SpaceX

SpaceX job posts hint at building satellite constellations for US military

Published within the last week, unusual SpaceX job postings have begun to combine a range of topics unusual for the company, indicating some level of internal interest in entering into an entirely new industry and mode of operations.

Judging from the job descriptions, SpaceX is looking to hire engineers familiar with integrating third-party payloads onto in-house satellite buses, and they are primarily interested in engineers with Top Secret security clearances.

https://twitter.com/collinkrum/status/1002425606401736704

Given the subtlety of the relevant job postings and the apparent need for high-level security clearances to become involved, it’s extremely difficult to figure out what exactly SpaceX’s goals are. Still, they contain just enough detail to point in the direction of several obvious explanations. These revolve around one industry in particular: satellite operations and sales to or for third parties.

To some extent, these job listings are to be expected: SpaceX has extensive experience building spacecraft (Falcon 9 upper stages and Dragon) explicitly intended for internal use and operations only. Instead, what is surprising about these job listings is the presence of repeated references to “customer payload[s]” in the context of “satellite mission design”, “SpaceX-developed satellite constellations and payload missions”, the “simulation of remote sensing payloads and constellations”, and a need for “on-orbit commissioning” or “activation”.

Put simply, there is no obvious explanation for why SpaceX would need any of those things, at least in the context of the company’s publicly-known activities and business interests. Taken individually, they might be explained by – as described in the same listings – “[SpaceX’s expanding] classified mission manifest”, as it’s well-known that SpaceX is in the process of certifying Falcon 9 and Falcon Heavy to launch all practicable Air Force (USAF) and National Reconnaissance Office (NRO) payloads. Those payloads often need to be placed in high-energy orbits that rely on extended upper stage coasts between orbit-raising maneuvers, essentially requiring modifications to Falcon 9’s upper stage such that it becomes a sort of ad-hoc, short-lived satellite.

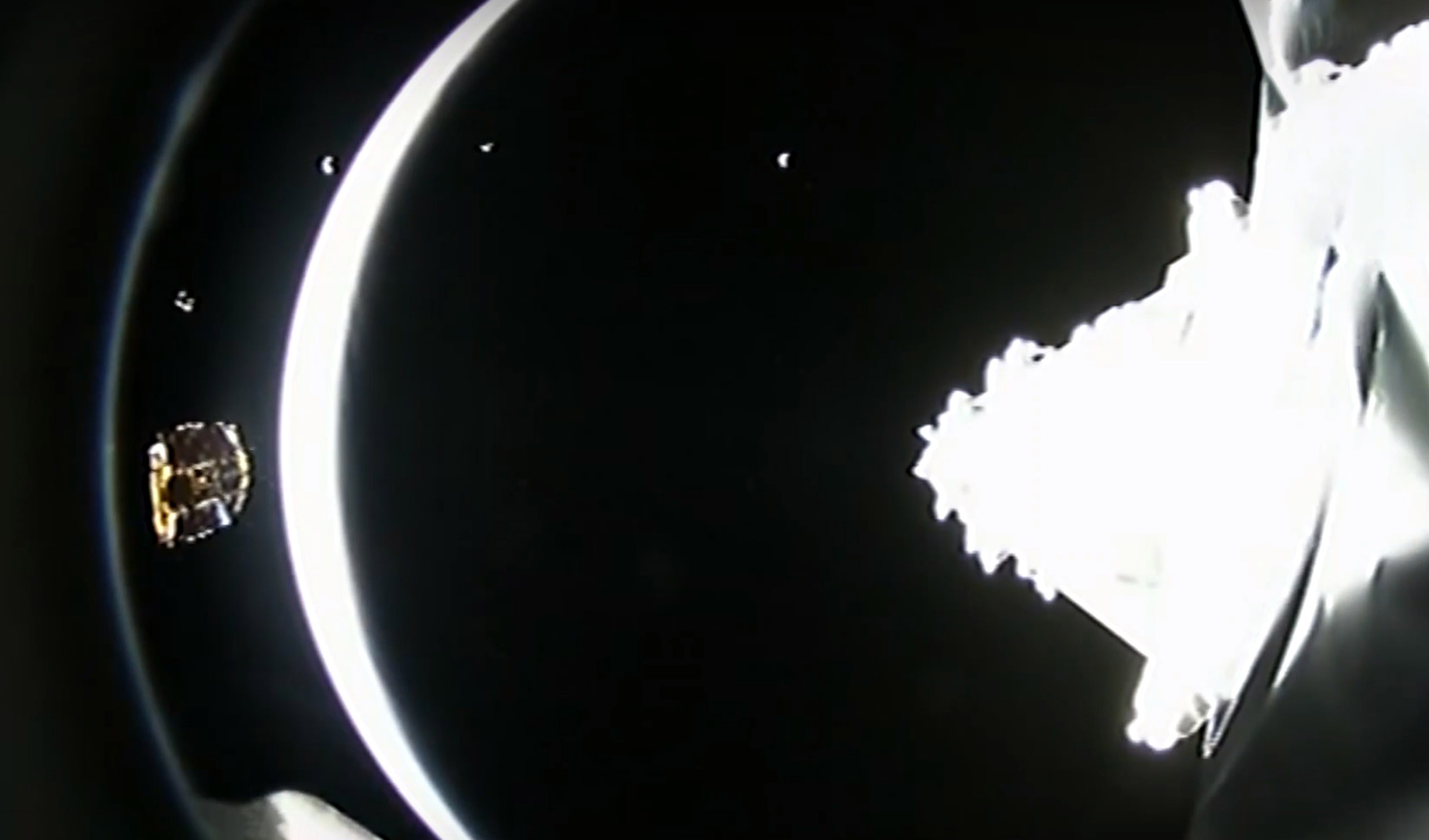

- SpaceX’s first Falcon Heavy launch also happened to be a strategic and successful test of Falcon upper stage coast capabilities. (SpaceX)

- SpaceX’s first two Starlink prototype satellites are pictured here before their inaugural launch, showing off a thoroughly utilitarian bus and several advanced components. (SpaceX)

Starlink spinoffs

However, in all (conceivable) cases where SpaceX might launch a highly-classified payload for a government customer, the dynamic is still precisely that – launch provider (SpaceX) and customer (NRO/USAF/etc). Just like FedEx or UPS have no ownership of or relationship with the goods they transport, satellite launch providers are simply delivering a (very expensive, fragile, and irreplaceable) payload from Point A (the ground) to Point B (orbit). When UPS ships a new smartphone from the manufacturer to the customer, they most certainly do not perform an “in-house commissioning” – if the customer needs help setting up their new phone, they go to the manufacturer or service provider (cell carrier).

In the same way, satellite commissioning is a generally necessary process where the satellite manufacturer – rarely the actual operator or service provider – raises or fine-tunes the expensive spacecraft’s orbit and verifies that all systems and payloads are functioning as intended – only after that process is complete does the manufacturer finally ‘hand off’ the satellite to the customer that paid for it. In some cases, the manufacturer continues to maintain or at least monitor the satellite in the background as the owner serves its own customers, much like how military airplane manufacturers are typically contracted to maintain or support those planes even after final delivery.

Judging from the need for top-secret security clearance in nearly all of these new job postings, SpaceX clearly has a very particular sort of customer in mind. Be it DARPA, NRO, the USAF, or some totally unknown government actor, one or several of the above entities have expressed explicit interest in coopting SpaceX’s newfound status as a prospective dirt-cheap-satellite manufacturer. If that were not the case, SpaceX would not be keen to publish 5+ engineering job postings with top-secret clearance as an explicit prerequisite.

Project Blackjack

Ultimately, it’s undeniable that the prospect of a completed vertically-integrated launch and satellite service provider could be so alluring that entities like the NRO, USAF, or DARPA simply could not pass up the opportunity to at least give it a try. From a purely speculative perspective, the services and processes SpaceX seems to be in the middle of developing are an almost perfect fit with DARPA’s (Defense Advanced Research Projects Agency) brand new Blackjack program. Perfectly summarized in September by Space News reporter Sandra Erwin,

“[DARPA] wants to buy small satellites from commercial vendors, equip them with military sensor payloads and deploy a small constellation in low-Earth orbit to see how they perform in real military operations.”

DARPA awarded a $1.5M contract to smallsat manufacturer and operator Blue Canyon on in October 2018, small relative to the program’s roughly $118M budget. DARPA has made clear that it plans to finalize multiple contracts with different prospective satellite designers and operators in order to ensure a competitive environment, fuel growth in a fairly new industry, and pave the way for the final procurement of an experimental constellation of 20 satellites by 2021. If successful, it could completely change the way the entire US government procures national security-related satellites, offering a far faster, cheaper, and more flexible route to set up unique capabilities.

For prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket recovery fleet check out our brand new LaunchPad and LandingZone newsletters!

Elon Musk

Rumored SpaceX-xAI merger gets apparent confirmation from Elon Musk

The comment follows reports that the rocket maker is weighing a transaction that could further consolidate Musk’s space and AI ventures.

Elon Musk appeared to confirm reports that SpaceX is exploring a potential merger with artificial intelligence startup xAI by responding positively to a post about the reported transaction on X.

Musk’s comment follows reports that the rocket maker is weighing a transaction that could further consolidate his space and AI ventures.

SpaceX xAI merger

As per a recent Reuters report, SpaceX has held discussions about merging with xAI, with the proposed structure potentially involving an exchange of xAI shares for SpaceX stock. The value, structure, and timing of any deal have not been finalized, and no agreement has been signed.

Musk appeared to acknowledge the report in a brief reply on X, responding “Yeah” to a post that described SpaceX as a future “Dyson Swarm company.” The comment references a Dyson Swarm, a sci-fi megastructure concept that consists of a massive network of satellites or structures that orbit a celestial body to harness its energy.

Reuters noted that two entities were formed in Nevada on January 21 to facilitate a potential transaction for the possible SpaceX-xAI merger. The discussions remain ongoing, and a transaction is not yet guaranteed, however.

AI and space infrastructure

A potential merger with xAI would align with Musk’s stated strategy of integrating artificial intelligence development with space-based systems. Musk has previously said that space-based infrastructure could support large-scale computing by leveraging continuous solar energy, an approach he has framed as economically scalable over time.

xAI already has operational ties to Musk’s other companies. The startup develops Grok, a large language model that holds a U.S. Department of Defense contract valued at up to $200 million. AI also plays a central role in SpaceX’s Starlink and Starshield satellite programs, which rely on automation and machine learning for network management and national security applications.

Musk has previously consolidated his businesses through share-based transactions, including Tesla’s acquisition of SolarCity in 2016 and xAI’s acquisition of X last year. Bloomberg has also claimed that Musk is considering a merger between SpaceX and Tesla in the future.

Elon Musk

SpaceX reportedly discussing merger with xAI ahead of blockbuster IPO

In a groundbreaking new report from Reuters, SpaceX is reportedly discussing merger possibilities with xAI ahead of the space exploration company’s plans to IPO later this year, in what would be a blockbuster move.

The outlet said it would combine rockets and Starlink satellites, as well as the X social media platform and AI project Grok under one roof. The report cites “a person briefed on the matter and two recent company filings seen by Reuters.”

Musk, nor SpaceX or xAI, have commented on the report, so, as of now, it is unconfirmed.

With that being said, the proposed merger would bring shares of xAI in exchange for shares of SpaceX. Both companies were registered in Nevada to expedite the transaction, according to the report.

On January 21, both entities were registered in Nevada. The report continues:

“One of them, a limited liability company, lists SpaceX and Bret Johnsen, the company’s chief financial officer, as managing members, while the other lists Johnsen as the company’s only officer, the filings show.”

The source also stated that some xAI executives could be given the option to receive cash in lieu of SpaceX stock. No agreement has been reached, nothing has been signed, and the timing and structure, as well as other important details, have not been finalized.

SpaceX is valued at $800 billion and is the most valuable privately held company, while xAI is valued at $230 billion as of November. SpaceX could be going public later this year, as Musk has said as recently as December that the company would offer its stock publicly.

The plans could help move along plans for large-scale data centers in space, something Musk has discussed on several occasions over the past few months.

At the World Economic Forum last week, Musk said:

“It’s a no-brainer for building solar-powered AI data centers in space, because as I mentioned, it’s also very cold in space. The net effect is that the lowest cost place to put AI will be space and that will be true within two to three years, three at the latest.”

He also said on X that “the most important thing in the next 3-4 years is data centers in space.”

If the report is true and the two companies end up coming together, it would not be the first time Musk’s companies have ended up coming together. He used Tesla stock to purchase SolarCity back in 2016. Last year, X became part of xAI in a share swap.

Elon Musk

SpaceX Starship V3 gets launch date update from Elon Musk

The first flight of Starship Version 3 and its new Raptor V3 engines could happen as early as March.

Elon Musk has announced that SpaceX’s next Starship launch, Flight 12, is expected in about six weeks. This suggests that the first flight of Starship Version 3 and its new Raptor V3 engines could happen as early as March.

In a post on X, Elon Musk stated that the next Starship launch is in six weeks. He accompanied his announcement with a photo that seemed to have been taken when Starship’s upper stage was just about to separate from the Super Heavy Booster. Musk did not state whether SpaceX will attempt to catch the Super Heavy Booster during the upcoming flight.

The upcoming flight will mark the debut of Starship V3. The upgraded design includes the new Raptor V3 engine, which is expected to have nearly twice the thrust of the original Raptor 1, at a fraction of the cost and with significantly reduced weight. The Starship V3 platform is also expected to be optimized for manufacturability.

The Starship V3 Flight 12 launch timeline comes as SpaceX pursues an aggressive development cadence for the fully reusable launch system. Previous iterations of Starship have racked up a mixed but notable string of test flights, including multiple integrated flight tests in 2025.

Interestingly enough, SpaceX has teased an aggressive timeframe for Starship V3’s first flight. Way back in late November, SpaceX noted on X that it will be aiming to launch Starship V3’s maiden flight in the first quarter of 2026. This was despite setbacks like a structural anomaly on the first V3 booster during ground testing.

“Starship’s twelfth flight test remains targeted for the first quarter of 2026,” the company wrote in its post on X.