LG Energy Solution (LGES) secured IRA-compliant (Inflation Reduction Act) battery minerals through an agreement with Tesla lithium supplier Liontown.

On July 4, 2024, LGES and Liontown signed a convertible note subscription agreement. According to the agreement, Liontown will supply LG Energy Solution with high-quality lithium spodumene from its Kathleen project. The pair will also explore the possibility of establishing a lithium refinery in the future.

“The agreement represents another significant step in our value chain investment strategy aimed at enhancing its resilience to market uncertainties. By partnering with strong players like Liontown, we will continue to secure stable supply of IRA-compliant critical minerals, fulfilling our efforts to provide competitive power solutions for electrification,” said LGES CEO David Kim.

Below are some key aspects of LGES and Liontown’s agreement.

- Liontown extends LG Energy Solution’s existing 5-year offtake agreement by an additional 10 years (15 years total). The extension will provide 700kt of spodumene concentrate over the first 5 years and 1,500kt spodumene concentrate over years 6 to 15 (in aggregate). This extension also includes a commitment to make up to 250kt spodumene concentrate available over the first 10 years (2.45Mt in total);

- Downstream collaboration agreement to commence feasibility studies to establish an IRA-compliant lithium refinery aimed at processing spodumene from Kathleen Valley into battery-grade lithium chemicals[2];

- LG Energy Solution will invest US$250 million (A$379 million[3]) through Convertible Notes. The funding will underpin the production ramp-up of Liontown’s world-class Kathleen Valley Project in Western Australia. The first production of lithium spodumene concentration from Kathleen Valley is anticipated by the end of July.

LG Energy Solution’s partnership with Liontown secures its battery supply chain in the United States as it ramps up 4680 production. Liontown also has lithium supply agreements with Tesla and Ford.

LGES is currently preparing to start 4680 production in South Korea. The company is also prioritizing the buildout of its 4680 battery assembly line in Arizona.

Battery minerals and their place of origin account for a big chunk of the IRA’s maximum credit. Critical battery minerals account for $3,750 out of the $7,500 credit. The IRA set applicable percentage goals for the value of critical minerals contained in electric vehicle (EV) batteries that automakers have to meet.

In 2023, the applicable percentage was 40%, meaning 40% of the minerals used in EV batteries must be extracted or processed in the United States, a country with a free trade agreement with the US, or recycled in North America. The IRA’s applicable percentage increases by 10% each year after 2023 until it hits 80% in 2027.

Many EVs did not qualify for the full $7,500 tax credit after battery mineral requirements were enforced. The US government has issued mineral exemptions to give automakers time to adjust their battery supply chain.

Below are the lists of EVs that qualify for the IRA’s tax credits. (Source: Internal Revenue Service)

If you have any tips, contact me at maria@teslarati.com or via X @Writer_01001101.

News

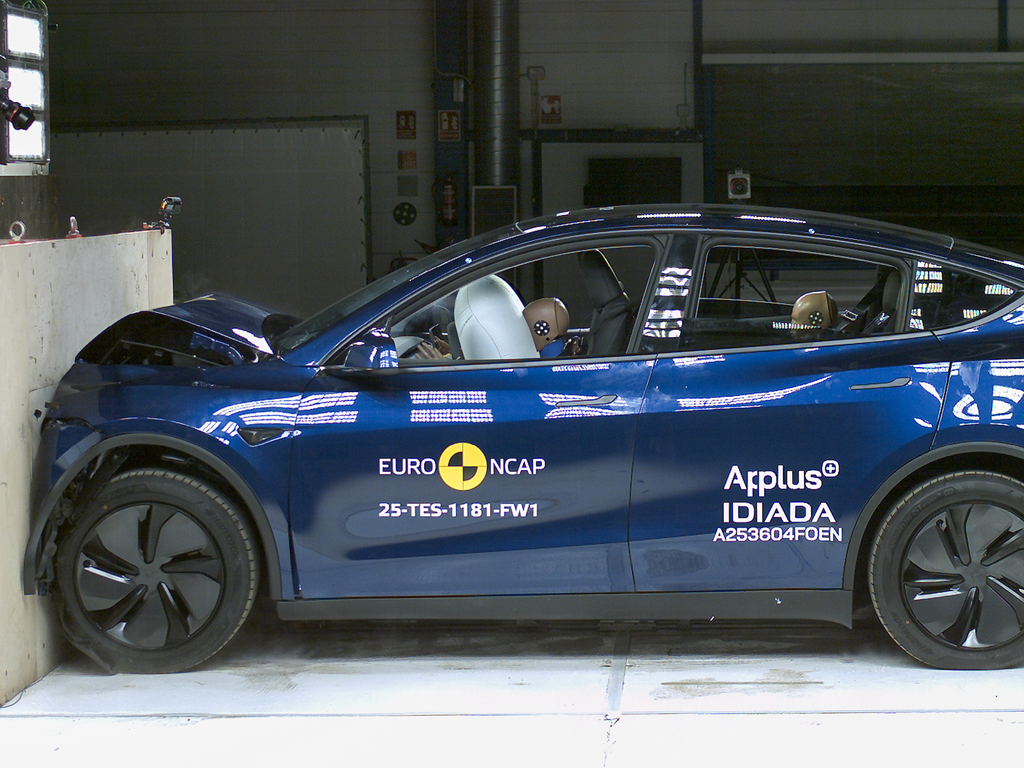

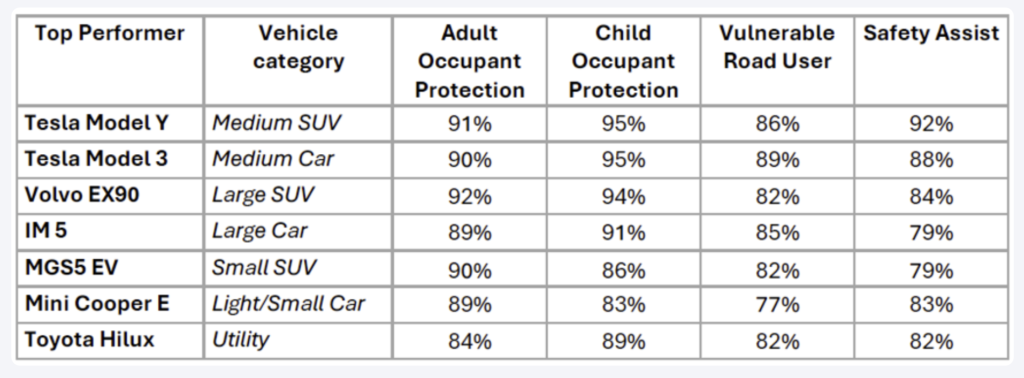

Tesla Model Y and Model 3 named safest vehicles tested by ANCAP in 2025

According to ANCAP in a press release, the Tesla Model Y achieved the highest overall weighted score of any vehicle assessed in 2025.

The Tesla Model Y recorded the highest overall safety score of any vehicle tested by ANCAP in 2025. The Tesla Model 3 also delivered strong results, reinforcing the automaker’s safety leadership in Australia and New Zealand.

According to ANCAP in a press release, the Tesla Model Y achieved the highest overall weighted score of any vehicle assessed in 2025. ANCAP’s 2025 tests evaluated vehicles across four key pillars: Adult Occupant Protection, Child Occupant Protection, Vulnerable Road User Protection, and Safety Assist technologies.

The Model Y posted consistently strong results in all four categories, distinguishing itself through a system-based safety approach that combines structural crash protection with advanced driver-assistance features such as autonomous emergency braking, lane support, and driver monitoring.

This marked the second time the Model Y has topped ANCAP’s annual safety rankings. The Model Y’s previous version was also ANCAP’s top performer in 2022.

The Tesla Model 3 also delivered a strong performance in ANCAP’s 2025 tests, contributing to Tesla’s broader safety presence across segments. Similar to the Model Y, the Model 3 also earned impressive scores across the ANCAP’s four pillars. This made the vehicle the top performer in the Medium Car category.

ANCAP Chief Executive Officer Carla Hoorweg stated that the results highlight a growing industry shift toward integrated safety design, with improvements in technologies such as autonomous emergency braking and lane support translating into meaningful real-world protection.

“ANCAP’s testing continues to reinforce a clear message: the safest vehicles are those designed with safety as a system, not a checklist. The top performers this year delivered consistent results across physical crash protection, crash avoidance and vulnerable road user safety, rather than relying on strength in a single area.

“We are also seeing increasing alignment between ANCAP’s test requirements and the safety technologies that genuinely matter on Australian and New Zealand roads. Improvements in autonomous emergency braking, lane support, and driver monitoring systems are translating into more robust protection,” Hoorweg said.

News

Tesla Sweden uses Megapack battery to bypass unions’ Supercharger blockade

Just before Christmas, Tesla went live with a new charging station in Arlandastad, outside Stockholm, by powering it with a Tesla Megapack battery.

Tesla Sweden has successfully launched a new Supercharger station despite an ongoing blockade by Swedish unions, using on-site Megapack batteries instead of traditional grid connections. The workaround has allowed the Supercharger to operate without direct access to Sweden’s electricity network, which has been effectively frozen by labor action.

Tesla has experienced notable challenges connecting its new charging stations to Sweden’s power grid due to industrial action led by Seko, a major Swedish trade union, which has blocked all new electrical connections for new Superchargers. On paper, this made the opening of new Supercharger sites almost impossible.

Despite the blockade, Tesla has continued to bring stations online. In Malmö and Södertälje, new Supercharger locations opened after grid operators E.ON and Telge Nät activated the sites. The operators later stated that the connections had been made in error.

More recently, however, Tesla adopted a different strategy altogether. Just before Christmas, Tesla went live with a new charging station in Arlandastad, outside Stockholm, by powering it with a Tesla Megapack battery, as noted in a Dagens Arbete (DA) report.

Because the Supercharger station does not rely on a permanent grid connection, Tesla was able to bypass the blocked application process, as noted by Swedish car journalist and YouTuber Peter Esse. He noted that the Arlandastad Supercharger is likely dependent on nearby companies to recharge the batteries, likely through private arrangements.

Eight new charging stalls have been launched in the Arlandastad site so far, which is a fraction of the originally planned 40 chargers for the location. Still, the fact that Tesla Sweden was able to work around the unions’ efforts once more is impressive, especially since Superchargers are used even by non-Tesla EVs.

Esse noted that Tesla’s Megapack workaround is not as easily replicated in other locations. Arlandastad is unique because neighboring operators already have access to grid power, making it possible for Tesla to source electricity indirectly. Still, Esse noted that the unions’ blockades have not affected sales as much.

“Many want Tesla to lose sales due to the union blockades. But you have to remember that sales are falling from 2024, when Tesla sold a record number of cars in Sweden. That year, the unions also had blockades against Tesla. So for Tesla as a charging operator, it is devastating. But for Tesla as a car company, it does not matter in terms of sales volumes. People charge their cars where there is an opportunity, usually at home,” Esse noted.

Elon Musk

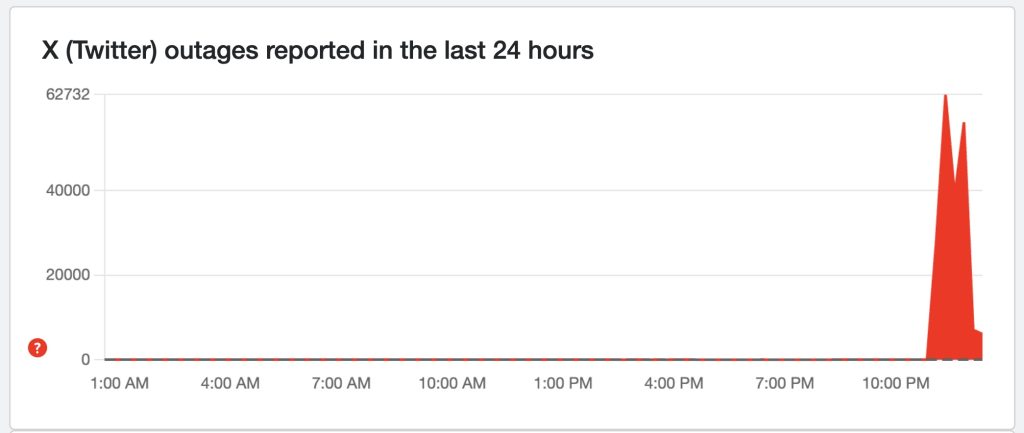

Elon Musk’s X goes down as users report major outage Friday morning

Error messages and stalled loading screens quickly spread across the service, while outage trackers recorded a sharp spike in user reports.

Elon Musk’s X experienced an outage Friday morning, leaving large numbers of users unable to access the social media platform.

Error messages and stalled loading screens quickly spread across the service, while outage trackers recorded a sharp spike in user reports.

Downdetector reports

Users attempting to open X were met with messages such as “Something went wrong. Try reloading,” often followed by an endless spinning icon that prevented access, according to a report from Variety. Downdetector data showed that reports of problems surged rapidly throughout the morning.

As of 10:52 a.m. ET, more than 100,000 users had reported issues with X. The data indicated that 56% of complaints were tied to the mobile app, while 33% were related to the website and roughly 10% cited server connection problems. The disruption appeared to begin around 10:10 a.m. ET, briefly eased around 10:35 a.m., and then returned minutes later.

Previous disruptions

Friday’s outage was not an isolated incident. X has experienced multiple high-profile service interruptions over the past two years. In November, tens of thousands of users reported widespread errors, including “Internal server error / Error code 500” messages. Cloudflare-related error messages were also reported.

In March 2025, the platform endured several brief outages spanning roughly 45 minutes, with more than 21,000 reports in the U.S. and 10,800 in the U.K., according to Downdetector. Earlier disruptions included an outage in August 2024 and impairments to key platform features in July 2023.