A California judge has forced General Motors’ (GM) self-driving unit Cruise to increase its settlement offer to the maximum amount, after one of the company’s robotaxis pinned and seriously injured a pedestrian in October.

On October 2, a driverless Cruise vehicle dragged and pinned a pedestrian in San Francisco, and the company’s license to operate self-driving cars was immediately revoked by the California Department of Motor Vehicles (DMV). The DMV later said that Cruise “misrepresented” and “omitted” crucial details about its response to the accident, and the California Public Utilities Commission (CPUC) in December ordered the company to appear before a judge this month.

During the hearing, which was held on Tuesday, California Administrative Law Judge (ALJ) Robert Mason III suggested that Cruise revise its $75,000 settlement offer to the maximum penalty of $112,500, after calling the company’s proposed amount “low,” and even suggesting the company was seeking a “discount.”

While Judge Mason III said he appreciated Cruise attempting to take “corrective action” in its crash response procedures, he added that the company should “take a hint” following his multiple questions about the offer amount, suggesting directly that Cruise change its settlement offer to the full penalty.

“Point taken, your Honor,” responded Craig Glidden, Cruise President and Chief Administrative Officer. “We immediately revise our offer to the amount requested.”

Waymo could face new legal barriers in its expansion to Los Angeles

The hearing discussed findings from an investigation conducted by the law firm Quinn Emanuel, which Cruise hired, including that internet connectivity hampered the company’s sharing of video footage from the accident with regulators in meetings that followed.

In response to the motion for approval to settle at $75,000, the commission can adopt, adopt with revisions, or reject Cruise’s filing. Following the hearing, the next step is for Judge Mason to write a proposed decision on the case for the commissioner’s consideration, with the general timeframe falling within about 60 days, as a CPUC spokesperson clarified to Teslarati.

Cruise said it was eager to resolve the case and move past the incident, adding that it wanted to continue to “advance the mission of bringing driverless cars that are safer to the public and also greater accessibility to the public to the market.”

However, Mason didn’t make it sound like the commission was eager to set the case aside:

“While the commission does fall on the side of getting its cases resolved, I don’t know that this is one of those protracted pieces of litigation that we’re usually most anxious to put aside and then move forward with the regulatory process,” Mason added.

In the original motion, filed on January 30, Cruise outlines the key requirements it would have to follow as part of the settlement:

1. Cruise will adopt voluntarily several new data reporting enhancements that will provide additional data to the Commission concerning California collisions and AVs operating in California under a deployment permit that enter a minimal risk condition (“MRC”) state and result in conditions described in Attachment A;

2. Cruise will provide the Commission with Cruise’s responses to the permit reinstatement questions from the California Department of Motor Vehicles (“DMV”) at the same time Cruise provides those responses to the DMV;

3. Cruise will make a payment of $75,000 to the State General Fund within ten (10) days of the Commission’s approval of the Settlement Agreement without modification; and

4. Upon the Commission’s approval of the Settlement Agreement, the OSC proceeding will be closed.

“We are committed to working in partnership with the CPUC, other regulators and government agencies to improve transportation safety in support of a shared goal –– providing better, safer and more accessible transportation to the public in our communities,” a Cruise spokesperson wrote in an email to Teslarati. “Over the past several months, we have taken important steps to improve our leadership, processes and culture, and we are committed to resolving matters to the Commission’s satisfaction as we work to restore regulatory and public trust.”

Cruise also noted that the accident, which occurred after the pedestrian had already been hit by a human driver, was partially caused by the driverless ride-hailing vehicle falsely identifying the situation as a side-impact collision rather than a frontal collision, causing the Minimal Risk Condition (MRC) response that forces the vehicle to pull over.

In addition, Cruise said it is currently expecting a new Chief Safety Officer in the “not too distant future,” after two co-founders resigned immediately following the accident, and after the company fired nine executives and laid off nearly a quarter of its staff on the same day in December.

GM recently announced plans to cut spending on Cruise in half this year, though it said it also hoped to “refocus and relaunch” the company’s operations. GM CEO Mary Barra highlighted significant changes at Cruise, which the company began implementing following the Quinn Emanuel investigation.

“At Cruise, we are committed to earning back the trust of regulators and the public through our commitments and our actions,” Barra said following GM’s 2023 earnings call.

You can see the full January 30 filing from Cruise below, including the findings from the Quinn Emanuel investigation, which Cruise made public last month.

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send your tips to us at tips@teslarati.com.

News

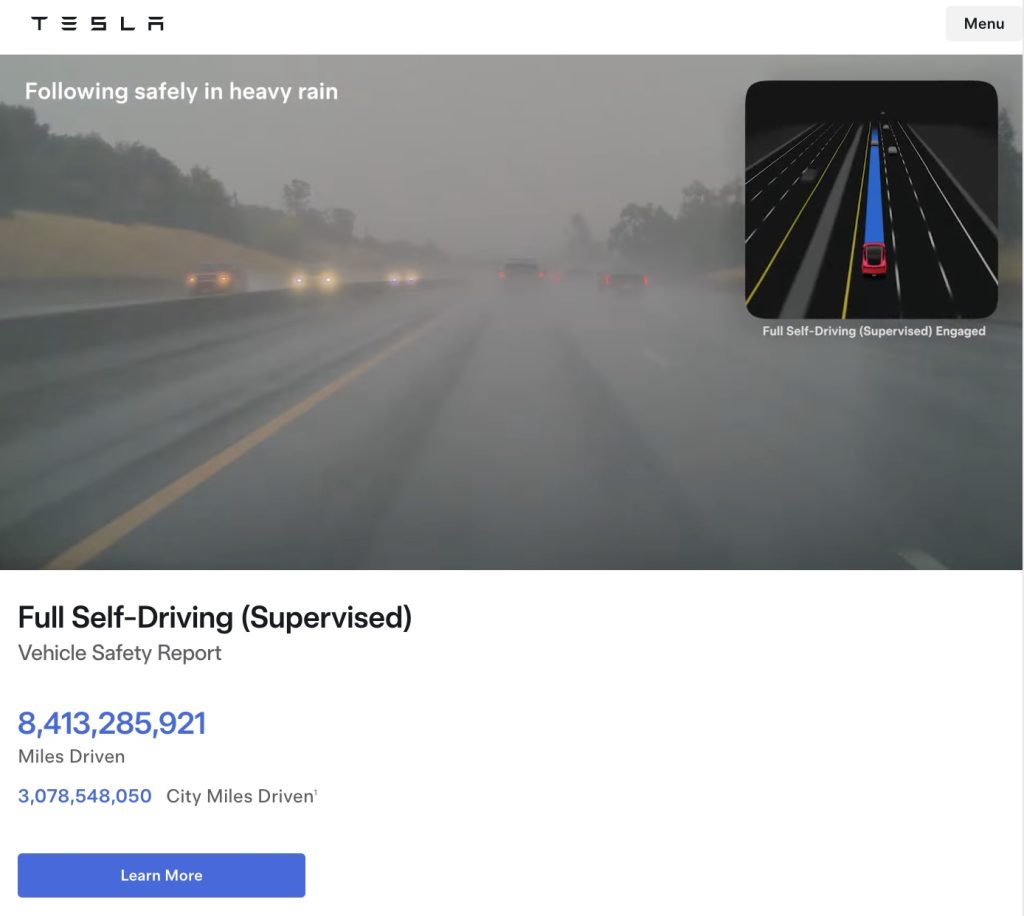

Tesla FSD (Supervised) fleet passes 8.4 billion cumulative miles

The figure appears on Tesla’s official safety page, which tracks performance data for FSD (Supervised) and other safety technologies.

Tesla’s Full Self-Driving (Supervised) system has now surpassed 8.4 billion cumulative miles.

The figure appears on Tesla’s official safety page, which tracks performance data for FSD (Supervised) and other safety technologies.

Tesla has long emphasized that large-scale real-world data is central to improving its neural network-based approach to autonomy. Each mile driven with FSD (Supervised) engaged contributes additional edge cases and scenario training for the system.

The milestone also brings Tesla closer to a benchmark previously outlined by CEO Elon Musk. Musk has stated that roughly 10 billion miles of training data may be needed to achieve safe unsupervised self-driving at scale, citing the “long tail” of rare but complex driving situations that must be learned through experience.

The growth curve of FSD Supervised’s cumulative miles over the past five years has been notable.

As noted in data shared by Tesla watcher Sawyer Merritt, annual FSD (Supervised) miles have increased from roughly 6 million in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and 4.25 billion in 2025. In just the first 50 days of 2026, Tesla owners logged another 1 billion miles.

At the current pace, the fleet is trending towards hitting about 10 billion FSD Supervised miles this year. The increase has been driven by Tesla’s growing vehicle fleet, periodic free trials, and expanding Robotaxi operations, among others.

With the fleet now past 8.4 billion cumulative miles, Tesla’s supervised system is approaching that threshold, even as regulatory approval for fully unsupervised deployment remains subject to further validation and oversight.

Elon Musk

Elon Musk fires back after Wikipedia co-founder claims neutrality and dubs Grokipedia “ridiculous”

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Elon Musk fired back at Wikipedia co-founder Jimmy Wales after the longtime online encyclopedia leader dismissed xAI’s new AI-powered alternative, Grokipedia, as a “ridiculous” idea that is bound to fail.

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Wales made the comments while answering questions about Wikipedia’s neutrality. According to Wales, Wikipedia prides itself on neutrality.

“One of our core values at Wikipedia is neutrality. A neutral point of view is non-negotiable. It’s in the community, unquestioned… The idea that we’ve become somehow ‘Wokepidea’ is just not true,” Wales said.

When asked about potential competition from Grokipedia, Wales downplayed the situation. “There is no competition. I don’t know if anyone uses Grokipedia. I think it is a ridiculous idea that will never work,” Wales wrote.

After Grokipedia went live, Larry Sanger, also a co-founder of Wikipedia, wrote on X that his initial impression of the AI-powered Wikipedia alternative was “very OK.”

“My initial impression, looking at my own article and poking around here and there, is that Grokipedia is very OK. The jury’s still out as to whether it’s actually better than Wikipedia. But at this point I would have to say ‘maybe!’” Sanger stated.

Musk responded to Sanger’s assessment by saying it was “accurate.” In a separate post, he added that even in its V0.1 form, Grokipedia was already better than Wikipedia.

During a past appearance on the Tucker Carlson Show, Sanger argued that Wikipedia has drifted from its original vision, citing concerns about how its “Reliable sources/Perennial sources” framework categorizes publications by perceived credibility. As per Sanger, Wikipedia’s “Reliable sources/Perennial sources” list leans heavily left, with conservative publications getting effectively blacklisted in favor of their more liberal counterparts.

As of writing, Grokipedia has reportedly surpassed 80% of English Wikipedia’s article count.

News

Tesla Sweden appeals after grid company refuses to restore existing Supercharger due to union strike

The charging site was previously functioning before it was temporarily disconnected in April last year for electrical safety reasons.

Tesla Sweden is seeking regulatory intervention after a Swedish power grid company refused to reconnect an already operational Supercharger station in Åre due to ongoing union sympathy actions.

The charging site was previously functioning before it was temporarily disconnected in April last year for electrical safety reasons. A temporary construction power cabinet supplying the station had fallen over, described by Tesla as occurring “under unclear circumstances.” The power was then cut at the request of Tesla’s installation contractor to allow safe repair work.

While the safety issue was resolved, the station has not been brought back online. Stefan Sedin, CEO of Jämtkraft elnät, told Dagens Arbete (DA) that power will not be restored to the existing Supercharger station as long as the electric vehicle maker’s union issues are ongoing.

“One of our installers noticed that the construction power had been backed up and was on the ground. We asked Tesla to fix the system, and their installation company in turn asked us to cut the power so that they could do the work safely.

“When everything was restored, the question arose: ‘Wait a minute, can we reconnect the station to the electricity grid? Or what does the notice actually say?’ We consulted with our employer organization, who were clear that as long as sympathy measures are in place, we cannot reconnect this facility,” Sedin said.

The union’s sympathy actions, which began in March 2024, apply to work involving “planning, preparation, new connections, grid expansion, service, maintenance and repairs” of Tesla’s charging infrastructure in Sweden.

Tesla Sweden has argued that reconnecting an existing facility is not equivalent to establishing a new grid connection. In a filing to the Swedish Energy Market Inspectorate, the company stated that reconnecting the installation “is therefore not covered by the sympathy measures and cannot therefore constitute a reason for not reconnecting the facility to the electricity grid.”

Sedin, for his part, noted that Tesla’s issue with the Supercharger is quite unique. And while Jämtkraft elnät itself has no issue with Tesla, its actions are based on the unions’ sympathy measures against the electric vehicle maker.

“This is absolutely the first time that I have been involved in matters relating to union conflicts or sympathy measures. That is why we have relied entirely on the assessment of our employer organization. This is not something that we have made any decisions about ourselves at all.

“It is not that Jämtkraft elnät has a conflict with Tesla, but our actions are based on these sympathy measures. Should it turn out that we have made an incorrect assessment, we will correct ourselves. It is no more difficult than that for us,” the executive said.