News

What’s causing SpaceX’s Falcon Heavy delays?

Although uncertainty in the schedule remains, SpaceX’s Falcon Heavy rocket appears to be nearly ready for its first engine ignition test (called a ‘static fire’) sometime within the next week or so.

An attempt at 1 PM EST today, January 16, was canceled for unspecified reasons, although Kennedy Space Center reportedly maintained the usual roadblock to prevent vehicles from driving past, implying that SpaceX still intends to conduct propellant loading tests with Falcon Heavy. It was noted earlier this morning by spaceflight journalist Chris Bergin that things were “a bit too quiet” if a test was indeed planned for today, and his intuition appears to have been correct. It still remains the case that Falcon Heavy is an experimental and untested rocket to an extent, and these delays are to be expected as SpaceX works out the inevitable kinks and bugs that arise during the extensive testing big launch vehicle has been and is still being put through.

KSC is in roadblock stance, so they will still do some testing it would seem, but we will have to wait for the Static Fire itself. https://t.co/DxzsRn85NR

— NSF – NASASpaceflight.com (@NASASpaceflight) January 16, 2018

Due to range requirements in support of an upcoming launch of the United Launch Alliance’s (ULA) Atlas 5 rocket, currently NET Thursday, SpaceX has postponed the static fire of Falcon Heavy without a replacement date. It is unlikely that another attempt will occur before the upcoming weekend, but SpaceX should have at least a solid week of uninterrupted range support once ULA’s launch occurs, hopefully without delay. Godspeed to ULA, in the meantime.

The crazy complexity of rocketry

Most recently, and perhaps somewhat related to Falcon Heavy’s static fire delays, SpaceX completed as many as two complete wet dress rehearsals (WDRs), which saw Falcon Heavy topped off with full tanks of its cryogenic (super cool) liquid oxygen (LOX) and rocket-grade jet fuel (RP-1). In essence, the rocket became equivalent to several hundred tons of carefully stabilized explosive. Nominally, these rehearsals appear entirely uneventful to an outside observer, with little more than ice formation and the occasional bursts of propellant tank vents to suggest that something important is occurring. However, anomalies like the failure of Falcon 9 during the Amos-6 static fire provide a staggering demonstration of just how explosive and sensitive a rocket’s fuel is, and Falcon Heavy has approximately three times the fuel capacity of Falcon 9. Empty, Falcon 9’s mass has been estimated to be around 30 metric tons, a minuscule amount of structure in the face of the more than 500 metric tons of propellant the vehicle carries at liftoff.

These propellant loading tests can also be challenging for reasons aside from their highly explosive nature. Due to basic realities of the physical nature of metal, the predominate ingredient for Falcon 9’s load-bearing structures, metallic structures shrink under extreme cold (and expand under heating). In the case of Falcon 9’s massive 45 meters (150 foot) tall first stage, the scale of this contraction can be on the order of several inches or more, particularly given SpaceX’s predilection towards cooling their propellant as much as possible to increase its energy density. For Falcon 9, these issues (thermodynamic loads) are less severe. However, add in three relatively different first stage boosters linked together with several extremely strong supports at both their tops and bottoms and that dynamic loading can become a fickle beast. The expansion or compression of materials due to temperature changes can create absolutely astounding amounts of pressure – if you’ve ever forgotten a glass bottled drink in the freezer and discovered it violently exploded at some future point, you’ll have experienced this yourself.

With several inches of freedom and the possibility that each Falcon Heavy booster might contract or expand slightly differently, these forces could understandably wreak havoc with the high precision necessary for the huge rocket to properly connect with the launch pad’s ground systems that transmit propellant, fluids, and telemetry back and forth. Information from two reliable Kennedy Space Center sources experienced with the reality of operating rockets, as well as NASASpaceflight.com, suggested that issues with dynamic loads (such as those created by thermal contraction/expansion) are a likely explanation for the delays, further evidenced by their observations that much of the pad crew’s attention appeared to be focused at the base of Transporter/Erector/Launcher (TEL). The TEL base hosts the clamps that hold the rocket down during static fires and launches, as well as the Tail Service Masts (TSMs) that connect with the Falcon 9/Heavy to transport propellant and data to the first stage(s). These connection points are both relatively tiny, mechanically sensitive, and absolutely critical for the successful operation of the rocket, and thus are a logical point of failure in the event of off-nominal or unpredicted levels of dynamic stresses.

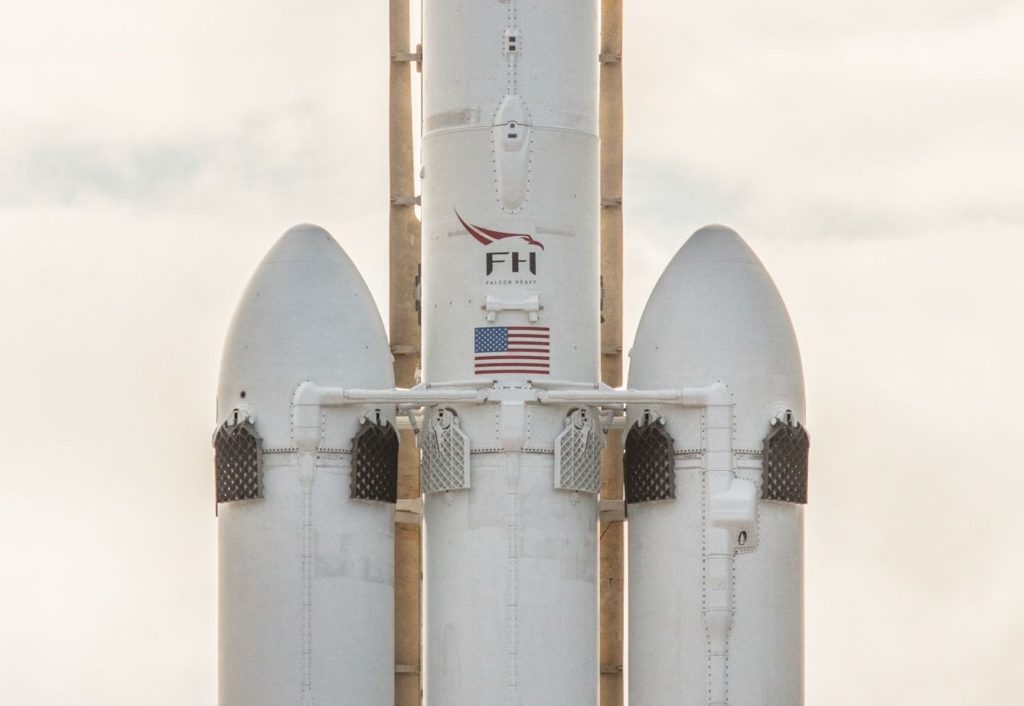

- The white bars in this photo are half of Falcon Heavy’s seperation mechanism. A number of actuators take the place of the more common solid rocket motors used with vehicles like the Delta IV Heavy. (SpaceX)

- Falcon Heavy’s three boosters and 27 Merlin 1D engines on full display. (SpaceX)

- Falcon Heavy. Modeled and rendered by NASASpaceflight forum user WBY1984. (WBY1984)

Test, launch, land, repeat.

All things considered, these difficulties demonstrate that even after months (even years) of relentless modeling, testing, remodeling, and retesting, rockets (and especially huge rockets like Falcon Heavy) are immensely complex, and even tiny mistakes can lead the vehicle to stray from its expected behavior. Quite simply, the reality of engineering only truly comes into play once hardware is fully in the loop, and it’s in this state that SpaceX has demonstrated again and again a distinct and elegant ability to learn from their hardware, rather than attempt to salve uncertainty with a neurotic and counterproductive level of statistical analysis, modelling, and documentation. The agile launch company still dabbles in those aspects when beneficial or necessary, but testing comes first in its importance.

The conclusion here, then, is that Falcon Heavy’s delays betray this aspect of SpaceX – a launch company that loves its fans, but also understands the need for cautious testing when it comes to new and untried rocket hardware. Whether Falcon Heavy succeeds or fails, SpaceX will learn from the proceedings, and they will be better off for it (although maybe less so financially…).

Follow along live as launch photographer Tom Cross and I cover these exciting proceedings as close to live as possible.

Teslarati – Instagram – Twitter

Tom Cross – Instagram

Eric Ralph – Twitter

News

Tesla Model Y outsells everything in three states, but Ford dominates

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

The Tesla Model Y was the best-selling vehicle in three different states in the U.S. last year, according to new data that shows the all-electric crossover outsold every other car in a few places. However, Ford widely dominated the sales figures with its popular F-Series of pickups.

According to new vehicle registration data compiled by Edmunds and visualized by Visual Capitalist, the Ford F-Series, encompassing models like the F-150, F-250, F-350, and F-450, claimed the title of best-selling vehicle in 29 states.

This dominance underscores the pickup truck’s unbreakable appeal across much of the country, particularly in rural, Midwestern, Southern, and Western states, where towing capacity, durability, and utility for work or recreation remain top priorities.

The Tesla Model Y is the best-selling vehicle in California, Washington, and Nevada

How many states will it dominate next year? https://t.co/ERyoyce42D

— TESLARATI (@Teslarati) March 9, 2026

The F-Series has held the crown as America’s overall best-selling vehicle for decades, a streak that continued strong into 2025 despite broader market shifts.

Yet, amid this truck-heavy reality, Tesla made a notable breakthrough. The Model Y emerged as the top-selling vehicle, not just the leading EV, but the outright best-seller in three key states: California, Nevada, and Washington.

These West Coast strongholds reflect regions with robust EV infrastructure, high environmental awareness, generous incentives, and tech-savvy populations. In California alone, nearly 50 percent of new vehicle registrations were electrified, far outpacing the national average of around 25 percent.

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

Elon Musk: Tesla Model Y is world’s best-selling car for 3rd year in a row

Elsewhere, Japanese crossovers filled many gaps: Toyota’s RAV4 and Honda’s CR-V topped charts in several urban and densely populated Northeastern and Midwestern states, where fuel efficiency, reliability, and family-friendly features win out over larger trucks.

While Ford’s broad reach shows traditional preferences persist, at least for now, Tesla’s Model Y victories in high-population, influential states signal a gradual but undeniable transition toward electrification. As charging networks expand and battery technology improves, more states could follow the West Coast’s lead in the coming years.

This 2025 map captures a pivotal moment: pickup trucks still rule the majority, but EVs are carving out meaningful territory where consumer priorities align with sustainability and innovation. The road ahead promises continued competition between legacy giants and electric disruptors.

Elon Musk

Elon Musk shares updated Starship V3 maiden launch target date

The comment was posted on Musk’s official account on social media platform X.

SpaceX CEO Elon Musk shared a brief Starship V3 update in a post on social media platform X, stating the next launch attempt of the spacecraft could take place in about four weeks.

The comment was posted on Musk’s official account on social media platform X.

Musk’s update suggests that Starship Flight 12 could target a launch around early April, though the schedule will depend on several remaining milestones at SpaceX’s Starbase launch facility in Texas.

Among the key steps is testing and certification of the site’s new launch tower, launch mount, and tank farm systems. These upgrades will support the next generation of Starship vehicles.

Booster 19 is expected to roll to the launch site and be placed on the launch mount before returning to the production facility to receive its 33 Raptor engines. The booster would then return for a static fire test, which could mark the first time a Super Heavy booster equipped with Raptor V3 engines is fired on the pad.

Ship 39 is expected to undergo a similar preparation process. The vehicle will likely return to the production site to receive its six engines before heading to Massey’s test site for static fire testing.

Once both stages are prepared, the booster and ship will roll out to the launch site for the first full stack of a V3 Super Heavy and V3 Starship. A full wet dress rehearsal is expected to follow before any launch attempt.

Elon Musk has previously shared how SpaceX plans to eventually recover Starship’s upper stage using the launch tower’s robotic arms. Musk noted that the company will only attempt to catch the Starship spacecraft after two successful soft landings in the ocean. The approach is intended to reduce risk before attempting a recovery over land.

“Should note that SpaceX will only try to catch the ship with the tower after two perfect soft landings in the ocean. The risk of the ship breaking up over land needs to be very low,” Musk wrote in a post on X.

Such a milestone would represent a major step toward the full reuse of the Starship system, which remains a central goal for SpaceX’s long-term launch strategy.

News

Tesla opens first public Tesla Semi Megacharger site in Los Angeles

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla has opened its first public Tesla Semi Megacharger site in Los Angeles. The station reportedly offers up to 750 kW charging speeds and is open to Tesla Semi customers.

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla Semi Megachargers

The Los Angeles site seems to be the first public Tesla Semi Megacharger that is not located at a Tesla factory. It is also the third Megacharger site currently visible on Tesla’s map.

The Megacharger system is designed specifically for the Tesla Semi and is capable of delivering extremely high charging speeds to support long-haul trucking operations. Infrastructure such as this will likely play a key role in making the Semi competitive with diesel-powered transport trucks.

Tesla’s progress with the Semi has also drawn attention in recent days after Elon Musk biographer Ashlee Vance shared photos from inside the Tesla Semi factory near Giga Nevada. The images suggested that preparations for higher production volumes may be underway, hinting that a broader ramp of the Tesla Semi’s production indeed be approaching.

New deployment strategies

Tesla has continued expanding its broader charging network through several new strategies aimed at accelerating infrastructure deployment. One of these initiatives is the Supercharger for Business program, which allows third parties to purchase Tesla Supercharger equipment and deploy charging stations while still integrating with Tesla’s network.

The program recently marked a milestone in Alpharetta, Georgia, where the city deployed four 325 kW city-branded Superchargers near the Alpharetta Department of Public Safety on Old Milton Parkway. The chargers support the city’s Tesla Model Y police vehicles while also remaining accessible to the public.

As per a report from EVwire, the project was designed not only to support fleet charging but also to generate economic returns that could offset the city’s investment. Tesla’s Supercharger for Business program has already attracted several participants, including businesses and charging providers such as Suncoast Charging, Pie Safe bakery in Idaho, Francis Energy in Oklahoma, and Wawa convenience stores.