Nine profitable quarters and counting. With its blockbuster Q3 2021 results, Tesla (NASDAQ:TSLA) has all but proven that is a sustainable business. An earnings per share (EPS) of $1.86 and a monster 30.5% automotive gross margin just proves that. Tesla was bold in its Q3 2021 Update Letter, and for good reason. In the third quarter, Tesla achieved its best-ever net income, operating profit, and gross profit — all while its ASP decreased by 6% year-over-year.

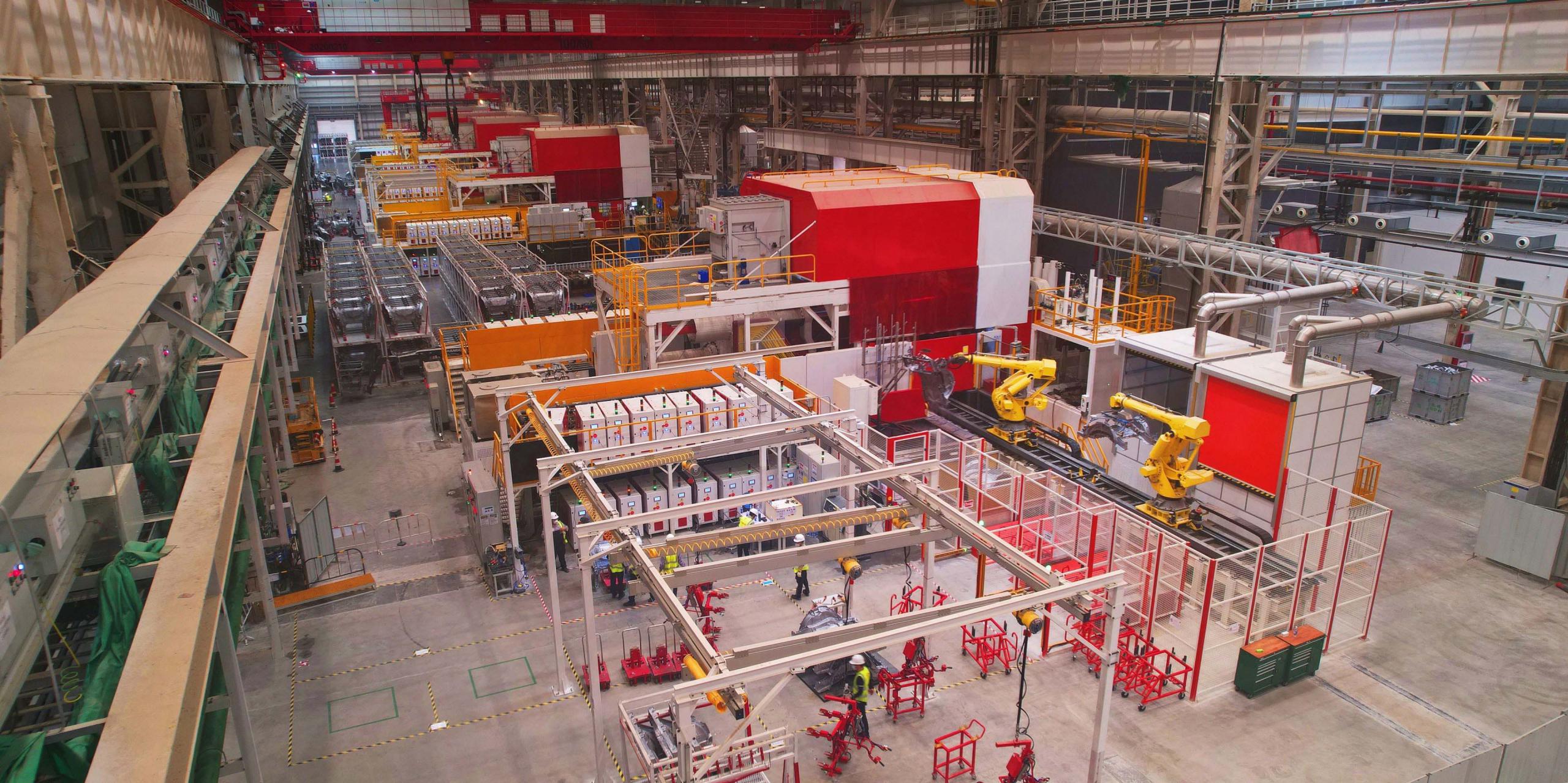

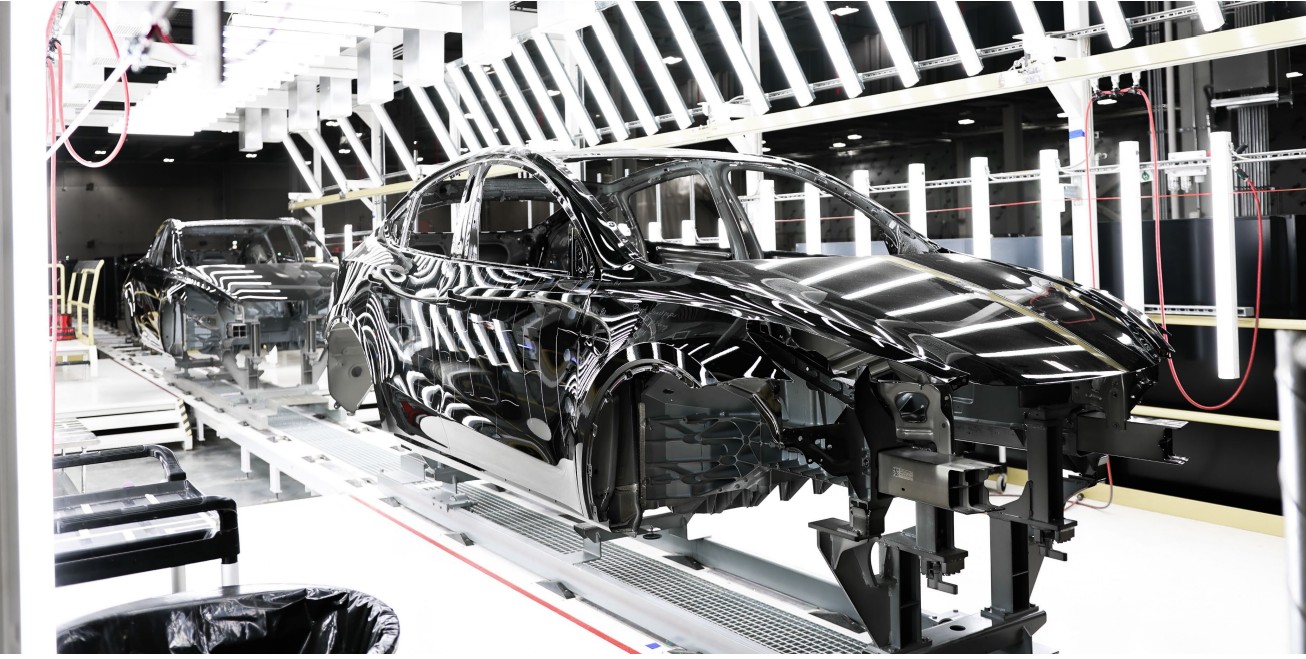

As discussed in the company’s Q3 2021 Update Letter, Tesla achieved some milestones in the third quarter. The Fremont Factory has produced more than 430,000 vehicles on its own in the last four quarters, and it’s still being improved. Giga Shanghai has settled into its role as the company’s export hub, Giga Texas is in the pre-production stage of the Model Y, and Giga Berlin is ready to hit the ground running. Tesla Energy also continues to ramp.

The following are live updates from Tesla’s Q3 2021 earnings call. I will be updating this article in real-time, so please keep refreshing the page to view the latest updates on this story. The first entry starts at the bottom of the page.

15:33 PT: And that wraps up Tesla’s first Elon-less earnings call! Thanks so much for staying with us for today’s coverage. Until the next time then!

15:31 PT: Jonathan Dorsheimer from Cannacord. Kirkhorn noted that Tesla is aiming to produce its first vehicles in both Berlin and Texas by the end of the year. With this in mind, there is quite an execution journey ahead of the company. There should be no expectation that there will be cars delivered from Giga Berlin and Giga Texas this year, however, partly due to regulatory reasons. As for how this impacts margins, it’s difficult to predict. It’s tricky to really tell how ramping production will effect margins.

15:28 PT: Trip Chowdry asks about the differences about Giga Berlin and Giga Texas. He also asks about the supply for the Cybertruck’s exoskeleton.

Tesla notes that the Cybertruck is designed for durability. There are some early decisions that were made, but there’s progress being made. Suppliers are being tapped to ensure that the Cybertruck could be ramped fairly well. That being said, Tesla has already begun the casting of the Cybertruck’s initial exoskeleton.

As for the differences between Giga Berlin and Giga Texas, their differences are more unique to their respective regional locations.

15:24 PT: Brian Johnson from Barclays takes the floor. He thanks Tesla for not making the earnings call into a “one man show.” He asks about the progress on FSD and its timetable for Level 4 capability.

Kirkhorn noted that it’s difficult to be specific on FSD’s timelines. Tesla can only state that it’s working very hard on this, and the company has been very transparent on its development. “Tesla Autopilot is working extremely hard. “You can feel the progress,” Kirkhorn said. The team is moving quickly too, so improvements should be substantial.

Lars Moravy adds that Tesla always works with regulatory bodies, including the NHTSA. He noted that Tesla is providing the information as incidents occur, and it is one of the only companies that responded to these probes.

15:20 PT: Collin Rusch from Oppenheimer asks about battery anode materials. With regards to this inquiry, Tesla notes that the anode materials are not at the same place in terms of commodities. The company also reiterated the notion that its primary focus on the anode side is to reduce costs, at least without impeding the long-term recyclability.

As for the company’s vehicle pricing strategies, the CFO noted that there seems to be a profound awakening among consumers about electric vehicles. “There has been a profound awakening of desirability for EVs,” Kirkhorn said. It’s so notable that Tesla has practically been caught off guard. The company has installed capacity to produce products like its vehicles more, but the grind is real.

Addressing Tesla’s price volatility, the CFO noted that all car companies do this. Tesla just happens to be pretty transparent about it. These fluctuations are due to a variety of factors.

15:15 PT: Colin Langan from Wells Fargo takes the floor. He asks about any possible impact from the battery material price hikes. Kirkhorn noted that Tesla has indeed seen the impact of this, though the company is focused on nickel. The CFO notes that some of these costs have been passed on to the company. It’s also possible for Tesla to see some cost headwinds in the coming year, at least considering the volatility of the market right now. Kirkhorn noted that Tesla must lower the price of its products, and optimize its operations even further. “We have no choice but to continue on that path,” the CFO said.

15:11 PT: Joseph Spak from RBC takes the floor. He asks if Tesla has a aspirational gross margin target when in the long term? Kirkhorn notes that Tesla is implementing lots of efficiencies and production ramps in multiple sites. This would likely put downward pressure on the company’s gross margins in the near term. Cost increases on the commodity side are also present. “There are a number of unknown unknowns that we need to work through. We are seeing costs increase on the commodity side,” the CFO said.

Kirkhorn also noted that Tesla’s operating expenses are decreasing, and the company hopes to improve this in the next four to five quarters. Tesla, at least for now, is focused on lowering overhead expenses and operating expenses.

15:07 PT: Looks like Tesla’s Safety Score system is working so far. There are about 150,000 cars currently using the Safety Score system, and the company has so far noted that the probability of a collision for a customer using the safety score is about 30% lower. That’s not bad at all. “We’re off to a good start here,” Kirkhorn said.

15:05 PT: And Pierre Ferragu is here! He asks about Tesla Insurance, especially since the company has launched the service in Texas. He asks how Tesla will distribute this service. Will there be a marketing push? What’s the expansion plan? How fast will it happen?

Kirkhorn noted that he is extremely passionate about Tesla Insurance. Tesla is doing a lot if work in its efforts to enter the insurance market. “We want as many people as possible to afford our products,” the CFO said, noting that this is key to the company’s mission. As such, lowering insurance costs helps Tesla and its customers at the same time.

The CFO noted that traditional insurance typically utilizes limited data. And this causes some insurance rates for Teslas to be quite unfair. “Low-risk customers end up paying more, essentially subsidizing high-risk customers,” Kirkhorn said. Tesla Insurance aims to change this. There’s the Safety Score system, as well as the immense amount of data that Tesla can access from its vehicles. With this data, insurance pricing becomes a lot fairer.

14:59 PT: Looks like some tech issues there. Tesla is now checking in to solve the analysts’ technical issues. To pass the time, more investor questions are taken. An inquiry about transferring FSD to another vehicle was asked. Kirkhorn noted that a premium is paid by the company when it buys back vehicles that are equipped with FSD. “We’re already actually doing the sentiment of this question,” he said.

14:57 PT: Pierre Ferragu from New Street Research is up. His mic is not working, however. Joseph Spak of RBC is called on to take Pierre’s spot temporarily. But his mic is also not working. Strange.

14:56 PT: Final question from investors is about FSD and its pricing. Kirkhorn declined to comment on any pricing strategies in the near term. However, he did state that Tesla is learning what it can from FSD subscriptions today. The CFO also noted that Tesla has observed how owners become curious about the company’s software offerings when they purchase vehicles.

14:53 PT: As for Supercharger wait ties, a dedicated team is monitoring congestions. Average congestion has decreased over the past 18 months, and the company is focused on accelerating the expansion of the rapid charging network. Tesla plans to double its Superchargers in the near future, potentially tripling the network later on. The company is also focused on lowering Supercharging time, and rolling out strategies like encouraging owners to charge their vehicles in off-peak hours.

14:51 PT: As for Tesla service issues and Supercharger wait times, Kirkhorn noted that these issues are not unique to Tesla. Returning to normalcy amidst a pandemic is no joke, after all. More people are driving now, and thus, the need for service has also increased. Logistics-wise, sourcing parts has also been challenging.

Tesla is so far focused on just expanding its service network, with the company’s service footprint growing by 35%. Mobile service footprint has grown by 40%. The company is adding staffing as fast as it can as well.

14:48 PT: As for NHTSA officials that seem engaged with TSLAQ and the potential tightening of regulations, Baglino noted that Tesla is also working with safety regulators in the United States. He did state that Tesla keeps safety as a key pillar in its vehicle development, so all I could really do is be as transparent as possible. “We expect and embrace this scrutiny. We take safety as a top priority. We will continue to be transparent on how our software is developing,” Baglino said.

“Safety is extremely important for Tesla. It’s the right thing to do,” Kirkhorn noted, adding that Tesla’s “goal is to go beyond what the software can provide.”

14:44 PT: As for the capacity of the company’s production facilities by 2024, Kirkhorn noted that Tesla’s goal is to grow about 50% every year. Estimates can be extrapolated from this goal. That being said, Tesla has pushed the boundaries in facilities like the Fremont Factory, which is still being optimized. “”Our goal is to grow on an average pace of 50% per year,” he said.

The CFO also mentioned Giga Shanghai, which is currently producing the Model Y. Kirkhorn noted that Austin and Berlin are both launching with the Model Y, but they were built in areas where massive expansions are possible. He quotes an estimate of 10,000 vehicles per week as a possible target.

14:41 PT: Next question is about FSD Beta. The CTO noted that it’s not a matter of how much data can be collected, but how quickly the data can be processed. Baglino noted that this is really where Dojo comes in.

14:40 PT: Retail investor questions begin. First up is are the 4680 cells. According to Drew Baglino, the testing of 4680 cells has gone well. The development of the $25K car is also progressing fairly, with estimates still poised for a potential 2023 release. For now, however, Baglino noted that Tesla is heavily focused on vehicles like the Cybertruck and Model Y.

14:38 PT: Giga Berlin and Texas are poised to start ramping. Echoing Elon’s typical comments, Zach noted that the two sites are nearing the built of their first production cars. The CFO noted, however, that the hardest work lies in ramping Austin and Berlin production lines. “Overall, I’m very proud of what the team has accomplished,” Kirkhorn said.

14:35 PT: Zach takes the floor, noting that Tesla is making great progress as a company. He states that Tesla has achieved an annualized production run rate of 1 million cars per year. He does note that Model S and Model X would take some time to get back to their previous volumes, but he is optimistic.

He adds that while Tesla has practically doubled its deliveries, the company is still heavily challenged by the supply chain shortage. Factories are still not at full capacity. Tesla is just making things work by sheer hard work. Backlog is also increasing. As for energy storage, Powerwall and Megapack production is getting better. The production of 4680 cells is also making some headway. Model S is back to positive gross margins too.

14:32 PT: It begins! NO ELON on today’s call. Just Zach and Drew. Martin Viecha is doing the preliminaries.

14:30 PT: As we wait for the start of the Q3 2021 earnings call, a particularly interesting question that would be answered in a few minutes is if Tesla CEO Elon Musk would be on the call itself. He did say that he’d probably stop attending these things last quarter, but there’s a ton of stuff that Elon would probably like to address today. If the Q3 2021 Update Letter is any indication, Tesla achieved a ton this quarter, and much of those milestones deserve some in-depth insights.

14:25 PT: Good day, everyone, and welcome to another live blog of Tesla’s earnings call! Well, look what we have here. Nine profitable quarters. Something like this would have gotten a Tesla bull beaten up on Twitter just a couple years ago, but here we are. Now we wait.

Disclaimer: I am long TSLA.

Don’t hesitate to contact us with news tips. Just send a message to tips@teslarati.com to give us a heads up.

Elon Musk

Tesla investors will be shocked by Jim Cramer’s latest assessment

Jim Cramer is now speaking positively about Tesla, especially in terms of its Robotaxi performance and its perception as a company.

Tesla investors will be shocked by analyst Jim Cramer’s latest assessment of the company.

When it comes to Tesla analysts, many of them are consistent. The bulls usually stay the bulls, and the bears usually stay the bears. The notable analysts on each side are Dan Ives and Adam Jonas for the bulls, and Gordon Johnson for the bears.

Jim Cramer is one analyst who does not necessarily fit this mold. Cramer, who hosts CNBC’s Mad Money, has switched his opinion on Tesla stock (NASDAQ: TSLA) many times.

He has been bullish, like he was when he said the stock was a “sleeping giant” two years ago, and he has been bearish, like he was when he said there was “nothing magnificent” about the company just a few months ago.

Now, he is back to being a bull.

Cramer’s comments were related to two key points: how NVIDIA CEO Jensen Huang describes Tesla after working closely with the Company through their transactions, and how it is not a car company, as well as the recent launch of the Robotaxi fleet.

Jensen Huang’s Tesla Narrative

Cramer says that the narrative on quarterly and annual deliveries is overblown, and those who continue to worry about Tesla’s performance on that metric are misled.

“It’s not a car company,” he said.

He went on to say that people like Huang speak highly of Tesla, and that should be enough to deter any true skepticism:

“I believe what Musk says cause Musk is working with Jensen and Jensen’s telling me what’s happening on the other side is pretty amazing.”

Tesla self-driving development gets huge compliment from NVIDIA CEO

Robotaxi Launch

Many media outlets are being extremely negative regarding the early rollout of Tesla’s Robotaxi platform in Austin, Texas.

There have been a handful of small issues, but nothing significant. Cramer says that humans make mistakes in vehicles too, yet, when Tesla’s test phase of the Robotaxi does it, it’s front page news and needs to be magnified.

He said:

“Look, I mean, drivers make mistakes all the time. Why should we hold Tesla to a standard where there can be no mistakes?”

It’s refreshing to hear Cramer speak logically about the Robotaxi fleet, as Tesla has taken every measure to ensure there are no mishaps. There are safety monitors in the passenger seat, and the area of travel is limited, confined to a small number of people.

Tesla is still improving and hopes to remove teleoperators and safety monitors slowly, as CEO Elon Musk said more freedom could be granted within one or two months.

Investor's Corner

Tesla gets $475 price target from Benchmark amid initial Robotaxi rollout

Tesla’s limited rollout of its Robotaxi service in Austin is already catching the eye of Wall Street.

Venture capital firm Benchmark recently reiterated its “Buy” rating and raised its price target on Tesla stock (NASDAQ: TSLA) from $350 to $475 per share, citing the company’s initial Robotaxi service deployment as a sign of future growth potential.

Benchmark analyst Mickey Legg praised the Robotaxi service pilot’s “controlled and safety-first approach,” adding that it could help Tesla earn the trust of regulators and the general public.

Confidence in camera-based autonomy

Legg reiterated Benchmark’s belief in Tesla’s vision-only approach to autonomous driving. “We are a believer in Tesla’s camera-focused approach that is not only cost effective but also scalable,” he noted.

The analyst contrasted Tesla’s simple setup with the more expensive hardware stacks used by competitors like Waymo, which use various sophisticated sensors that hike up costs, as noted in an Investing.com report. Compared to Tesla’s Model Y Robotaxis, Waymo’s self-driving cars are significantly more expensive.

He also pointed to upcoming Texas regulations set to take effect in September, suggesting they could help create a regulatory framework favorable to autonomous services in other cities.

“New regulations for autonomous vehicles are set to go into place on Sept. 1 in TX that we believe will further help win trust and pave the way for expansion to additional cities,” the analyst wrote.

Tesla as a robotics powerhouse

Beyond robotaxis, Legg sees Tesla evolving beyond its roots as an electric vehicle maker. He noted that Tesla’s humanoid robot, Optimus, could be a long-term growth driver alongside new vehicle programs and other future initiatives.

“In our view, the company is undergoing an evolution from a trailblazing vehicle OEM to a high-tech automation and robotics company with unmatched domestic manufacturing scale,” he wrote.

Benchmark noted that Tesla stock had rebounded over 50% from its April lows, driven in part by easing tariff concerns and growing momentum around autonomy. With its initial Robotaxi rollout now underway, the firm has returned to its previous $475 per share target and reaffirmed TSLA as a Benchmark Top Pick for 2025.

Elon Musk

Tesla blacklisted by Swedish pension fund AP7 as it sells entire stake

A Swedish pension fund is offloading its Tesla holdings for good.

Tesla shares have been blacklisted by the Swedish pension fund AP7, who said earlier today that it has “verified violations of labor rights in the United States” by the automaker.

The fund ended up selling its entire stake, which was worth around $1.36 billion when it liquidated its holdings in late May. Reuters first reported on AP7’s move.

Other pension and retirement funds have relinquished some of their Tesla holdings due to CEO Elon Musk’s involvement in politics, among other reasons, and although the company’s stock has been a great contributor to growth for many funds over the past decade, these managers are not willing to see past the CEO’s right to free speech.

However, AP7 says the move is related not to Musk’s involvement in government nor his political stances. Instead, the fund said it verified several labor rights violations in the U.S.:

“AP7 has decided to blacklist Tesla due to verified violations of labor rights in the United States. Despite several years of dialogue with Tesla, including shareholder proposals in collaboration with other investors, the company has not taken sufficient measures to address the issues.”

Tesla made up about 1 percent of the AP7 Equity Fund, according to a spokesperson. This equated to roughly 13 billion crowns, but the fund’s total assets were about 1,181 billion crowns at the end of May when the Tesla stake was sold off.

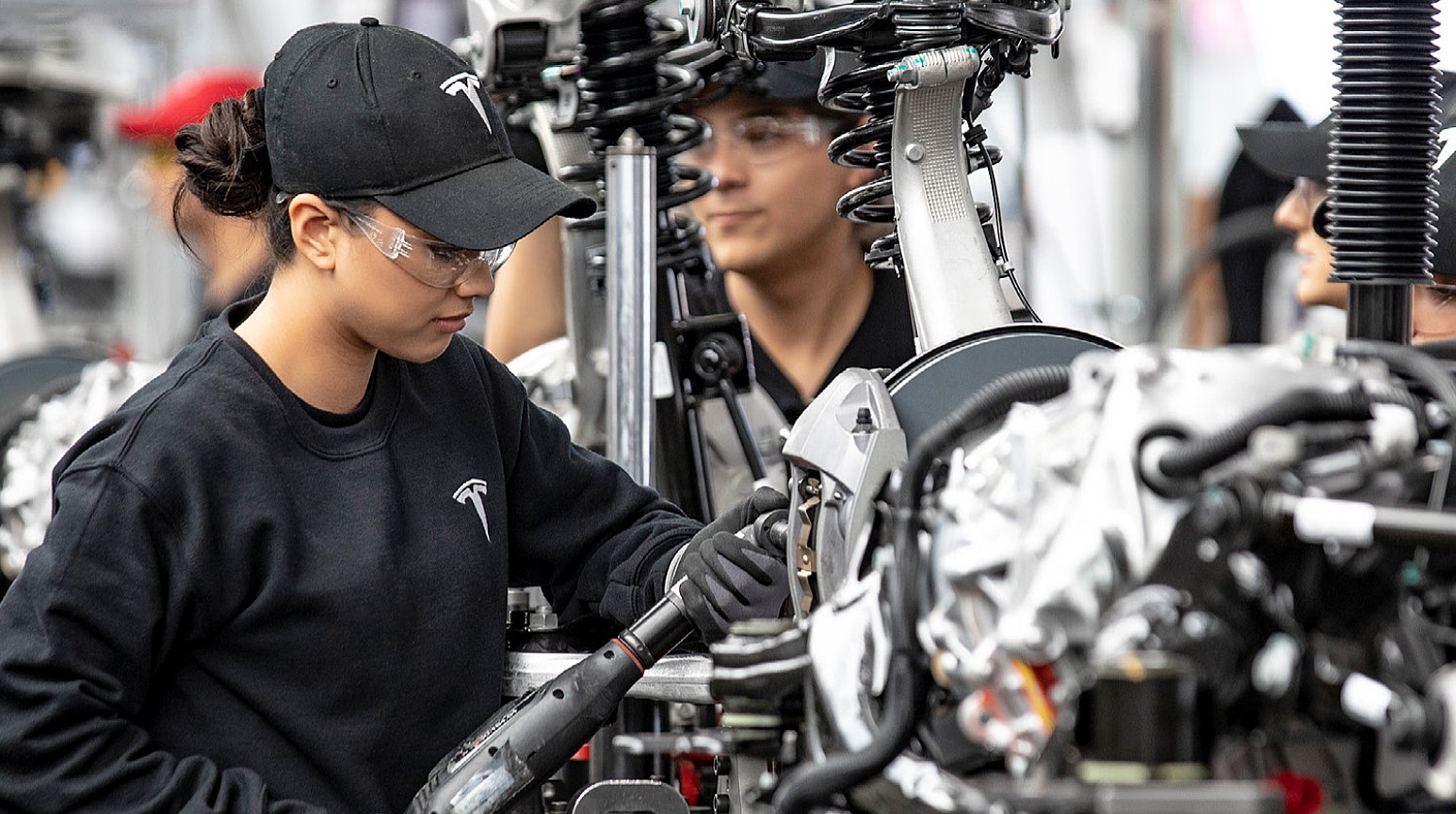

Tesla has had its share of labor lawsuits over the past few years, just as any large company deals with at some point or another. There have been claims of restrictions against labor union supporters, including one that Tesla was favored by judges, as they did not want pro-union clothing in the factory. Tesla argued that loose-fitting clothing presented a safety hazard, and the courts agreed.

(Photo: Tesla)

There have also been claims of racism at the Fremont Factory by a former elevator contractor named Owen Diaz. He was awarded a substantial sum of $137m. However, U.S. District Judge William Orrick ruled the $137 million award was excessive, reducing it to $15 million. Diaz rejected this sum.

Another jury awarded Diaz $3.2 million. Diaz’s legal team said this payout was inadequate. He and Tesla ultimately settled for an undisclosed amount.

AP7 did not list any of the current labor violations that it cited as its reason for

-

News5 days ago

News5 days agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

News2 weeks ago

News2 weeks agoTesla confirms massive hardware change for autonomy improvement

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTesla China roars back with highest vehicle registrations this Q2 so far

-

News2 weeks ago

News2 weeks agoTesla features used to flunk 16-year-old’s driver license test

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

News2 weeks ago

News2 weeks agoTesla dominates Cars.com’s Made in America Index with clean sweep

-

News2 weeks ago

News2 weeks agoTesla’s Grok integration will be more realistic with this cool feature