Lifestyle

Fight climate change while earning up to 7.5% annually?

Bloomberg New Energy Finance estimates that investment opportunity in the solar energy market through 2040 will be approximately $2.8 trillion. Much of that investment will come from governments and institutions. However, one firm, Wunder Capital, is allowing individuals to take part in the solar energy revolution by supporting small and medium-sized businesses and nonprofits as they make the transition to solar energy.

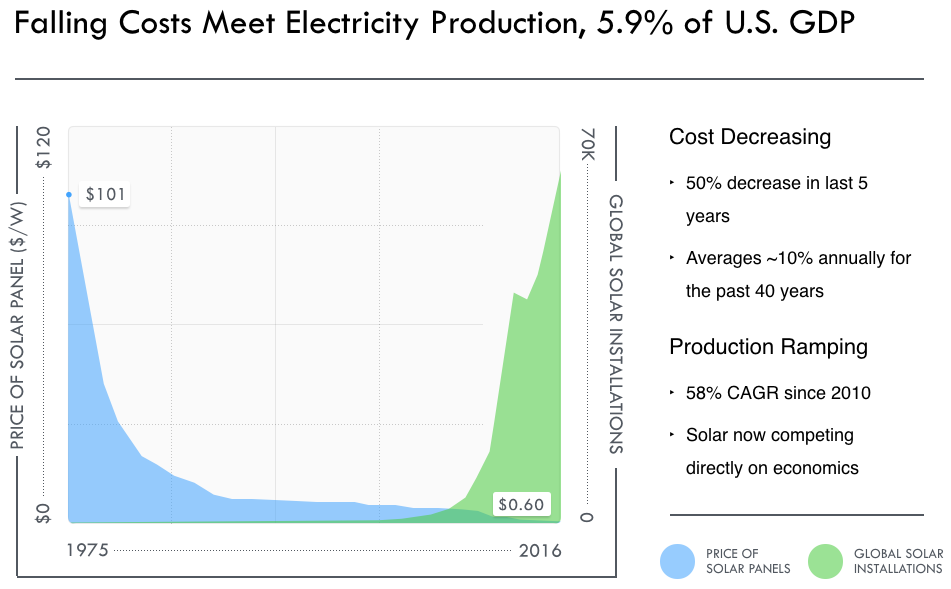

The massive growth seen in the solar energy sector over the last few years has been primarily driven by project economics. Meaning that solar is now cost competitive with traditional energy sources like coal and natural gas. Solar has achieved a remarkable cost decrease of ~10% annually for the last 40 years (see chart below).

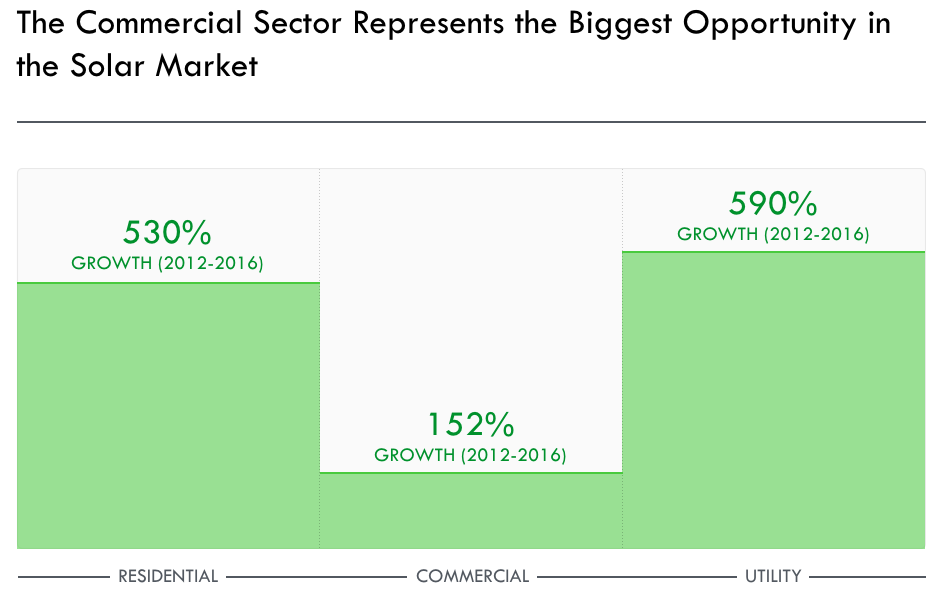

Even though the cost of solar is now competitive with other energy sources in many US states, the upfront cost for small and medium-sized businesses as well as nonprofits is still prohibitively expensive (with an average system cost of a few hundred thousand dollars). Because of this, the commercial solar sector has grown much more slowly when compared to the residential and utility-scale solar sectors (see graph below).

Wunder Capital’s mission to help fix that — by providing simple, cost-effective financing solutions to qualified borrowers across the US to help them go solar, and save money each month on their energy bills. Wunder Capital has a network of 155 solar installers and developers across 30 states who send them projects to review on a weekly basis.

To date, Wunder Capital has completed over 175+ solar financings across the US. Wunder’s 2017 Year-in-Review includes some impressive stats.

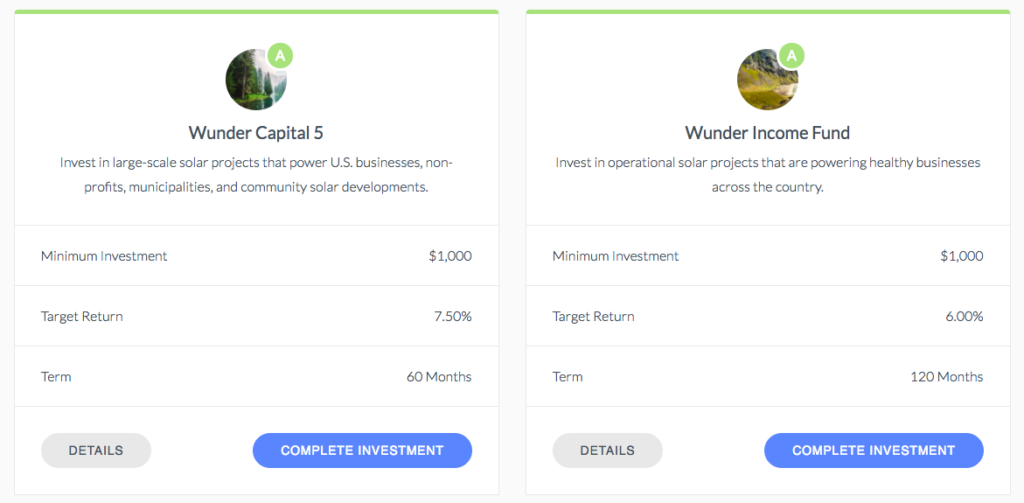

None of Wunder’s solar loan portfolios have suffered any losses or write-offs, meaning that investors’ projected returns have been met. Wunder Capital has two funds currently available for investors: the Wunder Income Fund and Wunder Capital 5.

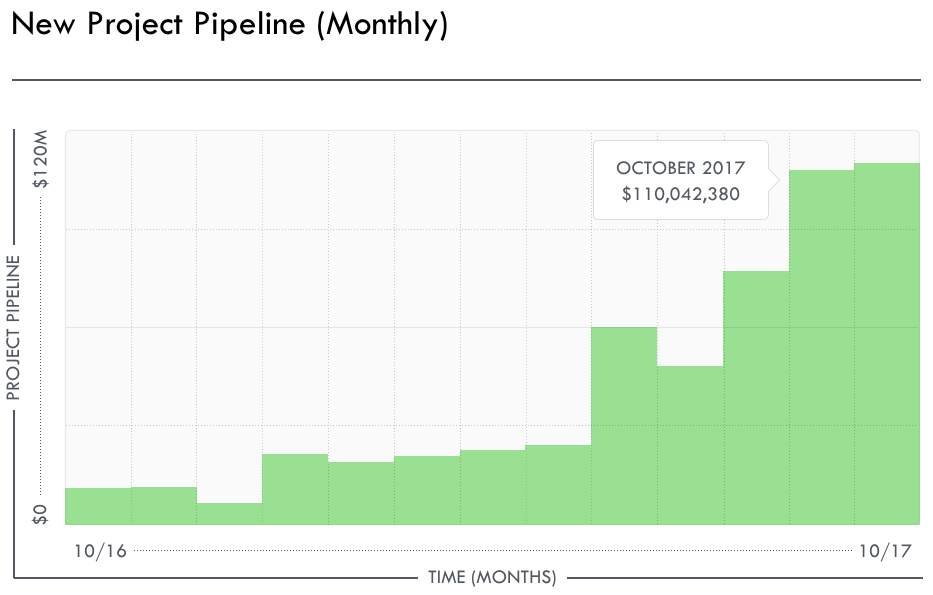

Wunder’s newest fund, Wunder Capital 5, was launched this past October, and has raised over $12M. Wunder has achieved record project pipeline numbers in the last several months, with over $110M in commercial solar projects in October alone (chart below).

Here’s a quote from a current Wunder investor, and his experience thus far with Wunder Capital.

I liked the market space Wunder looked to serve. Solar is but one of the many great ideas to keep literal energy flowing through the economy while leveraging established infrastructure and resources. The missing piece seemed to always be financing a long term investment in an economy built on short term results. Wunder spoke to this well and I bought in. —Wunder investor Skip Larson.

About Wunder Capital: Wunder is a financial technology company that is based out of Boulder, Colorado. Founded in 2013, Wunder won the US Department of Energy’s 2014 Sunshot Challenge, as well as COSEIA’s 2015 Summit Award. Wunder also participated in the Techstars technology accelerator program. Although Wunder’s solar funds are capitalized by individual accredited investors, the parent company and the operator of each of Wunder’s solar funds — The Wunder Company — is backed by venture capital (from the likes of Techstars Ventures, Fenway Summer, and Fintech Collective as well as others).

About the Author: Bryan Birsic is the Founder and CEO of Wunder Capital and brings extensive finance and capital raising expertise to Wunder, from private equity investing at Bain & Company to financing online commercial lending companies at Village Ventures. Notably, Bryan’s firm led early investments into commercial lending market leader OnDeck Capital. Along with his finance background, Bryan has built and led several companies that bring software approaches to new markets, most notably and recently SimpleReach, where Bryan was President and which has raised more than $15mm. Bryan attended Williams College, and moved with his family to Boulder from New York City several years ago.

About the Author: Bryan Birsic is the Founder and CEO of Wunder Capital and brings extensive finance and capital raising expertise to Wunder, from private equity investing at Bain & Company to financing online commercial lending companies at Village Ventures. Notably, Bryan’s firm led early investments into commercial lending market leader OnDeck Capital. Along with his finance background, Bryan has built and led several companies that bring software approaches to new markets, most notably and recently SimpleReach, where Bryan was President and which has raised more than $15mm. Bryan attended Williams College, and moved with his family to Boulder from New York City several years ago.

This article was supported by Bryan Birsic of Wunder Capital. For more information, contact brands@teslarati.com.

Elon Musk

X account with 184 followers inadvertently saves US space program amid Musk-Trump row

Needless to say, the X user has far more than 184 followers today after his level-headed feat.

An X user with 184 followers has become the unlikely hero of the United States’ space program by effectively de-escalating a row between SpaceX CEO Elon Musk and President Donald Trump on social media.

Needless to say, the X user has far more than 184 followers today after his level-headed feat.

A Near Fall

During Elon Musk and Donald Trump’s fallout last week, the U.S. President stated in a post on Truth Social that a good way for the United States government to save money would be to terminate subsidies and contracts from the CEO’s companies. Musk responded to Trump’s post by stating that SpaceX will start decommissioning its Dragon spacecraft immediately.

Musk’s comment was received with shock among the space community, partly because the U.S. space program is currently reliant on SpaceX to send supplies and astronauts to the International Space Station (ISS). Without Dragon, the United States will likely have to utilize Russia’s Soyuz for the same services—at a significantly higher price.

X User to the Rescue

It was evident among X users that Musk’s comments about Dragon being decommissioned were posted while emotions were high. It was then no surprise that an X account with 184 followers, @Fab25june, commented on Musk’s post, urging the CEO to rethink his decision. “This is a shame this back and forth. You are both better than this. Cool off and take a step back for a couple days,” the X user wrote in a reply.

Much to the social media platform’s surprise, Musk responded to the user. Even more surprising, the CEO stated that SpaceX would not be decommissioning Dragon after all. “Good advice. Ok, we won’t decommission Dragon,” Musk wrote in a post on X.

Not Planned, But Welcomed

The X user’s comment and Musk’s response were received extremely well by social media users, many of whom noted that @Fab25june’s X comment effectively saved the U.S. space program. In a follow-up comment, the X user, who has over 9,100 followers as of writing, stated that he did not really plan on being a mediator between Musk and Trump.

“Elon Musk replied to me. Somehow, I became the accidental peace broker between two billionaires. I didn’t plan this. I was just being me. Two great minds can do wonders. Sometimes, all it takes is a breather. Grateful for every like, DM, and new follow. Life’s weird. The internet’s weirder. Let’s ride. (Manifesting peace… and maybe a Model Y.)” the X user wrote.

Lifestyle

Tesla Cybertruck takes a bump from epic failing Dodge Charger

The Cybertruck seemed unharmed by the charging Charger.

There comes a time in a driver’s life when one is faced with one’s limitations. For the driver of a Dodge Charger, this time came when he lost control and crashed into a Tesla Cybertruck–an absolute epic fail.

A video of the rather unfortunate incident was shared on the r/TeslaLounge subreddit.

Charging Charger Fails

As could be seen in the video, which was posted on the subreddit by Model Y owner u/Hammer_of_something, a group of teens in a Dodge Charger decided to do some burnouts at a Tesla Supercharger. Unfortunately, the driver of the Charger failed in his burnout or donut attempt, resulting in the mopar sedan going over a curb and bumping a charging Cybertruck.

Ironically, the Dodge Charger seemed to have been parked at a Supercharger stall before its driver decided to perform the failed stunt. This suggests that the vehicle was likely ICE-ing a charging stall before it had its epic fail moment. Amusingly enough, the subreddit member noted that the Cybertruck did not seem like it took any damage at all despite its bump. The Charger, however, seemed like it ran into some trouble after crashing into the truck.

Alleged Aftermath

As per the the r/TeslaLounge subreddit member, the Cybertruck owner came rushing out to his vehicle after the Dodge Charger crashed into it. The Model Y owner then sent over the full video of the incident, which clearly showed the Charger attempting a burnout, failing, and bumping into the Cybertruck. The Cybertruck owner likely appreciated the video, in part because it showed the driver of the Dodge Charger absolutely freaking out after the incident.

The Cybertruck is not an impregnable vehicle, but it can take bumps pretty well thanks to its thick stainless steel body. Based on this video, it appears that the Cybertruck can even take bumps from a charging Charger, all while chilling and charging at a Supercharger. As for the teens in the Dodge, they likely had to provide a long explanation to authorities after the incident, since the cops were called to the location.

Lifestyle

Anti-Elon Musk group crushes Tesla Model 3 with Sherman tank–with unexpected results

Ironically enough, the group’s video ended up highlighting something very positive for Tesla.

Anti-Elon Musk protesters and critics tend to show their disdain for the CEO in various ways, but a recent video from political action group Led By Donkeys definitely takes the cake when it comes to creativity.

Ironially enough, the group’s video also ended up highlighting something very positive for Tesla.

Tank vs. Tesla

In its video, Led By Donkeys featured Ken Turner, a 98-year-old veteran who served in the British army during World War II. The veteran stated that Elon Musk, the richest man in the world, is “using his immense power to support the far-right in Europe, and his money comes from Tesla cars.”

He also noted that he had a message for the Tesla CEO: “We’ve crushed fascism before and we’ll crush it again.” To emphasize his point, the veteran proceeded to drive a Sherman tank over a blue Tesla Model 3 sedan, which, of course, had a plate that read “Fascism.”

The heavy tank crushed the Model 3’s glass roof and windows, much to the delight of Led By Donkeys’ commenters on its official YouTube channel. But at the end of it all, the aftermath of the anti-Elon Musk demonstration ended up showcasing something positive for the electric vehicle maker.

Tesla Model 3 Tanks the Tank?

As could be seen from the wreckage of the Tesla Model 3 after its Sherman encounter, only the glass roof and windows of the all-electric sedan were crushed. Looking at the wreckage of the Model 3, it seemed like its doors could still be opened, and everything on its lower section looked intact.

Considering that a standard M4 Sherman weighs about 66,800 to 84,000 pounds, the Model 3 actually weathered the tank’s assault really well. Granted, the vehicle’s suspension height before the political action group’s demonstration suggests that the Model 3’s high voltage battery had been removed beforehand. But even if it hadn’t been taken off, it seemed like the vehicle’s battery would have survived the heavy ordeal without much incident.

This was highlighted in comments from users on social media platform X, many of whom noted that a person in the Model 3 could very well have survived the ordeal with the Sherman. And that, ultimately, just speaks to the safety of Tesla’s vehicles. There is a reason why Teslas consistently rank among the safest cars on the road, after all.

-

Elon Musk4 days ago

Elon Musk4 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News1 week ago

News1 week agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

News2 weeks ago

News2 weeks agoWatch Tesla’s first driverless public Robotaxi rides in Texas

-

News2 weeks ago

News2 weeks agoSpaceX and Elon Musk share insights on Starship Ship 36’s RUD

-

News1 week ago

News1 week agoWatch the first true Tesla Robotaxi intervention by safety monitor

-

News2 weeks ago

News2 weeks agoTesla has started rolling out initial round of Robotaxi invites

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla to launch in India in July with vehicles already arriving: report