News

Tesla outpaces Volkswagen, Subaru, BMW in 2023 U.S. market share

Tesla held 4.2 percent of the total market share in the United States in 2023, outpacing companies like Volkswagen, Subaru, and BMW.

Tesla gained a small portion of market share in the United States’ overall vehicle sector and sold over 25 percent more vehicles in the country in 2023 compared to the year prior.

This morning, Kelley Blue Book published its figures for vehicle sales per manufacturer for 2023. General Motors was still the best-selling car company in the United States, selling 2,577,648 vehicles for the year, a 14.1 percent increase from the year before.

You can’t make this up

Tesla ended 2023 at exactly 4.20% market share.

(Source: Kelly Blue Book) pic.twitter.com/p2NuWXyr3K

— Car Dealership Guy (@GuyDealership) January 8, 2024

Tesla improved its sales figures by 25.4 percent, with 654,888 sales in the U.S. last year, improving from 2022’s numbers of 522,444.

In 2022, those 522,444 sales were good enough for 3.8 percent of the overall U.S. automotive market, which eclipsed the share automakers like BMW, Mazda, and Daimler had for the year, as those companies reported 2.5, 2.1, and 2.5 percent, respectively.

In 2023, Tesla sales reached a 4.2 percent market share, a 0.4 percent increase. Due to the improvement, Tesla is now above Volkswagen and Subaru, along with the three previously mentioned companies. Volkswagen and Subaru had only 0.1 percent less market share than Tesla.

Other notable changes on the list are a 33 percent increase in sales by Honda, which sold over 1.3 million cars in the U.S. this past year. Tesla was only outpaced in year-over-year change by Honda, Geely-Volvo, Rivian, and Lucid.

It is worth mentioning that Rivian grew from 20,332 sales in 2022 to 50,122 in 2023. Lucid went from 2,656 to 5,779. Geely-Volvo grew from 111,509 to 140,590.

It was a strong performance from Tesla in 2023, and the number should continue to grow into 2024, given that the company is set to offer new products in the U.S. this year.

While the Cybertruck technically started deliveries last year in November, a ramp-up of the pickup would supplement Tesla’s growth in the U.S. in 2024.

Additionally, we are expecting the Model 3 “Highland,” an updated version of the all-electric sedan, to hit the U.S. market in the coming months. It has already been delivered in China, Europe, and the Middle East, and we could see an increase in demand as current owners may want the newest version of the Model 3.

Tesla is also expected to update the Model Y this year, in a project that was rumoredly codenamed “Juniper.” The Model Y is Tesla’s most popular vehicle, and a revamp could increase demand for the car as it will have a new look and new tech.

I’d love to hear from you! If you have any comments, concerns, or questions, please email me at joey@teslarati.com. You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Elon Musk

Tesla Full Self-Driving’s newest behavior is the perfect answer to aggressive cars

According to a recent video, it now appears the suite will automatically pull over if there is a tailgater on your bumper, the most ideal solution for when a driver is riding your bumper.

Tesla Full Self-Driving appears to have a new behavior that is the perfect answer to aggressive drivers.

According to a recent video, it now appears the suite will automatically pull over if there is a tailgater on your bumper, the most ideal solution for when a driver is riding your bumper.

With FSD’s constantly-changing Speed Profiles, it seems as if this solution could help eliminate the need to tinker with driving modes from the person in the driver’s seat. This tends to be one of my biggest complaints from FSD at times.

A video posted on X shows a Tesla on Full Self-Driving pulling over to the shoulder on windy, wet roads after another car seemed to be following it quite aggressively. The car looks to have automatically sensed that the vehicle behind it was in a bit of a hurry, so FSD determined that pulling over and letting it by was the best idea:

Tesla appears to be implementing some sort of feature that will now pull over if someone is tailgating you to let the car by

Really cool feature, definitely get a lot of this from those who think they drive race cars

— TESLARATI (@Teslarati) February 26, 2026

We can see from the clip that there was no human intervention to pull over to the side, as the driver’s hands are stationary and never interfere with the turn signal stalk.

This can be used to override some of the decisions FSD makes, and is a great way to get things back on track if the semi-autonomous functionality tries to do something that is either unneeded or not included in the routing on the in-car Nav.

FSD tends to move over for faster traffic on the interstate when there are multiple lanes. On two-lane highways, it will pass slower cars using the left lane. When faster traffic is behind a Tesla on FSD, the vehicle will move back over to the right lane, the correct behavior in a scenario like this.

Perhaps one of my biggest complaints at times with Full Self-Driving, especially from version to version, is how much tinkering Tesla does with Speed Profiles. One minute, they’re suitable for driving on local roads, the next, they’re either too fast or too slow.

When they are too slow, most of us just shift up into a faster setting, but at times, even that’s not enough, see below:

What has happened to Mad Max?

At one point it was going 32 in a 35. Traffic ahead had pulled away considerably https://t.co/bjKvaMVTNX pic.twitter.com/aaZSWmLu5v

— TESLARATI (@Teslarati) January 24, 2026

There are times when it feels like it would be suitable for the car to just pull over and let the vehicle that is traveling behind pass. This, at least up until this point, it appears, was something that required human intervention.

Now, it looks like Tesla is trying to get FSD to a point where it just knows that it should probably get out of the way.

Elon Musk

Tesla Megapack powers $1.1B AI data center project in Brazil

By integrating Tesla’s Megapack systems, the facility will function not only as a major power consumer but also as a grid-supporting asset.

Tesla’s Megapack battery systems will be deployed as part of a 400MW AI data center campus in Uberlândia, Brazil. The initiative is described as one of Latin America’s largest AI infrastructure projects.

The project is being led by RT-One, which confirmed that the facility will integrate Tesla Megapack battery energy storage systems (BESS) as part of a broader industrial alliance that includes Hitachi Energy, Siemens, ABB, HIMOINSA, and Schneider Electric. The project is backed by more than R$6 billion (approximately $1.1 billion) in private capital.

According to RT-One, the data center is designed to operate on 100% renewable energy while also reinforcing regional grid stability.

“Brazil generates abundant energy, particularly from renewable sources such as solar and wind. However, high renewable penetration can create grid stability challenges,” RT-One President Fernando Palamone noted in a post on LinkedIn. “Managing this imbalance is one of the country’s growing infrastructure priorities.”

By integrating Tesla’s Megapack systems, the facility will function not only as a major power consumer but also as a grid-supporting asset.

“The facility will be capable of absorbing excess electricity when supply is high and providing stabilization services when the grid requires additional support. This approach enhances resilience, improves reliability, and contributes to a more efficient use of renewable generation,” Palamone added.

The model mirrors approaches used in energy-intensive regions such as California and Texas, where large battery systems help manage fluctuations tied to renewable energy generation.

The RT-One President recently visited Tesla’s Megafactory in Lathrop, California, where Megapacks are produced, as part of establishing the partnership. He thanked the Tesla team, including Marcel Dall Pai, Nicholas Reale, and Sean Jones, for supporting the collaboration in his LinkedIn post.

Elon Musk

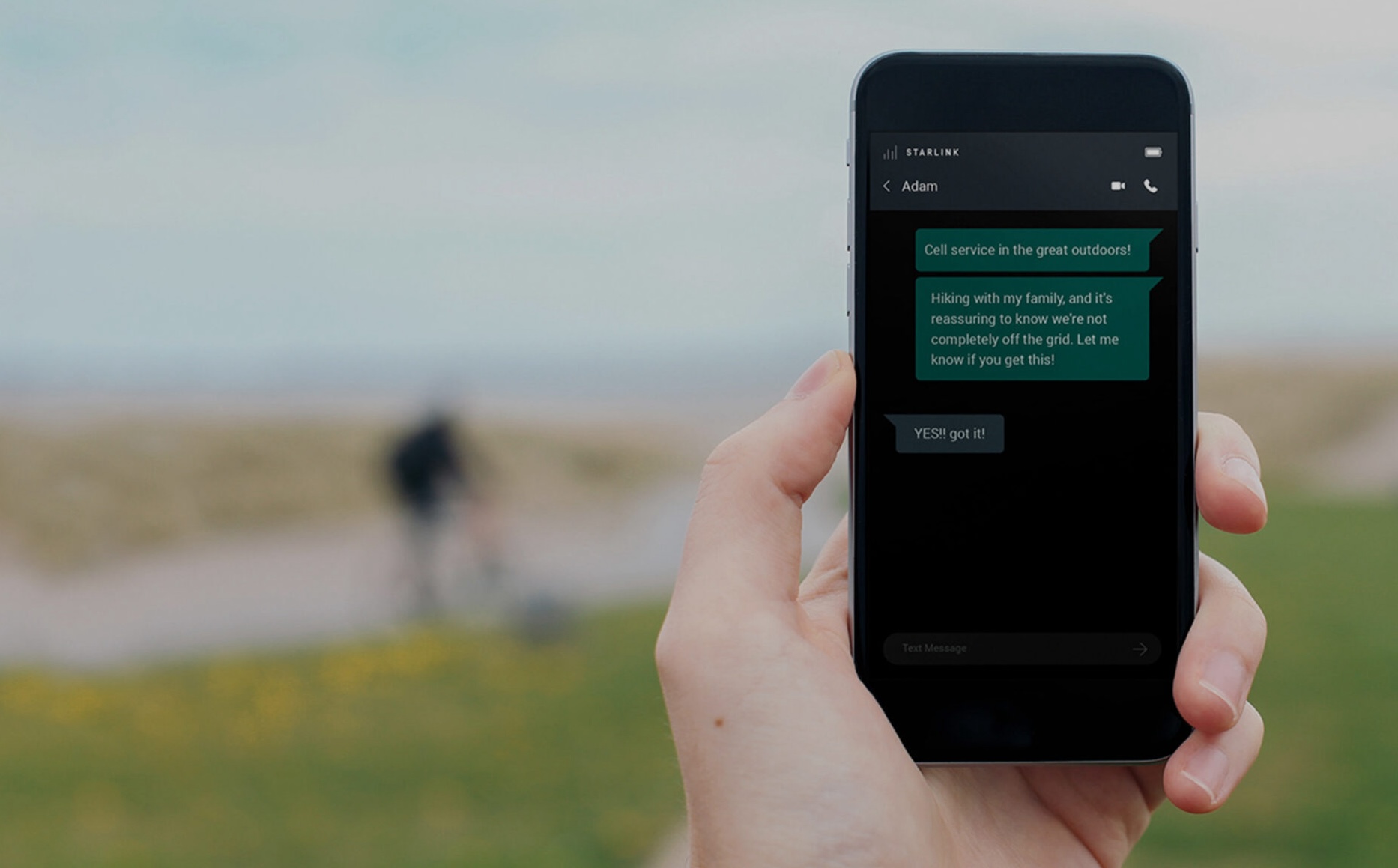

Starlink powers Europe’s first satellite-to-phone service with O2 partnership

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools.

Starlink is now powering Europe’s first commercial satellite-to-smartphone service, as Virgin Media O2 launches a space-based mobile data offering across the UK.

The new O2 Satellite service uses Starlink’s low-Earth orbit network to connect regular smartphones in areas without terrestrial coverage, expanding O2’s reach from 89% to 95% of Britain’s landmass.

Under the rollout, compatible Samsung devices automatically connect to Starlink satellites when users move beyond traditional mobile coverage, according to Reuters.

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools. O2 is pricing the add-on at £3 per month.

By leveraging Starlink’s satellite infrastructure, O2 can deliver connectivity in remote and rural regions without building additional ground towers. The move represents another step in Starlink’s push beyond fixed broadband and into direct-to-device mobile services.

Virgin Media O2 chief executive Lutz Schuler shared his thoughts about the Starlink partnership. “By launching O2 Satellite, we’ve become the first operator in Europe to launch a space-based mobile data service that, overnight, has brought new mobile coverage to an area around two-thirds the size of Wales for the first time,” he said.

Satellite-based mobile connectivity is gaining traction globally. In the U.S., T-Mobile has launched a similar satellite-to-cell offering. Meanwhile, Vodafone has conducted satellite video call tests through its partnership with AST SpaceMobile last year.

For Starlink, the O2 agreement highlights how its network is increasingly being integrated into national telecom systems, enabling standard smartphones to connect directly to satellites without specialized hardware.