News

NASA plans to purchase another seat on Russian Soyuz after SpaceX

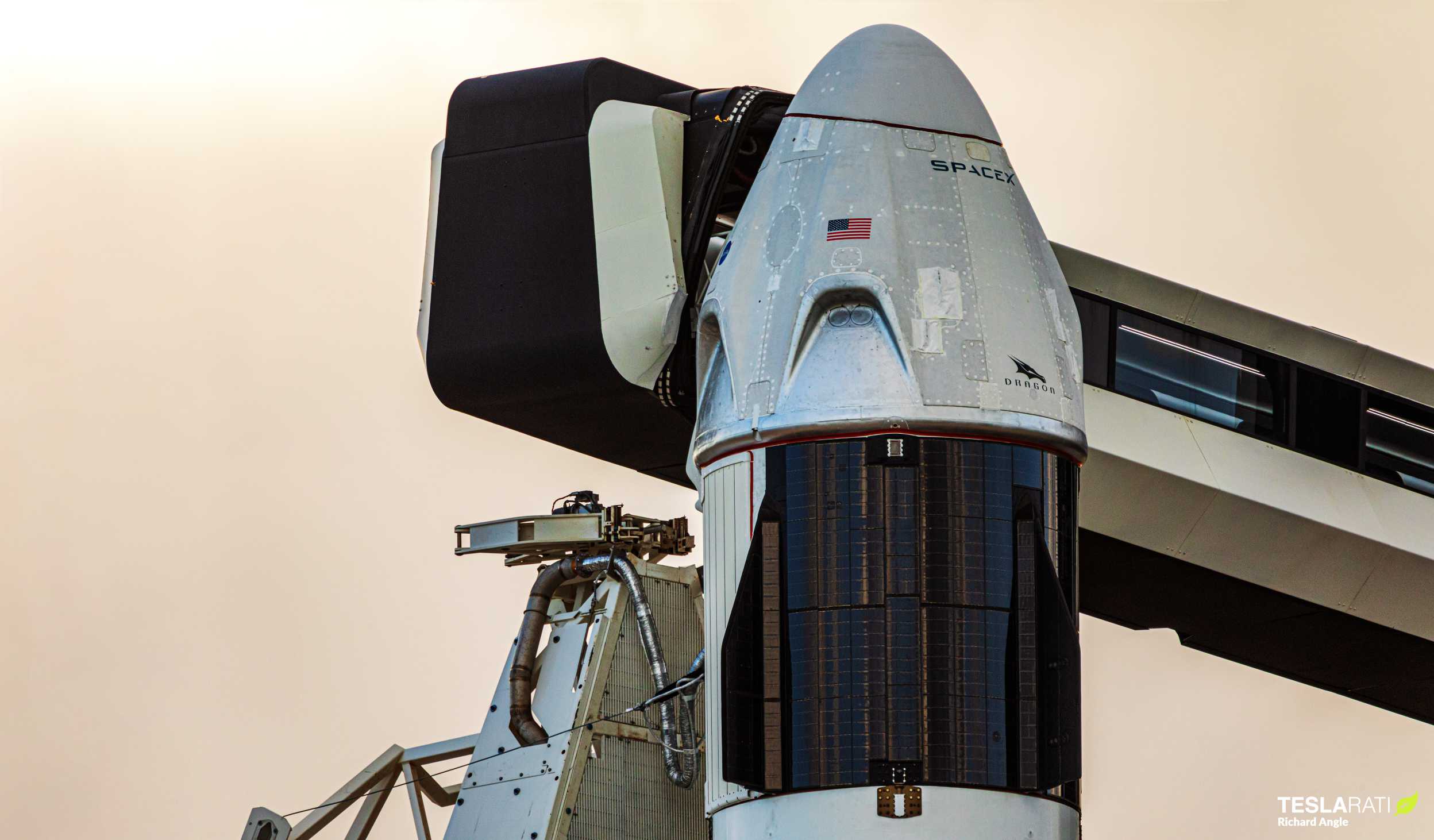

NASA and SpaceX are preparing to launch astronauts from U.S. soil for the first time in nearly a decade. The collaboration is designed to give NASA more flexibility when it comes to launching crewed missions.

When the agency’s storied shuttle program came to an end in 2011, it left NASA dependent upon Russian rockets as its sole means of transporting astronauts to and from the space station. But the arrangement, which costs NASA roughly $85 million per seat, was always intended as a temporary solution.

NASA wanted to support a burgeoning commercial market, so it turned to private industry to build its next-generation space taxi. To that end, in 2014, the agency selected two companies — SpaceX and Boeing — to transport future crews. Each company would design and build its spacecraft capable of carrying humans. Six years later, SpaceX is set to become the first commercial company to transport astronauts, as its inaugural crewed flight prepares to take off on May 27.

The mission, known as Demo-2, is a flight test that will be used to certify the Dragon spacecraft for routine astronaut transport to and from the space station. During the mission, astronauts Bob Behnken and Doug Hurley will pilot the craft to the space station, where it will dock itself to the orbital outpost.

Their time on station is still to be determined, but the duo will make the most of their orbital stay. Not only will they evaluate how Dragon performs at different stages of the mission, but they will also assist fellow NASA astronaut Chris Cassidy with routine maintenance and station keeping.

Once Crew Dragon has been cleared to ferry people regularly, it will give NASA the flexibility to carry out missions of many different durations. To date, crews have spent anywhere from a couple of weeks in space, all the way up to a year. Their time on orbit is typically limited by the spacecraft that brought them, but by having multiple vehicles capable of flying to and from the space station, gives agencies around the world greater flexibility in mission planning.

Currently, NASA is in talks to purchase one more seat on a Russian Soyuz that would fly this fall. As it stands now, Chris Cassidy is the sole NASA astronaut on station, joined by two Russian colleagues. However, that leaves the station understaffed. Simply maintaining the orbital outpost is more than one crew member can handle. (A full space station crew is six.)

Behnken and Hurley are scheduled to launch on May 27 and will stay on station for as many as 110 days. That’s because their ride is only certified to stay in space that long. The harsh space environment wears on hardware, and the Crew Dragon’s solar arrays contain sensitive electronics that have a limited space life.

So what happens when Behnken and Hurley come home? At this point, the schedules are a little unclear, but Cassidy could remain on station by himself until the next crew can launch. While preparing for Demo-2, SpaceX is currently finishing construction on the capsule that will carry its first official crew. Four astronauts will fly on Crew Dragon sometime late this year or early next year, providing a fresh batch of astronauts.

In the meantime, NASA wants to make sure it will be able to have access to the space station, so it’s in talks with Roscosmos to buy one more seat. After that deal is made, NASA has a much different idea for the future of its partnership with the Russian space agency. During a series of briefings in advance of Demo-2, NASA administrator Jim Bridenstine expressed how he hoped in the near future that NASA and Roscosmos could set up a trade agreement.

This would mean that U.S. astronauts would still fly on a Russian Soyuz and vice versa. Only instead of money exchanging hands, the two agencies would simply trade seats on each other’s vehicles. The first international partner to fly on a Crew Dragon will be Soichi Noguchi of the Japanese Space Agency (JAXA), who will join NASA astronauts Victor Glover, Mike Hopkins, and Shannon Walker as part of the Crew-1 mission.

News

Tesla China hires Autopilot Test Engineer amid continued FSD rollout preparations

The role is based in Lingang, the district that houses Gigafactory Shanghai.

Tesla is hiring an Autopilot Test Engineer in Shanghai, a move that signals continued groundwork for the validation of Full Self-Driving (FSD) in China. The role is based in Lingang, the district that houses Gigafactory Shanghai and has become a key testing zone for advanced autonomous features.

As observed by Tesla watchers, local authorities in Shanghai’s Nanhui New City within Lingang have previously authorized a fleet of Teslas to run advanced driving tests on public roads. This marked one of the first instances where foreign automakers were permitted to test autonomous driving systems under real traffic conditions in China.

Tesla’s hiring efforts come amid ongoing groundwork for a full FSD rollout in China. Earlier reporting noted that Tesla China has been actively preparing the regulatory and infrastructure foundation needed for full FSD deployment, even though the company has not yet announced a firm launch date for the feature in the market.

As per recent comments from Tesla China Vice President Grace Tao, the electric vehicle maker has been busy setting up the necessary facilities to support FSD’s full rollout in the country. In a comment to local media, Tao stated that FSD should demonstrate a level of performance that could surpass human drivers once it is fully rolled out.

“We have set up a local training center in China specifically to handle this adaptation,” Tao said. “Once officially released, it will demonstrate a level of performance that is no less than, and may even surpass, that of local drivers.”

Tesla CEO Elon Musk has been quite bullish about a potential FSD rollout in China. During the 2025 Annual Shareholder Meeting, Musk emphasized that FSD had only received “partial approval” in China, though full authorization could potentially arrive around February or March 2026. This timeline was reiterated by the CEO during his appearance at the World Economic Forum in Davos.

Elon Musk

Tesla Model Y outsells all EV rivals in Europe in 2025 despite headwinds

The result highlights the Model Y’s continued strength in the region.

The Tesla Model Y was Europe’s most popular electric car in 2025, leading all EV models by a wide margin despite a year marked by production transition, intensifying competition, and anti-Elon Musk sentiments.

The result highlights the Model Y’s continued strength in the region even as Volkswagen overtook Tesla as the top-selling EV brand overall.

As per data compiled by JATO Dynamics and reported by Swedish outlet Allt om Elbil, the Tesla Model Y recorded 149,805 registrations across Europe in 2025. That figure placed it comfortably at No. 1 among all electric car models in the region.

The Model Y’s performance in Europe is particularly notable given that registrations declined 28% year-over-year. The dip coincided with Tesla’s Q1 2025 transition to the updated Model Y, a changeover that temporarily affected output and deliveries in several markets. Anti-Elon Musk sentiments also spread across several European countries amidst the CEO’s work with U.S. President Donald Trump.

Even with these disruptions, the Model Y outsold its nearest rival by more than 50,000 units. Second place went to the newly launched Skoda Elroq with 93,870 registrations, followed by the Tesla Model 3 at 85,393 units. The Model 3 also recorded a 24% year-over-year decline. Renault’s new electric Renault 5 placed fourth with 85,101 registrations.

Other top performers included the Volkswagen ID.4, ID.3, and ID.7, along with the BMW iX1 and Kia EV3, many of which posted triple-digit growth from partial-year launches in 2024.

While the Model Y dominated individual model rankings, Volkswagen overtook Tesla as Europe’s top EV brand in 2025. Volkswagen delivered 274,278 electric cars in the region, a 56% increase compared to 2024. Much of that growth was driven by the Volkswagen ID.7. Tesla, by contrast, sold 236,357 electric vehicles in Europe, representing a 27% year-over-year decline.

JATO Dynamics noted that “Tesla’s small and aging model range faces fierce competition in Europe, both from traditional European automakers and a growing number of Chinese competitors.”

Despite intensifying competition and brand-level shifts, however. the Model Y’s commanding lead demonstrates that Tesla’s bestselling crossover remains a dominant force in Europe’s fast-evolving EV landscape.

News

Starlink gets its latest airline adoptee for stable and reliable internet access

The company said it plans to “rapidly integrate Starlink into its fleet,” and that the first Starlink-equipped aircraft will enter service this Summer.

SpaceX’s Starlink, the satellite internet program launched by Elon Musk’s company, has gotten its latest airline adoptee, offering stable and reliable internet to passengers.

Southwest Airlines announced on Wednesday that it would enable Starlink on its aircraft, a new strategy that will expand to more than 300 planes by the end of the year.

The company said it plans to “rapidly integrate Starlink into its fleet,” and that the first Starlink-equipped aircraft will enter service this Summer.

Tony Roach, Executive Vice President, Chief Customer and Brand Officer for the airline, said:

“Free WiFi has been a huge hit with our Rapid Rewards Members, and we know our Customers expect seamless connectivity across all their devices when they travel. Starlink delivers that at-home experience in the air, giving Customers the ability to stream their favorite shows from any platform, watch live sports, download music, play games, work, and connect with loved ones from takeoff to landing.”

Southwest also said that this is just one of the latest upgrades it is making to provide a more well-rounded experience to its aircraft. In addition to Starlink, it is updating cabin designs, offering more legroom, and installing in-seat power to all passengers.

Southwest became one of several airlines to cross over to Starlink, as reviews for the internet provider have raved about reliability and speed. Over the past year, Hawaiian Airlines, United Airlines, Alaska Airlines, airBaltic, Air France, JSX, Emirates, British Airways, and others have all decided to install Starlink on their planes.

This has been a major move away from unpredictable and commonly unreliable WiFi offerings on planes. Starlink has been more reliable and has provided more stable connections for those using their travel time for leisure or business.

Jason Fritch, VP of Starlink Enterprise Sales at SpaceX, said:

“We’re thrilled to deliver a connectivity experience to Southwest Airlines and its Customers that really is similar, if not better, than what you can experience in your own home. Starlink is the future of connected travel, making every journey faster, smoother, and infinitely more enjoyable.”

Starlink recently crossed a massive milestone of over 10 million subscribers.