Tesla has pushed delivery timelines back again for one of its upgraded Model 3 variants, just weeks after the automaker announced that the refreshed sedan would be hitting North American markets.

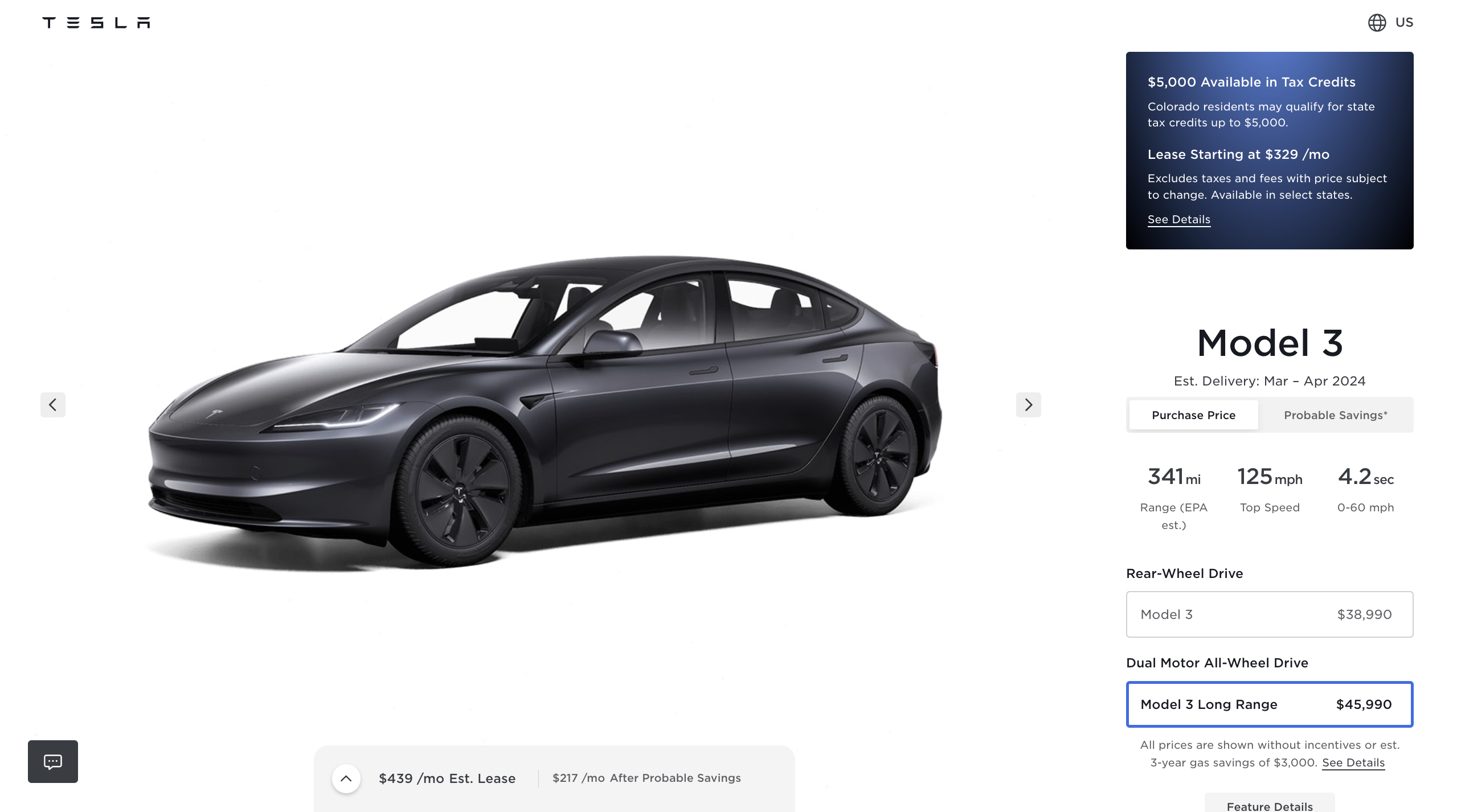

After Tesla adjusted delivery timelines for the new Model 3 to February through March earlier this month, the automaker has now pushed estimated deliveries back a little further for the Long Range variant. According to Tesla’s upgraded Model 3 order configurator, the automaker is now expecting Model 3 Long Range deliveries to make it to customers between March and April, pushed back one more month from the recent change.

Credit: Tesla

Despite the Long Range variant now being estimated to reach customers starting in March, the rear-wheel-drive (RWD) option is still showing a delivery timeline of February through March on the configurator. The Long Range starts at a price of $45,990, while the base-level RWD trim is priced at $38,990.

The change also comes after Tesla’s Head of Investor Relations, Martin Viecha, confirmed plans for a Performance Model 3 variant after an apparent prototype was recently spotted, though it’s not clear when the trim is expected to become available.

Tesla launched the upgraded Model 3 in North America on January 9, after the automaker started rolling the refreshed sedan out in several other markets throughout the latter half of 2023. The upgraded Model 3 is being built at Tesla’s factory in Fremont, California, though recent footage of the site doesn’t seem to show many units on the plant’s exterior just yet.

Demo drives for the upgraded Model 3 became available just over a week ago at select U.S. locations on the West Coast, though looking at the test drive site now shows that Tesla has expanded these to U.S. states across the country.

In drone footage taken on Friday around the Fremont factory, you can see more of the upgraded Model 3 units than in recent footage, though volume still appears somewhat low.

You can see the recent footage from Tesla’s Fremont factory below, with just a few Model 3 units appearing in the company’s outbound lot around the 4-minute mark.

https://www.youtube.com/watch?v=wmJ9ljU-LqU

Customers reported earlier this week that initial North American deliveries of the upgraded Model 3 were slated to begin, with one person’s order saying it would be arriving between January 25 and February 8. The vehicle was also showcased at the Washington D.C. Auto Show this month, alongside the newly released Cybertruck.

New Tesla Model 3 gets 5 stars in China’s IVISTA Intelligent Vehicle Integration test

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send your tips to us at tips@teslarati.com.

News

Tesla ends Full Self-Driving purchase option in the U.S.

In January, Musk announced that Tesla would remove the ability to purchase the suite outright for $8,000. This would give the vehicle Full Self-Driving for its entire lifespan, but Tesla intended to move away from it, for several reasons, one being that a tranche in the CEO’s pay package requires 10 million active subscriptions of FSD.

Tesla has officially ended the option to purchase the Full Self-Driving suite outright, a move that was announced for the United States market in January by CEO Elon Musk.

The driver assistance suite is now exclusively available in the U.S. as a subscription, which is currently priced at $99 per month.

Tesla moved away from the outright purchase option in an effort to move more people to the subscription program, but there are concerns over its current price and the potential for it to rise.

In January, Musk announced that Tesla would remove the ability to purchase the suite outright for $8,000. This would give the vehicle Full Self-Driving for its entire lifespan, but Tesla intended to move away from it, for several reasons, one being that a tranche in the CEO’s pay package requires 10 million active subscriptions of FSD.

Although Tesla moved back the deadline in other countries, it has now taken effect in the U.S. on Sunday morning. Tesla updated its website to reflect this:

🚨 Tesla has officially moved the outright purchase option for FSD on its website pic.twitter.com/RZt1oIevB3

— TESLARATI (@Teslarati) February 15, 2026

There are still some concerns regarding its price, as $99 per month is not where many consumers are hoping to see the subscription price stay.

Musk has said that as capabilities improve, the price will go up, but it seems unlikely that 10 million drivers will want to pay an extra $100 every month for the capability, even if it is extremely useful.

Instead, many owners and fans of the company are calling for Tesla to offer a different type of pricing platform. This includes a tiered-system that would let owners pick and choose the features they would want for varying prices, or even a daily, weekly, monthly, and annual pricing option, which would incentivize longer-term purchasing.

Although Musk and other Tesla are aware of FSD’s capabilities and state is is worth much more than its current price, there could be some merit in the idea of offering a price for Supervised FSD and another price for Unsupervised FSD when it becomes available.

Elon Musk

Musk bankers looking to trim xAI debt after SpaceX merger: report

xAI has built up $18 billion in debt over the past few years, with some of this being attributed to the purchase of social media platform Twitter (now X) and the creation of the AI development company. A new financing deal would help trim some of the financial burden that is currently present ahead of the plan to take SpaceX public sometime this year.

Elon Musk’s bankers are looking to trim the debt that xAI has taken on over the past few years, following the company’s merger with SpaceX, a new report from Bloomberg says.

xAI has built up $18 billion in debt over the past few years, with some of this being attributed to the purchase of social media platform Twitter (now X) and the creation of the AI development company. Bankers are trying to create some kind of financing plan that would trim “some of the heavy interest costs” that come with the debt.

The financing deal would help trim some of the financial burden that is currently present ahead of the plan to take SpaceX public sometime this year. Musk has essentially confirmed that SpaceX would be heading toward an IPO last month.

The report indicates that Morgan Stanley is expected to take the leading role in any financing plan, citing people familiar with the matter. Morgan Stanley, along with Goldman Sachs, Bank of America, and JPMorgan Chase & Co., are all expected to be in the lineup of banks leading SpaceX’s potential IPO.

Since Musk acquired X, he has also had what Bloomberg says is a “mixed track record with debt markets.” Since purchasing X a few years ago with a $12.5 billion financing package, X pays “tens of millions in interest payments every month.”

That debt is held by Bank of America, Barclays, Mitsubishi, UFJ Financial, BNP Paribas SA, Mizuho, and Société Générale SA.

X merged with xAI last March, which brought the valuation to $45 billion, including the debt.

SpaceX announced the merger with xAI earlier this month, a major move in Musk’s plan to alleviate Earth of necessary data centers and replace them with orbital options that will be lower cost:

“In the long term, space-based AI is obviously the only way to scale. To harness even a millionth of our Sun’s energy would require over a million times more energy than our civilization currently uses! The only logical solution, therefore, is to transport these resource-intensive efforts to a location with vast power and space. I mean, space is called “space” for a reason.”

The merger has many advantages, but one of the most crucial is that it positions the now-merged companies to fund broader goals, fueled by revenue from the Starlink expansion, potential IPO, and AI-driven applications that could accelerate the development of lunar bases.

News

Tesla pushes Full Self-Driving outright purchasing option back in one market

Tesla announced last month that it would eliminate the ability to purchase the Full Self-Driving software outright, instead opting for a subscription-only program, which will require users to pay monthly.

Tesla has pushed the opportunity to purchase the Full Self-Driving suite outright in one market: Australia.

The date remains February 14 in North America, but Tesla has pushed the date back to March 31, 2026, in Australia.

NEWS: Tesla is ending the option to buy FSD as a one-time outright purchase in Australia on March 31, 2026.

It still ends on Feb 14th in North America. https://t.co/qZBOztExVT pic.twitter.com/wmKRZPTf3r

— Sawyer Merritt (@SawyerMerritt) February 13, 2026

Tesla announced last month that it would eliminate the ability to purchase the Full Self-Driving software outright, instead opting for a subscription-only program, which will require users to pay monthly.

If you have already purchased the suite outright, you will not be required to subscribe once again, but once the outright purchase option is gone, drivers will be required to pay the monthly fee.

The reason for the adjustment is likely due to the short period of time the Full Self-Driving suite has been available in the country. In North America, it has been available for years.

Tesla hits major milestone with Full Self-Driving subscriptions

However, Tesla just launched it just last year in Australia.

Full Self-Driving is currently available in seven countries: the United States, Canada, China, Mexico, Australia, New Zealand, and South Korea.

The company has worked extensively for the past few years to launch the suite in Europe. It has not made it quite yet, but Tesla hopes to get it launched by the end of this year.

In North America, Tesla is only giving customers one more day to buy the suite outright before they will be committed to the subscription-based option for good.

The price is expected to go up as the capabilities improve, but there are no indications as to when Tesla will be doing that, nor what type of offering it plans to roll out for owners.