News

Elon Musk’s Neuralink unveils sleek V0.9 device, uses sassy pigs for live brain machine demo

After another year of successfully staying in the shadows, Elon Musk’s Neuralink has revealed what’s been going on behind the scenes in terms of technological progress. In a live streamed event on Friday afternoon, the brain-machine interface company gave a demonstration, took questions, and left audiences with even more to mull over than ever.

“The primary purpose of this demo is recruiting,” Musk stated at the very beginning of the presentation. He emphasized that everyone at some point in their life will face a brain or spine problem – all inherently electrical – meaning it takes electrical solutions to solve electrical problems. Neuralink’s goals are to solve these problems for anyone who wants them solved, and that application will be simple and reversible with no negative effects.

Two pigs were used for the ‘real-time’ demonstration promised in the days leading up to the event. The first, named Gertrude, had a Neuralink implant installed for two months and was shown to be healthy and happy. A second pig, named Dorothy, had the implant previously installed and removed with no side effects afterward.

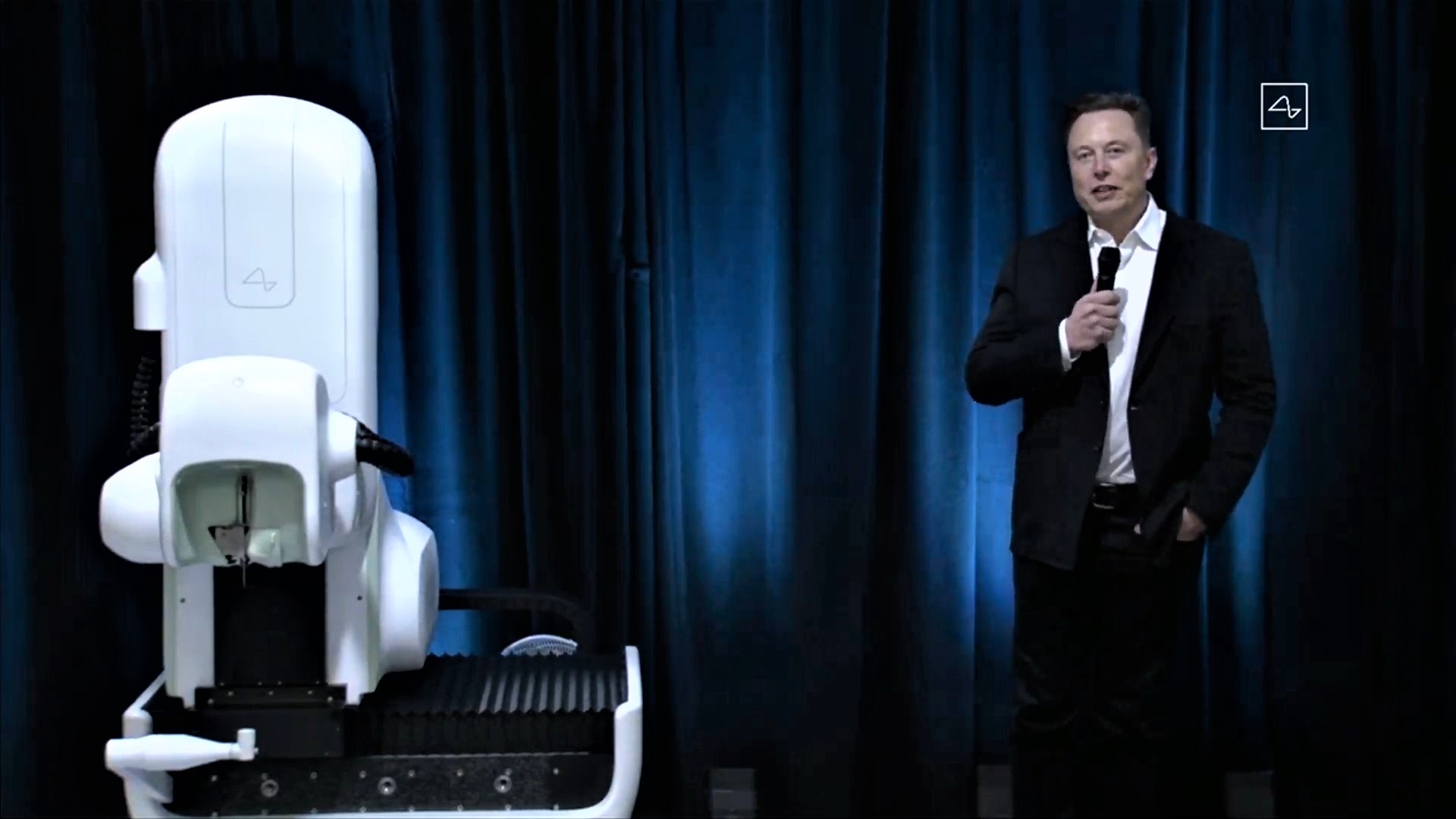

- Elon Musk shows off the Neuralink v0.9 Device (Credit: Neuralink)

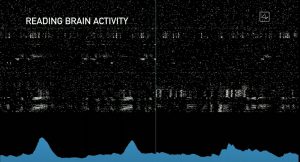

After a bit of a delay from the amusingly sassy Neuralink-implanted pigs, the live stream and in-house audience witnessed Gertrude’s device in action. Notably, the neural implants could predict all the limb movements of the pigs based on the neural activity being read. Each reading was shown on a screen and musical notes attached as the data was processed.

Overall, here are some of the main takeaways from the presentation.

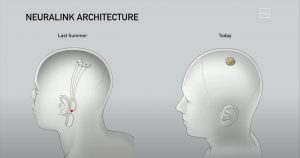

- The Neuralink implant device has been dramatically simplified since Summer 2019. Its design will be very low profile and nearly invisible on the outside, leaving only a small scar that could be covered by hair. “It’s like a FitBit in your skull with tiny wires,” Musk half-joked. “I could have it right now and you wouldn’t even know. Maybe I do!”

- The implant device is inductively charged, much like wireless smartphones are charged. It will also have functions that are akin to those available on smartwatches today.

- A “smart” robot installs the device, which requires engineering talent to accomplish, hence the recruiting focus of the Neuralink event. The “V2” robot featured in this year’s presentation looks like a step up from last year’s machine.

- The electrodes are installed without general anesthesia, no bleeding, and no noticeable damage. The currently developed robot has done all the current implant installations to date.

- The implant can be installed and removed without any side effects.

- You can have multiple Neuralink devices implanted and they will work seamlessly.

- The implant device would have an application linked to your phones.

- Neuralink received a ‘breakthrough device’ designation from the FDA in July, and the company is working with the agency to make the technology as safe as possible.

- The device will eventually be able to be sewn deeper within the brain, thereby having access to a greater range of functions beyond the upper cortex. Examples are motor function, depression, and addiction.

- Getting a Neuralink should take less than an hour, without the need for general anesthesia. Users could have the surgery done in the morning and go home later during the day.

- Credit: Neuralink

- Credit: Neuralink

The idea for Musk’s AI-focused brain venture first seemed to really take off after his appearance at Vox Media’s Recode Code Conference in 2016. The CEO had discussed the concept of a neural lace device on several occasions up to that point and suggested at the conference that he might be willing to tackle the challenge himself. A few months later, he revealed that he was in fact working on the idea, which was detailed at great length by Tim Urban on his website Wait But Why.

“He started Neuralink to accelerate our pace into the Wizard Era—into a world where he says that ‘everyone who wants to have this AI extension of themselves could have one, so there would be billions of individual human-AI symbiotes who, collectively, make decisions about the future.’ A world where AI really could be of the people, by the people, for the people,” Urban summarized. Given that bigger picture perspective, the 2020 Neuralink event seems even more impactful.

Neuralink’s official Twitter account opened the virtual floor to questions using the #askneuralink hashtag the night before the event, prompting several questions during the presentation. However, Musk fanned the building curiosity in the hours beforehand. “Giant gap between experimental medical device for use only in patients with extreme medical problems & widespread consumer use. This is way harder than making a small number of prototypes,” Musk responded to one question directed towards the mass market viability of a future Neuralink product line.

https://twitter.com/flcnhvy/status/1299422178329362437

Also in the days prior to the Neuralink event, Musk teased a few more bits of information about what to expect. “Live webcast of working @Neuralink device,” he said. Just prior to his confirmation of the device demonstration, he revealed that version two of the robot initially shown in the first progress update in 2019 wasn’t quite up to the level of a LASIK eye surgery machine, though only a few years away.

You can watch the full event below:

Elon Musk

Tesla is ramping up its advertising strategy on social media

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

Tesla seems to be ramping up its advertising strategy on social media once again. Marketing and advertising have not been a major focus of Tesla’s, something that has brought some criticism to the company from its fans.

However, the company looks to be making adjustments to that narrative, as it has at times in the past, as ads were spotted on several different platforms over the past few days.

On Facebook and YouTube, ads were spotted that were evidently placed by Tesla. On Facebook, Tesla was advertising Full Self-Driving, and on YouTube, an ad for its Energy Division was spotted:

Tesla also threw up some ads on YouTube for Energy https://t.co/19DGQMjBsA pic.twitter.com/XQRfgaDKxY

— TESLARATI (@Teslarati) March 9, 2026

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

In 2022, Tesla’s U.S. ad spend was roughly $152,000, a rounding error compared to General Motors’ $3.6 billion the following year.

Traditional automakers averaged about $495 per vehicle on ads; Tesla spent $0. CEOElon Musk’s stance was explicit: “Tesla does not advertise or pay for endorsements,” he posted on X in 2019. “Instead, we use that money to make the product great.”

The strategy relied on word-of-mouth from delighted owners, Elon’s massive X following, viral product launches, media frenzy, and customer referrals. A great product, Musk argued, sells itself. It does not need Super Bowl spots or billboards. Resources poured into R&D instead, with Tesla investing nearly $3,000 per car, far more than rivals.

Tesla counters jab at lack of advertising with perfect response

This reluctance wasn’t arrogance; it was philosophy, and Musk made it clear that the money was better spent on the product. Heavy spending on ads was seen as wasteful when innovation and authenticity drove organic demand. Shareholder calls for marketing budgets were ignored.

The current shift, paid Facebook ads promoting Full Self-Driving (Supervised) and YouTube Shorts offering up to $1,000 back on Powerwall batteries, marks a pragmatic evolution.

These targeted campaigns coincide with the end of one-time FSD purchases and a March 31 deadline for FSD transfer eligibility on new vehicles.

This move likely signals Tesla adapting to scale, as well as a more concerted effort to stop misinformation regarding its platform. As EV competition intensifies and the company bets big on robotaxis and energy storage, pure organic buzz may not suffice to hit adoption targets. Selective digital ads allow precise, cost-effective reach without abandoning core principles.

If successful, it could foreshadow measured expansion into marketing, boosting high-margin software and home energy revenue while preserving Tesla’s innovative edge. But, it’s nice to see the strategy return, especially as Tesla has been reluctant to change its mind in the past.

News

Tesla Model Y outsells everything in three states, but Ford dominates

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

The Tesla Model Y was the best-selling vehicle in three different states in the U.S. last year, according to new data that shows the all-electric crossover outsold every other car in a few places. However, Ford widely dominated the sales figures with its popular F-Series of pickups.

According to new vehicle registration data compiled by Edmunds and visualized by Visual Capitalist, the Ford F-Series, encompassing models like the F-150, F-250, F-350, and F-450, claimed the title of best-selling vehicle in 29 states.

This dominance underscores the pickup truck’s unbreakable appeal across much of the country, particularly in rural, Midwestern, Southern, and Western states, where towing capacity, durability, and utility for work or recreation remain top priorities.

The Tesla Model Y is the best-selling vehicle in California, Washington, and Nevada

How many states will it dominate next year? https://t.co/ERyoyce42D

— TESLARATI (@Teslarati) March 9, 2026

The F-Series has held the crown as America’s overall best-selling vehicle for decades, a streak that continued strong into 2025 despite broader market shifts.

Yet, amid this truck-heavy reality, Tesla made a notable breakthrough. The Model Y emerged as the top-selling vehicle, not just the leading EV, but the outright best-seller in three key states: California, Nevada, and Washington.

These West Coast strongholds reflect regions with robust EV infrastructure, high environmental awareness, generous incentives, and tech-savvy populations. In California alone, nearly 50 percent of new vehicle registrations were electrified, far outpacing the national average of around 25 percent.

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

Elon Musk: Tesla Model Y is world’s best-selling car for 3rd year in a row

Elsewhere, Japanese crossovers filled many gaps: Toyota’s RAV4 and Honda’s CR-V topped charts in several urban and densely populated Northeastern and Midwestern states, where fuel efficiency, reliability, and family-friendly features win out over larger trucks.

While Ford’s broad reach shows traditional preferences persist, at least for now, Tesla’s Model Y victories in high-population, influential states signal a gradual but undeniable transition toward electrification. As charging networks expand and battery technology improves, more states could follow the West Coast’s lead in the coming years.

This 2025 map captures a pivotal moment: pickup trucks still rule the majority, but EVs are carving out meaningful territory where consumer priorities align with sustainability and innovation. The road ahead promises continued competition between legacy giants and electric disruptors.

Elon Musk

Elon Musk shares updated Starship V3 maiden launch target date

The comment was posted on Musk’s official account on social media platform X.

SpaceX CEO Elon Musk shared a brief Starship V3 update in a post on social media platform X, stating the next launch attempt of the spacecraft could take place in about four weeks.

The comment was posted on Musk’s official account on social media platform X.

Musk’s update suggests that Starship Flight 12 could target a launch around early April, though the schedule will depend on several remaining milestones at SpaceX’s Starbase launch facility in Texas.

Among the key steps is testing and certification of the site’s new launch tower, launch mount, and tank farm systems. These upgrades will support the next generation of Starship vehicles.

Booster 19 is expected to roll to the launch site and be placed on the launch mount before returning to the production facility to receive its 33 Raptor engines. The booster would then return for a static fire test, which could mark the first time a Super Heavy booster equipped with Raptor V3 engines is fired on the pad.

Ship 39 is expected to undergo a similar preparation process. The vehicle will likely return to the production site to receive its six engines before heading to Massey’s test site for static fire testing.

Once both stages are prepared, the booster and ship will roll out to the launch site for the first full stack of a V3 Super Heavy and V3 Starship. A full wet dress rehearsal is expected to follow before any launch attempt.

Elon Musk has previously shared how SpaceX plans to eventually recover Starship’s upper stage using the launch tower’s robotic arms. Musk noted that the company will only attempt to catch the Starship spacecraft after two successful soft landings in the ocean. The approach is intended to reduce risk before attempting a recovery over land.

“Should note that SpaceX will only try to catch the ship with the tower after two perfect soft landings in the ocean. The risk of the ship breaking up over land needs to be very low,” Musk wrote in a post on X.

Such a milestone would represent a major step toward the full reuse of the Starship system, which remains a central goal for SpaceX’s long-term launch strategy.