News

Renderings of SpaceX clawboat’s huge net upgrade is a taste of what’s to come

After several close-but-no-cigar attempts at snatching a Falcon 9 payload fairing out of the air, SpaceX’s iconic recovery vessel Mr Steven is currently laid up at the company’s newly-acquired Berth 240 dock space, roughly a week into the process of upgrading his arms to support a much larger net. CEO Elon Musk recently hinted that the boat’s net would be expanded by a factor of four, but what would such a dramatic growth look like?

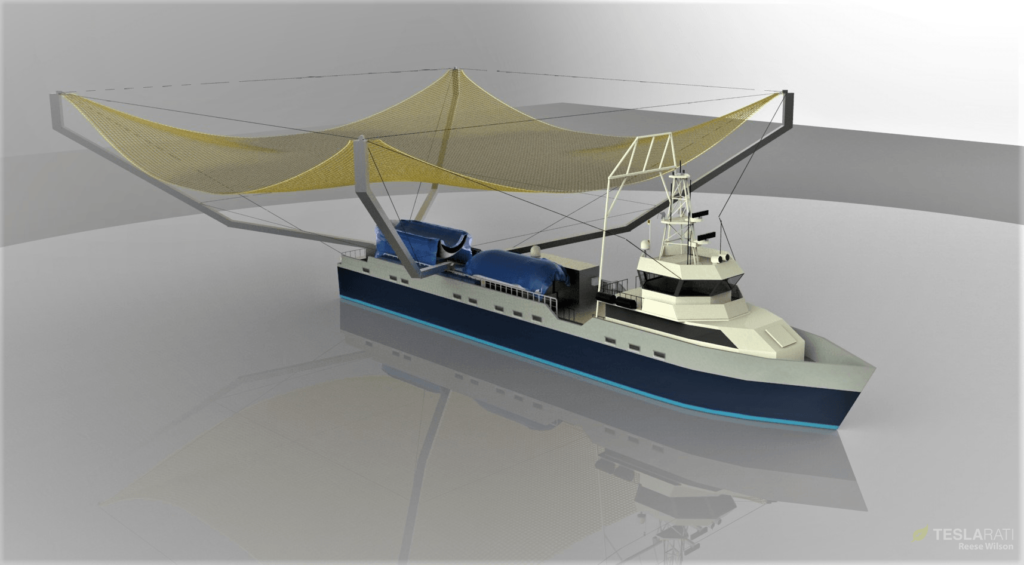

To give a better idea of what to expect from Mr Steven’s arm and net upgrades, Teslarati’s Reese Wilson modeled and rendered the fairing recovery vessel with one such interpretation. The dimensions and aspect ratios may not be a mirror-image of the real-world Mr Steven, but the visual effect of the net upgrade is still fundamentally the same.

With respect to these renders, the actual net growth is somewhat less than the full fourfold area upgrade mentioned by Musk in early June – the concept art’s net is closer to 2.5 or 3 times larger than Mr Steven’s original net. This slight inaccuracy may actually be serendipitous, as a true 4X net could be downright unwieldy without the addition of some sort of complex retraction mechanism, versus the simple but functional (and infinitely reliable) implementation of fixed steel arms at the current net’s scale.

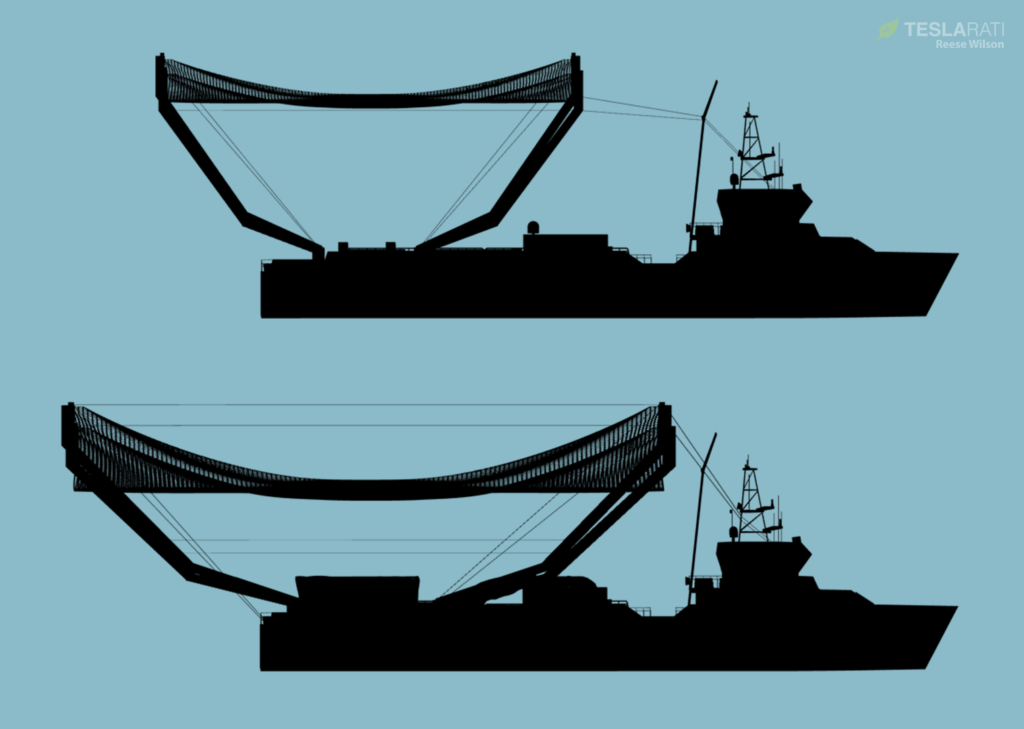

- A side-by-side comparison of Mr Steven before (top) and after (bottom) installation of a net with roughly 2.5X greater catching area. (Reese Wilson)

- Incredibly, this artist rendering of a much larger net installed on Mr Steven was perhaps two or more times smaller than the solution now installed on the vessel. (Reese Wilson)

Dramatic modifications nevertheless are all but guaranteed, as Mr Steven appears to have had the entire arm apparatus – including the steel base attaching them to his cargo deck – completely removed and placed on the side of the dock, still less permanent than the apparent decision to plasma or torch cut each arm off of that base, one of which is visible dockside at Berth 240. It may be possible to re-weld those severed arms onto the base, but it’s arguably more likely that entirely new arms, an entirely new base, or both will be fabricated, and those larger arms will themselves require a much larger net.

Ultimately, the fairing recovery vessel has gotten as close as 50 meters to gently catching a parasailing rocket fairing minutes after launch, an extraordinarily tiny error compared to the broader scope of the task at hand. Upon separation from Falcon 9’s upper stage, each payload fairing half is routinely traveling at speeds of 1.5 to 2 kilometers per second and reach apogees anywhere from 100 to 130 kilometers, all while traveling the better part of a thousand miles (800 mi/1300 km for Iridium-6) to reach Mr Steven’s net. As such, “missing” by 50 meters is an extraordinary achievement.

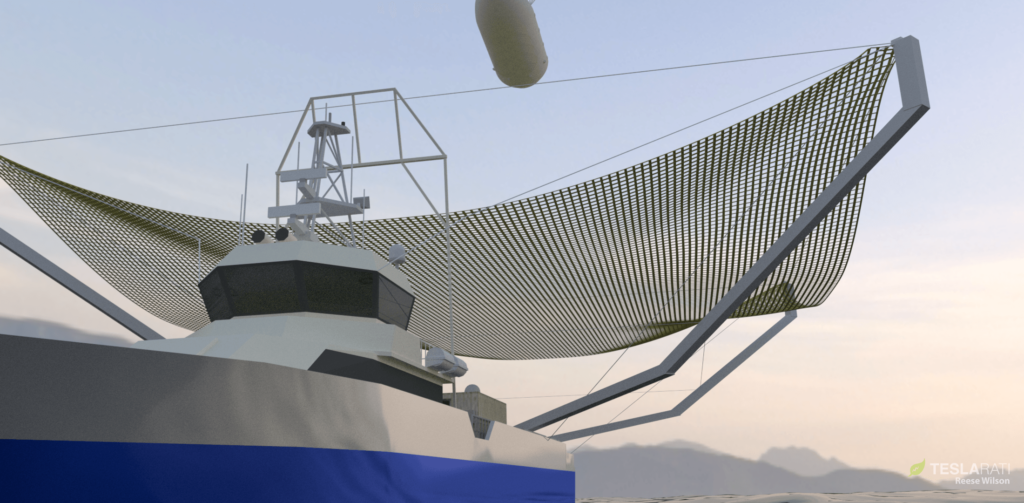

- A fairing floats gently into the welcoming embrace of Mr Steven’s upgrade net and arms. (Reese Wilson)

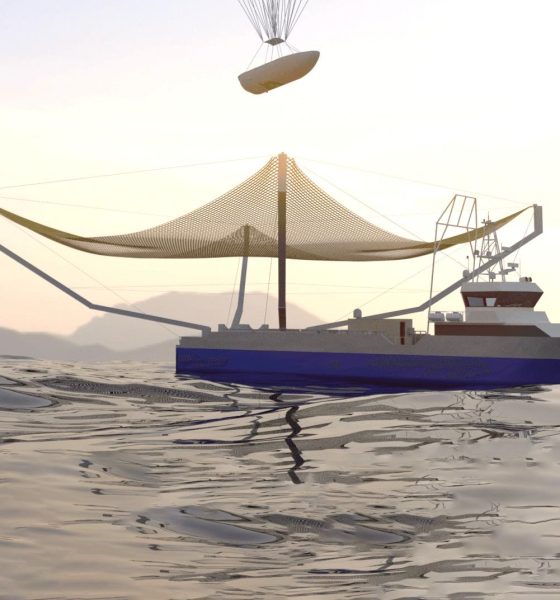

- With any luck, viewers may get a live view of the vessel’s next recovery attempts. (Reese Wilson)

- Mr Steven is currently undergoing arm surgery (upgrades) at SpaceX’s future BFR factory lot, known as Berth 240. (Elon Musk)

A fairing floats gently into the welcoming embrace of Mr Steven’s upgrade net and arms. (Reese Wilson)

With the vessel’s current net roughly 30 meters or 100 feet square (Mr Steven is 60m/200ft bow to stern), give or take 25%, a full fourfold upgrade would double each dimension, which could singlehandedly cut the error margin required for fairing recovery (currently 50 meters) by more than 50% if it remains square. If SpaceX finds a way to functionally achieve something close to a fourfold increase in area with a more rectangular aspect ratio (assuming that the fairing’s present error is more a matter of glideslope inaccuracy than properly pointing the half at Mr Steven), a rectangular net with a width ~50% and length ~300% larger – say 40 meters by 80 meters – would completely close the error gap between reliably missing and reliably catching Falcon fairings. To compare, a common football (soccer for our American readers) field is typically 70 meters by 100 meters.

Time will tell, and we’ll find out soon whether those arm and net upgrades can be available for SpaceX’s next California launch, currently scheduled on the morning of July 20th.

One half of SpaceX’s Iridium-6/GRACE-FO just moments before touchdown on the Pacific Ocean. (SpaceX)

Follow us for live updates, peeks behind the scenes, and photos from Teslarati’s East and West Coast photographers.

Teslarati – Instagram – Twitter

Tom Cross – Twitter

Pauline Acalin – Twitter

Eric Ralph – Twitter

Elon Musk

SpaceX to launch Starlink V2 satellites on Starship starting 2027

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls.

SpaceX is looking to start launching its next-generation Starlink V2 satellites in mid-2027 using Starship.

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls during remarks at Mobile World Congress (MWC) in Barcelona, Spain.

“With Starship, we’ll be able to deploy the constellation very quickly,” Nicolls stated. “Our goal is to deploy a constellation capable of providing global and contiguous coverage within six months, and that’s roughly 1,200 satellites.”

Nicolls added that once Starship is operational, it will be capable of launching approximately 50 of the larger, more powerful Starlink satellites at a time, as noted in a Bloomberg News report.

The initial deployment of roughly 1,200 next-generation satellites is intended to establish global and contiguous coverage. After that phase, SpaceX plans to continue expanding the system to reach “truly global coverage, including the polar regions,” Nicolls said.

Currently, all Starlink satellites are launched on SpaceX’s Falcon 9 rocket. The next-generation fleet will rely on Starship, which remains in development following a series of test flights in 2025. SpaceX is targeting its next Starship test flight, featuring an upgraded version of the rocket, as soon as this month.

Starlink is currently the largest satellite network in orbit, with nearly 10,000 satellites deployed. Bloomberg Intelligence estimates the business could generate approximately $9 billion in revenue for SpaceX in 2026.

Nicolls also confirmed that SpaceX is rebranding its direct-to-cell service as Starlink Mobile.

The service currently operates with 650 satellites capable of connecting directly to smartphones and has approximately 10 million monthly active users. SpaceX expects that figure to exceed 25 million monthly active users by the end of 2026.

Elon Musk

Elon Musk’s xAI and X to pay off $17.5B debt in full: report

The update was shared initially in a report from Bloomberg News, which cited people reportedly familiar with the matter.

Elon Musk’s social platform X and artificial intelligence startup xAI are reportedly preparing to repay approximately $17.5 billion in outstanding debt in full.

The update was shared initially in a report from Bloomberg News, which cited people reportedly familiar with the matter.

Morgan Stanley, which arranged the debt financing for both companies, has reportedly informed existing lenders that X and xAI plan to pay back the full amount of the $17.5 billion debt. Bloomberg’s sources did not disclose where the capital for the repayment would be coming from.

X, formerly known as Twitter, assumed roughly $12.5 billion in debt during Musk’s acquisition of the company. xAI separately borrowed about $5 billion through bonds and loans last June. The two firms merged last year under xAI Holdings.

Bloomberg noted that portions of the debt are relatively recent and may carry early repayment penalties. xAI’s $3 billion in high-yield bonds are expected to be redeemed at 117 cents on the dollar, reflecting a premium since the debt was expected to stay outstanding for at least two years.

X has been servicing tens of millions of dollars in monthly debt payments, while xAI has reportedly been burning approximately $1 billion in cash per month as it invests heavily in data centers, chips, and AI talent. That being said, xAI also concluded a funding round in January, where it raised $20 billion of new equity.

The repayment plans come as Musk consolidates several of his businesses. SpaceX recently acquired xAI, making it a subsidiary as the company explores plans for space-based data centers. The combined entity has been valued at approximately $1.25 trillion.

Bloomberg previously reported that SpaceX is targeting a confidential IPO filing as soon as this month, potentially positioning the private space firm for a public listing later this year. Representatives for Morgan Stanley declined to comment, and X and xAI did not immediately respond to requests for comment.

News

Tesla Giga Berlin head calls out Handelsblatt’s claimed 2025 production figures

Andre Thierig, Senior Director of Manufacturing at Giga Berlin, published a detailed post on LinkedIn challenging several points made in the publication’s coverage of the Grünheide facility.

Tesla Gigafactory Berlin’s plant manager has publicly pushed back against recent reporting by German business publication Handelsblatt, which cited reportedly erroneous data about the factory’s production figures and financial performance.

Andre Thierig, Senior Director of Manufacturing at Giga Berlin, published a detailed post on LinkedIn challenging several points made in the publication’s coverage of the Grünheide facility.

In his LinkedIn post, Thierig called out Handelsblatt’s claim that 149,000 Model Y vehicles were produced at Giga Berlin in 2025. He noted that “the article is simply filled from front to back with false information and claims!

“I have to set the record straight here! In the last article about Tesla in Grünheide, the Handelsblatt speaks e.g. of 149,000 Model Ys built in 2025. WRONG!

“In 2025, we again produced over 200,000 vehicles. And this despite the fact that we stopped production in Q1 for the changeover to the new Model Y and then ramped it up again to 5,000 units per week over several weeks,” Thierig wrote.

He added that production increased each quarter in 2025 compared to the prior quarter and stated that more than 700,000 Model Y units have been produced at Grünheide since manufacturing began in 2022. For the first quarter of 2026, he stated that the factory is planning another production increase compared to the fourth quarter of 2025.

Thierig also questioned Handelsblatt’s reported 0.74% profit margin, writing that how the publication calculated the figure “remains reserved for their secret ‘calculation skills.’”

Beyond production data, Thierig highlighted Tesla’s broader footprint in Germany, stating that the company has invested more than €5 billion in Grünheide since 2020 and created nearly 11,000 permanent, above-tariff jobs. He added that Tesla is currently investing nearly €100 million into battery cell production at the site, which is expected to generate several hundred additional positions.

In a follow-up comment, Thierig noted that he did communicate with the publication’s editor-in-chief in an effort to “start fresh,” but he was informed that Handelsblatt’s current approach works just fine.

“Last year, I spoke to a representative of the Handelsblatt editor-in-chief and suggested that we “start anew” again. Handelsblatt turned down this offer on the grounds that their current approach works well for them,” Thierig noted.

Sönke Iwersen, Head of Investigative Research at Handelsblatt, responded to Thierig’s post, stating that the newspaper’s figures were based on Tesla’s own annual financial statements for the Grünheide entity.

He cited reported 2024 revenue of €7.68 billion, operating profit of €156.8 million, and net income after taxes of €55.6 million. Iwersen also referenced prior public comments from Elon Musk about Cybertruck demand, noting the gap between reported pre-orders and subsequent annual sales figures.

He also stated that the works council election eligibility figures Giga Berlin had dropped to 10,703 employees today from 12,415 two years ago.

“As far as production figures are concerned, these are figures from the data service provider Inovev. This is also stated in the article. Please compare this with Elon Musk’s information on demand for the Cybertruck. According to Musk, there were one million pre-orders. In the first year, 39,000 units were sold, in the second year 20,000. How can this be explained? With a million pre-orders?

“You yourself have repeatedly pointed out in recent months that no jobs would be cut in Grünheide because Tesla is different from the competition. Now a new works council is being elected in Grünheide. 10,703 people are eligible to vote. Two years ago, 12,415 people were eligible to vote. So there were exactly 1712 fewer from 2024 to 2026,” Iwersen wrote.