News

SpaceX’s Crew Dragon preps for debut as race to return astronauts to US craft nears final stages

After spending two weeks testing in a specialized NASA-run facility, SpaceX’s first flightworthy Crew Dragon spacecraft was shipped from Ohio to Florida, where it will now spend a number of months preparing for its first (uncrewed) launch into Earth orbit.

Known as Demonstration Mission 1 (DM-1), this critical milestone must be passed before the capsule will be certified to carry NASA astronauts to the International Space Station (ISS) sometime in 2019. While DM-1 will not sport a human crew, the spacecraft is nevertheless expected to demonstrate all life and mission-critical components, ranging from Crew Dragon’s complex array of avionics and ground/orbital communications equipment to craft’s ability to safely return passengers to Earth with a soft ocean landing.

SpaceX’s Crew Dragon spacecraft has been in the serious hardware development phase for approximately five years, although the concept itself dates back about as early as its Cargo Dragon predecessor – 2005 to 2006, publicly. Over the course of roughly two weeks of testing at NASA’s Plum Brook Station, Crew Dragon was likely subjected to a suite of environmental conditions the spacecraft will need to routinely survive to make it through initial launch and successfully operate under the rigors of microgravity and thermal vacuum conditions.

Crew Dragon arrived in Florida this week ahead of its first flight after completing thermal vacuum and acoustic testing at @NASA’s Plum Brook Station in Ohio. https://t.co/xXJE8TjcTr pic.twitter.com/lr0P95zzIK

— SpaceX (@SpaceX) July 12, 2018

Given the DM-1 capsule and trunk’s fairly quick jaunt at the huge Plum Brook vacuum chamber and equally quick arrival in Florida, those test results were likely quite favorable. Still, a major amount of work lies ahead before the first full Crew Dragon is ready for its launch atop Falcon 9. Most significantly, the craft’s trunk did not follow its fellow capsule to Florida, but rather returned to SpaceX’s Hawthorne, CA factory to be outfitted with critical flight hardware, particularly radiators and solar arrays. Once that outfit is complete, the module will also be shipped to Florida before being integrated with the DM-1 Crew Dragon capsule.

Of note, the DM-1 capsule has been constructed from the start to support a plan to use the vehicle in an in-flight abort test meant to ensure that the craft can wrest its passengers from harm’s way even at the most intense point of launch, where aerodynamic pressures are at their peak. In order to properly support both the DM-1 orbital mission and the in-flight abort test to follow, the capsule has been outfitted with a fair amount (hundreds of pounds) of hardware that will be unique to the pathfinder spacecraft. This understandably adds its own complexity to the already intense program’s first orbital mission, although it will hopefully not translate into additional delays.

- NASA Astronaut Suni Williams, fully suited in SpaceX’s spacesuit, interfaces with the display inside a mock-up of the Crew Dragon spacecraft in Hawthorne, California, during a testing exercise on April 3. (SpaceX)

- SpaceX’s Demo Mission-1 Crew Dragon seen preparing for vacuum tests at a NASA-run facility, June 2018. (SpaceX)

- Crew Dragon parachute tests are likely to continue into the summer to ensure NASA certification in time for DM-1. (SpaceX)

SpaceX competitor’s crewed spacecraft and rocket take shape

It’s worth noting that SpaceX is effectively operating at a distinct – albeit partially self-wrought – financial handicap when compared with Boeing’s Starliner spacecraft program, one of two vehicles funded by NASA to accomplish the same task of safely and reliably transporting astronauts to and from the ISS.

“NASA awarded firm-fixed-price contracts in 2014 to Boeing and Space Exploration Technologies Corporation (SpaceX) [of] up to $4.2 billion [for Boeing] and $2.6 billion [for SpaceX] for the development of crew transportation systems.” (GAO-18-476)

- Boeing’s DM-2 Starliner undergoes integration in Florida earlier this year. (Boeing)

- The ULA Atlas V rocket that will launch Boeing’s DM-1 Starliner spacecraft captured at ULA’s Decatur, AL factory, October 2017. (ULA)

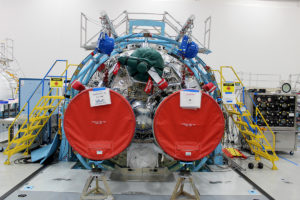

- The United Launch Alliance (ULA) dual engine Centaur upper stage of the Atlas V rocket in the final stages of production and checkout, May 2018. (ULA)

In other words, Boeing requested and received a full 60% more than SpaceX to – quite literally – accomplish an identical task. Alongside the storied and brutally expensive history of crewed American spaceflight, both contracts are an absolute steal for two modernized, crew-capable spacecraft, but a 60% premium is a 60% premium. Foreseeable but slight cost overruns caused, among other things, by additional contractual requirements from NASA have followed a similar trend, roughly proportional to each company’s slice of the original $6.8b Commercial Crew contract.

“As of April 2018, NASA requirement changes had increased the value of contract line item 001 for Boeing by approximately $191 million and for SpaceX by approximately $91 million.” (GAO-18-476)

Still, Boeing’s progress towards its own DM-1 and DM-2 demo flights and a pad-abort test are impressive, although it very likely is more of a demonstration of a different approach to public communications than of any actual step up on SpaceX. In the last few weeks, Boeing has released a number of photos showing off the progress made building its own Starliner capsules and service modules (trunks), three of which are currently in varied states of assembly and integration in the company’s Florida-based facility. Additionally, United Launch Alliance CEO Tory Bruno has shared off-and-on updates and photos of the launch contractor’s own progress assembling the rockets that will launch Boeing’s spacecraft.

The two engine Centaur is getting ready and excited for #StarLiner. pic.twitter.com/WIf3H8k9yq

— Tory Bruno (@torybruno) July 2, 2018

Regardless, a huge amount of work lies ahead before both Boeing and SpaceX’s crewed spacecraft are able to conduct their first uncrewed and crewed launches into orbit. Now very outdated, NASA has stated several times recently that the presently available targets of NET August 31 will likely be updated later this month, pushing DM-1 debuts into NET Q4 2018 and the first commercial crewed demo missions to 2019.

Stay tuned, as the Block 5 Falcon 9 tasked with launching SpaceX’s own DM-1 Crew Dragon will likely be the next of a recent flood of finished rockets to leave the company’s Hawthorne factory, where it will head to McGregor, Texas to complete acceptance wet dress rehearsals and static fire tests before shipping to SpaceX’s Pad 39A in Florida.

Follow us for live updates, peeks behind the scenes, and photos from Teslarati’s East and West Coast photographers.

Teslarati – Instagram – Twitter

Tom Cross – Twitter

Pauline Acalin – Twitter

Eric Ralph – Twitter

Elon Musk

The Boring Company’s Vegas Loop moves 82k riders during CONEXPO

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

The Boring Company said its Vegas Loop system transported roughly 82,000 passengers during the recent CONEXPO-CON/AGG construction trade show in Las Vegas. The event was held at the Las Vegas Convention Center (LVCC) from March 3-7, 2026.

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

CONEXPO-CON/AGG 2026

CONEXPO-CON/AGG is one of the largest construction trade shows in North America. This year’s event was quite impressive, attracting more than 140,000 construction professionals from 128 countries across the world.

Considering the number of this year’s attendees, the LVCC Loop seemed to have proven itself to be a very useful transportation solution. A video posted by The Boring Company on its official X account featured attendees expressing their enthusiasm for the underground transport system, with some stating that they would like to see similar tunnels across Las Vegas.

The LVCC Loop is only part of the greater Vegas Loop network, which is actively under construction.

New Vegas Loop extensions

One of the newest additions is a station at the Fontainebleau Las Vegas resort on the Strip. The station is located on level V-1 of the resort’s south valet area, according to a report from the Las Vegas Review-Journal. From the Fontainebleau, passengers can travel free of charge to stations serving the Las Vegas Convention Center, as well as to Loop stations at Encore and Westgate.

The system is also expanding beyond the Strip corridor. In December, The Boring Company began offering Vegas Loop rides to and from Harry Reid International Airport. These trips include a limited above-ground segment after receiving approval from the Nevada Transportation Authority to allow surface street travel tied to Loop operations.

The Boring Company President Steve Davis previously told the Review-Journal that the University Center Loop segment, which is currently under construction, is expected to open in the first quarter of 2026. The extension would allow Loop vehicles to travel beneath Paradise Road between the convention center and the airport, with a planned station just north of Tropicana Avenue.

News

Tesla preps to build its most massive Supercharger yet: 400+ V4 stalls

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

Tesla is preparing to build its most massive Supercharger yet, as it recently submitted plans for an over 400-stall Supercharging station in California, which would dwarf its massive 168-stall location in Lost Hills, California.

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

The expansion, adjacent to the existing Eddie World Supercharger, which is currently comprised of 22 older V2 and V3 stalls limited to 150 kW, unfolds across six phases.

Construction on Phase 1 begins later this year with 72 V4 stalls. Subsequent stages will progressively add hundreds more, culminating in over 400 next-generation chargers. Site plans label expansive parking arrays across Phases 1–5 along Calico Boulevard, with Phase 6 design still to be determined.

Tesla is planning an absolutely massive Supercharger expansion in Yermo, California!!

Over the course of 6 phases, Tesla is set to add over 400 V4 stalls in a commercial development known as Eddie World 2.

The first phase, which should begin construction sometime this year,… pic.twitter.com/ks5Y5dE8lR

— MarcoRP (@MarcoRPi1) March 6, 2026

The project was first flagged by MarcoRP, a notable Tesla Supercharger watcher.

Strategically located midway on I-15 between Los Angeles and Las Vegas, the station targets heavy EV traffic on this high-demand corridor.

The surrounding 20-mile stretch already hosts over 200 high-power stalls (including 40 at 250 kW, 120 at 325 kW, and more), plus 96 in nearby Baker—yet bottlenecks persist during peak travel.

In scale, it eclipses all existing Tesla Superchargers. The current record holder, the solar- and Megapack-powered “Project Oasis” in Lost Hills, California, offers 164 stalls. Barstow’s former leader had 120. Eddie World 2 will be more than double that size, cementing Tesla’s dominance in ultra-high-capacity charging.

Tesla finishes its biggest Supercharger ever with 168 stalls

Development blends charging with convenience. Architectural drawings show integrated retail: a 10,100 square foot Cracker Barrel, a 4,300 square foot McDonald’s, a 3,800 square foot convenience store, additional restaurants, drive-thrus, outdoor dining, and lease space.

EV-centric features include pull-through bays for Cybertrucks and trailers, ensuring accessibility for larger vehicles and future Semi trucks.

News

Tesla makes latest move to remove Model S and Model X from its lineup

Tesla’s latest decisive step toward phasing out its flagship sedan and SUV was quietly removing the Model S and Model X from its U.S. referral program earlier this week.

Tesla has made its latest move that indicates the Model S and Model X are being removed from the company’s lineup, an action that was confirmed by the company earlier this quarter, that the two flagship vehicles would no longer be produced.

Tesla has ultimately started phasing out the Model S and Model X in several ways, as it recently indicated it had sold out of a paint color for the two vehicles.

Now, the company is making even more moves that show its plans for the two vehicles are being eliminated slowly but surely.

Tesla’s latest decisive step toward phasing out its flagship sedan and SUV was quietly removing the Model S and Model X from its U.S. referral program earlier this week.

The change eliminates the $1,000 referral discount previously available to new buyers of these vehicles. Existing Tesla owners purchasing a new Model S or Model X will now only receive a halved loyalty discount of $500, down from $1,000.

The updates extend beyond the two flagship vehicles. New Cybertruck buyers using a referral code on Premium AWD or Cyberbeast configurations will no longer get $1,000 off. Instead, both referrer and buyer receive three months of Full Self-Driving (Supervised).

The loyalty discount for Cybertruck purchases, excluding the new Dual Motor AWD trim level, has also been cut to $500.

NEWS: Tesla has removed the Model S and Model X from the referral program.

New owners also no longer get a $1,000 referral discount on a new Cybertruck Premium AWD or Cyberbeast. Instead, you now get 3 months of FSD (Supervised).

Additionally, Tesla has reduced the loyalty… pic.twitter.com/IgIY8Hi2WJ

— Sawyer Merritt (@SawyerMerritt) March 6, 2026

These adjustments apply only in the United States, and reflect Tesla’s broader strategy to optimize margins while boosting adoption of its autonomous driving software.

The timing is no coincidence. Tesla confirmed earlier this year that Model S and Model X production will end in the second quarter of 2026, roughly June, as the company reallocates factory capacity toward its Optimus humanoid robot and next-generation vehicles.

With annual sales of the low-volume flagships already declining (just 53,900 units in 2025), incentives are no longer needed to drive demand. Production is winding down, and Tesla expects strong remaining interest without subsidies.

Industry observers see this as the clearest sign yet of an “end-of-life” phase for the vehicles that once defined Tesla’s luxury segment. Community reactions on X range from nostalgia, “Rest in power S and X”, to frustration among long-time owners who feel perks are eroding just as the models approach discontinuation.

Some buyers are rushing orders to lock in final discounts before they vanish entirely.

Doug DeMuro names Tesla Model S the Most Important Car of the last 30 years

For Tesla, the move prioritizes efficiency: fewer discounts on outgoing models, a stronger push for FSD subscriptions, and a focus on high-margin Cybertruck trims amid surging orders.

Loyalists still have a narrow window to purchase a refreshed Plaid or Long Range model with remaining incentives, but the message is clear: Tesla’s lineup is evolving, and the era of the original flagships is drawing to a close.