Firmware

Tesla could be sitting on a $1.2 trillion vehicle software market by 2030

The advent of fully autonomous cars could result in vehicle software revenues hitting as high as $1.2 trillion per year by 2030. This is according to recent statements from Elmar Degenhart, who serves as chief executive of Continental, one of the world’s biggest auto parts’ suppliers.

An emerging market

According to the auto parts exec, ensuring that self-driving vehicles will work correctly requires a lot of software mastery. Software is a key component for self-driving, as it will determine how well a vehicle processes signals and input from its suite of sensors. During the Auto Motor und Sport industry congress in Stuttgart, Germany on Tuesday, Degenhart noted that software is something the auto industry is lacking in. “Software competence is mission critical for successful car companies but the industry lacks scale in this competence,” he said.

Despite the emergence of companies like Tesla that use software as a key component of its vehicles, veteran carmakers still have a long way to go before they could reach parity with the electric car maker. This is particularly prominent in a number of Tesla competitors that have emerged over the past year. A perfect example of this is the Jaguar I-PACE, an excellent electric car save for its slow infotainment system and substandard range. Both these problems (particularly the infotainment system) could have been addressed through software optimizations.

Mastery of software, or lack thereof

The lack of mastery on the software front could become a huge liability for traditional automakers. Today, vehicle software generates annual revenues of about $280 billion a year, and Degenhart estimates that the market would grow more than four times by 2030. That’s $1.2 trillion a year. The Continental executive argues that this scenario presents a great opportunity for those that are proficient in vehicle software, since veteran carmakers can adapt to the autonomous driving trend by working with tech companies.

“Car companies are good at validation and homologation and lack software development skills, while software companies have the opposite problem. The IT industry has always valued speed of development more than perfecting the product, while the auto industry has tended to veer toward perfecting a product over rushing it out. The software and the auto industry will have to work more closely together to develop autonomous vehicles and this will lead to a change in approach on both sides,” he said.

A perfect fit

It could be said that the $1.2 trillion scenario described by Degenhart is a perfect fit for Tesla, which is arguably the most prominent automaker that currently develops both its vehicles’ hardware and software in-house. This vertical integration allows Tesla to develop technologies and features that are fully compatible with its vehicles. As shown by the success of companies that adopt the same strategy, such as Apple, Tesla’s synthesis of software and vehicle hardware could be a key advantage over other automakers that are stepping into the autonomous driving field.

Tesla’s potential in the full self-driving market is a key thesis for one of the company’s biggest bulls, Cathie Woods of ARK Invest. ARK has a long-term price target of $4,000 per share for Tesla, provided that the company taps into the autonomous mobility-as-a-service market. This is something that Elon Musk has actually discussed in the past. Dubbed the Tesla Network, the system would allow owners to have their vehicles be part of a self-driving ride-sharing service. Musk outlined Tesla’s advantage in this upcoming market during the Q3 2018 earnings call. “The advantages that Tesla will have is that we’ll have millions of cars in the field with full autonomy capability, and no one else will have that. So, I think that will end up putting us in the strongest competitive position long-term,” Musk said.

Firmware

Tesla mobile app shows signs of upcoming FSD subscriptions

It appears that Tesla may be preparing to roll out some subscription-based services soon. Based on the observations of a Wales-based Model 3 owner who performed some reverse-engineering on the Tesla mobile app, it seems that the electric car maker has added a new “Subscribe” option beside the “Buy” option within the “Upgrades” tab, at least behind the scenes.

A screenshot of the new option was posted in the r/TeslaMotors subreddit, and while the Tesla owner in question, u/Callump01, admitted that the screenshot looks like something that could be easily fabricated, he did submit proof of his reverse-engineering to the community’s moderators. The moderators of the r/TeslaMotors subreddit confirmed the legitimacy of the Model 3 owner’s work, further suggesting that subscription options may indeed be coming to Tesla owners soon.

Did some reverse engineering on the app and Tesla looks to be preparing for subscriptions? from r/teslamotors

Tesla’s Full Self-Driving suite has been heavily speculated to be offered as a subscription option, similar to the company’s Premium Connectivity feature. And back in April, noted Tesla hacker @greentheonly stated that the company’s vehicles already had the source codes for a pay-as-you-go subscription model. The Tesla hacker suggested then that Tesla would likely release such a feature by the end of the year — something that Elon Musk also suggested in the first-quarter earnings call. “I think we will offer Full Self-Driving as a subscription service, but it will be probably towards the end of this year,” Musk stated.

While the signs for an upcoming FSD subscription option seem to be getting more and more prominent as the year approaches its final quarter, the details for such a feature are still quite slim. Pricing for FSD subscriptions, for example, have not been teased by Elon Musk yet, though he has stated on Twitter that purchasing the suite upfront would be more worth it in the long term. References to the feature in the vehicles’ source code, and now in the Tesla mobile app, also listed no references to pricing.

The idea of FSD subscriptions could prove quite popular among electric car owners, especially since it would allow budget-conscious customers to make the most out of the company’s driver-assist and self-driving systems without committing to the features’ full price. The current price of the Full Self-Driving suite is no joke, after all, being listed at $8,000 on top of a vehicle’s cost. By offering subscriptions to features like Navigate on Autopilot with automatic lane changes, owners could gain access to advanced functions only as they are needed.

Elon Musk, for his part, has explained that ultimately, he still believes that purchasing the Full Self-Driving suite outright provides the most value to customers, as it is an investment that would pay off in the future. “I should say, it will still make sense to buy FSD as an option as in our view, buying FSD is an investment in the future. And we are confident that it is an investment that will pay off to the consumer – to the benefit of the consumer.” Musk said.

Firmware

Tesla rolls out speed limit sign recognition and green traffic light alert in new update

Tesla has started rolling out update 2020.36 this weekend, introducing a couple of notable new features for its vehicles. While there are only a few handful of vehicles that have reportedly received the update so far, 2020.36 makes it evident that the electric car maker has made some strides in its efforts to refine its driver-assist systems for inner-city driving.

Tesla is currently hard at work developing key features for its Full Self-Driving suite, which should allow vehicles to navigate through inner-city streets without driver input. Tesla’s FSD suite is still a work in progress, though the company has released the initial iterations of key features such Traffic Light and Stop Sign Control, which was introduced last April. Similar to the first release of Navigate on Autopilot, however, the capabilities of Traffic Light and Stop Sign Control were pretty basic during their initial rollout.

2020.36 Showing Speed Limit Signs in Visualization from r/teslamotors

With the release of update 2020.36, Tesla has rolled out some improvements that should allow its vehicles to handle traffic lights better. What’s more, the update also includes a particularly useful feature that enables better recognition of speed limit signs, which should make Autopilot’s speed adjustments better during use. Following are the Release Notes for these two new features.

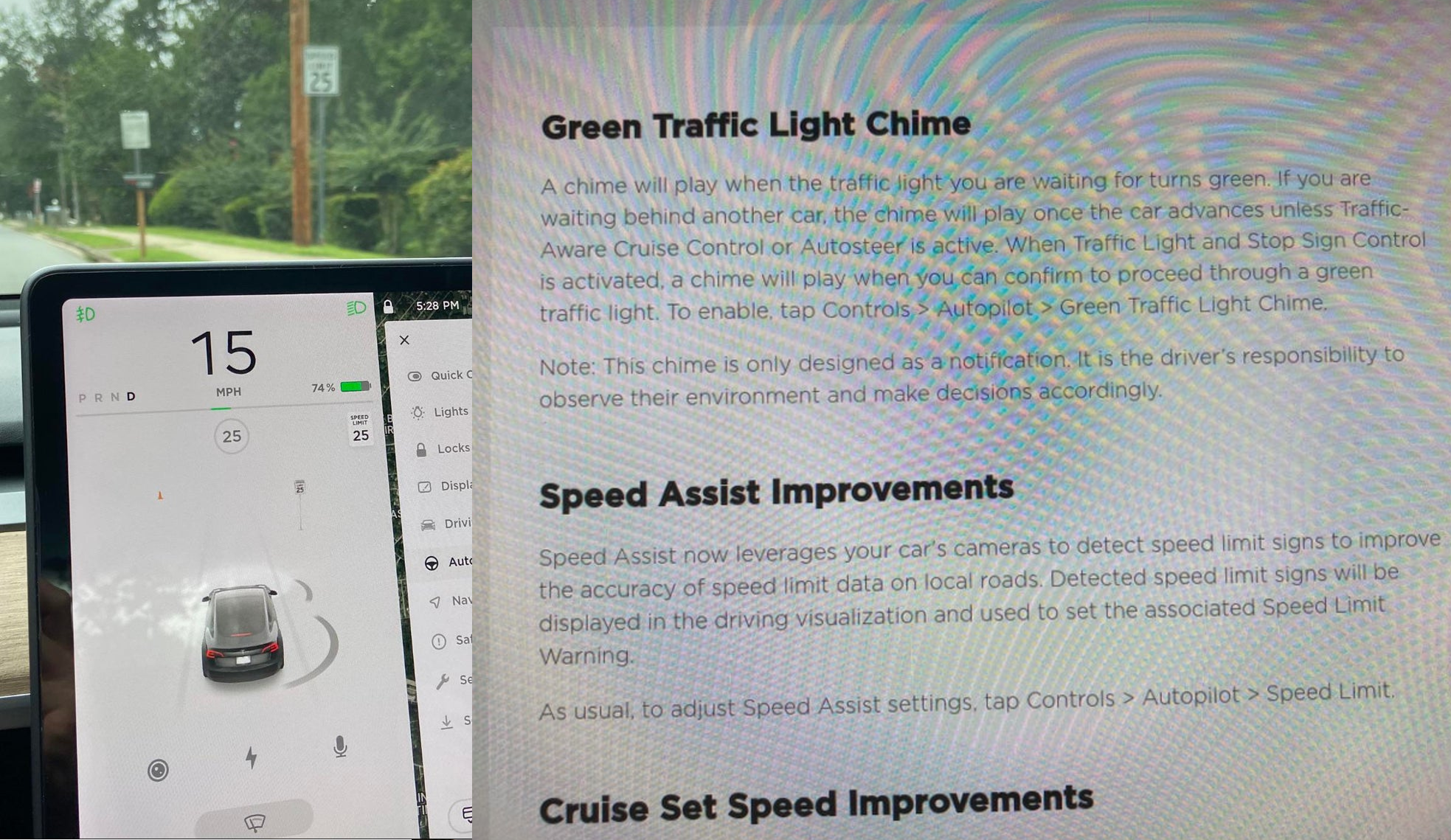

Green Traffic Light Chime

“A chime will play when the traffic light you are waiting for turns green. If you are waiting behind another car, the chime will play once the car advances unless Traffic-Aware Cruise Control or Autosteer is active. When Traffic Light and Stop Sign Control is activated, a chime will play when you can confirm to proceed through a green traffic light. To enable, tap Controls > Autopilot > Green Traffic Light Chime.

“Note: This chime is only designed as a notification. It is the driver’s responsibility to observe their environment and make decisions accordingly.”

Speed Assist Improvements

“Speed Assist now leverages your car’s cameras to detect speed limit signs to improve the accuracy of speed limit data on local roads. Detected speed limit signs will be displayed in the driving visualization and used to set the associated Speed Limit Warning.

“As usual, to adjust Speed Assist settings, tap Controls > Autopilot > Speed Limit.”

Footage of the new green light chime in action via @NASA8500 on Twitter ✈️ from r/teslamotors

Amidst the rollout of 2020.36’s new features, speculations were abounding among Tesla community members that this update may include the first pieces of the company’s highly-anticipated Autopilot rewrite. Inasmuch as the idea is exciting, however, Tesla CEO Elon Musk has stated that this was not the case. While responding to a Tesla owner who asked if the Autopilot rewrite is in “shadow mode” in 2020.36, Musk responded “Not yet.”

Firmware

Tesla rolls out Sirius XM free three-month subscription

Tesla has rolled out a free three-month trial subscription to Sirius XM, in what appears to be the company’s latest push into making its vehicles’ entertainment systems more feature-rich. The new Sirius XM offer will likely be appreciated by owners of the company’s vehicles, especially considering that the service is among the most popular satellite radios in the country today.

Tesla announced its new offer in an email sent on Monday. An image that accompanied the communication also teased Tesla’s updated and optimized Sirius XM UI for its vehicles. Following is the email’s text.

“Beginning now, enjoy a free, All Access three-month trial subscription to Sirius XM, plus a completely new look and improved functionality. Our latest over-the-air software update includes significant improvements to overall Sirius XM navigation, organization, and search features, including access to more than 150 satellite channels.

“To access simply tap the Sirius XM app from the ‘Music’ section of your in-car center touchscreen—or enjoy your subscription online, on your phone, or at home on connected devices. If you can’t hear SiriusXM channels in your car, select the Sirius XM ‘Subscription’ tab for instruction on how to refresh your audio.”

Tesla has actually been working on Sirius XM improvements for some time now. Back in June, for example, Tesla rolled out its 2020.24.6.4 update, and it included some optimizations to its Model S and Model X’s Sirius XM interface. As noted by noted Tesla owner and hacker @greentheonly, the source code of this update revealed that the Sirius XM optimizations were also intended to be released to other areas such as Canada.

Interestingly enough, Sirius XM is a popular feature that has been exclusive to the Model S and X. Tesla’s most popular vehicle to date, the Model 3, is yet to receive the feature. One could only hope that Sirius XM integration to the Model 3 may eventually be included in the future. Such an update would most definitely be appreciated by the EV community, especially since some Model 3 owners have resorted to using their smartphones or third-party solutions to gain access to the satellite radio service.

The fact that Tesla seems to be pushing Sirius XM rather assertively to its customers seems to suggest that the company may be poised to roll out more entertainment-based apps in the coming months. Apps such as Sirius XM, Spotify, Netflix, and YouTube, may seem quite minor when compared to key functions like Autopilot, after all, but they do help round out the ownership experience of Tesla owners. In a way, Sirius XM does make sense for Tesla’s next-generation of vehicles, especially the Cybertruck and the Semi, both of which would likely be driven in areas that lack LTE connectivity.

-

Elon Musk4 days ago

Elon Musk4 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News1 week ago

News1 week agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

News2 weeks ago

News2 weeks agoSpaceX and Elon Musk share insights on Starship Ship 36’s RUD

-

News2 weeks ago

News2 weeks agoWatch Tesla’s first driverless public Robotaxi rides in Texas

-

News1 week ago

News1 week agoWatch the first true Tesla Robotaxi intervention by safety monitor

-

News2 weeks ago

News2 weeks agoTesla has started rolling out initial round of Robotaxi invites

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla to launch in India in July with vehicles already arriving: report