News

Tesla’s ‘Unboxed Process’ patent highlights affordability through efficiency

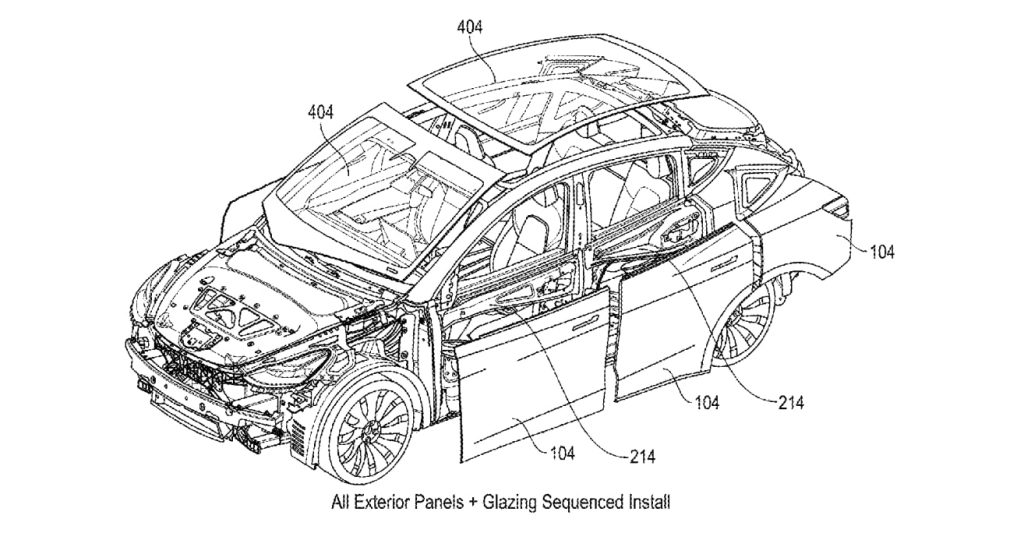

The process includes utilizing past methods that Tesla has brought into automotive manufacturing, including Gigacasting and structural battery integration, with more efficient “post-manufacturing” processes, like pre-painting.

Tesla has been granted a new patent for its “Unboxed Process” of manufacturing, which aims to enhance affordability for customers by increasing efficiency at the manufacturing stage.

This is one way the company aims to create a larger impact from start to finish, especially with upcoming vehicles. For those who are not familiar, the Unboxed Process was first unveiled by Tesla back in 2023 during its “Investor Day.”

The company brought forth the idea that vehicle manufacturing could shift from traditional assembly lines, making production more efficient, more cost-effective, and more scalable for the future, especially with mass-market models like Cybercab.

The process includes utilizing past methods that Tesla has brought into automotive manufacturing, including Gigacasting and structural battery integration, with more efficient “post-manufacturing” processes, like pre-painting.

Tesla describes the main advantages in the patent:

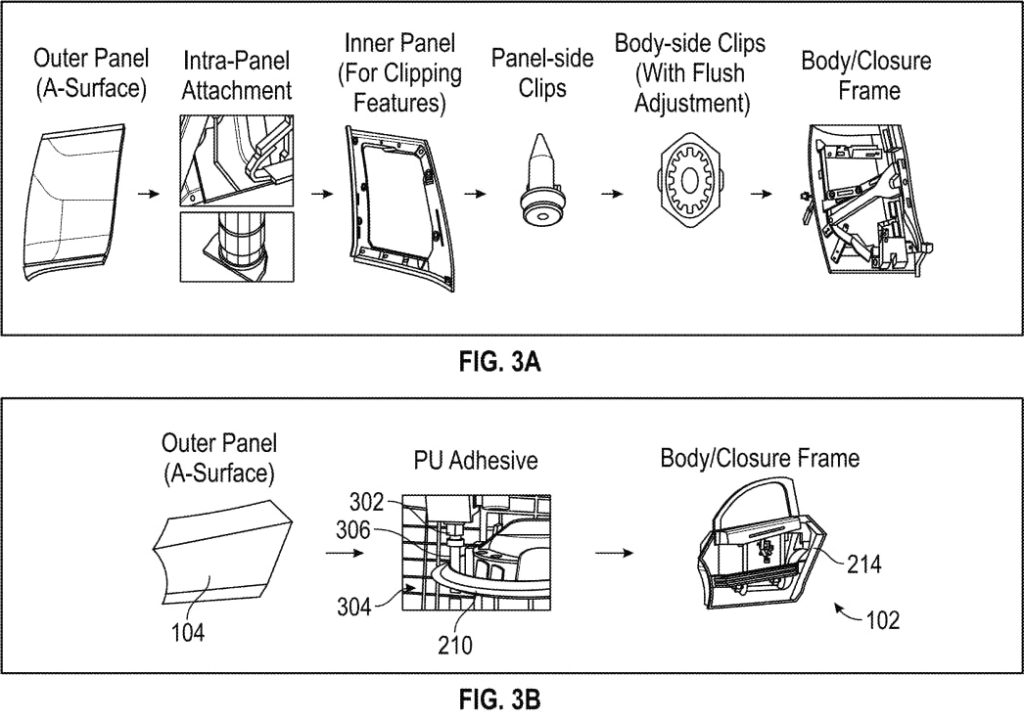

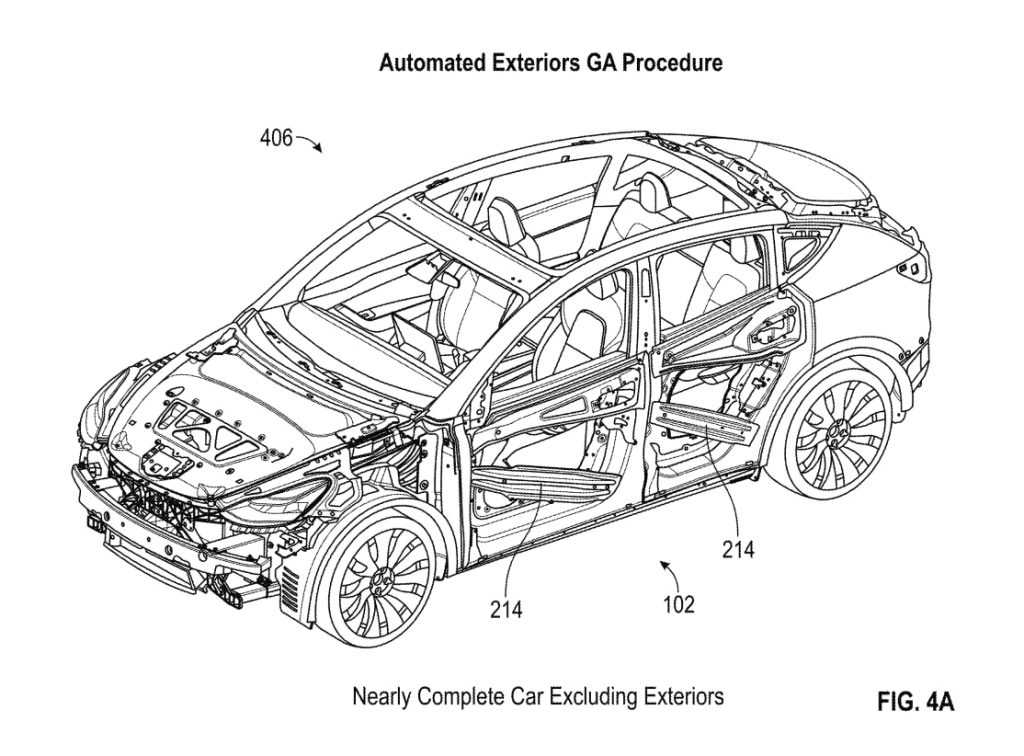

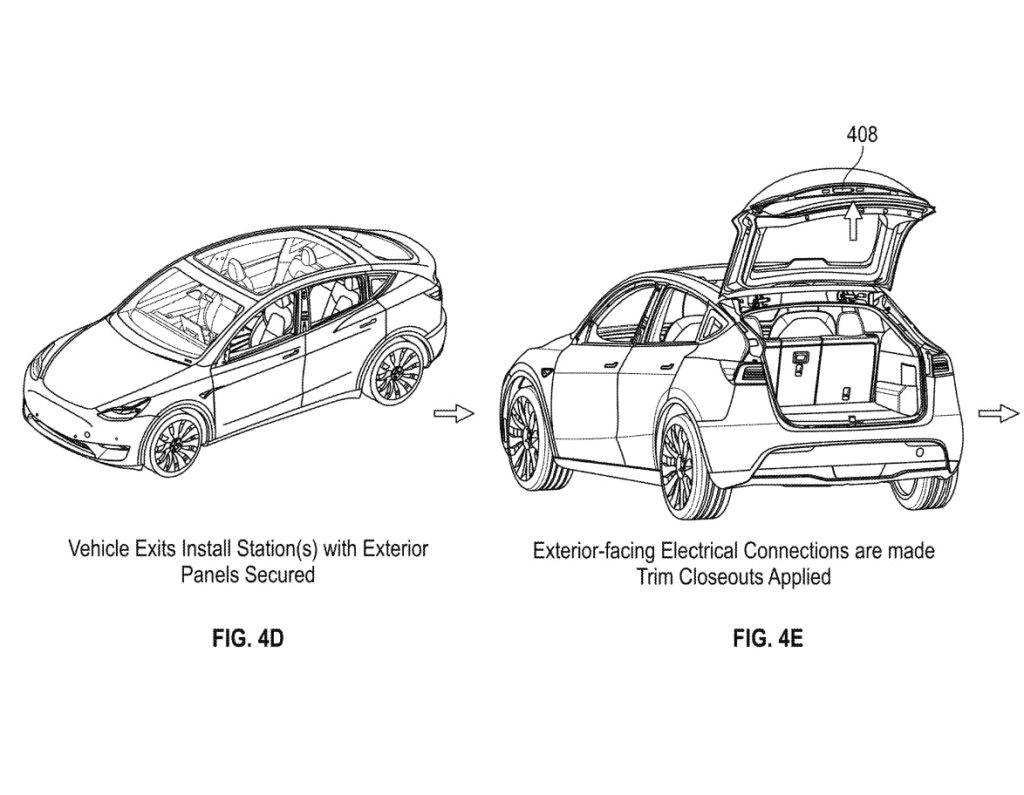

“The present disclosure relates to an automated system and method for assembling exterior vehicle parts to a vehicle assembly structure. The system utilizes an automated assembly cell with fixtures corresponding to each exterior vehicle part and references a global datum for precise alignment…The method improves assembly efficiency by compensating for substructure irregularities with an engineered adhesive gap and allows for continued assembly during adhesive curing through tacking operations.”

Instead of traditional welding strategies, the company plans to use a different bonding method, through adhesives.

The patent goes on:

“In described examples, a modular vehicle architecture allows for the assembly of a vehicle in sections, which are then joined in a final assembly operation. This approach eliminates the traditional need for welding stamped panels and applying secondary coatings or painting at the full vehicle assembly level. Instead, the vehicle can be constructed in parts, with metal surface treatments like e-coating and painting applied beforehand.”

The goal behind this manufacturing process is that Tesla will be able to build more vehicles at a faster rate for a lower price, something it believes it will need to accomplish as it addresses autonomy and Robotaxis, which are in higher demand.

With this rate of speed of manufacturing, Tesla says traditional manufacturing methods have the potential consequence of “compounding errors,” as “any slight misalignment or variance can add up.”

There is a refined focus on efficiency, while also recognizing the importance of build quality. This should eliminate most of the issues Tesla would confront with its current, more traditional, linear manufacturing processes.

News

Tesla Robotaxi has a highly-requested hardware feature not available on typical Model Ys

These camera washers are crucial for keeping the operation going, as they are the sole way Teslas operate autonomously. The cameras act as eyes for the car to drive, recognize speed limit and traffic signs, and travel safely.

Tesla Robotaxi has a highly-requested hardware feature that is not available on typical Model Ys that people like you and me bring home after we buy them. The feature is something that many have been wanting for years, especially after the company adopted a vision-only approach to self-driving.

After Tesla launched driverless Robotaxi rides to the public earlier this week in Austin, people have been traveling to the Lone Star State in an effort to hopefully snag a ride from one of the few vehicles in the fleet that are now no longer required to have Safety Monitors present.

BREAKING: Tesla launches public Robotaxi rides in Austin with no Safety Monitor

Although only a few of those completely driverless rides are available, there have been some new things seen on these cars that are additions from regular Model Ys, including the presence of one new feature: camera washers.

With the Model Y, there has been a front camera washer, but the other exterior “eyes” have been void of any solution for this. For now, owners are required to clean them manually.

In Austin, Tesla is doing things differently. It is now utilizing camera washers on the side repeater and rear bumper cameras, which will keep the cameras clean and keep operation as smooth and as uninterrupted as possible:

🚨 Tesla looks to have installed Camera Washers on the side repeater cameras on Robotaxis in Austin

pic.twitter.com/xemRtDtlRR— TESLARATI (@Teslarati) January 23, 2026

Rear Camera Washer on Tesla Robotaxi pic.twitter.com/P9hgGStHmV

— TESLARATI (@Teslarati) January 24, 2026

These camera washers are crucial for keeping the operation going, as they are the sole way Teslas operate autonomously. The cameras act as eyes for the car to drive, recognize speed limit and traffic signs, and travel safely.

This is the first time we are seeing them, so it seems as if Safety Monitors might have been responsible for keeping the lenses clean and unobstructed previously.

However, as Tesla transitions to a fully autonomous self-driving suite and Robotaxi expands to more vehicles in the Robotaxi fleet, it needed to find a way to clean the cameras without any manual intervention, at least for a short period, until they can return for interior and exterior washing.

News

Tesla makes big Full Self-Driving change to reflect future plans

Tesla made a dramatic change to the Online Design Studio to show its plans for Full Self-Driving, a major part of the company’s plans moving forward, as CEO Elon Musk has been extremely clear on the direction moving forward.

With Tesla taking a stand and removing the ability to purchase Full Self-Driving outright next month, it is already taking steps to initiate that with owners and potential buyers.

On Thursday night, the company updated its Online Design Studio to reflect that in a new move that now lists the three purchase options that are currently available: Monthly Subscription, One-Time Purchase, or Add Later:

🚨 Check out the change Tesla made to its Online Design Studio:

It now lists the Monthly Subscription as an option for Full Self-Driving

It also shows the outright purchase option as expiring on February 14 pic.twitter.com/pM6Svmyy8d

— TESLARATI (@Teslarati) January 23, 2026

This change replaces the former option for purchasing Full Self-Driving at the time of purchase, which was a simple and single box to purchase the suite outright. Subscriptions were activated through the vehicle exclusively.

However, with Musk announcing that Tesla would soon remove the outright purchase option, it is clearer than ever that the Subscription plan is where the company is headed.

The removal of the outright purchase option has been a polarizing topic among the Tesla community, especially considering that there are many people who are concerned about potential price increases or have been saving to purchase it for $8,000.

This would bring an end to the ability to pay for it once and never have to pay for it again. With the Subscription strategy, things are definitely going to change, and if people are paying for their cars monthly, it will essentially add $100 per month to their payment, pricing some people out. The price will increase as well, as Musk said on Thursday, as it improves in functionality.

I should also mention that the $99/month for supervised FSD will rise as FSD’s capabilities improve.

The massive value jump is when you can be on your phone or sleeping for the entire ride (unsupervised FSD). https://t.co/YDKhXN3aaG

— Elon Musk (@elonmusk) January 23, 2026

Those skeptics have grown concerned that this will actually lower the take rate of Full Self-Driving. While it is understandable that FSD would increase in price as the capabilities improve, there are arguments for a tiered system that would allow owners to pay for features that they appreciate and can afford, which would help with data accumulation for the company.

Musk’s new compensation package also would require Tesla to have 10 million active FSD subscriptions, but people are not sure if this will move the needle in the correct direction. If Tesla can potentially offer a cheaper alternative that is not quite unsupervised, things could improve in terms of the number of owners who pay for it.

News

Tesla Model S completes first ever FSD Cannonball Run with zero interventions

The coast-to-coast drive marked the first time Tesla’s FSD system completed the iconic, 3,000-mile route end to end with no interventions.

A Tesla Model S has completed the first-ever full Cannonball Run using Full Self-Driving (FSD), traveling from Los Angeles to New York with zero interventions. The coast-to-coast drive marked the first time Tesla’s FSD system completed the iconic, 3,000-mile route end to end, fulfilling a long-discussed benchmark for autonomy.

A full FSD Cannonball Run

As per a report from The Drive, a 2024 Tesla Model S with AI4 and FSD v14.2.2.3 completed the 3,081-mile trip from Redondo Beach in Los Angeles to midtown Manhattan in New York City. The drive was completed by Alex Roy, a former automotive journalist and investor, along with a small team of autonomy experts.

Roy said FSD handled all driving tasks for the entirety of the route, including highway cruising, lane changes, navigation, and adverse weather conditions. The trip took a total of 58 hours and 22 minutes at an average speed of 64 mph, and about 10 hours were spent charging the vehicle. In later comments, Roy noted that he and his team cleaned out the Model S’ cameras during their stops to keep FSD’s performance optimal.

History made

The historic trip was quite impressive, considering that the journey was in the middle of winter. This meant that FSD didn’t just deal with other cars on the road. The vehicle also had to handle extreme cold, snow, ice, slush, and rain.

As per Roy in a post on X, FSD performed so well during the trip that the journey would have been completed faster if the Model S did not have people onboard. “Elon Musk was right. Once an autonomous vehicle is mature, most human input is error. A comedy of human errors added hours and hundreds of miles, but FSD stunned us with its consistent and comfortable behavior,” Roy wrote in a post on X.

Roy’s comments are quite notable as he has previously attempted Cannonball Runs using FSD on December 2024 and February 2025. Neither were zero intervention drives.