Energy

Tesla’s Powerpack battery farm starts killing fossil fuel backup plants in Australia

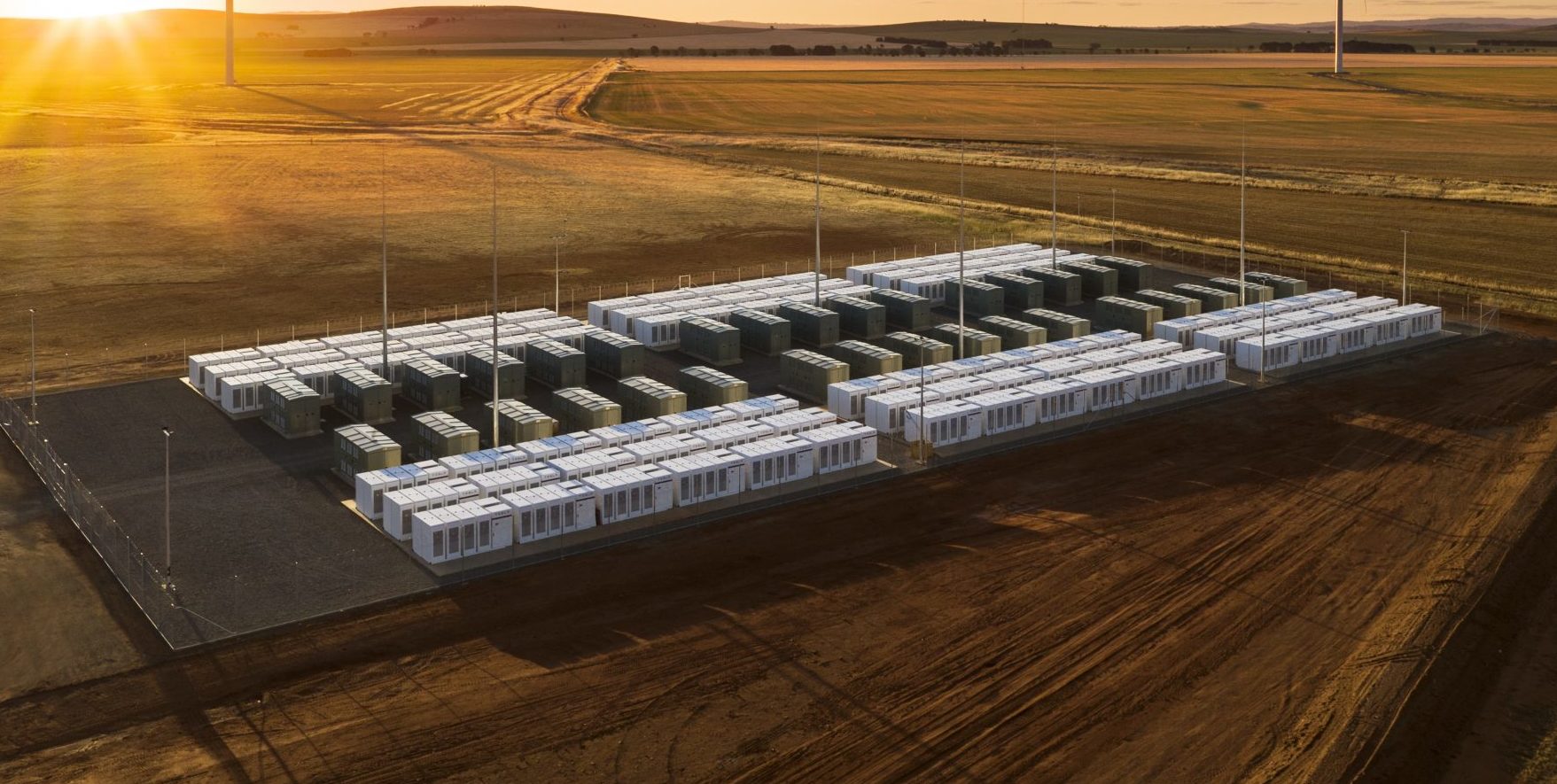

Since going online last year, Tesla’s Powerpack farm in South Australia has established a reputation for being a quick, clean, and efficient backup to the region’s beleaguered energy grid. As the big battery continues to prove its critics wrong, the Australian Energy Market Operator (AEMO) has announced that it would no longer be needing the services of several fossil fuel-powered plants, which supported the grid prior to the arrival of the Tesla Powerpack Farm.

AEMO’s recent initiative closes the page on a three-year-old requirement for 35 MW of Frequency Control Ancillary Services (FCAS) to be provided in South Australia during instances when the state’s grid is at risk of separating from the national grid, ensuring that the state’s grid could operate safely and securely by itself. In an announcement on Thursday, the AEMO acknowledged that the energy landscape in the region has changed during the past year.

“The operation of SA has changed significantly over the past 12 months. Synchronous unit requirements (for SA system strength) and the installation of the Hornsdale battery have ensured regulation FCAS is more readily available post-islanding of SA. Hence this requirement is no longer considered necessary,” AEMO noted.

Prior to the installation of the Tesla Powerpack farm, the local providers of FCAS turned the South Australian energy grid into a booming business. The providers, which utilize fossil fuel-powered plants, kept the price of FCAS in the state extremely high, rising nearly 100-fold to the market cap of $14,000/MWh. At one point, the cost of South Australia’s FCAS rose to around $6 million a day, and considering the strain on the region’s energy grid; the state ended up paying more than $100 million in 2016 and 2017.

The Tesla big battery, officially named as the Hornsdale Power Reserve, disrupted the market when it went online. With the Powerpack farm present, gas generators were unable to dictate the price of backup energy services. The battery farm also proved that it was quicker, more flexible, more accurate, and even more cost-effective than fossil fuel-powered plants.

The Powerpack farm’s capabilities were put to the test in late August, after twin lightning strikes resulted in the failure of two major transmission lines linking Queensland and New South Wales. The results of the lightning strikes were notable — the South Australia and Queensland grids were separated and there were widespread power losses in NSW, Tasmania, and Victoria. In South Australia, there was no loss of power, and no failure of generators due to the fast response of the Tesla Powerpack farm.

The feats of the Horsndale Power Reserve has triggered an energy movement in Australia, becoming the frontliner in AEMO’s contingencies against major faults and disturbances to the grid. New battery-based projects are currently underway in several other areas, such as Dalrymple North in South Australia, at the Ganawarra solar farm, and a Ballarat network junction in Victoria. In a statement to Renew Economy, Christian Schaefer, AEMO’s head of system capability, noted that the region’s move away from fossil fuel-powered backup plants is a step in the right direction.

“This is a good news story. The work that our engineers in the AEMO team have done shows that we can continue to operate South Australia in a stable and secure manner. Hornsdale has had a significant impact on the South Australia system, and we have got new batteries coming online with Victoria and South Australia. That is really positive. It shows that all parts of the industry — networks, generators, the renewable sector, battery providers and regulators — are getting behind this and showing an interest in what has been done,” he said.

Tesla Energy does not make as many headlines as the company’s electric car business, but the business is in a constant process of growth. In a recent statement, billionaire investor Ron Baron noted that he expects Tesla’s electric car and energy business to be equally worth $500 billion each by 2030. Tesla CTO JB Straubel, for his part, has previously teased that Tesla Energy is indeed going after backup peaker plants.

“I think what we’ll see is we won’t build many new peaker plants, if any. Already what we’re seeing happening is the number of new ones being commissioned is drastically lower, and batteries are already outcompeting natural gas peaker plants,” Straubel said.

Energy

Tesla Powerwall distribution expands in Australia

Inventory is expected to arrive in late February and official sales are expected to start mid-March 2026.

Supply Partners Group has secured a distribution agreement for the Tesla Powerwall in Australia, with inventory expected to arrive in late February and official sales beginning in mid-March 2026.

Under the new agreement, Supply Partners will distribute Tesla Powerwall units and related accessories across its national footprint, as noted in an ecogeneration report. The company said the addition strengthens its position as a distributor focused on premium, established brands.

“We are proud to officially welcome Tesla Powerwall into the Supply Partners portfolio,” Lliam Ricketts, Co-Founder and Director of Innovation at Supply Partners Group, stated.

“Tesla sets a high bar, and we’ve worked hard to earn the opportunity to represent a brand that customers actively ask for. This partnership reflects the strength of our logistics, technical services and customer experience, and it’s a win for installers who want premium options they can trust.”

Supply Partners noted that initial Tesla Powerwall stock will be warehoused locally before full commercial rollout in March. The distributor stated that the timing aligns with renewed growth momentum for the Powerwall, supported by competitive installer pricing, consumer rebates, and continued product and software updates.

“Powerwall is already a category-defining product, and what’s ahead makes it even more compelling,” Ricketts stated. “As pricing sharpens and capability expands, we see a clear runway for installers to confidently spec Powerwall for premium residential installs, backed by Supply Partners’ national distribution footprint and service model.”

Supply Partners noted that a joint go-to-market launch is planned, including Tesla-led training for its sales and technical teams to support installers during the home battery system’s domestic rollout.

Energy

Tesla Megapack Megafactory in Texas advances with major property sale

Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet.

Tesla’s planned Megapack factory in Brookshire, Texas has taken a significant step forward, as two massive industrial buildings fully leased to the company were sold to an institutional investor.

In a press release, Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet. The properties are 100% leased to Tesla under a long-term agreement and were acquired by BGO on behalf of an institutional investor.

The two facilities, located at 100 Empire Boulevard in Brookshire, Texas, will serve as Tesla’s new Megafactory dedicated to manufacturing Megapack battery systems.

According to local filings previously reported, Tesla plans to invest nearly $200 million into the site. The investment includes approximately $44 million in facility upgrades such as electrical, utility, and HVAC improvements, along with roughly $150 million in manufacturing equipment.

Building 9, spanning roughly 1 million square feet, will function as the primary manufacturing floor where Megapacks are assembled. Building 10, covering approximately 600,000 square feet, will be dedicated to warehousing and logistics operations, supporting storage and distribution of completed battery systems.

Waller County Commissioners have approved a 10-year tax abatement agreement with Tesla, offering up to a 60% property-tax reduction if the company meets hiring and investment targets. Tesla has committed to employing at least 375 people by the end of 2026, increasing to 1,500 by the end of 2028, as noted in an Austin County News Online report.

The Brookshire Megafactory will complement Tesla’s Lathrop Megafactory in California and expand U.S. production capacity for the utility-scale energy storage unit. Megapacks are designed to support grid stabilization and renewable-energy integration, a segment that has become one of Tesla’s fastest-growing businesses.

Energy

Tesla meets Giga New York’s Buffalo job target amid political pressures

Giga New York reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease.

Tesla has surpassed its job commitments at Giga New York in Buffalo, easing pressure from lawmakers who threatened the company with fines, subsidy clawbacks, and dealership license revocations last year.

The company reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease at the state-built facility.

As per an employment report reviewed by local media, Tesla employed 2,399 full-time workers at Gigafactory New York and 1,060 additional employees across the state at the end of 2025. Part-time roles pushed the total headcount of Tesla’s New York staff above the 3,460-job target.

The gains stemmed in part from a new Long Island service center, a Buffalo warehouse, and additional showrooms in White Plains and Staten Island. Tesla also said it has invested $350 million in supercomputing infrastructure at the site and has begun manufacturing solar panels.

Empire State Development CEO Hope Knight said the agency was “very happy” with Giga New York’s progress, as noted in a WXXI report. The current lease runs through 2029, and negotiations over updated terms have included potential adjustments to job requirements and future rent payments.

Some lawmakers remain skeptical, however. Assemblymember Pat Burke questioned whether the reported job figures have been fully verified. State Sen. Patricia Fahy has also continued to sponsor legislation that would revoke Tesla’s company-owned dealership licenses in New York. John Kaehny of Reinvent Albany has argued that the project has not delivered the manufacturing impact originally promised as well.

Knight, for her part, maintained that Empire State Development has been making the best of a difficult situation.

“(Empire State Development) has tried to make the best of a very difficult situation. There hasn’t been another use that has come forward that would replace this one, and so to the extent that we’re in this place, the fact that 2,000 families at (Giga New York) are being supported through the activity of this employer. It’s the best that we can have happen,” the CEO noted.