News

SpaceX rocket catch simulation raises more questions about concept

CEO Elon Musk has published the first official visualization of what SpaceX’s plans to catch Super Heavy boosters might look like in real life. However, the simulation he shared raises just as many questions as it answers.

Since at least late 2020, SpaceX CEO Elon Musk has been floating the idea of catching Starships and Super Heavy boosters out of the sky as an alternative to having the several-dozen-ton steel rockets use basic legs to land on the ground. This would be a major departure from SpaceX’s highly successful Falcon family, which land on a relatively complex set of deployable legs that can be retracted after most landings. The flexible, lightweight structures have mostly been reliable and easily reusable but Falcon boosters occasionally have rough landings, which can use up disposable shock absorbers or even damage the legs and make boosters hard to safely recover and slower to reuse.

As a smaller rocket, Falcon boosters have to be extremely lightweight to ensure healthy payload margins and likely weigh about 25-30 tons empty and 450 tons fully fueled – an excellent mass ratio for a reusable rocket. While it’s still good to continue that practice of rigorous mass optimization with Starship, the vehicle is an entirely different story. Once plans to stretch the Starship upper stage’s tanks and add three more Raptors are realized, it’s quite possible that Starship will be capable of launching more than 200 tons (~440,000 lb) of payload to low Earth orbit (LEO) with ship and booster recovery.

One might think that SpaceX, with the most capable rocket ever built potentially on its hands, would want to take advantage of that unprecedented performance to make the rocket itself – also likely to be one of the most complex launch vehicles ever – simpler and more reliable early on in the development process. Generally speaking, that would involve sacrificing some of its payload capability and adding systems that are heavier but simpler and more robust. Once Starship is regularly flying to orbit and gathering extensive flight experience and data, SpaceX might then be able refine the rocket, gradually reducing its mass and improving payload to orbit by optimizing or fully replacing suboptimal systems and designs.

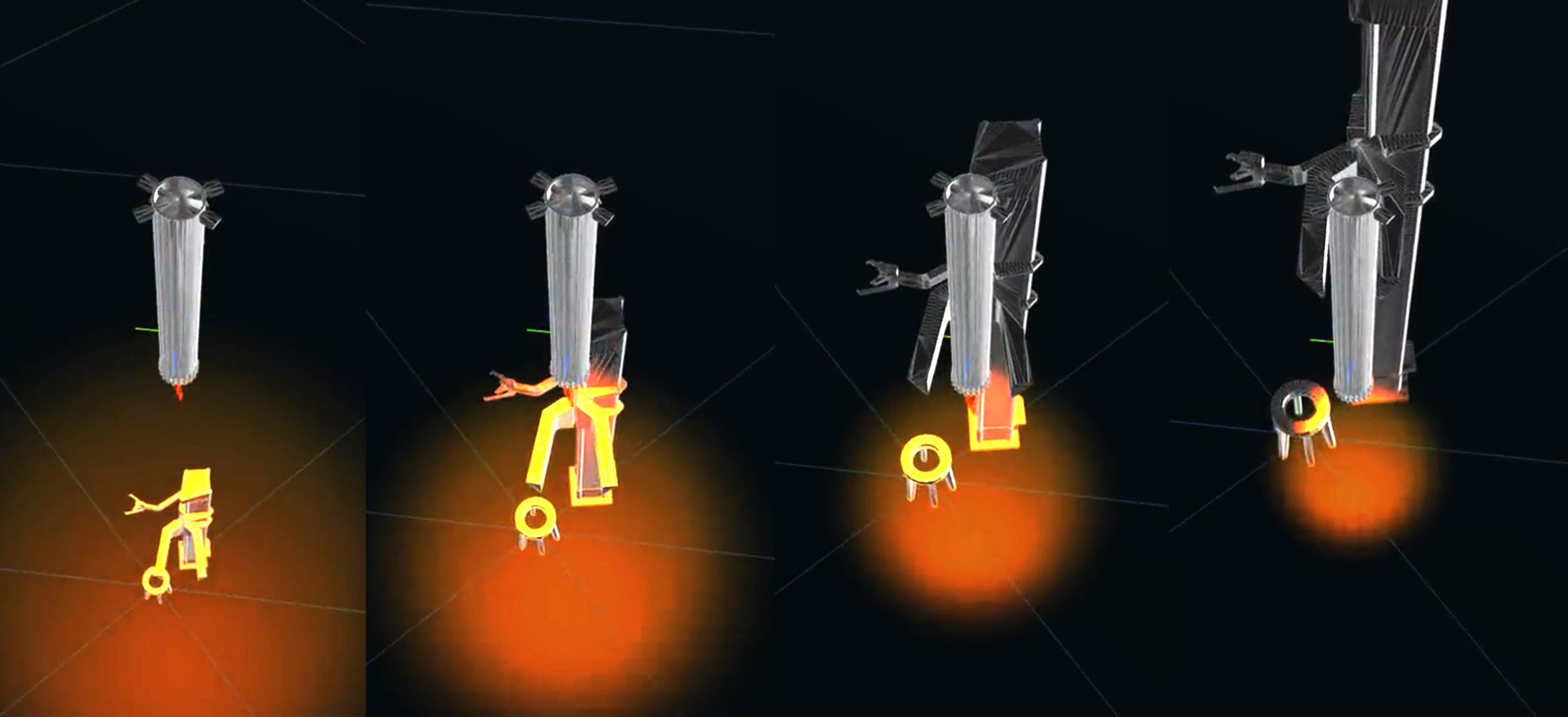

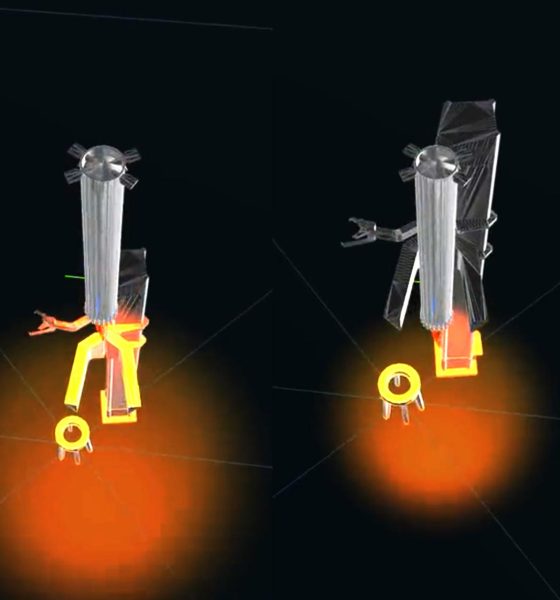

Instead, SpaceX appears to be trying to substantially optimize Starship before it’s attempted a single orbital launch. The biggest example is Elon Musk’s plan to catch Super Heavy boosters – and maybe Starships, too – for the sole purpose of, in his own words, “[saving] landing leg mass [and enabling] immediate reflight of [a giant, unwieldy rocket].” Musk, SpaceX executives, or both appear to be attempting to refine a rocket that has never flown. Further, based on a simulation of a Super Heavy “catch” Musk shared on January 20th, all that oddly timed effort may end up producing a solution that’s actually worse than what it’s trying to replace.

Based on the simulated telemetry shown in the visualization, Super Heavy’s descent to the landing zone appears to be considerably gentler than the ‘suicide burn’ SpaceX routinely uses on Falcon. By decelerating as quickly as possible and making landing burns as short as possible, Falcon saves a considerable amount of propellant during recovery – extra propellant that, if otherwise required, would effectively increase Falcon’s dry mass and decrease its payload to orbit. In the Super Heavy “catch” Musk shared, the booster actually appears to be landing – just on an incredibly small patch of steel on the tower’s ‘Mechazilla’ arms instead of a concrete pad on the ground.

Aside from a tiny bit of lateral motion, the arms appear motionless during the ‘catch,’ making it more of a landing. Further, Super Heavy is shown decelerating rather slowly throughout the simulation and appears to hover for almost 10 seconds near the end. That slow, cautious descent and even slower touchdown may be necessary because of how incredibly accurate Super Heavy has to be to land on a pair of hardpoints with inches of lateral margin for error and maybe a few square feet of usable surface area. The challenge is a bit like if SpaceX, for some reason, made Falcon boosters land on two elevated ledges about as wide as car tires. Aside from demanding accurate rotational control, even the slightest lateral deviation would cause the booster to topple off the pillars and – in the case of Super Heavy – fall about a hundred feet onto concrete, where it would obviously explode.

What that slow descent and final hover mean is that the Super Heavy landing shown would likely cost significantly more delta V (propellant) than a Falcon-style suicide burn. Propellant has mass, so Super Heavy would likely need to burn at least 5-10 tons more to carefully land on arms that aren’t actively matching the booster’s position and velocity. Ironically, SpaceX could probably quite easily add rudimentary, fixed legs – removing most of the bad aspects of Falcon legs – to Super Heavy with a mass budget of 10 tons. But even if SpaceX were to make those legs as simple, dumb, and reliable as physically possible and they wound up weighing 20 tons total, the inherent physics of rocketry mean that adding 20 tons to Super Heavy’s likely 200-ton dry mass would only reduce the rocket’s payload to orbit by about 3-5 tons or 1-3%.

Further, per Musk’s argument that landing on the arms would enhance the speed of reuse, it’s difficult to see how landing Super Heavy or Starship in the exact same corridor – but on the ground instead of on the arms – would change anything. If Super Heavy is accurate enough to land on a few square meters of steel, it must inherently be accurate enough to land within the far larger breadth of those arms. The only process landing on the arms would clearly remove is reattaching the arms to a landed booster or ship, which it’s impossible to imagine would save more than a handful of minutes or maybe an hour of work. SpaceX’s Falcon booster turnaround record is currently 27 days, so it’s even harder to imagine why SpaceX would be worrying about cutting minutes or a few hours off of the turnaround and reuse of a rocket that has never even performed a full static fire test – let alone attempted an orbital-class launch, reentry, or landing.

Put simply, while Starbase’s launch tower arms will undoubtedly be useful for quickly lifting and stacking Super Heavy and Starship, it’s looking more and more likely that using those arms as a landing platform will, at best, be an inferior alternative to basic Falcon-style landings. More importantly, even if everything works perfectly, the arms actually cooperate with boosters to catch them, and it’s possible for Super Heavy to avoid hovering and use a more efficient suicide burn, the apparent best-case outcome of all that effort is marginally faster reuse and perhaps a 5% increase in payload to orbit. Only time will tell if such a radical change proves to be worth such marginal benefits.

Elon Musk

Elon Musk confirms SpaceX is not developing a phone

Despite many recent rumors and various reports, Elon Musk confirmed today that SpaceX is not developing a phone based on Starlink, not once, but twice.

Today’s report from Reuters cited people familiar with the matter and stated internal discussions have seen SpaceX executives mulling the idea of building a mobile device that would connect directly to the Starlink satellite constellation.

Musk did state in late January that SpaceX developing a phone was “not out of the question at some point.” However, He also said it would have to be a major difference from current phones, and would be optimized “purely for running max performance/watt neural nets.”

Not out of the question at some point. It would be a very different device than current phones. Optimized purely for running max performance/watt neural nets.

— Elon Musk (@elonmusk) January 30, 2026

While Musk said it was not out of the question “at some point,” that does not mean it is currently a project SpaceX is working on. The CEO reaffirmed this point twice on X this afternoon.

Musk said, “Reuters lies relentlessly,” in one post. In the next, he explicitly stated, “We are not developing a phone.”

Reuters lies relentlessly

— Elon Musk (@elonmusk) February 5, 2026

We are not developing a phone

— Elon Musk (@elonmusk) February 5, 2026

Musk has basically always maintained that SpaceX has too many things going on, denying that a phone would be in the realm of upcoming projects. There are too many things in the works for Musk’s space exploration company, most notably the recent merger with xAI.

SpaceX officially acquires xAI, merging rockets with AI expertise

A Starlink phone would be an excellent idea, especially considering that SpaceX operates 9,500 satellites, serving over 9 million users worldwide. 650 of those satellites are dedicated to the company’s direct-to-device initiative, which provides cellular coverage on a global scale.

Nevertheless, there is the potential that the Starlink phone eventually become a project SpaceX works on. However, it is not currently in the scope of what the company needs to develop, so things are more focused on that as of right now.

News

Tesla adds notable improvement to Dashcam feature

Tesla has added a notable improvement to its Dashcam feature after complaints from owners have pushed the company to make a drastic change.

Perhaps one of the biggest frustrations that Tesla owners have communicated regarding the Dashcam feature is the lack of ability to retain any more than 60 minutes of driving footage before it is overwritten.

It does not matter what size USB jump drive is plugged into the vehicle. 60 minutes is all it will hold until new footage takes over the old. This can cause some issues, especially if you were saving an impressive clip of Full Self-Driving or an incident on the road, which could be lost if new footage was recorded.

This has now been changed, as Tesla has shown in the Release Notes for an upcoming Software Update in China. It will likely expand to the U.S. market in the coming weeks, and was first noticed by NotaTeslaApp.

The release notes state:

“Dashcam Dynamic Recording Duration – The dashcam dynamically adjusts the recording duration based on the available storage capacity of the connected USB drive. For example, with a 128 GB USB drive, the maximum recording duration is approximately 3 hours; with a 1 TB or larger USB drive, it can reach up to 24 hours. This ensures that as much video as possible is retained for review before it gets overwritten.”

Tesla Adds Dynamic Recording

Instead of having a 60-minute cap, the new system will now go off the memory in the USB drive. This means with:

- 128 GB Jump Drive – Up to Three Hours of Rolling Footage

- 1TB Jump Drive – Up to 24 Hours of Rolling Footage

This is dependent on the amount of storage available on the jump drive, meaning that if there are other things saved on it, it will take away from the amount of footage that can be retained.

While the feature is just now making its way to employees in China, it will likely be at least several weeks before it makes its way to the U.S., but owners should definitely expect it in the coming months.

It will be a welcome feature, especially as there will now be more customization to the number of clips and their duration that can be stored.

Elon Musk

Will Tesla join the fold? Predicting a triple merger with SpaceX and xAI

With the news of a merger between SpaceX and xAI being confirmed earlier this week by CEO Elon Musk directly, the first moves of an umbrella company that combines all of the serial tech entrepreneur’s companies have been established.

The move aims to combine SpaceX’s prowess in launches with xAI’s expanding vision in artificial intelligence, as Musk has detailed the need for space-based data centers that will require massive amounts of energy to operate.

It has always been in the plans to bring Musk’s companies together under one umbrella.

“My companies are, surprisingly in some ways, trending toward convergence,” Musk said in November. With SpaceX and xAI moving together, many are questioning when Tesla will be next. Analysts believe it is a no-brainer.

SpaceX officially acquires xAI, merging rockets with AI expertise

Dan Ives of Wedbush wrote in a note earlier this week that there is a “growing chance” Tesla could be merged in some form with the new conglomeration over the next 12 to 18 months.

“In our view, there is a growing chance that Tesla will eventually be merged in some form into SpaceX/xAI over time. The viewis this growing AI ecosystem will focus on Space and Earth together… and Musk will look to combine forces,” Ives said.

Let’s take a look at the potential.

The Case for Synergies – Building the Ultimate AI Ecosystem

A triple merger would create a unified “Musk Trinity,” blending Tesla’s physical AI with Robotaxi, Optimus, and Full Self-Driving, SpaceX’s orbital infrastructure through Starlink and potential space-based computer, and xAI’s advanced models, including Grok.

This could accelerate real-world AI applications, more specifically, ones like using satellite networks for global autonomy, or even powering massive training through solar-optimized orbital data centers.

The FCC welcomes and now seeks comment on the SpaceX application for Orbital Data Centers.

The proposed system would serve as a first step towards becoming a Kardashev II-level civilization and serve other purposes, according to the applicant. pic.twitter.com/TDnUPuz9w7

— Brendan Carr (@BrendanCarrFCC) February 4, 2026

This would position the entity, which could ultimately be labeled “X,” as a leader in multiplanetary AI-native tech.

It would impact every level of Musk’s AI-based vision for the future, from passenger use to complex AI training models.

Financial and Structural Incentives — and Risks

xAI’s high cash burn rate is now backed by SpaceX’s massive valuation boost, and Tesla joining the merger would help the company gain access to private funding channels, avoiding dilution in a public-heavy structure.

The deal makes sense from a capital standpoint, as it is an advantage for each company in its own specific way, addressing specific needs.

Because xAI is spending money at an accelerating rate due to its massive compute needs, SpaceX provides a bit of a “lifeline” by redirecting its growing cash flows toward AI ambitions without the need for constant external fundraising.

Additionally, Tesla’s recent $2 billion investment in xAI also ties in, as its own heavy CapEx for Dojo supercomputers, Robotaxis, and Optimus could potentially be streamlined.

Musk’s stake in Tesla and SpaceX, after the xAI merger, is also uneven. His ownership in Tesla equates to about 13 percent, only increasing as he achieves each tranche of his most recent compensation package. Meanwhile, he owns about 43 percent of the private SpaceX.

A triple merger between the three companies could boost his ownership in the combined entity to around 26 percent. This would give Musk what he wants: stronger voting power and alignment across his ventures.

It could also be a potential facilitator in private-to-public transitions, as a reverse merger structure to take SpaceX public indirectly via Tesla could be used. This avoids any IPO scrutiny while accessing the public markets’ liquidity.

Timeline and Triggers for a Public Announcement

As previously mentioned, Ives believes a 12-18 month timeline is realistic, fueled by Musk’s repeated hints at convergence between his three companies. Additionally, the recent xAI investment by Tesla only points toward the increased potential for a conglomeration.

Of course, there is speculation that the merger could happen in the shorter term, before June 30 of this year, which is a legitimate possibility. While this possibility exists but remains at low probability, especially when driven by rapid AI/space momentum, longer horizons, like 2027 or later, allow for key milestones like Tesla’s Robotaxi rollout and Cybercab ramp-up, Optimus scaling, or regulatory clarity under a favorable administration.

Credit: Grok Imagine

The sequencing matters: SpaceX-xAI merger as “step one” toward a unified stack, with a potential SpaceX IPO setting a valuation benchmark before any Tesla tie-up.

Full triple convergence could follow if synergies prove out.

Prediction markets are also a reasonable thing to look at, just to get an idea of where people are putting their money. Polymarket, for example, sits at between a 12 and 24 percent chance that a Tesla-SpaceX merger is officially announced before June 30, 2026.

Looking Ahead

The SpaceX-xAI merger is not your typical corporate shuffle. Instead, it’s the clearest signal yet that Musk is architecting a unified “Muskonomy” where AI, space infrastructure, and real-world robotics converge to solve humanity’s biggest challenges.

Yet the path is fraught with execution risks that could turn this visionary upside into a major value trap. Valuation mismatches remain at the forefront of this skepticism: Tesla’s public multiples are unlike any company ever, with many believing they are “stretched.” On the other hand, SpaceX-xAI’s private “marked-to-muth” pricing hinges on unproven synergies and lofty projects, especially orbital data centers and all of the things Musk and Co. will have to figure out along the way.

Ultimately, the entire thing relies on a high-conviction bet on Musk’s ability to execute at scale. The bullish case is transformative: a vertically integrated AI-space-robotics giant accelerates humanity toward abundance and multi-planetary civilization faster than any siloed company could.