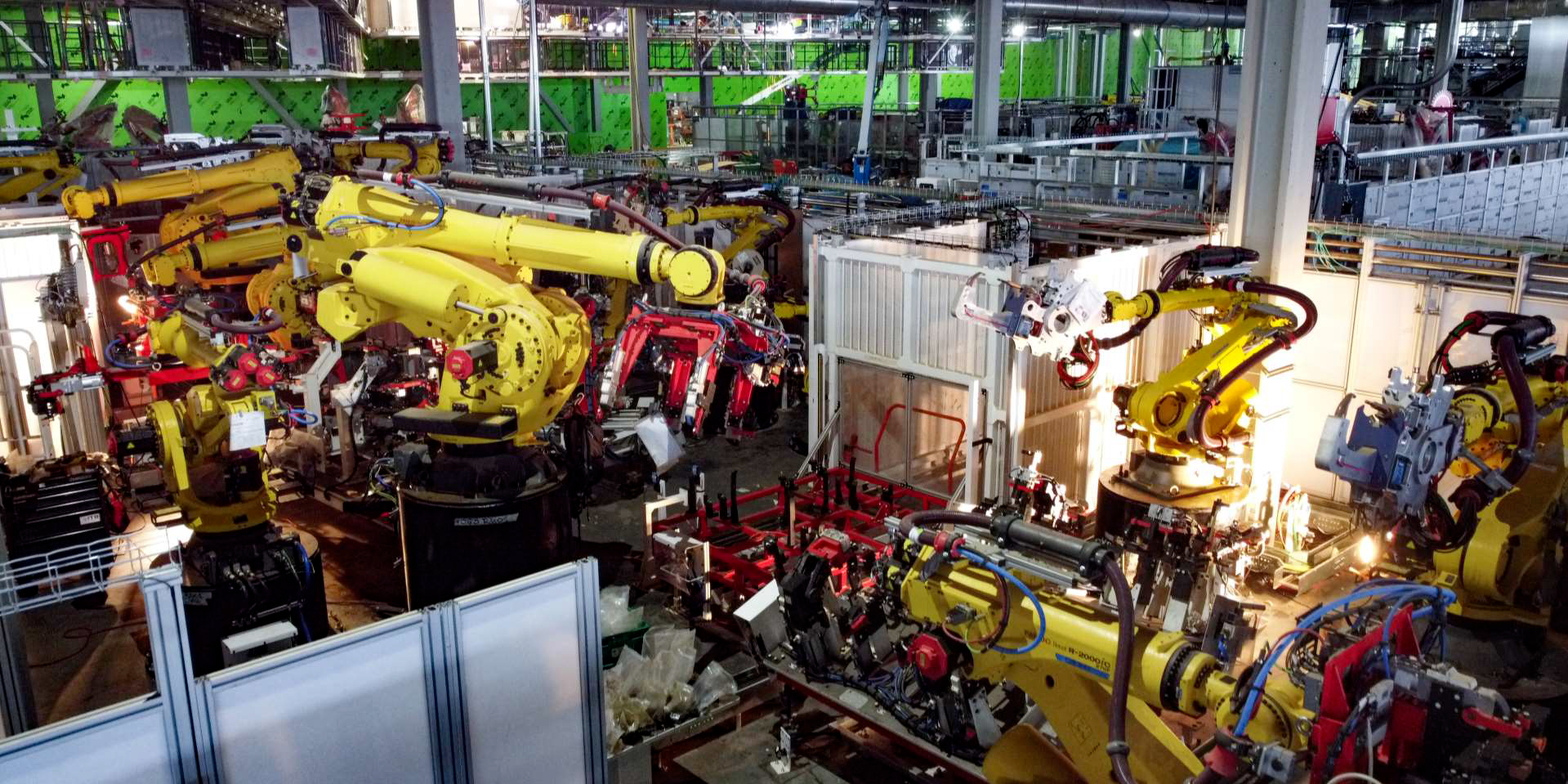

15:24 PT – An inquiry about vehicle production is asked. Musk notes that people still do not understand the difficulties of production. “Prototypes are child’s play,” he said, noting that mass-production is insanely difficult. Musk notes that Tesla is the first company to achieve volume production of cars in a hundred years and not go bankrupt. “Tesla has had several aneurysms to get this done,” Musk said.

Musk shared some of the challenges that Tesla experienced over the years, from production stops due to trivial items like carpets and USB ports. “Solving those constraints is insane,” Musk reiterated.

15:16 PT – An inquiry about vampire drain was asked. Musk notes that vampire drain is not an issue. “We’ve got a long way to go before we’re dealing with season technology issues,” he said.

15:15 PT – An inquiry about MSM FUD is asked. Elon comments on the “extremely deceptive” media coverage of the Texas crash. According to Lars Moravy, VP of Vehicle Engineering, Tesla is working with Texas authorities about the high-profile, tragic accident. Tesla has conducted a study to understand what happened in the crash together with authorities. As per the findings, it appears that the steering wheel was deformed, and someone was in the driver’s seat during the crash. All seatbelts were unbuckled in the car.

15:11 PT – A question about digital currencies are asked for Zachary Kirkhorn. He reiterates Tesla’s Bitcoin investment and eventual sale, as well as the company’s decision to support Bitcoin for payments. According to Kirkhorn, Tesla had been looking for a place to store its cash. Bitcoin presented itself as a preferable avenue for such an endeavor, considering that traditional systems simply provide far less.

“Bitcoin was a good place to put Tesla cash and be able to get some return on it,” he said. Considering that Tesla added over $200 million from its investment in a few months, this decision definitely seems well worth it. “We’ve been pleased with how much liquidity there is in the Bitcoin market. We do we believe long-term in the value of Bitcoin,” Kirkhorn said.

15:08 PT – Musk continues to discuss the Powerwall’s potential, noting that the home battery’s virtual power plant capabilities are profound. This is especially notable considering that the world is now heading towards an era where EVs are the norm. With this in mind, there has to be a way to produce more electricity to meet the demand that would be produced by an all-electric future.

Considering Tesla’s mission, this shift would be beneficial to the company. “This is a prosperous future for Tesla and for utilities ,” he said. Otherwise, we will see more of what happened in Texas earlier this year. “If this is not done, utilities won’t be able to serve their customers. We’ll see a lot more of what we saw in Texas and California,” Musk said.

15:05 PT – Next question is up. This time it’s about the Solar Roof, its price increase, and its ramp. Musk notes that Solar Roof demand is strong, though he admits that Tesla has made mistakes in evaluating the difficulties in assessing the difficulty of installing the solar tiles. “You can’t have a one size fits all system,” he said.

Musk reiterated Tesla’s decision to bundle the Powerwall and its solar products, adding that batteries produced last year have a higher peak capability. With the bundle in place, musk states that the difficulty of installations would be much easier. Installers would not even need to touch the house’s circuit breaker. This, according to Musk, is important for scalability.

15:00 PT – Elon notes that Tesla is actually getting good at auto-labeling, which is pretty much the holy grail for neural net training. This is something that Dojo would be designed for.

“We think Dojo would be probably an order of magnitude more cost-efficient in hardware and energy usage compared to the next best solution we’re aware of. Possibly it could be used by others,“ Musk remarked, adding that “Probably others would want to use it too. And if they do, we’d make it available.”

14:57 PT – Retail investors from Say begin. First up is a question about Dojo. Elon notes that right now, people think Tesla is a car and energy company, but in the long run, people will likely see Tesla as a robotics company. “I think we are developing some of the strongest hardware and software teams in the world,” he said. And if one were to look at Tesla’s tech evolution, Tesla came to a point where it needed something more powerful than what the market offers.

It then makes sense for Tesla to create a supercomputer that would help train its neural nets. “If you have a system that has very good eyes, which can see in all directions at once, never gets tired, has redundancy, and whose reaction time is superhuman, then such a system would achieve a high level of safety,” Musk said, describing the thinking behind Project Dojo. With over a million cars, after all, that’s a lot of data. And next year, this would grow to two million.

14:53 PT – Tesla has trimmed its Bitcoin investment by 10%, resulting in a profit of $272 million.

14:50 PT – Zachary Kirkhorn explains the Model S and Model X delays, noting that the delays are a meaningful headwind for the company’s finances. He also highlights that Tesla is experiencing some challenges with the ongoing global supply shortage, though the company is working with its partners to address them.

14:48 PT – Elon adds that Model X should ramp in Q3 2021. “We’re going to aim to produce 2,000 Model S and Model X per week,” Musk said. He also adds that he believes that the two flagship cars would see a lot of demand.

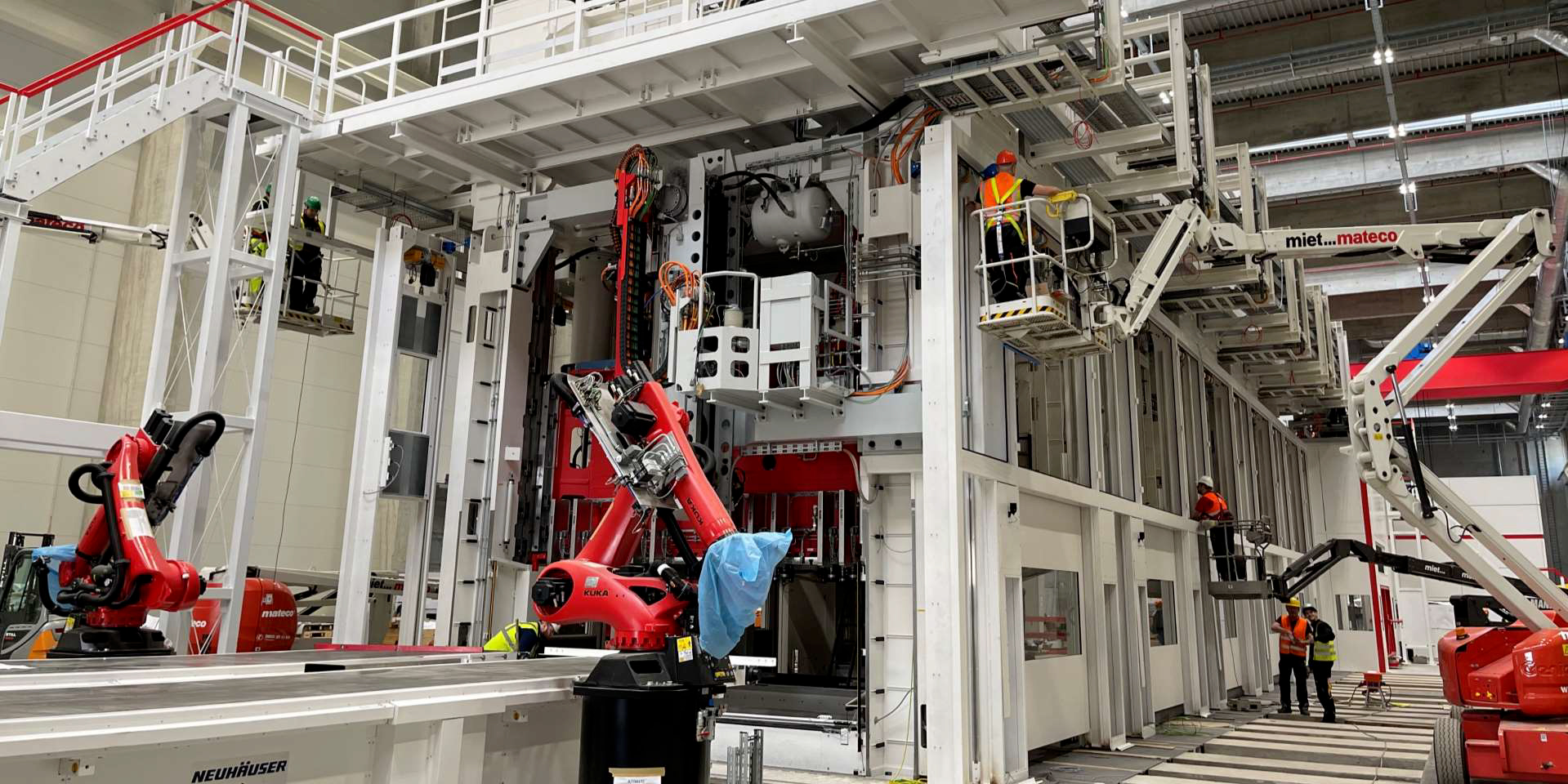

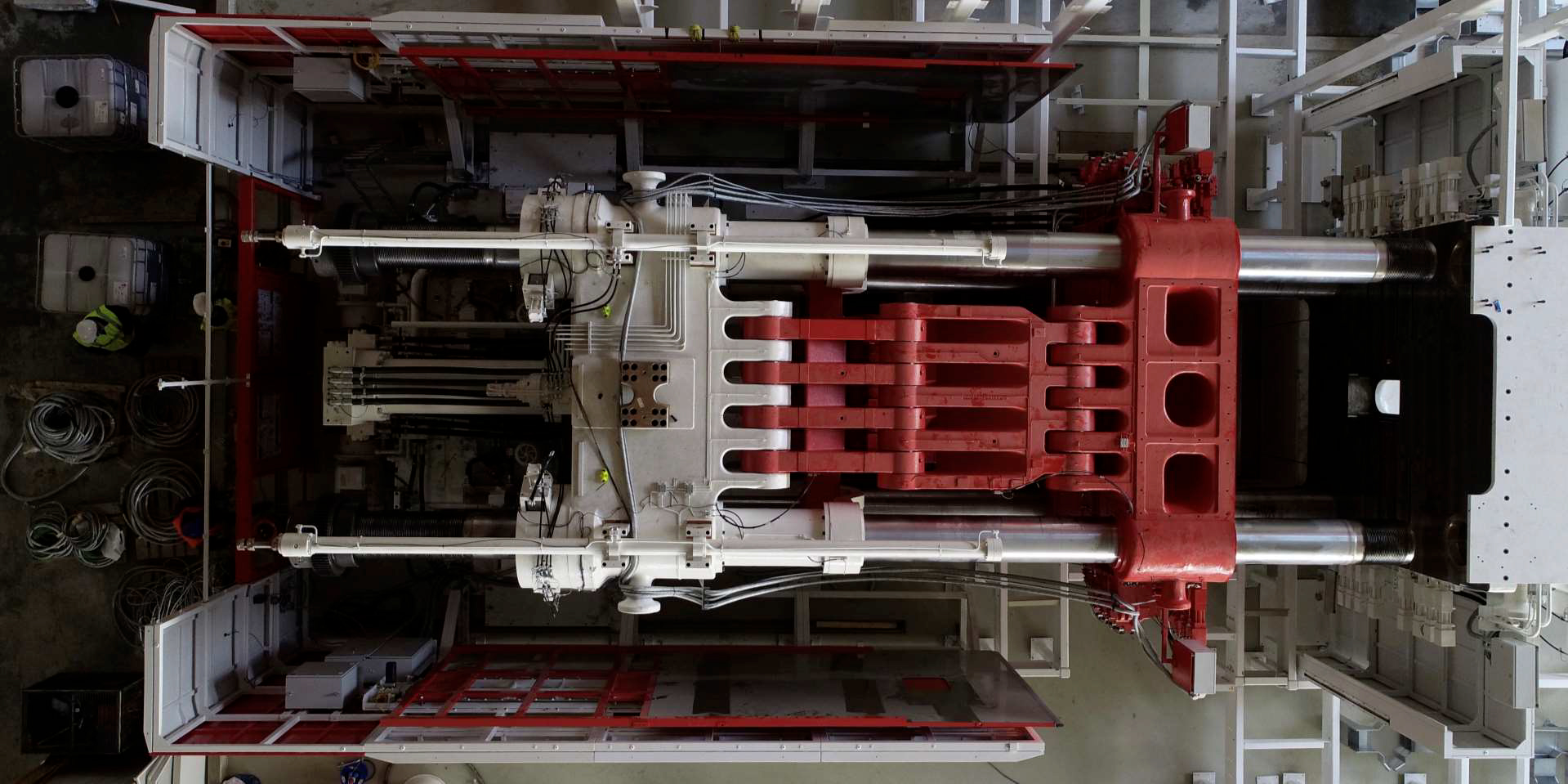

Musk also highlighted that the new Model S and Model X are actually cheaper to produce. Giga Berlin and Giga Texas would likely see volume production next year. In closing, he thanks the Tesla team for their efforts.

14:45 PT – Elon notes that solving FSD is a matter of having a massive data set. And in this case, Tesla has an edge with its large fleet of over a million cars on the road. This should help the company handle edge cases. “It’s quite tricky, but we’re highly confident that we’ll get this (FSD) done,” Musk said.

“Q1 had some of the most difficult supply chain challenges that we’ve ever experienced at Tesla,” Musk said, describing the ongoing chip shortage currently plaguing the auto industry.

As for Model S and Model X, Musk notes that there are more challenges than expected. Musk lists some improvements coming to the vehicles, such as their new interior, battery pack, electric motor, and features. Elon adds that Tesla is just making refinements to cars that are already built. A ramp is coming likely in May.

14:40 PT – The Q1 earnings call begins. Martin Viecha takes the floor. Elon Musk, Zachary Kirkhorn, and a number of executives are present in the call. Opening remarks from Elon Musk. He highlights that Q1 was a record quarter for Tesla. He says that Tesla has seen a shift in the perception for EVs, and demand has been even more formidable than ever. “Demand is the best we’ve ever seen,” he said. This is the reason why Q1 became such an outlier compared to past first quarters, which tended to be softer than other quarters.

Elon also mentions the Model 3’s victory in the premium sedan market, beating veterans like the BMW 3-Series. As for the Model Y, the CEO states that the vehicle has a chance of becoming the best-selling car in the world of any kind. Elon estimates that this would happen sometime in 2022. As for FSD, the Beta has been making progress, though Musk admits that it is one of the most difficult technical problems out there. Elon also emphasizes Tesla’s vision-only approach, reiterating his previous statements on Twitter about radar eventually being retired.

14:32 PT – Of course it’s on Elon Time. 😀

14:30 PT – And… it’s time! Butts in seats, everyone.

14:28 PT – And the earnings call stream is live. We’re now treated with some classical music. Definitely a celebratory air here.

14:25 PT – Now that the Tesla Semi has been announced to be on track for a 2021 release, perhaps we’d see more updates on the release of the next-generation Roadster too? The Semi and new Roadster were unveiled at the same time, after all.

14:20 PT – While the Q1 Update Letter is rife with information, there are quite a number of things that were not mentioned as much. A big one is the company’s 4680 battery cell production developments and plans, which were notably absent in the Update Letter. Hopefully, we can get some nice tidbits of information about the 4680 cells in the earnings call. Crossing our fingers.

14:15 PT – Good day, everyone, and welcome to another live blog of Tesla’s earnings call! We all knew that this quarter would be special when the Q1 vehicle delivery and production numbers came out. Even Wall Street was optimistic about the company’s numbers. Well, the Q1 results are here, and they are actually better than expected. Tesla soundly beat Wall Street’s expectations for revenue and EPS. Though in true Tesla fashion, TSLA stock has now dipped around 1.9% after hours.

Don’t hesitate to contact us for news tips. Just send a message to tips@teslarati.com to give us a heads up.

Elon Musk

SpaceX IPO could push Elon Musk’s net worth past $1 trillion: Polymarket

The estimates were shared by the official Polymarket Money account on social media platform X.

Recent projections have outlined how a potential $1.75 trillion SpaceX IPO could generate historic returns for early investors. The projections suggest the offering would not only become the largest IPO in history but could also result in unprecedented windfalls for some of the company’s key investors.

The estimates were shared by the official Polymarket Money account on social media platform X.

As noted in a Polymarket Money analysis, Elon Musk invested $100 million into SpaceX in 2002 and currently owns approximately 42% of the company. At a $1.75 trillion valuation following SpaceX’s potential $1.75 trillion IPO, that stake would be worth roughly $735 billion.

Such a figure would dramatically expand Musk’s net worth. When combined with his holdings in Tesla Inc. and other ventures, a public debut at that level could position him as the world’s first trillionaire, depending on market conditions at the time of listing.

The Bloomberg Billionaires Index currently lists Elon Musk with a net worth of $666 billion, though a notable portion of this is tied to his TSLA stock. Tesla currently holds a market cap of $1.51 trillion, and Elon Musk’s currently holds about 13% to 15% of the company’s outstanding common stock.

Founders Fund, co-founded by Peter Thiel, invested $20 million in SpaceX in 2008. Polymarket Money estimates the firm owns between 1.5% and 3% of the private space company. At a $1.75 trillion valuation, that range would translate to approximately $26.25 billion to $52.5 billion in value.

That return would represent one of the most significant venture capital outcomes in modern Silicon Valley history, with a growth of 131,150% to 262,400%.

Alphabet Inc., Google’s parent company, invested $900 million into SpaceX in 2015 and is estimated to hold between 6% and 7% of the private space firm. At the projected IPO valuation, that stake could be worth between $105 billion and $122.5 billion. That’s a growth of 11,566% to 14,455%.

Other major backers highlighted in the post include Fidelity Investments, Baillie Gifford, Valor Equity Partners, Bank of America, and Andreessen Horowitz, each potentially sitting on multibillion-dollar gains.

Elon Musk

Elon Musk hints Tesla investors will be rewarded heavily

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet,” Musk said.

Elon Musk recently hinted that he believes Tesla investors will be rewarded heavily if they continue to hold onto their shares, and he reiterated that in a new interview that the company released on its social accounts this week.

Musk is one of the most successful CEOs in the modern era and has mammothed competitors on the Forbes Net Worth List over the past year as his holdings in his various companies have continued to swell.

Tesla investors, especially those who have been holding shares for several years, have also felt substantial gains in their portfolios. Over the past five years, the stock is up over 78 percent. Since February 2019, nearly seven years ago to the day, the stock is up over 1,800 percent.

Musk said in the interview:

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet.”

Elon Musk in new interview: “Hold on to your $TSLA stock. It’s going to be worth a lot, I think. That’s my bet.” pic.twitter.com/cucirBuhq0

— Sawyer Merritt (@SawyerMerritt) February 26, 2026

It’s no secret Musk has been extremely bullish on his own companies, but Tesla in particular, because it is publicly traded.

However, the company has so many amazing projects that have an opportunity to revolutionize their respective industries. There is certainly a path to major growth on Wall Street for Tesla through its various future projects, including Optimus, Cybercab, Semi, and Unsupervised FSD.

- Optimus (Tesla’s humanoid robot): Musk has discussed its potential for tasks like childcare, walking dogs, or assisting elderly parents, positioning it as a massive long-term driver of company value.

- Cybercab (Tesla’s robotaxi/autonomous ride-hailing vehicle): a fully autonomous vehicle geared specifically for Tesla’s ride-sharing ambitions.

- Semi (Tesla’s electric truck, with mentions of expansion, like in Europe): brings Tesla into the commercial logistics sector.

- Unsupervised FSD (Full Self-Driving software achieving full autonomy without human supervision): turns every Tesla owner’s vehicle into a fully-autonomous vehicle upon release

These projects specifically are some of the highest-growth pillars Tesla has ever attempted to develop, especially in Musk’s eyes, as he has said Optimus will be the best-selling product of all-time.

Many analysts agree, but the bullish ones, like Cathie Wood of ARK Invest, are perhaps the one who believes Tesla has incredible potential on Wall Street, predicting a $2,600 price target for 2030, but this is not even including Optimus.

She told Bloomberg last March that she believes that the project will present a potential additive if Tesla can scale faster than anticipated.

Elon Musk

Tesla stock gets latest synopsis from Jim Cramer: ‘It’s actually a robotics company’

“Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session,” Cramer said.

Tesla stock (NASDAQ: TSLA) got its latest synopsis from Wall Street analyst Jim Cramer, who finally realized something that many fans of the company have known all along: it’s not a car company. Instead, it’s a robotics company.

In a recent note that was released after Tesla reported Earnings in late January, Cramer seemed to recognize that the underwhelming financials and overall performance of the automotive division were not representative of the current state of affairs.

Instead, we’re seeing a company transition itself away from its early identity, essentially evolving like a caterpillar into a butterfly.

The narrative of the Earnings Call was simple: We’re not a car company, at least not from a birds-eye view. We’re an AI and Robotics company, and we are transitioning to this quicker than most people realize.

Tesla stock gets another analysis from Jim Cramer, and investors will like it

Tesla’s Q4 Earnings Call featured plenty of analysis from CEO Elon Musk and others, and some of the more minor details of the call were even indicative of a company that is moving toward AI instead of its cars. For example, the Model S and Model X will be no more after Q2, as Musk said that they serve relatively no purpose for the future.

Instead, Tesla is shifting its focus to the vehicles catered for autonomy and its Robotaxi and self-driving efforts.

Cramer recognizes this:

“…we got results from Tesla, which actually beat numbers, but nobody cares about the numbers here, as electric vehicles are the past. And according to CEO Elon Musk, the future of this company comes down to Cybercabs and humanoid robots. Stock fell more than 3% the next day. That may be because their capital expenditures budget was higher than expected, or maybe people wanted more details from the new businesses. At this point, I think Musk acolytes might be more excited about SpaceX, which is planning to come public later this year.”

He continued, highlighting the company’s true transition away from vehicles to its Cybercab, Optimus, and AI ambitions:

“I know it’s hard to believe how quickly this market can change its attitude. Last night, I heard a disastrous car company speak. Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session. I didn’t like it as a car company. Boy, I love it as a Cybercab and humanoid robot juggernaut. Call me a buyer and give me five robots while I’m at it.”

Cramer’s narrative seems to fit that of the most bullish Tesla investors. Anyone who is labeled a “permabull” has been echoing a similar sentiment over the past several years: Tesla is not a car company any longer.

Instead, the true focus is on the future and the potential that AI and Robotics bring to the company. It is truly difficult to put Tesla shares in the same group as companies like Ford, General Motors, and others.

Tesla shares are down less than half a percent at the time of publishing, trading at $423.69.