News

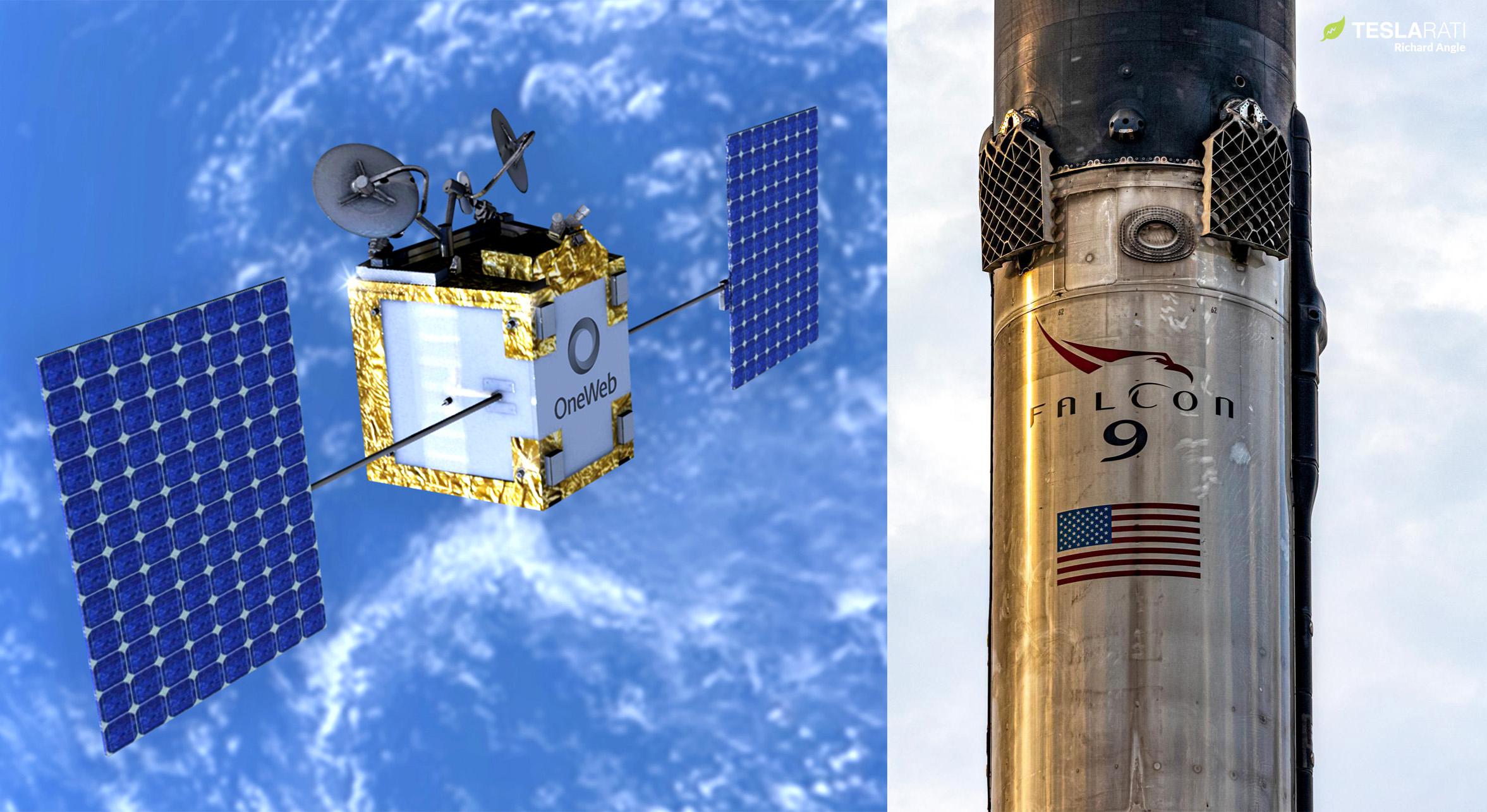

SpaceX wins OneWeb launch contracts, demonstrating extreme flexibility

Demonstrating a level of flexibility that no other commercial launch provider on Earth can likely match, SpaceX and OneWeb have entered into a major launch contract barely three weeks after Russia kicked the satellite internet company off of its Soyuz rockets.

Beginning in early 2020, OneWeb has launched approximately 430 operational small internet satellites – about two-thirds of its first constellation – on a dozen different Russian Soyuz 2.1b and ST-B rockets, including a mission completed as recently as February 10th, 2022. That nominal – albeit slow – deployment ground to a violent halt alongside Russia’s second unprovoked invasion of Ukraine on February 24th, 2022. Within a week, extraordinary Western economic sanctions pushed the unstable head of Russia’s Roscosmos space agency to retaliate by both ending the practice of European-owned Soyuz launches and holding OneWeb’s 13th operational launch hostage.

Another three weeks later, outside of increasingly tense and reluctant cooperation on the International Space Station, the relationship between Russian and Western spaceflight programs has effectively ceased to exist. That includes all 6-7 of OneWeb’s remaining Soyuz launch contracts, each of which the company had already paid more than $50 million for. Though OneWeb technicians were able to escape the increasingly hostile country, Russia effectively repossessed (i.e. stole) OneWeb’s remaining rockets and its 13th batch of operational satellites.

That left OneWeb in an unsurprisingly precarious situation. Having already gone bankrupt once, a major delay could be financially catastrophic for the company. Normally, procuring half a dozen near-term launch contracts at the last second would be virtually impossible. Indeed, ignoring a certain US company, no other launch provider on Earth could even theoretically find or build enough capacity to launch the last third of OneWeb’s constellation without at least a one or two-year delay. Luckily for OneWeb, SpaceX does exist.

As discussed in a March 2nd Teslarati newsletter, SpaceX is extraordinarily unique in a sea of expendable, outdated rockets.

“SpaceX – a direct competitor that is far more vertically integrated than OneWeb and has suffered no major issues from Russian sanctions – may be OneWeb’s only near-term option for its orphaned satellites. The only obvious alternative would be to self-inflict what could be years of delays to avoid SpaceX purely out of spite and instead wait for space to open up on the manifests of companies like Arianespace and ULA or for even less available rockets from India or Japan.

SpaceX has plans for as many as 52+ Falcon launches in 2022, many of which are Starlink missions that the company might be willing to partially replace with a handful of lucrative launches for OneWeb.”

Teslarati – March 2nd, 2022

Because of SpaceX’s exceptional vertical integration and decision to launch its own Starlink internet satellites, which directly compete with OneWeb, the company has dozens of flexible launches planned over the next year or two that it can feasibly convert into commercial missions. No other international launch provider on Earth has the ability to scavenge its own internal manifest to effectively create capacity for last-second commercial demand out of thin air.

At the cost of a handful of Starlink launches, of which SpaceX already has close to 2100 working satellites in orbit, the company will be able to almost heroically step in and complete OneWeb’s constellation, allowing the company to avoid a potential multi-year delay if forced to use other providers.

In fact, due to Europe’s chronic lack of domestic launch capacity as a result of years of Ariane 6 delays, even some institutional European satellites orphaned by Russia’s actions may ultimately be moved to SpaceX Falcon 9 rockets to avoid lengthy launch delays. All told, OneWeb has offered no specific details about the cost, the number of total missions procured, or any other changes implemented in its new SpaceX contract, but the company says it could begin launches as early as this summer – a truly extraordinary demonstration of flexibility from both OneWeb and SpaceX.

News

Tesla Model Y outsells everything in three states, but Ford dominates

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

The Tesla Model Y was the best-selling vehicle in three different states in the U.S. last year, according to new data that shows the all-electric crossover outsold every other car in a few places. However, Ford widely dominated the sales figures with its popular F-Series of pickups.

According to new vehicle registration data compiled by Edmunds and visualized by Visual Capitalist, the Ford F-Series, encompassing models like the F-150, F-250, F-350, and F-450, claimed the title of best-selling vehicle in 29 states.

This dominance underscores the pickup truck’s unbreakable appeal across much of the country, particularly in rural, Midwestern, Southern, and Western states, where towing capacity, durability, and utility for work or recreation remain top priorities.

The Tesla Model Y is the best-selling vehicle in California, Washington, and Nevada

How many states will it dominate next year? https://t.co/ERyoyce42D

— TESLARATI (@Teslarati) March 9, 2026

The F-Series has held the crown as America’s overall best-selling vehicle for decades, a streak that continued strong into 2025 despite broader market shifts.

Yet, amid this truck-heavy reality, Tesla made a notable breakthrough. The Model Y emerged as the top-selling vehicle, not just the leading EV, but the outright best-seller in three key states: California, Nevada, and Washington.

These West Coast strongholds reflect regions with robust EV infrastructure, high environmental awareness, generous incentives, and tech-savvy populations. In California alone, nearly 50 percent of new vehicle registrations were electrified, far outpacing the national average of around 25 percent.

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

Elon Musk: Tesla Model Y is world’s best-selling car for 3rd year in a row

Elsewhere, Japanese crossovers filled many gaps: Toyota’s RAV4 and Honda’s CR-V topped charts in several urban and densely populated Northeastern and Midwestern states, where fuel efficiency, reliability, and family-friendly features win out over larger trucks.

While Ford’s broad reach shows traditional preferences persist, at least for now, Tesla’s Model Y victories in high-population, influential states signal a gradual but undeniable transition toward electrification. As charging networks expand and battery technology improves, more states could follow the West Coast’s lead in the coming years.

This 2025 map captures a pivotal moment: pickup trucks still rule the majority, but EVs are carving out meaningful territory where consumer priorities align with sustainability and innovation. The road ahead promises continued competition between legacy giants and electric disruptors.

Elon Musk

Elon Musk shares updated Starship V3 maiden launch target date

The comment was posted on Musk’s official account on social media platform X.

SpaceX CEO Elon Musk shared a brief Starship V3 update in a post on social media platform X, stating the next launch attempt of the spacecraft could take place in about four weeks.

The comment was posted on Musk’s official account on social media platform X.

Musk’s update suggests that Starship Flight 12 could target a launch around early April, though the schedule will depend on several remaining milestones at SpaceX’s Starbase launch facility in Texas.

Among the key steps is testing and certification of the site’s new launch tower, launch mount, and tank farm systems. These upgrades will support the next generation of Starship vehicles.

Booster 19 is expected to roll to the launch site and be placed on the launch mount before returning to the production facility to receive its 33 Raptor engines. The booster would then return for a static fire test, which could mark the first time a Super Heavy booster equipped with Raptor V3 engines is fired on the pad.

Ship 39 is expected to undergo a similar preparation process. The vehicle will likely return to the production site to receive its six engines before heading to Massey’s test site for static fire testing.

Once both stages are prepared, the booster and ship will roll out to the launch site for the first full stack of a V3 Super Heavy and V3 Starship. A full wet dress rehearsal is expected to follow before any launch attempt.

Elon Musk has previously shared how SpaceX plans to eventually recover Starship’s upper stage using the launch tower’s robotic arms. Musk noted that the company will only attempt to catch the Starship spacecraft after two successful soft landings in the ocean. The approach is intended to reduce risk before attempting a recovery over land.

“Should note that SpaceX will only try to catch the ship with the tower after two perfect soft landings in the ocean. The risk of the ship breaking up over land needs to be very low,” Musk wrote in a post on X.

Such a milestone would represent a major step toward the full reuse of the Starship system, which remains a central goal for SpaceX’s long-term launch strategy.

News

Tesla opens first public Tesla Semi Megacharger site in Los Angeles

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla has opened its first public Tesla Semi Megacharger site in Los Angeles. The station reportedly offers up to 750 kW charging speeds and is open to Tesla Semi customers.

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla Semi Megachargers

The Los Angeles site seems to be the first public Tesla Semi Megacharger that is not located at a Tesla factory. It is also the third Megacharger site currently visible on Tesla’s map.

The Megacharger system is designed specifically for the Tesla Semi and is capable of delivering extremely high charging speeds to support long-haul trucking operations. Infrastructure such as this will likely play a key role in making the Semi competitive with diesel-powered transport trucks.

Tesla’s progress with the Semi has also drawn attention in recent days after Elon Musk biographer Ashlee Vance shared photos from inside the Tesla Semi factory near Giga Nevada. The images suggested that preparations for higher production volumes may be underway, hinting that a broader ramp of the Tesla Semi’s production indeed be approaching.

New deployment strategies

Tesla has continued expanding its broader charging network through several new strategies aimed at accelerating infrastructure deployment. One of these initiatives is the Supercharger for Business program, which allows third parties to purchase Tesla Supercharger equipment and deploy charging stations while still integrating with Tesla’s network.

The program recently marked a milestone in Alpharetta, Georgia, where the city deployed four 325 kW city-branded Superchargers near the Alpharetta Department of Public Safety on Old Milton Parkway. The chargers support the city’s Tesla Model Y police vehicles while also remaining accessible to the public.

As per a report from EVwire, the project was designed not only to support fleet charging but also to generate economic returns that could offset the city’s investment. Tesla’s Supercharger for Business program has already attracted several participants, including businesses and charging providers such as Suncoast Charging, Pie Safe bakery in Idaho, Francis Energy in Oklahoma, and Wawa convenience stores.